TradingView.com Review: Traders Should Be Cautious

The global financial trading industry has rapidly evolved over the past decade, and platforms promising advanced tools for traders are at the center of this evolution. Among these is TradingView.com, a name that has gained widespread recognition. The platform advertises itself as a sophisticated charting and social trading network where traders can analyze markets, share ideas, and collaborate with a community.

However, behind its professional appearance and popularity, there are growing concerns among traders about how TradingView operates. Complaints range from hidden practices and manipulative tactics to unfair policies that trap users into paying for services that do not deliver what was promised. In this detailed review, we uncover the reasons why many consider TradingView.com to be a scam-like operation that should be approached with caution.

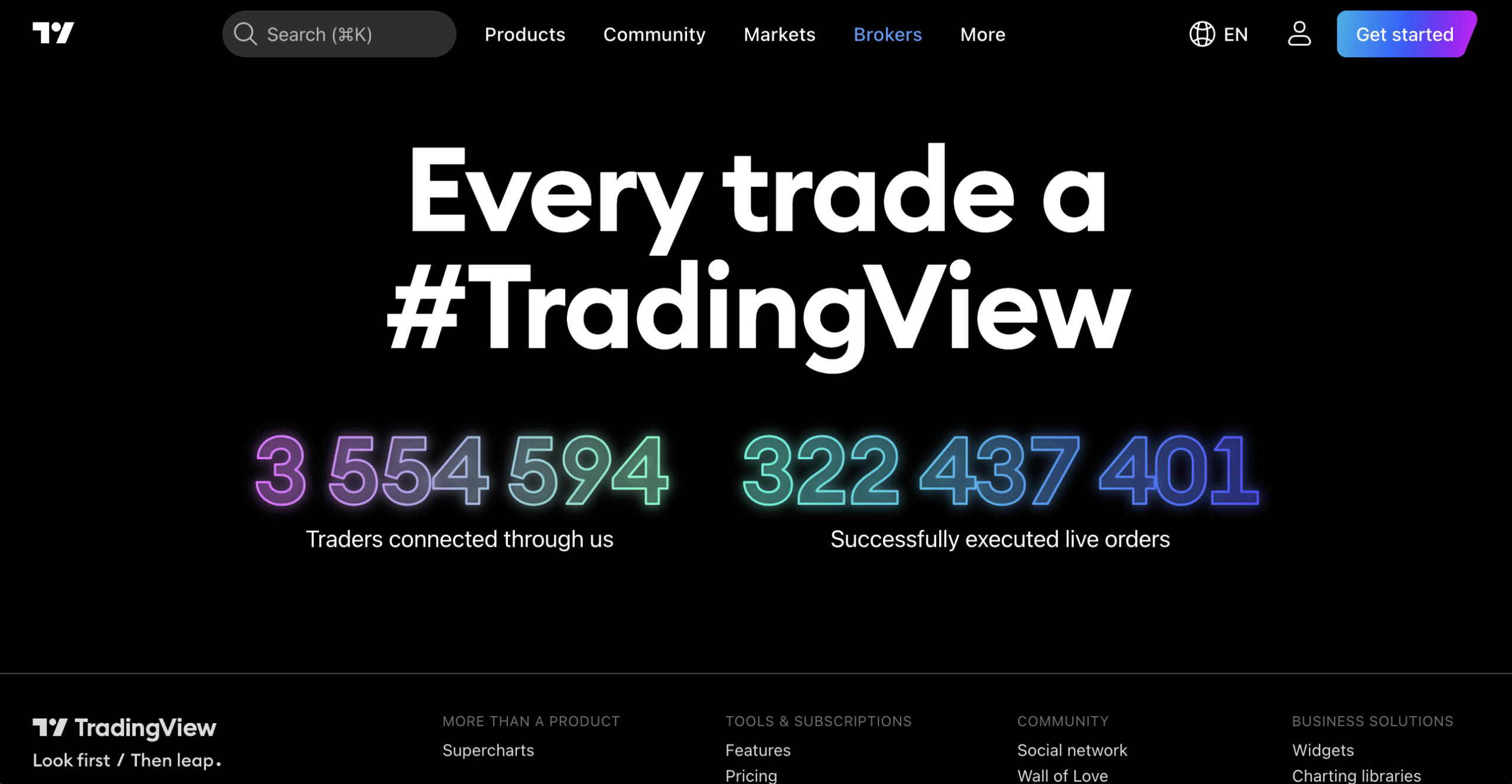

First Impressions – A Professional Facade

At first glance, TradingView.com presents itself as a highly professional platform. Its interface is sleek, modern, and packed with tools that give the impression of sophistication. New users are often impressed by its broad range of charts, indicators, and social features that allow traders to exchange ideas.

This polished appearance, however, can mask deeper issues. Many scam-like platforms invest heavily in creating a professional facade to establish credibility. By doing so, they lower the guard of inexperienced traders who may not question the legitimacy of what they are signing up for.

Subscription Model – A Trap for Users

One of the most significant complaints about TradingView revolves around its subscription plans. While the platform claims to offer a free tier, serious traders quickly discover that most useful features are locked behind paid subscriptions.

-

Aggressive Upselling: The free plan is intentionally restricted, with constant pop-ups pushing users to upgrade.

