WorldwideCapitalFX.com Scam Review: A Comprehensive Warning

In the fast-paced world of online trading, the promise of high returns and professional support draws in many hopeful investors. But unfortunately, not all trading platforms are built with investors’ best interests in mind. WorldwideCapitalFX.com has emerged in recent years with marketing that appeals to both new and experienced traders—but a close examination reveals a number of serious red flags. This in-depth review breaks down why WorldwideCapitalFX is considered highly risky, possibly fraudulent, and why potential users should proceed with extreme caution.

First Impressions: Polished but Suspicious

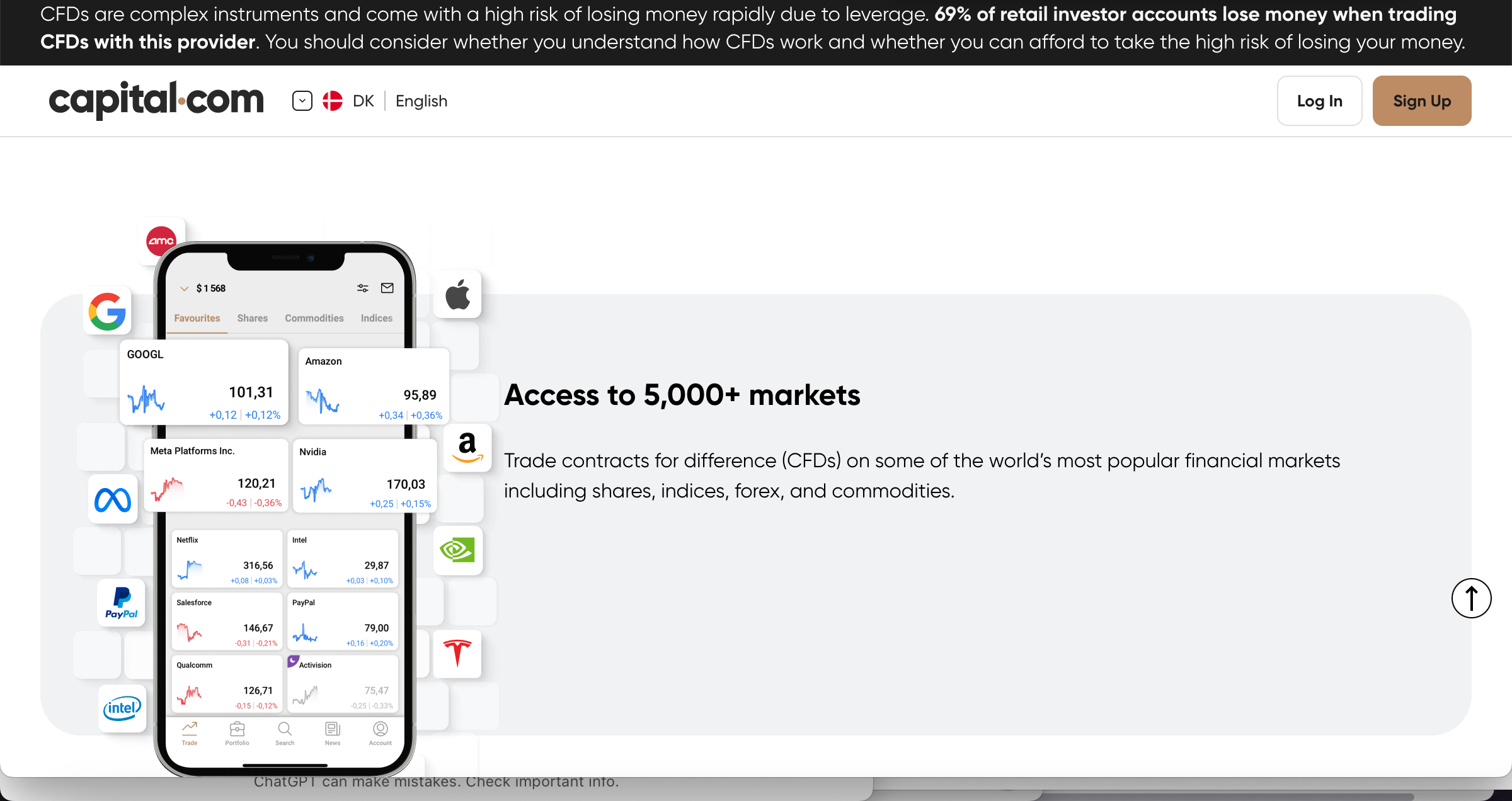

At first glance, WorldwideCapitalFX.com looks like a professionally constructed broker site. The homepage features sleek graphics, clean trading dashboards, and promises of lucrative investment plans. The site touts capabilities such as:

-

Forex and cryptocurrency trading

-

High-leverage accounts

-

Managed accounts or “expert” account managers

-

Fast deposit processing

-

Investment packages with attractive profit projections

Such a presentation is common among many legitimate brokers. However, in the case of WorldwideCapitalFX, the underlying substance is murky. While the design suggests sophistication and trustworthiness, critical details that should instill confidence are missing or poorly explained. The polished marketing appears tailored to gloss over deeper operational uncertainties.

