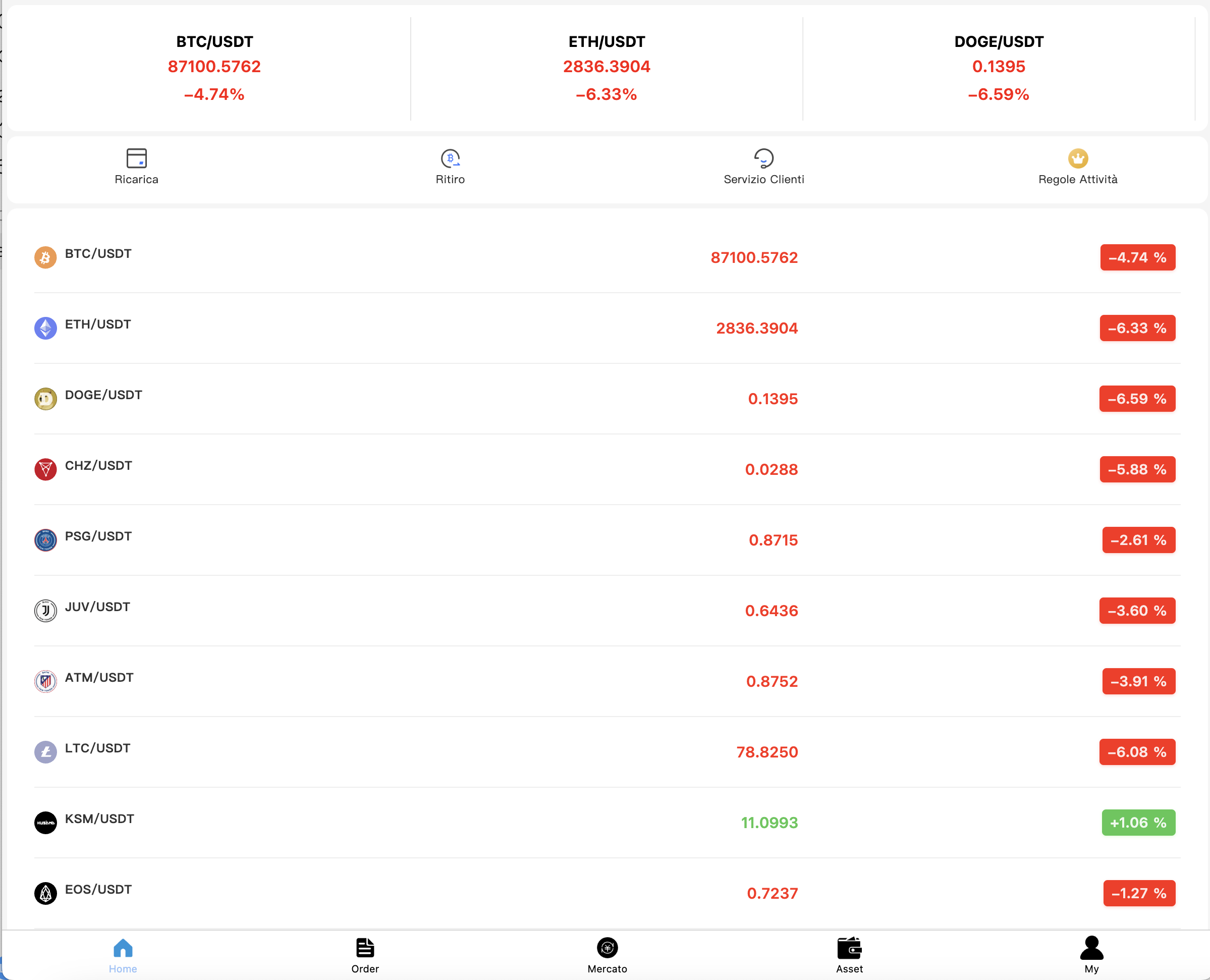

Zerotrillionworld.it Review: Deceptive Investment

When new digital-investment platforms appear online, users often gravitate toward their promises of easy profits, advanced trading tools, or revolutionary financial opportunities. But not every platform is as solid as its marketing suggests. Zerotrillionworld.it is one such platform generating attention — and concern — due to its structure, online footprint, lack of transparency, and strikingly aggressive claims.

This review provides a detailed, caution-based analysis of Zerotrillionworld.it. It does not assert fraud as fact; instead, it evaluates observable risk factors that traders and investors should carefully consider before engaging.

1. First Impressions & Why the Website Raises Concerns Immediately

Most reputable financial companies present:

-

clear business registration

-

traceable leadership

-

long-standing online presence

-

transparent physical headquarters

-

verifiable regulation

Zerotrillionworld.it does not provide this level of transparency.

Several issues typically stand out upon visiting platforms structured this way:

New or Recently Registered Domain

Platforms that appear suddenly with minimal history often raise concern within the trading community. Short domain age means:

-

no long-term reputation

-

no established track record

-

no user history that can be reliably evaluated

This lack of operating history makes it difficult for users to verify the platform’s credibility, reliability, or commitment to clients.

Minimal Corporate Identity

Professional financial companies normally display extensive “About Us” information. Zerotrillionworld.it, however, may offer:

-

no named founders

-

no team profiles

-

no verifiable company background

-

no identifiable corporate ownership

Anonymous or vague ownership is one of the strongest indicators that a platform should be approached with caution.

