Voskcoins Scam Review — A Deep Dive

In the booming world of cryptocurrency and cloud‑mining investments, many new names surface promising high returns, passive income, and minimal effort. One such name is Voskcoins — a brand which, depending on the domain you encounter (e.g., “voskcoins.com”, “voskcoins.co”, “voskcoin.net”, “voskcoin.network”), claims to offer mining contracts, token purchases, or investment packages with attractive yields. Yet, beneath this flashy exterior lie warning signs of deceptive operations, hidden risk, and likely fraud. This review explores how Voskcoins operates, the serious red flags surrounding it, and why investors should approach with caution.

What Voskcoins presents itself as

Voskcoins markets itself in the following way:

-

Promises of cloud mining contracts or token investments, suggesting that users can invest a sum and then receive daily or weekly returns from mining profits or token value growth.

-

A seemingly professional website, with testimonials, dashboards showing “profits”, affiliate referral bonuses, and claims of “passive income.”

-

Appeal to both newcomers and experienced investors: “no hardware needed,” “mine from home,” “join our mining farm,” or “early token allocation.”

-

Referral or commission plans highlighting rewards for bringing in new investors, along with higher tier “contracts” for larger deposit amounts.

All of this is designed to lure people into believing that they are getting access to real mining or token gains, effortlessly. However, the promise of high returns with minimal transparency is the hallmark of many crypto‑fraud schemes.

Key red flags in transparency and legitimacy

When one investigates further, the transparency and legitimacy of Voskcoins collapse:

Lack of credible ownership or registration

A legitimate mining or investment operation will publicly disclose the management team, corporate registration, physical location, regulatory registration (if applicable), and audit documents or proof of operations. Voskcoins does not provide verifiable details of the team behind it. Domain registrations are often masked via privacy services, ownership is hidden, and no clear legal entity is documented.

Vague business model and no proof of mining infrastructure or token liquidity

Many users report that the mining or token model is not reasonably explained: how many miners are used, what the hash‑rate is, where the data centre is, what the power cost is, how the token trades on exchanges, and how liquidity is provided. Voskcoins lacks independent verification of mining operations or token listing volume. This lack of proof means the value proposition is more hypothetical than real.

Unrealistic return guarantees

Voskcoins advertises what appear to be “too good to be true” returns — daily earning percentages, short‑term contracts with “principal returned,” or guaranteed profits. In genuine crypto/mining operations, returns are variable, subject to changing difficulty, coin price fluctuations, hardware breakdowns, and market risk. When a platform claims very high, consistent returns with little risk, this is a major warning sign.

