Vestocoin Scam Review — A Deep Examination

In the booming world of cryptocurrencies and digital investment platforms, shiny new projects emerge every week, promising high returns, innovative tokens, and “next-gen” blockchain utility. One such name that has surfaced is Vestocoin. On surface level it appears like yet another crypto token offering big gains — but when you dig deeper, the warning signs mount. This review unpacks what Vestocoin claims, how it operates (or appears to operate), and why it fits the profile of a scam platform.

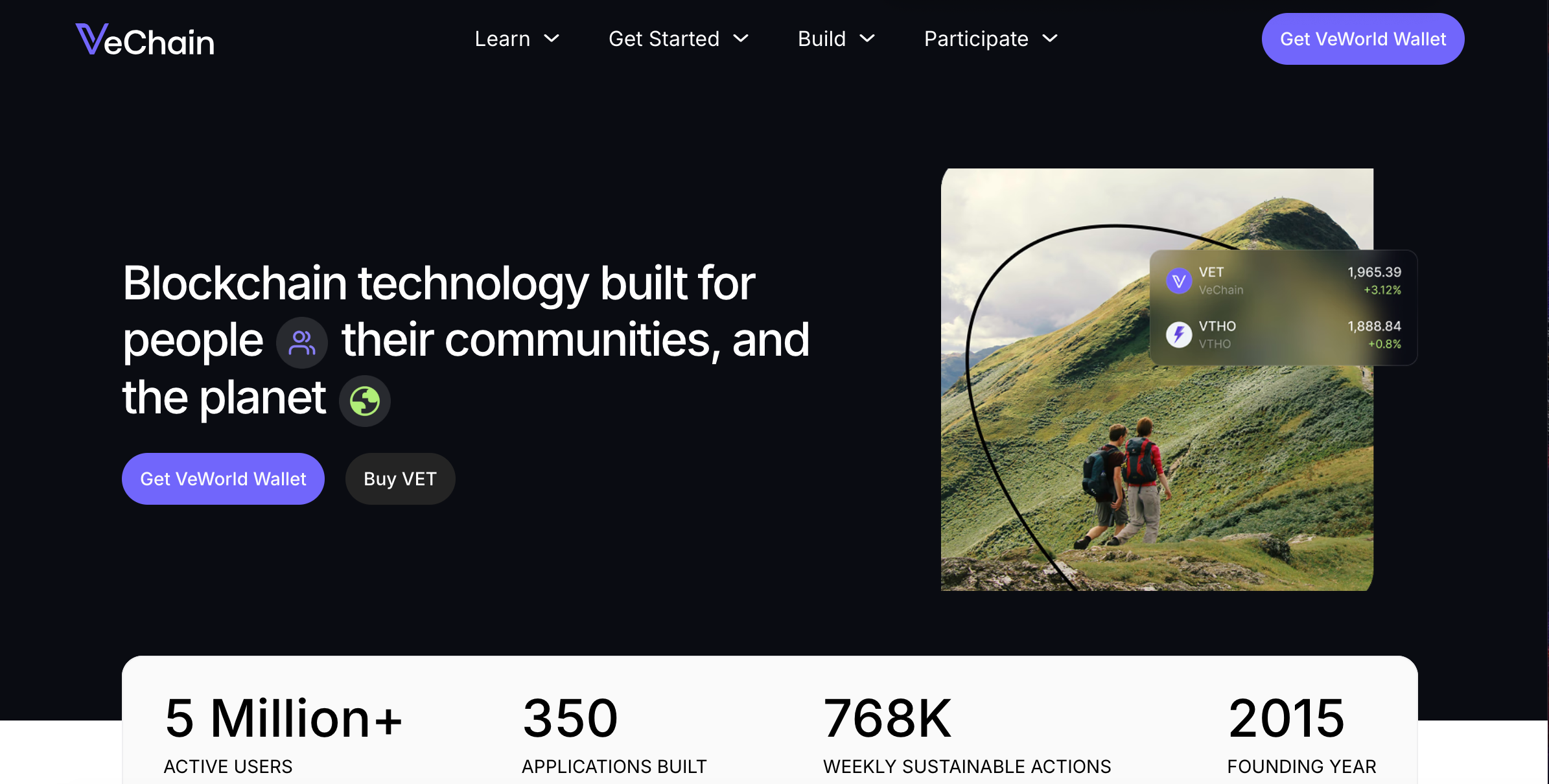

What Vestocoin presents itself as

Vestocoin markets itself as a digital currency or token initiative designed to give early investors exceptional upside. Its branding includes token issuance, references to a blockchain ecosystem, token holdings and “investment potential.” For example, there are profiles showing massive token issuance (e.g., 10 million+ tokens created).

The platform presumably invites users to buy into this token, hold it, maybe trade it, and benefit from projected value growth. The narrative is one of joining early, investing now and reaping value later.

At first glance, this might feel like a typical altcoin launch — but the devil is in the details.

Lack of transparency and missing verifiable details

One of the most obvious red flags with Vestocoin is the lack of verifiable company or operational information. Legitimate crypto projects usually provide clear documentation: who the founders are, where the company is registered, tokenomics details audited, smart contract addresses, roadmap verifiable, exchange listings confirmed, etc. With Vestocoin, that transparency is missing or extremely weak.

-

No clear team identity: The individuals behind the token issuance remain anonymous or unverified.

-

No credible tokenomics documentation: While there may be token numbers shown (e.g., millions of tokens created), there is little explanation of distribution, vesting, unlock schedules, audit of contracts, or exchange liquidity.

-

Minimal verifiable market presence: There is little public trading volume or credible listings on major exchanges that one can easily confirm.

-

The “ecosystem” is vague: The promise of utility or real-world usage is weakly defined, making it difficult to assess if the token has any genuine value beyond hype.

When a project lacks these foundational pieces, it’s very difficult to treat it as a credible investment.

Unrealistic promise of value or returns

