Wisefexcapitallimited.com Scam Review – Legit or Scam?

In the fast-paced world of online finance, opportunities to grow your wealth are abundant—but so are the risks. With thousands of new investment websites emerging, distinguishing between legitimate platforms and scams is becoming increasingly difficult. One such platform under growing scrutiny is Wisefexcapitallimited.com, which presents itself as a modern investment firm offering profitable and “guaranteed” returns on capital.

This comprehensive review examines the inner workings of Wisefexcapitallimited.com, highlights its suspicious behavior, and explores why many believe this platform is not what it claims to be.

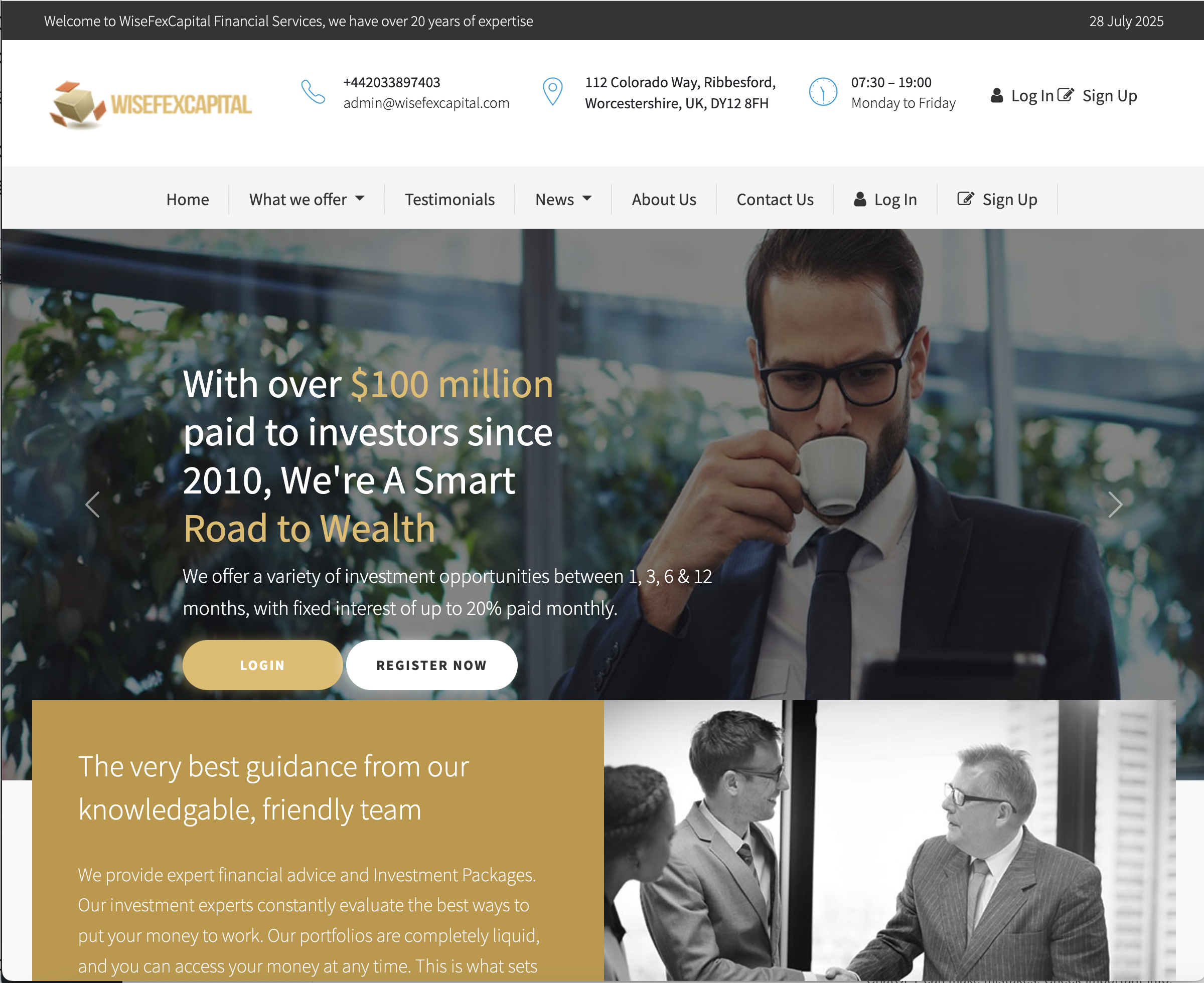

What Is Wisefexcapitallimited.com?

Wisefexcapitallimited.com claims to be an online investment firm providing access to:

-

Forex trading

-

Cryptocurrency investment

-

Commodities and stock options

-

Managed investment portfolios

-

“High-return” fixed plans

At first glance, the platform boasts a sleek, modern website filled with financial terminology, trading charts, and investor-friendly language. It markets itself as a trustworthy partner for beginners and experienced investors alike. However, a closer look reveals inconsistencies and signs that the platform might be part of a larger online fraud scheme.

How the Wisefexcapitallimited.com Scam Works

Scams like Wisefexcapitallimited.com often follow a strategic pattern designed to exploit the investor’s trust and eagerness for fast returns. Here’s how the typical scam process works:

1. Initial Approach

Most users report being contacted through social media or messaging platforms. Scammers posing as financial advisors or traders reach out with promises of helping you earn passive income through their “secure investment platform.”

2. Enticing Promises

The website shows high return rates, some even as high as 15% per week, along with testimonials and screenshots of successful withdrawals. These tactics are used to create urgency and reduce doubt.

3. Registration and Deposit

Users are asked to register and make an initial deposit, typically as low as $250 to gain access to the investment plans. Account managers then contact users to offer guidance and help “grow” the account.

