Tradewill.com Scam Review: A Scamming Platform

This detailed review will expose the red flags surrounding Tradewill.com, explain the tactics it uses to defraud unsuspecting traders, and demonstrate why this platform should be avoided at all costs.

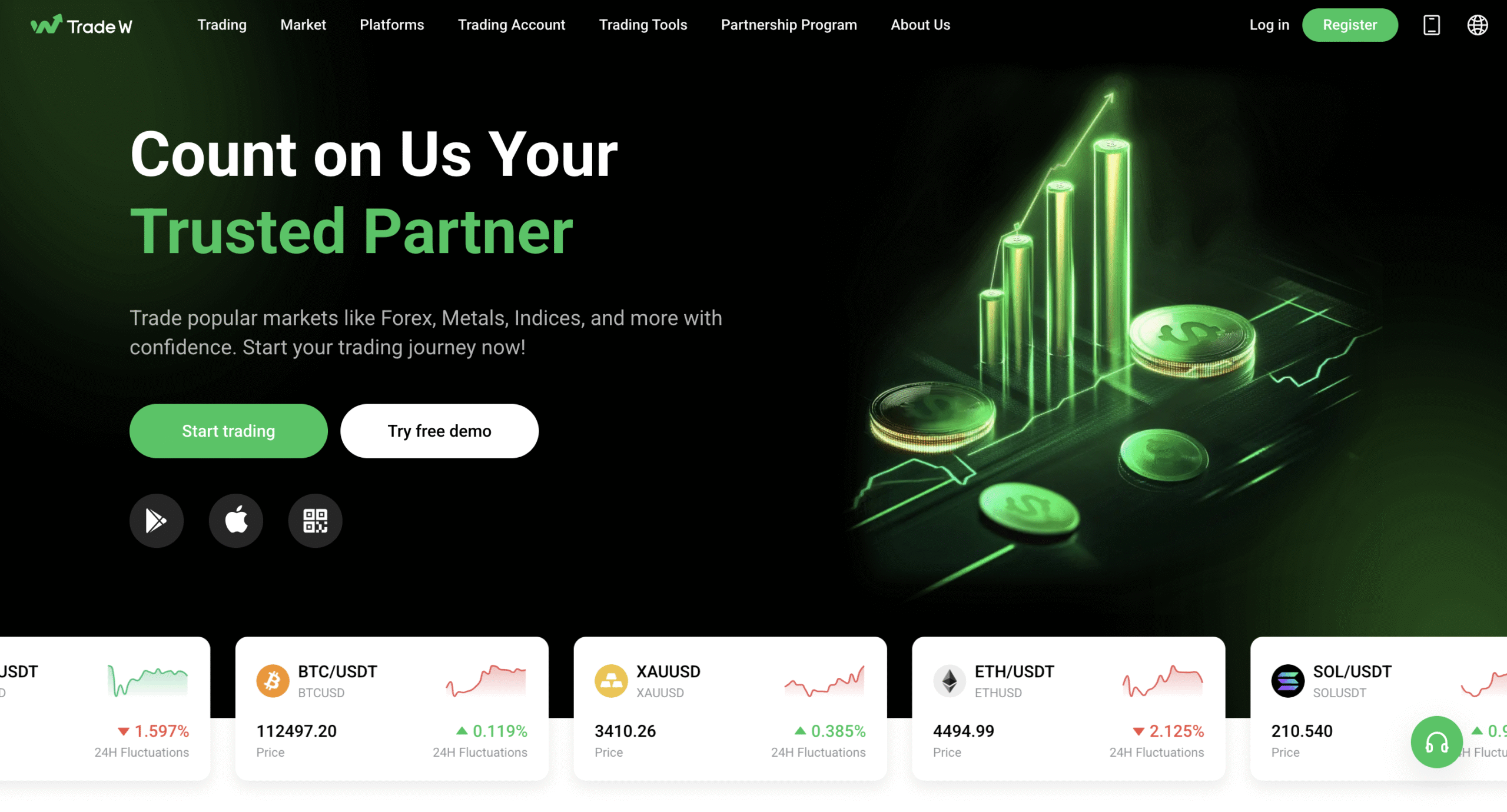

First Impressions – A Professional Facade

Tradewill.com invests heavily in appearances. The website design is modern and convincing, filled with stock market images, trading charts, and financial jargon. It promises:

-

Advanced trading platforms

-

Low spreads and high leverage

-

Access to multiple asset classes

-

Professional account managers and support

For someone unfamiliar with scam brokers, this professional presentation can be very persuasive. Unfortunately, this facade is nothing more than a carefully constructed trap.

Regulatory Concerns – The Biggest Red Flag

One of the most important indicators of a broker’s legitimacy is regulation. Licensed brokers are overseen by financial authorities such as the FCA, ASIC, or CySEC. They must follow strict rules designed to protect traders, including transparent pricing, segregation of client funds, and dispute resolution procedures.

Tradewill.com, however, fails to provide any verifiable evidence of regulation. The website makes vague references to compliance and financial standards, but when one checks with actual regulatory bodies, there is no record of Tradewill.com holding a license.

This means the platform is completely unregulated. Without oversight, Tradewill.com can manipulate trades, deny withdrawals, and vanish overnight without facing consequences.

