Ucoincash Scam Review – The Truth Behind

In recent years, the cryptocurrency industry has attracted millions of investors eager to profit from the digital revolution. Unfortunately, this growth has also created an environment ripe for online scams that prey on people’s desire for fast and easy wealth. Among such schemes, Ucoincash stands out as a prime example of how deceptive online investment operations can ruin investors financially and emotionally.

This detailed review breaks down what Ucoincash is, how it operates, the warning signs of fraud it displays, and why potential investors must stay far away.

What Is Ucoincash?

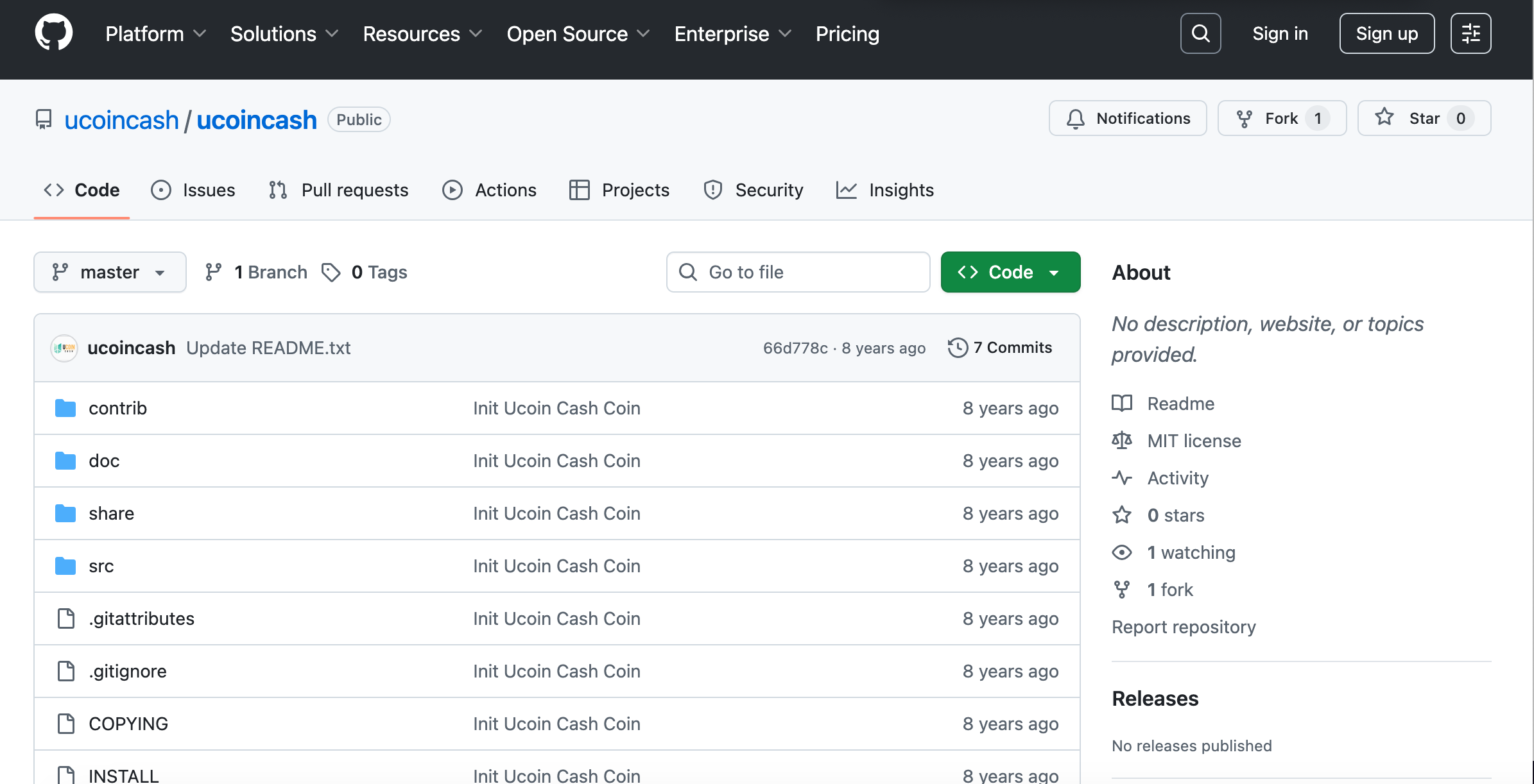

Ucoincash presents itself as a legitimate cryptocurrency or online investment platform that allows users to earn profits through simple tasks, trading, or staking. The website once promised incredible returns and easy participation, appealing to both beginners and experienced traders.

At first glance, Ucoincash appeared to be a professional and profitable venture. It featured sleek web pages, detailed investment plans, and claims of revolutionary technology. However, behind this polished front was a system designed to extract money from unsuspecting investors and disappear without fulfilling any promises.

The project claimed to offer “guaranteed daily earnings” and a “secure blockchain-based investment system.” Yet, it provided no verifiable proof of any registered company, legitimate management team, or technical documentation—clear signs that the operation was never genuine.

How Ucoincash Operates

Ucoincash follows a manipulative pattern that is commonly seen in online Ponzi-style scams. Its entire model revolves around attracting deposits, creating false profits, and blocking withdrawals once investors demand their money back.

Here’s how the operation typically plays out:

-

Attractive Promotion and False Promises

The scam begins with advertising campaigns across social media, messaging platforms, and crypto forums. These promotions claim that users can earn daily income, passive rewards, or quick profits simply by investing small amounts or completing tasks. -

Account Creation and Deposit Stage

Users are encouraged to open an account and deposit funds, often through cryptocurrency payments such as Bitcoin, Ethereum, or USDT. These payment methods make it easier for scammers to remain anonymous and prevent fund recovery. -

Fake Earnings Display

Once a user deposits funds, the website’s dashboard begins to display fake earnings or growing balances. This illusion convinces investors that their money is being actively traded or used productively. -