4. Fabricated Profits

Once the deposit is made, the platform begins showing significant profits in the dashboard—often within hours or a few days. These numbers are entirely fake and meant to convince users to invest more.

5. Requests for More Funds

After seeing fake profits, users are encouraged to upgrade to a premium account, reinvest earnings, or participate in a “limited-time” plan that requires a larger deposit.

6. Withdrawal Blockage

When users attempt to withdraw their profits, they face various obstacles—unverified account issues, additional tax fees, or system errors. Some are told they must deposit more money before withdrawals can be approved.

7. Disappearance

Eventually, access is denied, support goes silent, and the investor realizes they’ve been defrauded. In some cases, the platform vanishes completely, only to reappear under a different name.

Major Red Flags Identified on Wisefexcapitallimited.com

Several critical red flags suggest that Wisefexcapitallimited.com is not a legitimate financial service provider:

1. No Regulatory Licensing

A trustworthy investment platform must be registered and regulated by a financial authority. Wisefexcapitallimited.com fails to mention any licensing information or oversight from bodies such as the FCA, SEC, or CySEC. The absence of this information is a major warning sign.

2. Anonymous Ownership

There is no transparency regarding who owns or operates the platform. No company registration details, physical address, or executive profiles are provided. This anonymity is typical of scam operations that disappear once they’ve gathered enough money.

3. Unrealistic Profit Promises

The platform offers guaranteed profits, high daily interest, and risk-free investments. This is not only unrealistic but also unethical. Genuine investment platforms never guarantee specific returns, especially not in high-volatility markets like forex or crypto.

4. Poor Website Content

Despite its polished design, the website contains grammatical errors, vague language, and duplicated sections. This is common with scam websites that reuse templates across multiple fake domains.

5. Fake Testimonials

The platform shows user reviews praising its services, but many appear fabricated. Profile images are often taken from stock photo websites, and testimonials lack verifiable names or links to actual investor experiences.

6. Suspicious Payment Methods

Most scam platforms insist on cryptocurrency payments, as they are difficult to trace and irreversible. If Wisefexcapitallimited.com primarily accepts Bitcoin or other crypto-only payments, this is another red flag.

What Victims Are Saying

Numerous users have come forward with complaints after dealing with Wisefexcapitallimited.com. Their stories often follow the same pattern:

-

Deposits vanish: After initial success, the account either stops working or begins showing losses out of nowhere.

-

No withdrawals: Users who try to withdraw funds are met with silence or excuses, and the requested amount is never released.

-

Account freezing: Some users report their accounts being “frozen” due to fake compliance issues.

-

Disappearing support: Once a user becomes suspicious or stops sending money, communication from the platform ceases entirely.

These user experiences confirm a clear pattern of fraudulent behavior.

Psychological Tactics Used to Deceive Investors

Scam platforms like Wisefexcapitallimited.com are designed not just to trick investors financially, but also to manipulate their emotions and decision-making. Here are a few tactics commonly used:

• False Sense of Urgency

Scammers claim there are limited-time offers or that spots in certain plans are filling quickly. This pushes users to act fast and skip research.

• Building Trust with Fake Success

Initial deposits may show small profits and even allow a minor withdrawal. This small “win” is used to gain the user’s trust before larger amounts are requested.

• Authority Pressure

“Account managers” speak in authoritative tones, use financial jargon, and claim insider knowledge to make the platform seem more legitimate.

• Fear of Missing Out (FOMO)

Users are shown fake testimonials or screenshots of others making huge returns to create social pressure and a fear of missing the opportunity.

Why Wisefexcapitallimited.com Is Dangerous

This platform poses a serious risk to investors—not only financially but also emotionally and personally:

-

Loss of Funds: Most users lose their entire investment, sometimes in multiple rounds of deposits.

-

Risk of Identity Theft: Many victims are asked to upload identity documents, which can be misused.

-

Repeat Targeting: Once someone is scammed, their information may be shared with other scammers who target them again.

-

Emotional Damage: Many victims report stress, shame, and regret after realizing they’ve been manipulated.

How to Protect Yourself from Similar Scams

Here are practical tips to avoid becoming a victim of fraudulent investment platforms like Wisefexcapitallimited.com:

✅ Check Regulatory Status

Only use platforms that are licensed and supervised by reputable financial authorities. Licensing information should be easily accessible and verifiable.

✅ Research the Company

Look for reviews, complaints, and warnings from previous users. Scam platforms are often discussed in forums and online watchdog communities.

✅ Avoid Guaranteed Returns

Any promise of fixed or high returns with no risk is a red flag. All legitimate investments involve risk.

✅ Use Traceable Payment Methods

Avoid platforms that demand cryptocurrency payments only. Legitimate companies accept credit cards, bank transfers, and secure payment gateways.

✅ Read the Fine Print

Always read the terms and conditions, refund policies, and privacy agreements before making any financial commitment.

Final Verdict: Wisefexcapitallimited.com Cannot Be Trusted

After careful analysis, it is evident that Wisefexcapitallimited.com shows nearly every sign of being an investment scam. Its lack of regulation, anonymous operations, unrealistic profit claims, and a growing list of user complaints all point toward a fraudulent agenda.

No credible financial platform guarantees returns, asks for extra payments to withdraw funds, or hides behind anonymity. If you are currently engaging with this website, it is strongly advised to stop all communication and avoid further deposits.

Investing online can be rewarding when done through verified, licensed brokers—but platforms like Wisefexcapitallimited.com only exist to deceive and defraud.

-

Report Wisefexcapitallimited.com and Recover Your Funds

If you have fallen victim to Wisefexcapitallimited.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Wisefexcapitallimited.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.