Opaque Ownership and Management

One of the most alarming issues with WorldwideCapitalFX is how little information is provided about who runs the operation. A reliable broker typically discloses:

-

Corporate name and legal entity

-

Physical address of its headquarters

-

Names and credentials of the leadership or management team

-

Regulatory or compliance contacts

WorldwideCapitalFX offers almost none of this. There are no verifiable names of executives, no business registration details, and no published track record of the firm’s operations. This lack of transparency makes it nearly impossible for users to vet the company’s legitimacy or to hold anyone accountable in case of disputes. Anonymous ownership is a common tactic used by fraudulent platforms to avoid legal risk while gathering funds.

No Clear Regulatory Oversight

Regulatory oversight is a cornerstone of investor protection. Legitimate brokers are typically regulated by recognized financial authorities, which enforce rules like segregation of client funds, mandatory audits, and strict compliance protocols. WorldwideCapitalFX, by contrast, fails to present any credible regulatory registration. There is no publicly verifiable license number, nor is there an indication that the company is subject to established regulatory standards.

Without regulation, the following risks become real:

-

No guarantee that client funds are kept separate from company operating funds

-

No formal mechanism for dispute resolution through a financial authority

-

No obligation for periodic reporting or financial transparency

-

High potential for misconduct, manipulation, or misuse of deposited capital

The absence of regulatory control is among the most significant warning signs that WorldwideCapitalFX could be operating as a high-risk or fraudulent entity.

Promise of Unrealistic Returns

A recurring theme on WorldwideCapitalFX’s website is the promise of very high returns in a short time. They advertise:

-

Very large profit margins

-

Fast growth of deposits through “professional strategies”

-

Automated trading or trade-signal systems that supposedly generate consistent gains

-

No obvious mention — or a gross understatement — of risk

These kinds of promises are inherently suspect. Financial markets, particularly forex and crypto, are volatile and unpredictable. No trustworthy broker can legitimately guarantee large returns with little or no risk. Claims that suggest otherwise often serve to entice less experienced investors into making large deposits without fully understanding the dangers.

Platforms that promise “risk-free” or “guaranteed” profits typically lean toward high-yield investment schemes, rather than sustainable trading businesses.

Suspicious Trading Interface and “Simulated” Activity

Many users who have interacted with WorldwideCapitalFX report that the trading interface looks very polished, but the activity may not be genuine. Characteristics that raise concern include:

-

Account balances that increase in a very smooth, mechanical way

-

“Trades” that appear perfect or too successful, without losses

-

Price charts that don’t align with real market conditions

-

Very few or no real trade confirmations via market exchanges

-

Unrealistic “volume” or trade frequency

These symptoms strongly suggest that the platform may be simulating trades or using a fake trading backend. The goal appears to be to convince users that their investments are growing and that the system is reliable, thereby encouraging them to deposit more.

Deposits Seem Easy – Withdrawals Are Not

WorldwideCapitalFX makes depositing funds seem seamless and attractive. Their platform encourages:

-

Crypto deposits

-

Bank transfers

-

Various account “tiers” requiring larger initial deposits

-

Promotions or “bonus” deposit incentives

However, once the money is in, users frequently run into problems when trying to withdraw. Reports indicate that:

-

Withdrawal requests are delayed or denied.

-

Suddenly, new “fees,” “verification requirements,” or “tax obligations” are introduced.

-

Customer support recites convoluted explanations or is unresponsive.

-

Support may imply the user must deposit even more to “unlock” withdrawal functionality.

-

Users feel trapped, unable to leave with their initial capital or “earnings.”

This one-way flow encourages users to contribute more deposits while making it difficult to move money out, a structure common in scams.

Pressure and Sales Tactics

An often-overlooked aspect of fraudulent investment platforms is their use of emotional pressure. On WorldwideCapitalFX, many users describe:

-

Receiving phone calls, messages, or emails from “account managers” urging them to deposit more funds

-

Being told about limited-time “exclusive” investment plans or profit opportunities

-

Being promised special treatment, higher returns, or VIP status if they upgrade their accounts

-

Warnings that they might miss out or that their “growth window” is closing

These tactics lean heavily on urgency and the fear of missing out. They are not based on transparent financial planning or actual market opportunities, but on sales psychology. Legitimate brokers may offer support and advice, but they rarely rely on high-pressure recruitment to grow client funds.