Pressure to Invest More

After showing initial “profits,” the platform encourages users to deposit larger sums. Scammers often claim that higher investments will unlock VIP levels, greater rewards, or access to exclusive programs. -

Withdrawal Denial

When users attempt to withdraw funds, they face endless obstacles. The system may demand additional “verification fees,” “tax payments,” or “account activation deposits.” Each new excuse is designed to squeeze more money out of victims. -

Complete Disappearance

Eventually, the platform becomes unresponsive, accounts are locked, and the website either shuts down or stops updating. The operators vanish, taking all invested funds with them.

Major Red Flags That Prove Ucoincash Is a Scam

1. Lack of Regulation or Legal Oversight

No legitimate financial platform operates without oversight from recognized regulatory authorities. Ucoincash provided no official license, registration details, or proof of being monitored by any government body. Its operators remained completely anonymous, which is a classic hallmark of financial fraud.

2. Unrealistic Profit Promises

The platform’s claims of daily guaranteed returns defy the basic principles of real investing. No authentic trading or staking platform can offer consistent profits without risk. The promise of easy, risk-free gains is one of the strongest indicators of a scam.

3. Anonymous Ownership and Team

A transparent and genuine company lists its founders, management, and business address. Ucoincash revealed none of these. The “About Us” page contained vague statements without any verifiable information. This anonymity ensures that victims have no one to hold accountable once the scam collapses.

4. Fake Trading Activity and Dashboards

The platform’s dashboards often displayed false data, such as simulated trades, inflated balances, and profit charts. These numbers were programmed to rise automatically, creating the illusion of activity and profit while nothing real occurred behind the scenes.

5. Withdrawal Barriers

Victims repeatedly reported that they could not withdraw their funds. When they requested payouts, they were told to pay additional charges, taxes, or “upgrade” fees. Once these were paid, the scammers either demanded more or disappeared completely.

6. No Customer Support

Legitimate financial platforms have responsive support teams and transparent communication channels. Ucoincash’s support was either unresponsive, automated, or disappeared entirely after investors deposited money.

