WallWood Broker Scam Review — A Deep Dive

In the online trading world, a slick website and big promises can make even careful investors sit up and take notice. But unfortunately, beneath the surface many platforms are structured not to serve traders, but to extract deposits and vanish. WallWood Broker is one such platform that raises multiple alarms. This review breaks down how WallWood Broker markets itself, how it operates (or fails to), and why it should be considered extremely high-risk.

What WallWood Broker claims to be

WallWood Broker presents itself as a full-service online broker offering access to forex, commodities, indices, and possibly cryptocurrencies. Its website promotes features like:

-

MetaTrader4 support or “professional trading terminals”

-

High or “competitive” leverage (often up to 1:300 in user complaints)

-

“Tight spreads” or “ideal trading conditions”

-

Multiple account tiers (Basic, Silver, Gold)

-

Global coverage and “award-winning service”

On the face of it, this is what many legitimate brokers promise. But the devil is in the operational details — and in WallWood Broker’s case, the details don’t hold up.

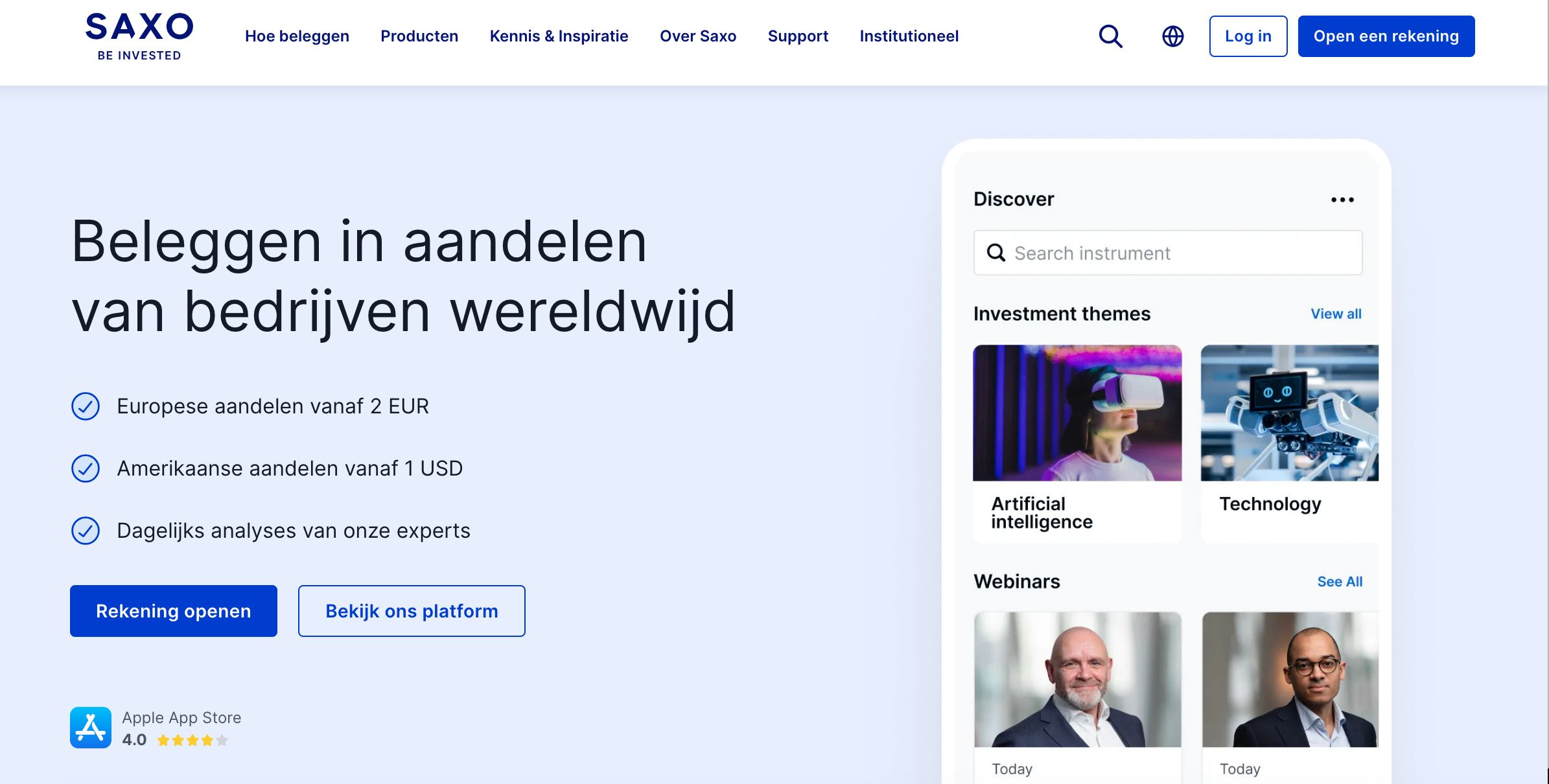

No verifiable regulation or license

One of the most critical issues: WallWood Broker lacks credible regulation. A legitimate broker should be registered with a recognized financial supervisor (such as the UK’s FCA, Australia’s ASIC, or Cyprus’s CySEC), publish its licence number clearly, and allow verification. WallWood Broker claims regulation in its website footer (citing the UK’s FCA and Italy’s CONSOB), but searches of the regulators’ public registers show no matching company or licence.

Without regulation:

-

Client funds may not be held in segregated accounts.