Unqualified “Expert” Managers

WorldwideCapitalFX claims to provide expert account managers to help users navigate investment decisions. Yet, for many users:

-

The “managers” cannot produce verifiable credentials or trading track records

-

Their advice seems more concerned with getting users to deposit more than with real trading strategy

-

Their communication resembles sales calls more than advisory or educational discussion

Rather than offering genuine value as trading professionals, these managers appear to function primarily as high-pressure salespeople, whose primary goal is to convert leads into deposits.

Poor Customer Support and No Clear Escalation Path

A trustworthy broker provides comprehensive and responsive customer support — live chat, phone lines, knowledgeable personnel, and clearly documented escalation paths. WorldwideCapitalFX, unfortunately, exhibits all the hallmarks of weak support:

-

Slow or no responses to customer inquiries

-

Support scripts that repeat generic responses without resolving actual problems

-

No clear escalation team for complaints or verification issues

-

Lack of transparency in communications when users raise concerns about withdrawals or fraud

This poor service quality is a serious problem for any platform dealing with real money. If customer support disappears or refuses to engage meaningfully, users are effectively trapped in a system with little recourse.

Short Domain History and Weak Reputation

A deeper look at the history of WorldwideCapitalFX reveals signs that it may not be a long-standing, well-established broker:

-

The domain appears relatively new

-

There is minimal verifiable brand recognition in the broader financial trading community

-

Very few credible, independent reviews or reliable testimonials from long-term users

-

A limited online footprint beyond the platform’s own marketing materials

These characteristics are common in platforms that are built to gather deposits quickly, then rebrand, shut down, or disappear when complaints mount. A short or unstable domain history undermines claims of a serious, committed financial institution.

User Complaints and Warning Signs

Across user discussions and anecdotal reports, several recurring themes emerge:

-

Withdrawal Frustration – Many users struggle to withdraw, citing sudden fees, request denials, or indefinite delays.

-

Fake Profit Displays – Account holders see consistent gains, but those “profits” often collapse when attempting a cash-out.

-

Sales Pressure – Users describe being sold repeatedly on upgrading or depositing more, rather than being advised on risk.

-

Non-Responsive Support – When major issues arise, customer service either vanishes or becomes unhelpful.

-

Unclear Risk Disclosure – Risks are lightly or vaguely mentioned, while earning potential is heavily emphasized.

These user sentiments align with the structural red flags identified above, painting a disturbing picture of how WorldwideCapitalFX operates in practice.

Risk Assessment Summary

When evaluating WorldwideCapitalFX, the following risk factors stand out clearly:

-

Unregulated operation: No proof of licensing or oversight.

-

Hidden ownership: Anonymous operators make accountability difficult.

-

Suspicious trading activity: Simulated dashboards and “too-good-to-be-true” trade results.

-

Deposit-friendly, withdrawal-hostile design: Easy to invest, hard to cash out.

-

Manipulative sales strategies: Constant pressure to deposit more.

-

Unqualified “managers”: Salespeople disguised as expert account advisors.

-

Weak customer support: Unhelpful responses and limited escalation options.

-

Short operational history: Minimal reputation, no established presence.

Taken together, these risk factors suggest that WorldwideCapitalFX operates more like a high-risk or fraudulent investment scheme than a genuine broker.

Final Verdict: WorldwideCapitalFX.com Is Extremely High Risk

Based on the evidence and patterns outlined above, WorldwideCapitalFX.com raises many of the hallmarks commonly associated with scam-like platforms:

-

The business is opaque and anonymous.

-

There is no regulatory verification, making user funds vulnerable.

-

Promises of consistent, high returns seem unrealistic and structured to lure users.

-

The trading interface may be “fake,” showing simulated growth.

-

Withdrawal processes are suspiciously restrictive and unpredictable.

-

The use of high-pressure sales tactics seems central to the business model.

-

Sales agents pose as experts but seem more interested in securing deposits than helping clients.

-

Customer support is unresponsive when it matters most.

-

The platform has a short, murky history with limited independent validation.

In short, WorldwideCapitalFX appears to operate in a way that prioritizes deposit collection and retention — not honest trading or sustainable investing. For anyone considering putting money into this platform, the potential danger is significant.

-

Conclusion

While WorldwideCapitalFX.com presents a sleek and credible façade, the reality behind the scenes is fraught with risk. Its lack of transparency, unverified regulatory status, and problematic user experiences strongly suggest that it could be a deceptive trading operation rather than a trustworthy broker. For investors who value transparency, security, and regulatory protection, this platform carries too many warning signs to consider safely.

-

Report WorldwideCapitalFX.com and Recover Your Funds

If you have fallen victim to WorldwideCapitalFX.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like WorldwideCapitalFX.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.