VIX500.com Scam Review – Customers Report

The rise of online trading has created countless opportunities for investors around the world. Unfortunately, it has also opened the door for deceptive platforms that exploit the excitement and inexperience of traders seeking quick profits. One platform that has recently attracted negative attention is VIX500.com. While it presents itself as a modern and sophisticated trading broker, a deeper analysis reveals several warning signs that suggest it may not be a safe or reliable option for investors.

This scam review examines VIX500.com in detail, highlighting its business practices, transparency issues, and the risks traders may face when dealing with this platform.

What Is VIX500.com?

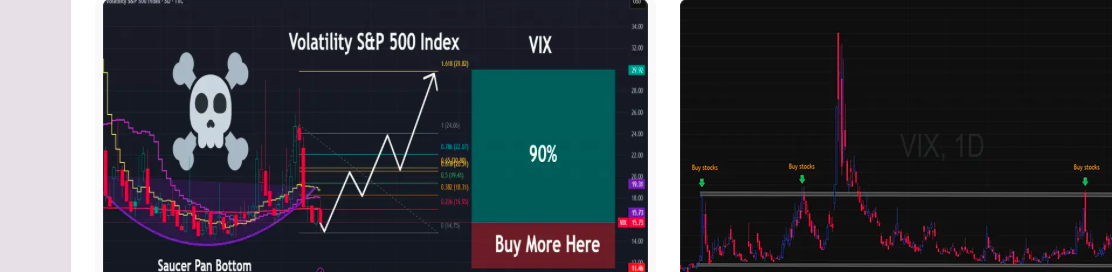

VIX500.com claims to be an online trading platform offering access to various financial markets, including forex, indices, commodities, and cryptocurrencies. The website promotes advanced trading tools, fast execution, and professional support services. At first glance, it appears to cater to both beginners and experienced traders, positioning itself as a comprehensive solution for online trading.

However, when evaluating any broker, it is crucial to look beyond marketing claims. In the case of VIX500.com, several aspects of its operation raise serious concerns.

Lack of Regulatory Oversight

One of the most significant red flags associated with VIX500.com is the absence of clear regulatory information. Reputable brokers are licensed and supervised by recognized financial authorities, which enforce strict standards to protect investors. These standards typically include capital requirements, client fund segregation, and transparent reporting.

VIX500.com does not provide verifiable evidence of regulation by any well-known financial authority. The platform either offers vague statements about compliance or avoids disclosing regulatory details altogether. This lack of oversight means there is no external body ensuring fair practices or safeguarding client funds, leaving investors exposed to unnecessary risk.

Unclear Company Background

Transparency is a cornerstone of trust in the financial industry. Legitimate brokers clearly disclose their legal entity, registration details, physical address, and jurisdiction of operation. In contrast, VIX500.com provides little to no concrete information about the company behind the platform.

The absence of identifiable ownership makes it difficult for users to verify who they are dealing with. This anonymity is a common characteristic of scam brokers, as it allows operators to avoid accountability and disappear easily if problems arise.

Questionable Account Structures

VIX500.com advertises multiple account types designed to appeal to different categories of traders. These accounts often promise enhanced benefits such as higher leverage, tighter spreads, and personalized support. While this may sound attractive, the details surrounding these account offerings are often unclear.

In many cases, important information about minimum deposits, fees, and trading conditions is either buried in fine print or not disclosed at all. This lack of clarity can result in unexpected costs and unfavorable conditions for traders once they have already committed funds.

High-Risk Trading Conditions

The platform appears to promote high leverage options, which significantly increase trading risk. While leverage can amplify profits, it can also magnify losses just as quickly. Due to these dangers, many regulators impose strict limits on leverage for retail traders.

The fact that VIX500.com seemingly offers excessive leverage without proper risk disclosures suggests a disregard for investor protection. Such practices often benefit the broker rather than the trader, especially when combined with opaque trading conditions.