Hidden Ownership and Zero Transparency

Another serious red flag is the lack of transparency about who owns or operates Tradewill.com. The website does not provide a physical office address, corporate registration details, or the names of key executives.

Legitimate brokers openly display this information because they are proud of their regulatory status and accountability. Tradewill.com’s silence on these matters suggests deliberate concealment. Scam brokers hide their identities so that when their scheme collapses, they can disappear without leaving a trace.

Deposits Are Easy – Withdrawals Are Impossible

One of the most common complaints from traders who have dealt with Tradewill.com is the withdrawal issue. Depositing funds is made extremely easy. Clients can fund their accounts using bank transfers, credit cards, and even cryptocurrencies.

But when it comes time to withdraw, traders face endless obstacles:

-

Withdrawals delayed for weeks or months without explanation.

-

Requests for additional identity documents that are never “approved.”

-

Sudden account freezes after profits are made.

-

Outright refusal to process withdrawal requests.

This is a hallmark of scam brokers. They make it effortless to deposit but nearly impossible to get money out. The goal is to trap traders’ funds indefinitely.

Manipulated Trading Conditions

Tradewill.com advertises advanced trading platforms and market-leading execution. But reports from users indicate that the trading environment is manipulated to ensure losses.

Common manipulations include:

-

Widened spreads that quickly drain profits.

-

Slippage manipulation, where orders are executed at unfavorable prices.

-

Platform freezes during volatile market movements.

-

Stop-loss hunting, closing trades at the worst possible levels.

These unethical practices make it virtually impossible for traders to succeed. Since Tradewill.com is unregulated, it faces no penalties for rigging its platform.

The Bonus Trap

Tradewill.com lures traders with deposit bonuses, presenting them as rewards for funding accounts. But these bonuses come with hidden conditions.

To withdraw funds, traders must meet unrealistic trading volume requirements tied to these bonuses. In many cases, the required trading activity is so high that it becomes practically impossible to ever qualify.

This is a common scam tactic. By accepting a bonus, traders unknowingly give Tradewill.com the excuse to block withdrawals.

Hidden Fees and Costs

Another way Tradewill.com exploits traders is through hidden charges. While legitimate brokers clearly disclose their fees, Tradewill.com often surprises clients with unexpected deductions, including:

-

High withdrawal fees

-

Inactivity fees that drain accounts

-

Excessive overnight charges

-

Undisclosed maintenance costs

These fees gradually eat away at traders’ balances, ensuring that even profitable accounts end up in the negative.

Aggressive Sales Pressure

Like many fraudulent brokers, Tradewill.com employs aggressive account managers whose main role is to push clients to deposit more money.

These so-called managers are actually high-pressure sales agents who use manipulation to convince traders to invest more than they can afford. They often:

-

Promise guaranteed profits.

-

Claim to have insider knowledge.

-

Pressure traders into “time-limited” opportunities.

-

Dismiss any concerns about risk.

But once a trader refuses to deposit more or asks about withdrawals, these agents often disappear or turn hostile.

Fake Testimonials and Paid Reviews

Tradewill.com tries to build trust by flooding its website and online spaces with glowing testimonials. These reviews praise the broker’s services, withdrawals, and support. However, the language is often generic, and the images are clearly stock photos.

In reality, genuine trader forums paint a completely different picture. Here, real users share stories of blocked withdrawals, rigged platforms, and vanished support. This stark contrast exposes the extent of Tradewill.com’s deception.

Customer Support – Only Available Before Deposits

Tradewill.com claims to offer 24/7 support via email, chat, and phone. However, this promise falls apart after deposits are made. Many traders report unanswered messages, disconnected phone lines, and nonfunctional live chat.

The only time support appears active is when potential clients are being courted to make their first deposit. Afterward, assistance becomes nonexistent.

Red Flags Summary

When evaluating Tradewill.com as a broker, the warning signs are overwhelming:

-

No verified regulation or licensing.

-

Lack of company transparency and ownership details.

-

Easy deposits but nearly impossible withdrawals.

-

Manipulated trading conditions that ensure losses.

-

Deposit bonuses with hidden traps.

-

Unexpected and excessive fees.

-

Aggressive and manipulative sales tactics.

-

Fake testimonials and misleading reviews.

-

Nonexistent customer support after deposits.

Each red flag alone is cause for concern. Together, they form a clear picture of fraud.

Real Trader Experiences

Many traders online have shared similar stories about Tradewill.com, including:

-

“I made profits, but when I tried to withdraw, they froze my account.”

-

“They kept asking for more documents and never approved my withdrawal.”

-

“The spreads and fees were ridiculous; I lost money even when I traded correctly.”

-

“The account manager pressured me every day to deposit more, promising guaranteed results.”

These consistent reports across different individuals confirm that the issues with Tradewill.com are not isolated, but systematic.

Conclusion – Tradewill.com Is a Scam

Tradewill.com might look like a professional broker on the surface, but everything about its operation reveals otherwise. From fake regulatory claims to manipulative trading practices, blocked withdrawals, and fabricated reviews, it is clear that this platform is a fraudulent scheme designed to exploit traders.

Report Tradewill.com and Recover Your Funds

If you have fallen victim to Tradewill.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Tradewill.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.