Another pattern common with scam token launches — and present with Vestocoin — is the promise of outsized or rapid gains. The marketing around “join early,” “massive upside,” “token value will multiply,” etc. all aim to drive enthusiasm and deposit from investors.

In legitimate markets, token value depends on utility, demand, clearance, exchange listing, liquidity and fundamental usage. Without those, value claims become speculative at best. Vestocoin’s structure appears more reliant on investor expectation than on operational fundamentals. That means the main benefit for early participants is recruitment of more participants or hype, rather than real trading or usage.

Hidden ownership and domain risk

Integral to assessing platforms like Vestocoin is domain ownership and registration transparency. Many scam platforms hide domain registrant information, use privacy shields, or are only a few months old. Such practices reduce accountability and make it easier for the operators to vanish or rebrand later.

With Vestocoin, the domain appears fairly new, and key ownership details are masked or non-transparent. That increases risk significantly: if the platform fails or disappears, there is no legal entity you can hold accountable. The anonymity is a strong warning sign.

Weak or non-existent liquidity / trading volume

One of the practical tests of a token’s credibility is: can you easily buy/sell it? Does it have meaningful trading volume on reputable exchanges? Are there independent charts and data showing price movement, liquidity depth, and real-world trades?

In the case of Vestocoin, reports and public listings are minimal or extremely limited. The absence of strong exchange integration suggests that even if you acquire tokens, you may have trouble exiting them or realizing value. Many scam tokens rely on this illiquidity to trap investor funds — one can buy, but the selling pressure means the token price can collapse or cannot be exited.

Fake marketing, testimonials and hype

A typical feature of scam platforms is reliance on aggressive marketing and hype rather than substance. You’ll see testimonials, “success stories”, social proof, referral incentives, and “limited time offers” — all designed to push participants into depositing or buying quickly without thorough due diligence.

Vestocoin exhibits such features: the narrative emphasises early joining, big token creation numbers, apparently generous distribution to token holders, and implies that the value will rise dramatically. However, behind that hype there is little independent verification. When testimonials cannot be validated or appear generic, they become marketing tools rather than indicators of genuine success.

