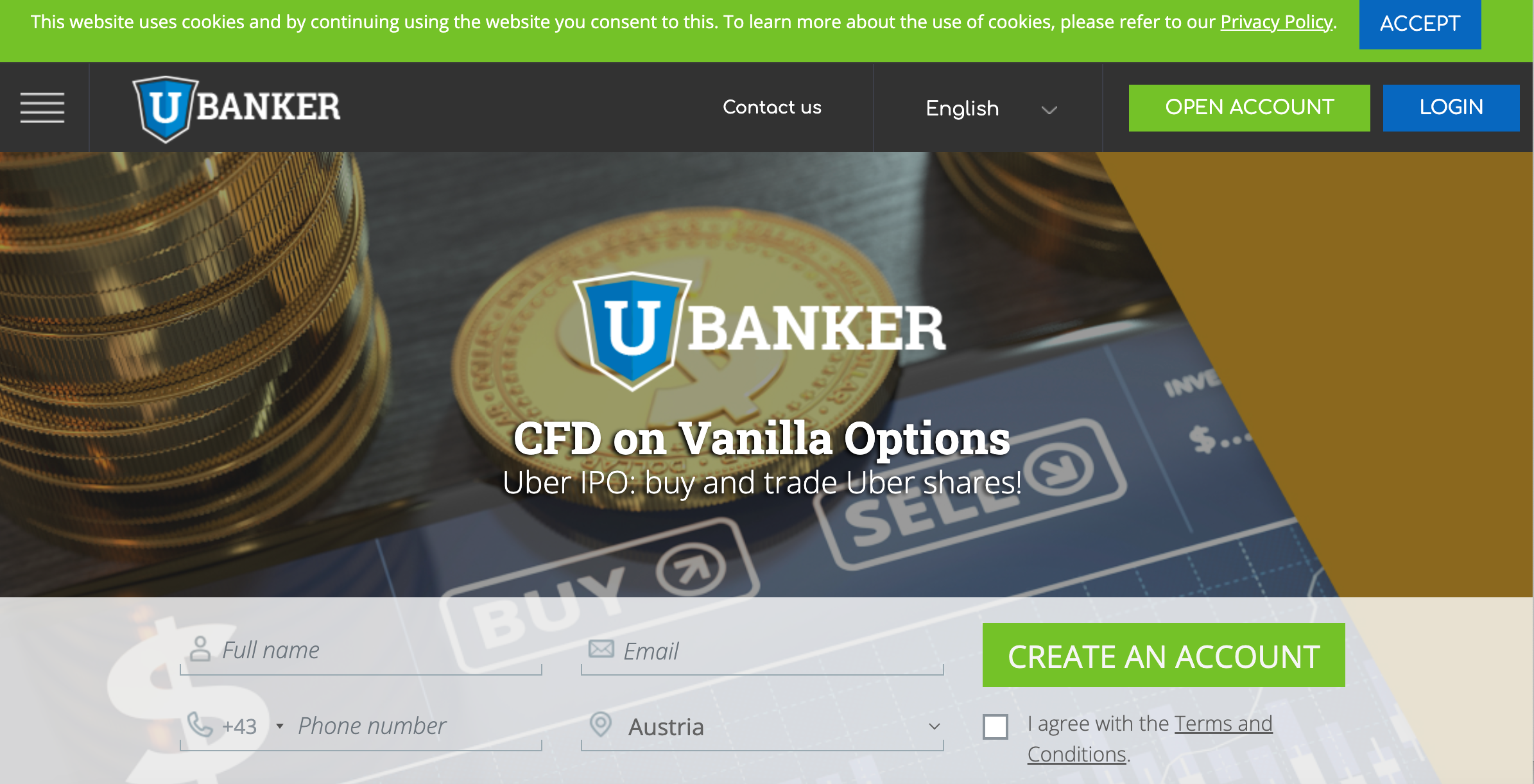

UBanker Scam Review – Deceptive Trading Platform

The online trading world has grown rapidly, offering countless platforms that promise easy access to global markets and substantial profits. However, not all of these brokers are what they seem. Some hide behind professional-looking websites while running manipulative schemes designed to drain investors’ funds. One of the most controversial among these is UBanker — a platform that has drawn significant criticism and suspicion for deceptive practices. This comprehensive review exposes the truth behind UBanker, how the scam works, and why traders should avoid it entirely.