-

There is no legal guarantee in many jurisdictions that you’ll get your money back if the broker fails or acts illegitimately.

-

Trading conditions, withdrawals and pricing may all be subject to manipulation without oversight.

Platforms that falsely claim regulation are operating with one foot in a grey zone — or worse.

Hidden ownership and opaque company details

Transparency is fundamental for trust in a broker. Where is the company registered? Who are its directors? What is its share capital? WallWood Broker fails on most of these counts:

-

The website gives generic or inconsistent contact details and vague physical address claims.

-

The domain registration is anonymised or uses proxy services, masking the true ownership.

-

No audited accounts or banking partnership disclosure appears.

-

Terms & Conditions or User Agreements are either missing or extremely minimal — in some reviews the site even operated without a proper legal contract.

When a broker hides who is running it, accountability disappears. If something goes wrong, you have no entity to pursue and no regulator to enforce action.

Unrealistic promises and ambiguous trading conditions

WallWood Broker uses marketing language focused on “easy profits,” “elite accounts,” and “industry-leading leverage.” Yet actual user reports suggest:

-

Spreads advertised as low but in practice very wide, especially during volatile times.

-

Execution delays or platform freezes during major market moves.

-

Promotions of large leverage or special packages requiring large deposits with insufficient explanation of risk.

-

Emphasis on upgrades and more deposits to access better terms — rather than transparency and risk education.

The issue: if a broker emphasises profit and growth but offers little about risk, you’re likely dealing with a marketing machine rather than a responsible service.

Withdrawal issues and user complaints

One of the most concrete indicators of trouble is withdrawal problems. Reviews of WallWood Broker show that:

-

Initial deposits are accepted easily, sometimes with small “profits” credited on the platform to build confidence.

-

When a user requests a withdrawal of profits or their principal, the broker either delays indefinitely or imposes new conditions (e.g., trade volume requirements far above industry norms).

-

Some users report being asked to deposit additional “fees” or “taxes” before withdrawal.

-

If enough time passes or the withdrawal is denied, the platform may become unresponsive or change domain/name.

A broker that allows deposits easily but blocks withdrawals is not offering a genuine service — it is functioning more like a fund trap.

Referral models and pressure to deposit more

WallWood Broker also appears to rely on upselling and referral schemes:

-

Account upgrades to “Gold” or “VIP” levels often require large additional deposits and offer “better terms” which rarely materialise.

-

Referral or “introducer” programmes encourage current clients to recruit new ones — shifting the business model from genuine trading to deposit-recruitment.

-

The narrative often shifts from “trade well” to “invest more” or “upgrade now” once the user is inside.

When the broker’s business model looks more like recruitment of new funds than delivering trading value, the risk is much higher.

Technical and operational red flags

Beyond policy and marketing, other indicators of risk for WallWood Broker include:

-

Domain is relatively recent, or domain history shows multiple similar domains used in quick succession (suggesting re-branding).

-

Hosting or platform setup uses generic “web-traders” rather than well-known platforms with clear audit trails. In many reviews, the “MT4” claim is not backed by real terminal downloads but a basic web interface.

-

Lack of external audit of account management, trade logs, or segregation of funds.

-

Terms and Conditions that give the broker wide discretion (e.g., “we may change pricing/spreads at any time,” “we may refuse withdrawals under our discretion”).

These structural weaknesses accentuate the risk — they mean you’re trusting not a regulated entity but an anonymous operator behind a website.

Why WallWood Broker fits the scam broker profile

When all this evidence is pulled together, WallWood Broker aligns with what analysts call a “scam broker” model:

-

Attractive marketing with promise of easy gains.

-

No credible regulation or transparent ownership.

-

High leverage, high deposit requirement, referral/upsell pressure.

-

Withdrawal problems and client complaints.

-

Domain anonymity and technical platform issues.

While not every unregulated broker is a scam, the convergence of these many red flags in WallWood Broker’s case places it firmly in the “high-risk/likely fraudulent” category rather than a serious trading partner.

Important takeaways for traders

If you ever come across a broker like WallWood Broker, keep these lessons in mind:

-

Always verify regulation by searching official regulatory websites for the broker’s licence number. If you cannot find it, assume high risk.

-

Ensure you can withdraw a small amount easily before committing large funds. If withdrawal is blocked or delayed, that’s a red flag.

-

Be sceptical of brokers that emphasise profit over risk, push account upgrades, or recruit friends. Genuine brokers emphasise risk, provide education, and allow you to trade transparently.

-

Check who is behind the company: company registration, physical address, leadership details. Anonymous ownership = less accountability.

-

Review multiple independent sources for complaints — consistent negative reports around one platform mean the risk is real.

Final verdict

WallWood Broker (wallwoodbroker.com) is not a trustworthy broker. Its claims of regulation are unsubstantiated, its ownership is hidden, its trading conditions are unrealistic and somewhat opaque, and client reports consistently point to withdrawal issues and manipulation. For anyone considering depositing funds with this platform: the risk is extremely high.

In the online trading space, transparency, regulatory oversight, verified ownership and reliable withdrawal records matter most. WallWood Broker fails to meet those standards. If you’re seeking to trade online, you’ll be better protected choosing a broker with proven credentials, clear licensing and a strong track record — rather than betting on the promises of a platform with so many warning signs.

-

Report WallWood Broker and Recover Your Funds

If you have fallen victim to WallWood Broker and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like WallWood Broker persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.