WealthChainPro.com Scam Review – Scam or Legit?

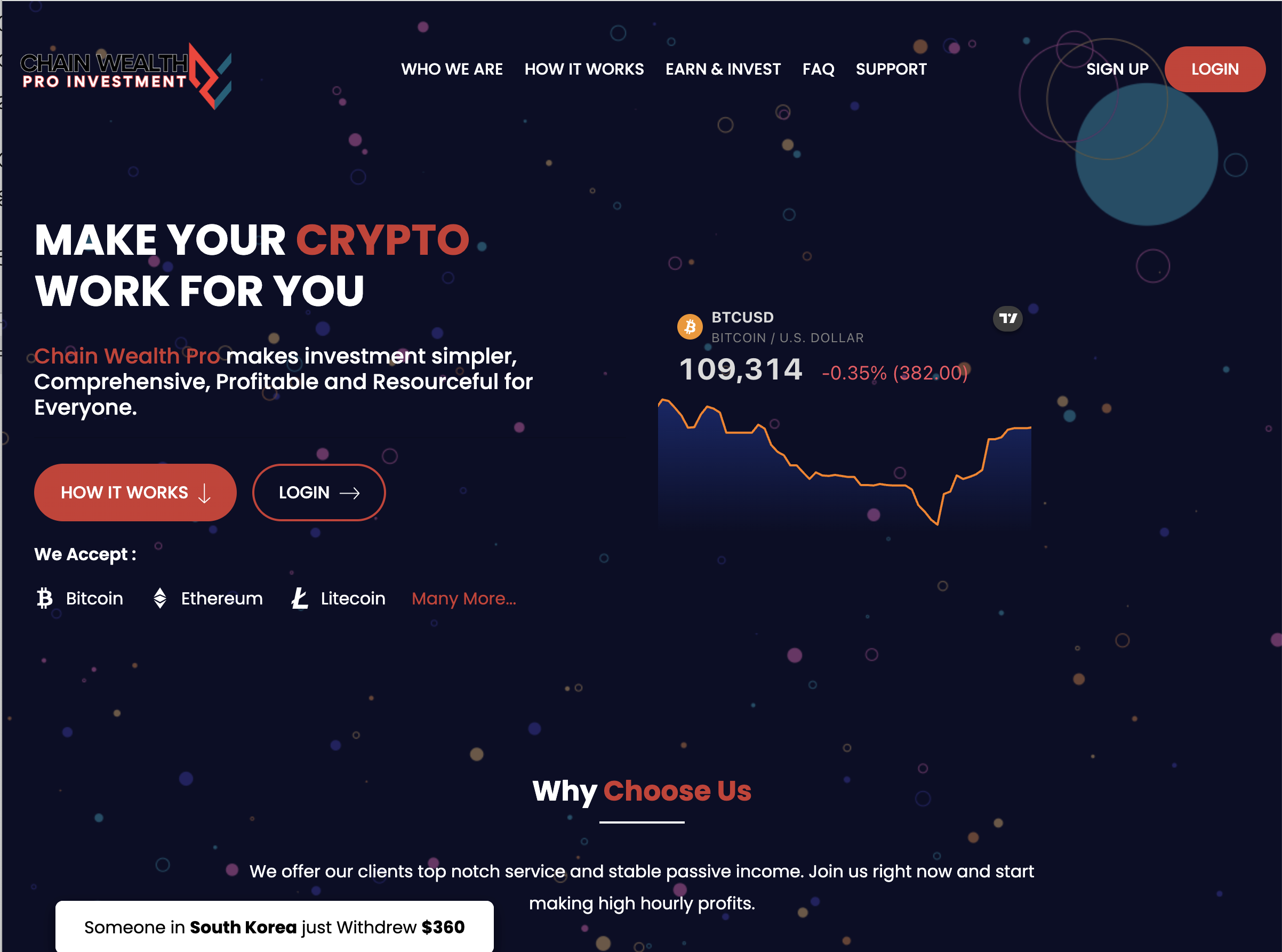

Online investment platforms offering high returns, passive income, or crypto gains are everywhere. Some may be legitimate—but others exist mostly to take users’ money. WealthChainPro.com is a platform that has raised multiple red flags. This review digs into the details: what WealthChainPro claims, what doesn’t add up, patterns of concern, and why you should approach it with caution.

1. Domain & Anonymity Red Flags

One of the first warning signs is that WealthChainPro.com’s domain is very new, having been registered recently. New financial-investment sites with little history often carry higher risk because there’s no long track record of performance, user interactions, or oversight.

Additionally, domain registration information is hidden or masked—meaning there’s no public transparency about who owns the site. Legitimate brokers or investment entities usually provide full corporate registration, registered address, leadership team, and publicly accessible contact details. When ownership is hidden, accountability vanishes.

2. Trust Scores & Automated Warnings

Automated reviewers and trust-algorithms flag WealthChainPro.com with very low trust scores. These systems examine many factors—domain age, whether ownership is anonymized, how the website is hosted, whether the site is listed or flagged by regulatory bodies, how popular or visible it is, whether SSL/security is valid, etc.