Likely Ponzi-style or speculative token structure

Putting the above factors together, the operational model of Vestocoin strongly resembles a Ponzi-style or speculative token scheme:

-

Investors buy tokens based mainly on promised future value rather than clear utility.

-

Early participants may get small gains or the illusion of value growth (to build trust).

-

Growth of token value depends largely on new investor money or hype rather than sustainable earnings.

-

Once incoming investment slows, the value collapses or becomes illiquid, leaving many investors unable to exit.

This model is unsustainable over time, and many tokens with similar footprints collapse once the “new investor” inflow diminishes.

Why Vestocoin fits every major red-flag category

To summarise why Vestocoin should be treated with caution:

-

Anonymous or unverified team – No credible founders or oversight.

-

Lack of regulation or company registration – No verifiable legal entity behind the token.

-

Vague utility – The token’s usage and value proposition are not clearly defined or verifiable.

-

Illiquidity and poor exchange presence – Without real trading volume, value cannot be realized.

-

Aggressive marketing and unrealistic promises – The narrative targets early investment rather than long-term value.

-

Domain anonymity / short lifespan – The token’s domain registration and hidden ownership add risk of disappearance.

-

Reliance on new investor inflows – The model appears dependent on new money rather than revenue or usage.

When a project exhibits this combination, it meets the typical profile of a high-risk or fraudulent token platform.

Practical consequences for investors

For individuals involved with Vestocoin (or considering involvement), the following outcomes are plausible:

-

You may buy tokens at a low price, believing you are getting in early — but lack of liquidity means you might not be able to sell without large losses.

-

Even if your token holding is visible, the value may be driven only by inflated numbers displayed on the website or by hype, not by real trading or usage.

-

Deposit or purchase funds may be directed into wallets controlled by the token’s operators — not invested in any underlying asset or service.

-

As the flow of new investors diminishes, token value will stagnate or crash, and the platform may go offline.

-

With no verifiable company or regulatory backing, you have limited recourse if funds are lost or token value disappears.

In short: being early does not guarantee profit; with Vestocoin the risk of loss may be extremely high.

Lessons for others evaluating similar tokens

To avoid ending up in the same position as Vestocoin’s investors, consider these protective checks for any token:

-

Verify who the team and founders are — do they have credible backgrounds?

-

Check for audited smart contracts and public tokenomics (supply, vesting, distribution).

-

Confirm meaningful exchange listing and trading volume (so you can realistically exit).

-

Read the utility proposition: What is the token used for? Can you see actual usage?

-

Check domain registration and company legal entity information (is it hidden or transparent?).

-

Be wary of guaranteed returns or revenue-sharing promises — crypto is volatile and all tokens carry risk.

-

Test small transactions: if you can’t easily sell or withdraw value, the token may be illiquid or locked.

-

Watch for aggressive referral programs and high pressure to invest quickly — these often signal dependency on new money.

If a token fails many of these checks — like Vestocoin does — it should be considered highly speculative or unsafe.

Final verdict: treat Vestocoin as a likely scam

In conclusion, Vestocoin (vestocoin.com) shows all the structural and behavioral patterns common to scam token platforms: hidden ownership, unrealistic value promises, lack of transparency, potential illiquidity, and reliance on hype rather than fundamentals.

While it is always possible that a token could develop into something legitimate in the future, based on current public information — or lack thereof — the risk profile is very high. Investors should approach such platforms with extreme caution.

Given the evidence, Vestocoin is better treated as a high-risk or likely fraudulent project rather than a credible long-term investment. Unless major changes occur (e.g., full transparency of the team, audited tokenomics, verifiable exchange listings, real usage), the prudent presumption should be that the platform is built to extract funds rather than generate value.

Always remember: in the crypto world, due diligence is your best defence — and just because something looks professional doesn’t mean it is legitimate.

-

Report Vestocoin and Recover Your Funds

If you have fallen victim to Vestocoin and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Vestocoin persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.