-

Non-Refundable Payments: Once users pay for a subscription, refunds are almost impossible to obtain, even if the service does not meet expectations.

-

Hidden Costs: Beyond the advertised subscription fee, there are additional charges tied to data feeds and premium access.

-

Auto-Renewal: Subscriptions renew automatically, often without clear reminders, leading to unexpected charges on users’ accounts.

Many traders feel tricked into paying for services that fail to deliver the promised advantages.

Data Issues and Chart Manipulation

A trading platform is only as reliable as its data. Unfortunately, users have raised serious concerns about TradingView’s accuracy.

-

Delayed Data: Market data often lags, creating a disadvantage for traders who rely on real-time updates.

-

Inconsistent Charts: Price levels on TradingView charts sometimes differ from those on actual broker platforms, raising suspicions about manipulation.

-

Paid Data Feeds: Real-time data often requires extra payments, despite claims that the platform already provides live market information.

Such inconsistencies can lead traders to make poor decisions, ultimately costing them money. The fact that this “premium” platform charges extra for reliable data is a major red flag.

Fake Community Engagement

A major selling point of TradingView.com is its community. The platform promotes itself as a hub where traders share ideas and strategies. However, much of this engagement appears questionable.

-

Paid Promotions: Some “top” contributors are suspected of being sponsored to promote specific brokers, services, or trading strategies.

-

Fake Followers: Popular accounts often show suspicious follower patterns, suggesting artificial boosting.

-

Biased Content Moderation: Users who criticize TradingView or question certain contributors report being silenced or having their posts removed.

Instead of being a genuine community, the social side of TradingView seems more like a controlled environment designed to drive users toward certain products and services.

Withdrawal of Trust – Partner Broker Scams

TradingView.com does not directly handle trading, but it partners with brokers that integrate into its platform. This is where another layer of concern emerges.

-

Unverified Brokers: Some of the brokers promoted on TradingView have poor reputations and questionable licensing.

-

Conflicts of Interest: TradingView benefits financially from these partnerships, creating incentives to promote brokers regardless of legitimacy.

-

User Losses: Traders who opened accounts through these partners have reported withdrawal problems, unfair fees, and manipulative practices.

By associating with shady brokers, TradingView exposes its users to risks far beyond poor charting tools.

Customer Support – Unhelpful and Evasive

For a platform that charges premium fees, TradingView’s customer support leaves much to be desired. Many users report:

-

Slow Responses: Emails and tickets take days, if not weeks, to receive a reply.

-

Generic Answers: When replies do arrive, they often fail to address the actual problem.

-

No Phone Support: There is no way to reach the company directly by phone, leaving customers with limited recourse.

Instead of being a resource for solving problems, customer support appears to exist solely to deflect accountability.

Hidden Policies and Fine Print

Like many scam-like operations, TradingView relies heavily on its terms and conditions to protect itself from liability. Key issues include:

-

Unclear Refund Policies: The platform states that payments are non-refundable, even if users cancel immediately after being charged.

-

Data Liability: TradingView absolves itself of responsibility for inaccurate or delayed data, despite charging for premium access.

-

Community Rules: Vague community guidelines allow moderators to remove criticism or silence users arbitrarily.

These policies favor the company at the expense of its customers, leaving users without real protection.

Manipulative Marketing Tactics

TradingView employs several psychological strategies to encourage users to spend money:

-

Fear of Missing Out (FOMO): Constant reminders that upgrading to premium unlocks “exclusive” tools.

-

Scarcity Tactics: Limited-time discounts that pressure users into paying quickly.

-

Social Proof: Highlighting popular contributors to create the impression of expertise, even when advice is questionable.

-

Authority Bias: Using professional-looking charts to give the illusion of reliability, even when the data is flawed.

These manipulations are designed not to help traders, but to extract maximum value from them.

Reputation Management and Fake Reviews

Online research reveals a pattern: while independent forums are filled with complaints about TradingView, certain review sites show overwhelmingly positive feedback. This suggests the company engages in reputation management strategies, such as:

-

Paid Positive Reviews: Flooding review platforms with 5-star ratings to bury genuine complaints.

-

Removal of Criticism: Users report that negative reviews are flagged or taken down quickly.

-

Influencer Partnerships: Paid influencers on YouTube and social media praise TradingView while hiding their financial incentives.

This deliberate effort to control its reputation further undermines the platform’s credibility.

Key Red Flags of TradingView.com

When examining TradingView closely, the red flags are undeniable:

-

Aggressive subscription traps with auto-renewals.

-

Delayed or inaccurate data that undermines trading decisions.

-

Extra charges for real-time feeds despite premium subscriptions.

-

Fake or manipulated community engagement.

-

Partnerships with untrustworthy brokers.

-

Poor and evasive customer support.

-

Hidden policies that deny refunds and accountability.

-

Manipulative marketing tactics to pressure users.

-

Reputation management through fake reviews.

These issues collectively indicate a platform that prioritizes profit over transparency or user trust.

Conclusion – Why Traders Should Avoid TradingView.com

While TradingView.com presents itself as a professional trading tool and community, the reality is filled with red flags. The platform relies on aggressive upselling, hidden fees, data manipulation, and questionable partnerships to maximize profits at the expense of its users.

Report TradingView.com and Recover Your Funds

If you have fallen victim to TradingView.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like TradingView.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.