The Psychology Behind the Scam

The Ucoincash scam works by exploiting human emotions—specifically greed, trust, and urgency. It follows a calculated sequence designed to manipulate users psychologically:

-

Building Trust: By presenting professional-looking web pages and using buzzwords like “blockchain,” “AI trading,” and “decentralized finance,” scammers create an image of credibility.

-

Triggering Greed: The promise of doubling or tripling money in a short period blinds users to red flags.

-

Creating Urgency: Fake countdown timers, “limited offers,” or “special bonus programs” pressure users to invest quickly without thinking critically.

-

Exploiting Fear of Loss: Once users deposit, scammers use fear tactics—claiming accounts will be frozen or profits lost unless they invest more money.

Common Experiences of Victims

Victims of Ucoincash have shared remarkably similar experiences, which include:

-

Depositing funds and seeing quick “profits” appear in their dashboards.

-

Being told to deposit more to unlock withdrawals or increase earnings.

-

Attempting to withdraw funds and being asked to pay additional fees.

-

Having accounts frozen after refusing to deposit further.

-

Losing access to their accounts altogether when the website shut down.

These consistent stories show a clear, deliberate pattern of fraud aimed at extracting as much money as possible from users before disappearing.

Why People Fall for Ucoincash

Many victims fall into traps like Ucoincash because the scam feels legitimate at first. The platform’s interface looks professional, and its terms sound reasonable to inexperienced investors. People also fall victim because:

-

They lack deep knowledge of how crypto investments work.

-

They are swayed by fake testimonials and social media posts.

-

The scammers use convincing language and customer service scripts.

-

The fear of missing out (FOMO) pushes them to invest quickly.

These psychological tactics make it easy for even cautious individuals to get drawn in.

Consequences of Engaging with Ucoincash

-

Loss of Funds:

Every deposit made into Ucoincash is at risk of being lost permanently. Once the scammers receive the funds, there is no recovery or refund. -

Identity Theft:

Many victims provided personal information such as names, addresses, and identification documents. These details can be misused for identity fraud or sold to other scammers. -

Emotional Impact:

The emotional toll of realizing one has been scammed is severe. Victims often experience guilt, stress, and loss of trust in future financial opportunities. -

Exposure to Further Scams:

Scammers often share victim data with other fraudulent groups. Victims may later receive offers from fake “recovery” services claiming they can help retrieve lost money.

How to Identify Safe Investment Platforms

To avoid scams like Ucoincash, investors should always take precautionary steps before trusting any online platform. Here are key safety checks:

-

Verify Regulation: Only invest in platforms officially registered with financial authorities.

-

Check Ownership: Confirm that real names, addresses, and verifiable business information are available.

-

Research Reputation: Look for independent reviews and real user feedback.

-

Avoid Unrealistic Promises: High, guaranteed returns are always a scam.

-

Test Withdrawals: Attempt small withdrawals early to confirm whether the platform actually allows them.

-

Use Secure Payment Methods: Avoid sending cryptocurrency to unverified wallets.

If a platform fails any of these checks, it should be avoided entirely.

Final Thoughts

Ucoincash is a classic example of a cryptocurrency investment scam designed to manipulate investors through false promises and deceptive marketing. It uses professional branding, psychological manipulation, and fake profit systems to steal money from unsuspecting users.

Everything about Ucoincash—from its anonymous ownership to its unrealistic guarantees and blocked withdrawals—proves that it was never a legitimate investment opportunity. Instead, it is another elaborate trap targeting those looking to profit from the crypto boom.

The safest approach is simple: avoid any platform that demands deposits upfront, promises guaranteed profits, or hides behind anonymity. Ucoincash is not an exception—it is a warning to investors to always verify before they invest.

Stay informed, stay skeptical, and always remember—if an investment opportunity seems too good to be true, it almost certainly is.

-

Report Ucoincash and Recover Your Funds

If you have fallen victim to Ucoincash and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Ucoincash persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.