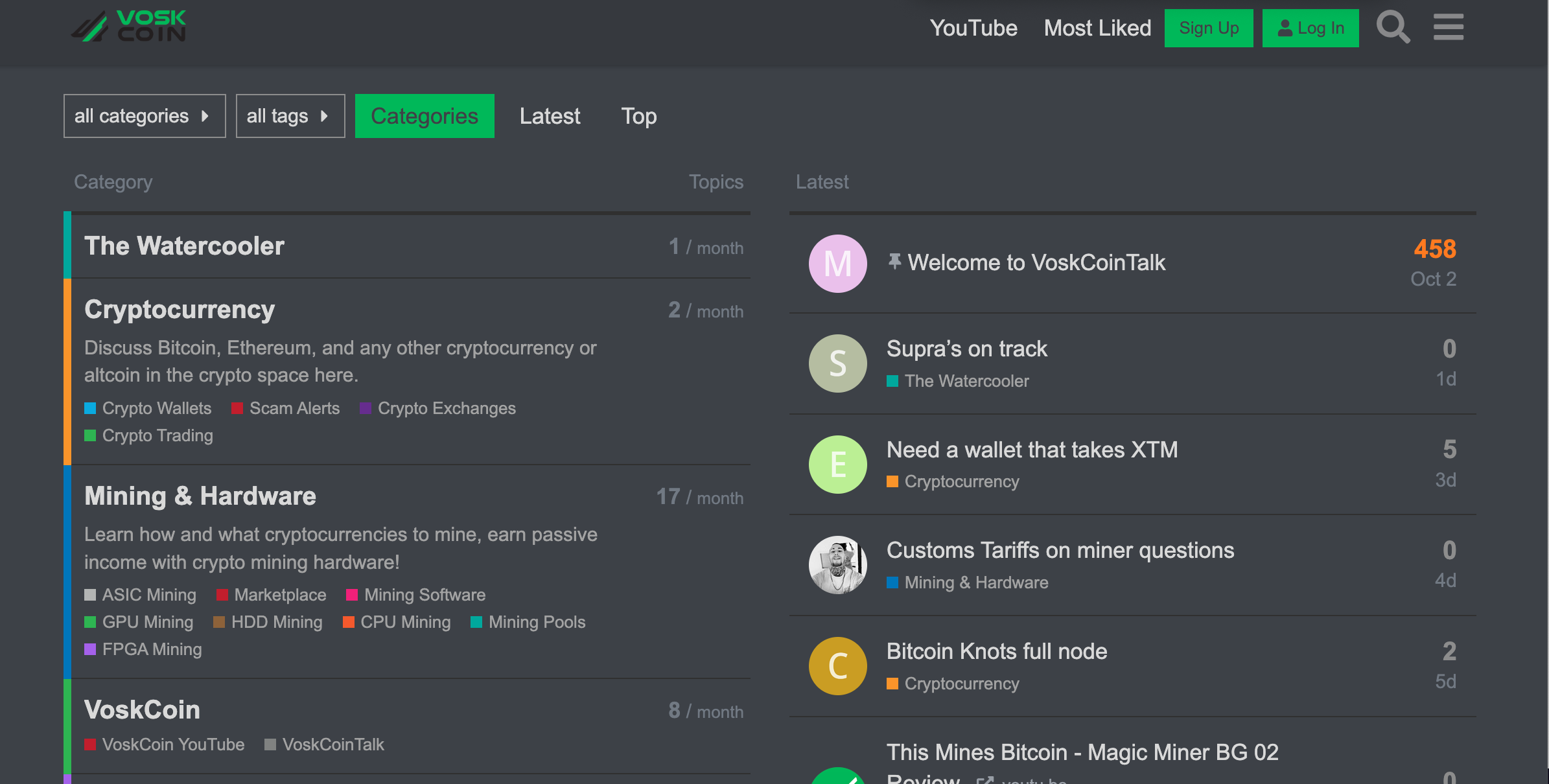

Duplicate or fake testimonials,‑ misleading branding and impersonation

In forums and independent review threads, many reports claim Voskcoins is impersonating other known individuals or brands. There are disguised brands using names similar to real miners or YouTubers — for example, “VoskCoin” is a well‑known crypto YouTuber/miner, and scammers have used similar names/domains to mislead people. Reviewers point out that the platform imitates official channels in order to exploit trust. This impersonation is a serious red flag.

Reports of withdrawal difficulty and user complaints

A consistent pattern among user reports of Voskcoins is the initial allowance of small deposits and small withdrawals, followed by larger deposits becoming trapped or blocked. The sequence often goes like this:

-

A user deposits a modest amount to test the platform (say $100‑$500).

-

The dashboard shows incremental “profits” credited, sometimes a small withdrawal is processed, building trust.

-

The user is encouraged to invest a larger amount (e.g., $1,000 or more) in “premium contract” or “VIP mining package.”

-

When a withdrawal of larger sums or principal is requested, the platform either demands extra verification or “maintenance fee”, “tax fee”, “upgrade to VIP” or simply the withdrawal is stalled or never executed.

-

Contact details or support disappear, the site goes offline or restricts access, and funds become inaccessible.

-

Complaints in forums detail this exact pattern and warn others.

This behaviour is indicative of a Ponzi‑style operation or a short‑term scam: light payouts at first, followed by blocked exits when the amounts grow.

Hidden referral model and recruitment pressure

Another significant concern is the referral or affiliate system built into Voskcoins:

-

Multiple levels of referral commission encourage existing “members” to recruit new depositors, which amplifies the flow of new funds.

-

The marketing emphasises “get paid for everyone you bring in,” “upgrade your tier and earn more,” suggesting a dependency on recruitment rather than genuine mining or trading profits.

-

Many users report that once they became active referrers, they were pressured to invest more themselves, upgrade packages, and bring in others to unlock promised benefits.

This recruitment‑dependent model is often a central axis of fraudulent investment schemes, because profit relies on new deposits rather than sustainable operations.

Domain history, technical and operational weaknesses

From a technical and operational perspective, Voskcoins exhibits numerous weaknesses:

-

Domain registrations are recent or recurrent: several variants appear (e.g., “voskcoins.com”, “voskcoins.co”, “voskcoin.net” ), pointing to re‑launches under new names once a domain becomes discredited.

-

Domain ownership typically uses privacy services, making research into the owners or hosting opaque.

-

Fake or reused site templates are noted across different domains that use nearly identical content, copy/pasted text, or testimonials, which suggests a network of scam sites rather than a single legitimate operation.

-

There is minimal evidence of third‑party audits, hardware proof photographs with verifiable metadata, or blockchain‑based verification of mining output or token distribution.

All of these technical indicators suggest that the operation is not set up for long‑term legitimacy but maybe structured for quick deposits and exit.

Why Voskcoins fits the classic scam profile

Putting it all together, Voskcoins fits almost every major hallmark of online crypto investment scams:

-

Anonymous and unverified owners

-

Lack of audited infrastructure or token liquidity

-

Unrealistic profit promises with minimal risk disclosed

-

Referral recruitment and upgrade pressure

-

Withdrawal issues, blocked exits, and disappearing support

-

Domain churn and impersonation of legitimate brands

-

Urgency and “too good to be true” marketing

When a platform exhibits this combination of traits, the probability that it is operating as a fraudulent scheme is very high.

Lessons for investors and key takeaways

For anyone considering platforms like Voskcoins, here are critical lessons and caution signals:

-

Verify the team and entity behind the service: If you cannot find credible backgrounds, company registration, or contact details, be extremely cautious.

-

Check for independent proof of operations: Mining or token operations should have public audit reports, exchange listings, wallet transparency, or third‑party verification.

-

Be cautious of promises of guaranteed returns: All real investments carry risk — high promises require scrutiny.

-

Test withdrawal with small amounts: A low deposit, then request a withdrawal and evaluate whether the process is smooth and transparent.

-

Avoid “upgrade to win more” pressure: If you’re told that you must invest more or recruit others to unlock benefits, ask why the business requires your recruitment rather than organic profit.

-

Research domain and history: If the site swapped domains multiple times or is very new, it increases risk.

-

Look for impersonation: If the site claims a famous name but the legitimate entity publicly disowns it, that is a critical red flag.

Conclusion

While the world of crypto and cloud mining holds genuine opportunities, platforms like Voskcoins demonstrate the danger of polished websites masking high-risk or fraudulent models. Numerous indicators — hidden ownership, unrealistic returns, referral pressure, difficulty withdrawing funds, and technical opacity — combine into a strong case that Voskcoins is not a legitimate investment service but rather a highly risky operation designed to extract deposits.

Anyone encountering offers from Voskcoins or similar platforms should assume the risk is extreme, and should avoid depositing significant amounts until extensive verification is completed.

-

Report Voskcoins and Recover Your Funds

If you have fallen victim to Voskcoins and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Voskcoins persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.

Author