Aggressive Sales and Marketing Practices

Another concerning aspect of VIX500.com is its reported use of aggressive marketing tactics. Traders have described receiving frequent phone calls and messages encouraging them to deposit more money. These communications often create a sense of urgency, implying that users may miss out on lucrative opportunities if they do not act quickly.

In some cases, representatives may present themselves as financial experts or account managers offering guidance. However, legitimate brokers do not pressure clients or promise profits. High-pressure sales tactics are a common indicator of fraudulent operations.

Deposit-Friendly, Withdrawal-Resistant Behavior

A recurring issue with platforms like VIX500.com is the imbalance between deposit and withdrawal processes. Depositing funds is typically quick and straightforward, but withdrawing money can become a major challenge.

Users have reported delays, repeated requests for documentation, unexpected fees, and additional trading requirements imposed at the withdrawal stage. Such obstacles often appear only after a trader attempts to access their funds, raising serious concerns about the platform’s intentions.

Trading Platform Concerns

VIX500.com claims to offer a reliable and advanced trading platform. However, there is limited information about the technology used or whether it has been independently audited. Many untrustworthy brokers rely on proprietary web-based platforms that lack transparency.

Without independent verification, traders cannot be certain that prices, execution speeds, and account balances are accurate. This creates opportunities for manipulation, including artificial losses or altered trade outcomes, all of which work against the trader’s interests.

Misleading Promotions and Bonuses

Promotional offers are another area of concern. VIX500.com may advertise bonuses or special incentives to encourage deposits. While these offers can seem appealing, they often come with restrictive terms that make it difficult to withdraw funds.

Bonus conditions frequently include high trading volume requirements that are unrealistic for most traders. As a result, users may find themselves unable to access their own money unless they meet conditions that heavily favor the platform.

Targeting Inexperienced Traders

Platforms like VIX500.com often focus their efforts on new or inexperienced traders. Educational materials and tutorials may be presented as value-added services, but they are typically basic and designed to build trust rather than provide meaningful knowledge.

Beginners are more likely to be influenced by confident promises and professional-looking websites. Without sufficient experience, they may not recognize the warning signs until they encounter problems with withdrawals or account access.

Customer Support Issues

Reliable customer support is essential for any legitimate trading platform. In the case of VIX500.com, user feedback suggests that support quality is inconsistent at best. While representatives may be responsive during the deposit phase, communication often deteriorates once issues arise.

Unanswered emails, delayed responses, and vague explanations are common complaints. Poor customer support further undermines confidence in the platform and leaves traders without assistance when they need it most.

Financial Risks for Investors

The combination of unverified regulation, anonymous ownership, and questionable practices presents a serious risk to investor funds. Without regulatory protection, there is no assurance that client money is kept separate from operational funds or handled responsibly.

If the platform experiences financial difficulties or engages in misconduct, users may have little to no protection. This makes trading on VIX500.com a high-risk endeavor that could result in significant financial loss.

How Traders Can Avoid Similar Platforms

The situation surrounding VIX500.com highlights the importance of thorough research before choosing a broker. Traders should always confirm regulatory status, verify company information, and read independent reviews from multiple sources.

It is also wise to avoid platforms that promise guaranteed returns, pressure you to invest quickly, or lack transparency about fees and conditions. Caution and skepticism are essential tools in protecting your capital.

Final Verdict on VIX500.com

Based on the numerous red flags identified, VIX500.com exhibits many characteristics commonly associated with scam or high-risk brokers. The lack of regulatory oversight, unclear company background, aggressive sales tactics, and withdrawal-related complaints all point to a platform that does not prioritize trader safety.

Investors should exercise extreme caution and consider safer, well-regulated alternatives when entering the online trading market. While the promise of fast profits may be tempting, preserving your capital and working with transparent, regulated brokers should always come first.

-

Report VIX500.com and Recover Your Funds

If you have fallen victim to VIX500.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like VIX500.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.