What Is UBanker?

UBanker presents itself as a global online trading broker specializing in forex, commodities, indices, and cryptocurrencies. The website claims to offer “professional trading tools,” “experienced account managers,” and “unmatched profit opportunities.” It promotes a user-friendly platform where traders of all experience levels can supposedly achieve financial independence.

However, beneath the polished interface lies a network of deceit. A closer inspection reveals numerous red flags: lack of valid regulation, fake testimonials, manipulative sales tactics, and widespread complaints about withdrawal restrictions. These warning signs strongly suggest that UBanker’s primary goal is not to help traders succeed, but to separate them from their money.

Lack of Regulation and Transparency

The first and most critical red flag with UBanker is its lack of legitimate regulation. Real trading platforms are supervised by financial authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus). These regulators ensure brokers comply with strict operational and financial standards to protect clients.

UBanker, on the other hand, claims to operate under the name Green Pole Ltd, allegedly based in Vanuatu or the Marshall Islands—two jurisdictions notorious for loose financial oversight. There is no verifiable license number, no mention of credible regulators, and no proof of compliance with global financial laws.

This lack of regulation means:

-

No investor protection.

-

No oversight of trading activity.

-

No assurance that client funds are kept in segregated accounts.

Essentially, once you deposit funds into UBanker, you are at the mercy of an unregulated entity that can manipulate your trades or deny withdrawals without consequences.

Misleading Marketing Tactics

UBanker’s website and promotional materials are designed to create an illusion of legitimacy. They feature professional graphics, market charts, and supposed “expert analyses.” The platform frequently uses emotionally charged language, promising “financial freedom,” “high returns,” and “success without prior experience.”

They often target beginners with limited knowledge of forex or crypto trading—people who are easily swayed by promises of quick profits. UBanker even claims to provide free training, “personal mentorship,” and “advanced trading tools,” but these features often serve as hooks to lure users into depositing more money.

In reality, the “training” materials are generic and outdated, offering no real value. The so-called account managers are actually salespeople trained to pressure users into depositing additional funds under the guise of “unlocking premium features.”

Unrealistic Profit Claims

UBanker aggressively markets itself as a platform where anyone can make consistent profits, even without trading experience. They boast about “success stories” and “clients earning thousands in just weeks.”

But the truth is that no broker can guarantee profits—especially not in volatile markets like forex or cryptocurrency. Such claims are clear violations of ethical trading standards. When a broker promises guaranteed returns, it’s usually a scam designed to create false hope and urgency.

UBanker’s unrealistic marketing is a deliberate psychological tactic. By showing fabricated success stories, they create the illusion that traders are missing out on easy money—pushing them to invest more without questioning the legitimacy of the platform.

The Deposit Trap

Once a user registers, UBanker makes it incredibly easy to deposit funds—accepting methods like credit cards, wire transfers, and cryptocurrencies. The onboarding process is fast and friendly, designed to remove hesitation.

Initially, users might even experience small “profits” displayed in their dashboards, making them believe their investment is growing. But these profits are not real market gains—they’re numbers manipulated within the platform’s internal system to build trust.

Then comes the pressure to upgrade. Account managers call or email users, encouraging them to “increase investment” to access “higher profit tiers” or “exclusive market opportunities.” Each new deposit is portrayed as a chance to “multiply earnings.”

In reality, these funds are just being funneled deeper into the scam’s control.

The Withdrawal Nightmare

One of the most common complaints against UBanker is withdrawal denial. Victims report that when they try to withdraw their funds, they face a series of obstacles:

-

Unexpected “verification requirements.”