For WealthChainPro, many of those checks fail:

-

Ownership is hidden.

-

The site has minimal external feedback or user verification.

-

Hosting and registration data suggest a lack of stability or visibility.

These algorithmic warnings don’t prove fraud on their own, but they are serious “yellow lights” that point to risk.

3. Regulatory Warning & Lack of Authorization

WealthChainPro is explicitly listed in a warning list by a financial oversight agency in Switzerland. The watchdog has pointed out that the site claims some address in Zurich, but the company is not entered in the official commercial register there. This means it lacks required legal registration to carry out financial or investment services under those laws.

When a platform uses seemingly reputable addresses or names without having the formal legal standing or licensing, it’s often a tactic to give false legitimacy. Clients who rely on such unverified claims tend to end up with little or no protection in case of disputes.

4. Claims vs Evidence: What Doesn’t Check Out

WealthChainPro.com tends to make bold promotional claims—investment returns, passive income, “opportunities,” etc. But several aspects don’t add up:

-

No clear disclosure of how profits are generated. If a platform claims steady returns, testers or users often ask: what is the trading mechanism? Who are the partners/liquidity providers? Are earnings audited? For WealthChainPro, these details are either vague or missing.

-

Risk disclosures are minimal or hard to find. Any legitimate investment firm would lay out the risks—market, leverage, volatility—very clearly. With WealthChainPro, negative scenarios are downplayed or omitted.

This mismatch between flashy marketing and thin operational detail is classic for platforms that are more interested in attracting deposits than delivering sustainable investment.

5. Withdrawal & Access Problems

Though public accounts are mixed, recurring user complaints suggest that people who deposit with WealthChainPro have trouble withdrawing funds—especially profits. Common issues include:

-

Withdrawal requests are delayed or ignored.

-

Sudden additional requirements appear (verification, “bonus unlocks,” or volume thresholds).

-

When someone achieves a supposedly good balance, communication may become vague, and customer support becomes less responsive.

A site that accepts user funds freely but makes withdrawals difficult or obstructed is displaying one of the most serious warning signs of a scam brokerage or investment scheme.

6. Ownership of Addresses & “Registered Location” Claims

The site claims a business address in Zurich (Josefstrasse 218, 8005 Zürich), but regulatory records indicate no legal entity under that name is registered there. Using address names from reputable cities without matching corporate registration is a strategy some platforms use to mislead clients into thinking they’re dealing with a regulated, stable institution.

It’s a credibility tactic. But when the registration doesn’t match, it suggests an attempt at appearance rather than actual legitimacy.

7. Marketing, Testimonials & Bonus Structures

WealthChainPro uses marketing tools common in suspect investment schemes:

-

Promotions of bonuses, referral incentives, or special “investment tiers” to draw in more deposits.

-

Testimonials or “success stories” that are general and vague—often showing big gains but without substantive detail or independent verification.

-

Pressure or urgency suggested in marketing (limited “spots,” “exclusive opportunity,” etc.).

These are psychological tactics: they encourage individuals to decide quickly without fully verifying details.

8. Behavior Under Scrutiny & User Feedback Patterns

From forum reports and user reviews, there is a pattern:

-

Some users say they saw initial gains (on paper) but were unable to move that money out.

-

Others report support becoming much less responsive when withdrawal requests are made.

-

Several say that conditions appear after deposit—for instance, needing to reach a certain trading volume or pay additional fees before any payout.

These consistent complaints across different users suggest repeated behavioral issues.

9. Emotional and Financial Consequences

Users of WealthChainPro describe not only loss of money but also frustration, regret, and a sense of betrayal. The emotional toll often includes:

-

Loss of trust in other investment platforms.

-

Stress over financial planning when expected returns don’t materialize.

-

Time lost, hoping for payouts that don’t come.

These are real costs—even if small in dollar terms in some cases, the impact can be significant.

10. What a Safe Investment Platform Looks Like

Putting WealthChainPro next to known safer brokers highlights what to look for:

| Feature | What a Legit Platform Should Provide |

|---|---|

| Verified licensing in jurisdictions of operation | Clear registrations, disclosures, licensing visible |

| Transparent ownership & contact information | Names, addresses, corporate registrations, office addresses |

| Clear risk disclosures & realistic return expectations | Promises are always balanced with possible downside |

| Easy withdrawals with clear conditions | No surprise fees or hidden thresholds |

| Stable website & domain info | No domain masking, unclear registration, or frequent changes |

| Independent reviews and community history | Real people describing their experiences, verified by multiple sources |

Final Verdict: WealthChainPro.com Is High Risk

WealthChainPro.com exhibits many of the warning signs that strongly suggest it is a high risk, possibly fraudulent investment platform. New domain, hidden ownership, regulatory warnings, difficulties with withdrawal, and marketing heavy on promises and light on proof—all fit a troubling pattern.

If you are evaluating this site, extreme caution is warranted. It is safer to assume that risk is real and substantial until strong, verifiable evidence proves otherwise.

Report WealthChainPro.com and Recover Your Funds

If you have fallen victim to WealthChainPro.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like WealthChainPro.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.