2. Unclear Regulation and Licensing Transparency

A trustworthy investment platform must be regulated by a recognized authority. Examples include:

-

FCA (UK)

-

CySEC (Europe)

-

ASIC (Australia)

-

FINMA (Switzerland)

However, platforms that target international users without clearly stating their regulatory body pose significant risks.

Why Lack of Regulation Is a Major Red Flag

Unregulated platforms:

-

are not legally required to safeguard user funds

-

are not audited

-

cannot offer verified financial protection

-

have no external oversight

-

can modify rules, fees, or conditions without accountability

If Zerotrillionworld.it does not provide a verifiable license number, it is essential to view the platform as unprotected territory for users.

3. Bold Claims of High Returns or Guaranteed Results

A common risk indicator in modern investment sites is the promise — or strong implication — of:

-

unusually high profits

-

safe or guaranteed returns

-

low risk with high reward

-

automated systems that “never lose”

If a platform positions itself as offering consistent gains or extraordinary returns with minimal effort, it is important to remain skeptical. The global financial markets simply do not operate that way.

Why These Claims Are Problematic

No legitimate trading platform can:

-

guarantee profit

-

eliminate market risk

-

deliver fixed returns from volatile markets

Strong promotional language is often designed to create urgency or trigger emotional decision-making.

4. Poor Transparency in Fees, Trading Conditions, or Withdrawal Policies

Reputable platforms publish clear documentation on:

-

spreads and fees

-

trading conditions

-

margin/leverage rules

-

withdrawal timelines

-

commissions

If Zerotrillionworld.it lacks transparent policies or buries critical details deep within vague documentation, this is a structural risk for users.

Common Problems with Platforms Structured This Way

Users often report:

-

difficulty withdrawing funds

-

unexpected fees

-

changing account requirements

-

new “verification steps” added during withdrawal attempts

Again, this review does not claim that Zerotrillionworld.it does this — but these are typical risks associated with platforms lacking transparency and regulation.

5. Limited or Suspicious Online Footprint

A legitimate platform usually has:

-

years-long digital footprint

-

a strong user community

-

third-party reviews

-

mentions in industry publications

Platforms with a minimal online history, unclear reviews, or inconsistent branding invite scrutiny.

Branding or Identity Inconsistencies

Some red flags to watch for:

-

brand name mismatches

-

stolen or AI-generated promotional content

-

reused templates from other questionable platforms

-

identical website structure to known high-risk investment sites

If Zerotrillionworld.it displays similar traits, it is prudent to analyze its authenticity carefully.

6. No Verifiable Physical Headquarters

Many unregulated investment platforms claim to be located in prestigious financial hubs such as:

-

London

-

Zurich

-

Singapore

-

New York

Yet these claims often lack evidence.

Why This Matters

A platform with no:

-

physical office

-

publicly listed address

-

confirmed business registration

cannot easily be held accountable for disputes, misconduct, or operational failures.

If Zerotrillionworld.it’s listed address (if any) appears vague, unverifiable, or used by multiple unrelated businesses, this is a critical red flag.

7. Overly Aggressive Marketing & High-Pressure Sales Behaviors

Users have identified consistent behavioral patterns among questionable platforms:

-

repeated calls from “account managers”

-

pushing for higher deposits

-

urgency tactics

-

promises that “opportunities expire soon”

-

pressure to invest more quickly

High-pressure sales is a known psychological tactic used to limit a user’s ability to research or think critically.

If Zerotrillionworld.it (or individuals representing it) displays similar behavior, extreme caution is advised.

8. Lack of Independent Third-Party Verification

Legitimate financial platforms often undergo:

-

audits

-

compliance inspections

-

independent ratings

-

reputational assessments

Platforms without third-party validation cannot demonstrate operational transparency.

If Zerotrillionworld.it has no:

-

audited statements

-

independent certifications

-

verified security standards

-

public financial disclosures

it becomes difficult to trust its statements regarding fund safety or investment performance.

9. Technical Red Flags: Hosting, Security, or Setup Issues

Technology also reveals much about a platform’s credibility.

Risks include:

-

shared hosting with many suspicious websites

-

low-cost server infrastructure

-

missing legal pages

-

poor or incomplete cybersecurity details

-

unprofessional design

-

broken links or incomplete features

Though not definitive, such issues commonly correlate with short-term, high-risk platforms intended to operate temporarily.

10. Summary: Why Users Should Approach Zerotrillionworld.it With Caution

Based on available structural indicators, Zerotrillionworld.it presents multiple red-flag characteristics, including:

-

unclear or absent regulation

-

anonymous ownership

-

lack of long-term online presence

-

unrealistic marketing claims

-

minimal transparency

-

unverifiable business details

-

potential high-pressure interactions

None of these automatically prove wrongdoing — but together, they form a profile widely associated with high-risk online investment operations.

Final Thought

Anyone considering involvement with Zerotrillionworld.it should thoroughly research the platform, prioritize safety, and examine all risk factors before making financial commitments.

-

Report Zerotrillionworld.it and Recover Your Funds

If you have fallen victim to Zerotrillionworld.it and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Zerotrillionworld.it persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.