-

Claims that funds are “under review.”

-

Requests for additional deposits to “cover fees” or “unlock withdrawals.”

-

Complete unresponsiveness from customer support.

In many cases, traders never receive their money back. The withdrawal policies are intentionally vague and full of loopholes, allowing UBanker to delay or reject requests indefinitely.

Even worse, once users complain or threaten to report the scam, the so-called account managers often disappear—leaving victims with no means to recover their money.

Fake Testimonials and Reviews

To appear credible, UBanker floods the internet with fake testimonials and paid reviews. These fabricated comments often appear on review sites and social media, praising the platform’s “professionalism” and “profitability.”

However, when you read beyond the surface, you’ll find dozens of genuine complaints on forums and watchdog websites describing identical experiences of fraud, loss, and deceit. Victims consistently describe being manipulated into depositing large sums and then being locked out from accessing their accounts.

These fabricated reviews are part of UBanker’s strategy to drown out negative publicity and keep new investors unaware of the risks.

Hidden Fees and Fine Print

Another deceptive tactic used by UBanker involves hidden fees buried deep within its terms and conditions. While the site claims “zero commissions” or “low spreads,” users often discover high withdrawal fees, inactivity charges, and unexplained deductions from their balances.

Worse yet, the platform imposes trading volume requirements before users can withdraw profits. For instance, a trader might be told they need to execute dozens of trades or meet a specific turnover before funds become “eligible for withdrawal.” This tactic ensures that most traders either lose their balance through trading or give up entirely.

Aggressive Communication and Psychological Manipulation

UBanker’s representatives are known for aggressive sales tactics. After signing up, users report receiving frequent phone calls from “senior brokers” or “investment managers” who pressure them into depositing more money.

These agents use persuasive language—claiming they’re offering “limited-time opportunities” or “insider market access.” When users hesitate, they employ guilt or fear tactics, suggesting that failure to invest means missing out on life-changing profits.

Once users make larger deposits, the communication changes dramatically. Calls become infrequent, customer support stops responding, and any mention of withdrawal leads to excuses or hostility.

Pattern of Offshore Scam Operations

UBanker fits the exact profile of a boiler-room style offshore scam—a model that has been replicated by countless fraudulent brokers. These companies often operate from loosely regulated jurisdictions like Vanuatu, Seychelles, or the Marshall Islands. They change domain names frequently, rebrand under new identities, and continue luring victims under fresh names.

Reports suggest that UBanker is part of a larger network of interconnected scam operations using similar websites, templates, and communication strategies. Once one domain gets flagged or blacklisted, the operators simply move their operations elsewhere.

Key Warning Signs

If you encounter any broker with these characteristics, be extremely cautious:

-

No verifiable regulation or licence number.

-

Promises of guaranteed profits or low-risk trading.

-

Aggressive account managers urging you to invest more.

-

Difficulty withdrawing funds or vague withdrawal conditions.

-

Fake testimonials or untraceable company ownership.

-

Pressure tactics involving “limited offers” or “urgent upgrades.”

UBanker exhibits all these signs, confirming its position as a deceptive and predatory platform.

Final Verdict – A Scam Disguised as a Broker

After thorough analysis, it is clear that UBanker is not a legitimate trading platform but rather a well-orchestrated scam designed to exploit traders through false promises and manipulative tactics.

The absence of regulation, fabricated marketing, withdrawal barriers, and numerous victim reports paint a consistent picture: UBanker’s business model revolves around attracting deposits, creating false hope, and preventing withdrawals.

If you’re considering trading online, avoid UBanker at all costs. Instead, choose brokers that are fully regulated by reputable authorities, have transparent policies, and maintain a proven record of client satisfaction.

In conclusion, UBanker should be treated as a scam platform that preys on the hopes of new traders. It offers illusions of wealth but delivers only frustration and financial loss. Awareness and caution are your best defenses against such deceptive operations.

Report UBanker and Recover Your Funds

If you have fallen victim to UBanker and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like UBanker persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.