TradeTime.com Review: Trading Conditions & Safety

Executive Summary

Online trading continues to attract retail investors, offering access to forex, commodities, indices, stocks, and cryptocurrencies from anywhere in the world. Amid this growth, numerous brokers have emerged, some of which operate with minimal transparency and questionable practices. TradeTime.com is one such broker that has raised concerns among traders and industry observers.

This review explores TradeTime.com’s regulatory standing, corporate structure, trading conditions, platform reliability, account types, customer support, and overall risk profile. By the end of this analysis, traders will have a clearer understanding of whether TradeTime.com is a safe trading partner or a high-risk platform that requires caution.

Platform & Corporate Background

TradeTime.com presents itself as a modern online trading platform, offering a variety of financial instruments such as forex pairs, commodities, indices, stocks, and cryptocurrencies. The website claims to provide:

-

Competitive spreads and low fees

-

Multiple account types catering to beginners and advanced traders

-

Advanced trading tools and charting software

While the platform’s visual design is professional, aesthetics alone cannot confirm legitimacy. Traders must look past marketing materials to evaluate ownership, company registration, and operational transparency.

Ownership and Company Registration

TradeTime.com provides limited corporate information, which makes verification difficult. Reputable brokers usually disclose:

-

Legal entity name and registration number

-

Physical office location and jurisdiction

-

Names of directors or owners

-

Proof of financial stability

TradeTime.com, however, does not clearly provide these details, making it challenging to verify who is ultimately responsible for managing funds. Such opacity raises questions about accountability, a common trait in high-risk brokers.

Technical Audit of Website

From a technical perspective, TradeTime.com appears functional, with secure HTTPS connections and working platform interfaces. However, several red flags were observed:

-

No third-party security audits publicly available

-

Limited transparency about server locations or trading infrastructure

-

Absence of information regarding liquidity providers

While the platform can operate effectively on a superficial level, traders should consider whether underlying operational integrity can be trusted.

Regulatory Compliance & Oversight

Licensing Status

Regulation is a cornerstone of broker credibility. Properly licensed brokers are required to:

-

Segregate client funds

-

Maintain minimum capital reserves

-

Submit to audits and regular reporting

-

Offer formal dispute resolution

TradeTime.com does not present verifiable evidence of regulation by recognized financial authorities. This lack of oversight increases risk because:

-

Deposited funds may not be protected

-

No investor compensation or guarantee schemes exist

-

Trading practices are unmonitored

-

Legal recourse is limited

Traders should be especially wary of unregulated brokers, as operational changes or fund restrictions can occur without warning.

Red Flags in Compliance

Additional concerns include:

-

No public records of licenses or regulatory reviews

-

Offshore registration with minimal legal accountability

-

No indication of adherence to anti-money laundering (AML) or know-your-customer (KYC) policies

These gaps reduce the trustworthiness of the platform and suggest that traders could be exposed to significant financial risk.

Operational Integrity Analysis

Trading Conditions

A broker’s trading conditions define how profitable or risky the experience can be. Critical factors include:

-

Spreads and commissions

-

Leverage and margin rules

-

Swap or rollover fees

-

Order execution transparency

TradeTime.com does not provide full disclosure of these aspects. Several potential issues arise:

-

High or variable spreads during volatile market periods

-

Leverage offerings that could amplify losses for inexperienced traders

-

Limited information about fees, slippage, or order execution quality

Ambiguous conditions like these can result in unexpected costs or unfair trade execution.

Account Types and Minimum Deposits

TradeTime.com offers multiple account options, typically marketed as “Starter,” “Professional,” and “VIP.” However, there is a lack of clear information on:

-

Minimum deposit requirements

-

Benefits and limitations of each tier

-

Withdrawal conditions linked to bonuses or account types

This ambiguity can lead to traders depositing more than necessary or misunderstanding the platform’s actual conditions.

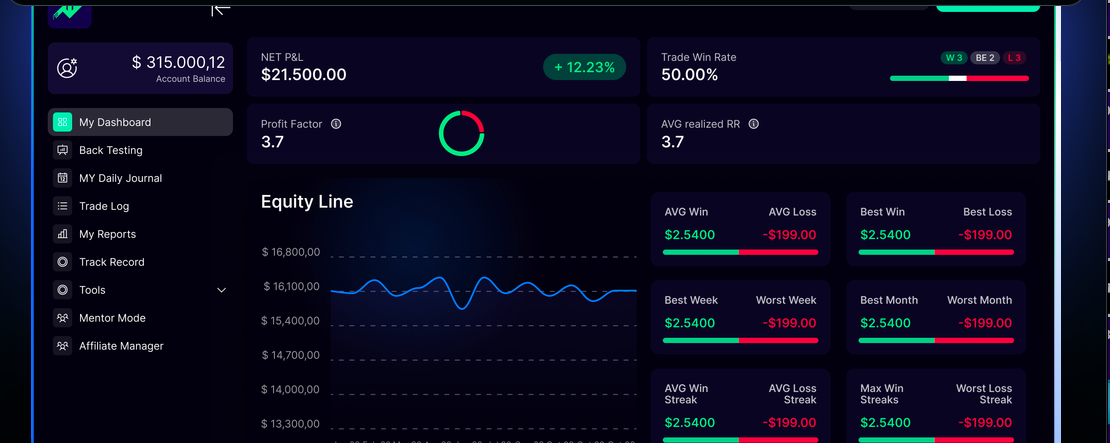

Platform Functionality

The trading platform itself is crucial for executing orders efficiently. Observed issues include:

-

Limited information about pricing sources and liquidity

-

Lack of transparency around order execution policies

-

Potential for slippage or delayed execution

While the interface appears user-friendly, execution transparency is insufficient, leaving traders unsure if they are receiving fair market prices.

User Experience & Reported Issues

Trader reports offer valuable insights into platform behavior. Common complaints about TradeTime.com include:

-

Difficulty withdrawing funds, sometimes requiring repeated verification or additional fees

-

Pressure from account managers to deposit larger sums

-

Limited or delayed customer support responses

-

Unclear bonus conditions that complicate withdrawal

These complaints highlight recurring operational patterns typical of brokers that prioritize deposits over client protection.

Behavioral Red Flags

Patterns observed from user feedback include:

-

Deposit easy, withdrawal difficult: classic indicator of potential fund retention issues

-

Aggressive marketing and incentives aimed at increasing deposits

-

Inconsistent communication from support staff once funds are deposited

Such behavioral trends are highly indicative of elevated risk.

Risk Quantification

Based on the findings above, TradeTime.com can be assigned a Fraud Exposure Score of 8/10. This rating is justified by:

-

Unverified regulatory status

-

Limited corporate transparency

-

Ambiguous trading conditions and account structures

-

Withdrawal complaints and operational anomalies

-

Mixed customer support reliability

A score of 8/10 suggests high risk. Traders should proceed with extreme caution and consider alternative platforms with verified oversight and clear operational protocols.

Documented Warning Signs

Evidence-backed indicators include:

-

Lack of verifiable licensing – no official regulator confirmation

-

Opaque corporate structure – unclear ownership and jurisdiction

-

Withdrawal difficulties – delays, additional verification, or fund retention

-

Aggressive promotions – high-pressure marketing with bonus incentives

-

Platform transparency gaps – unclear execution methods and pricing sources

-

Limited risk education – emphasis on profit potential over risk awareness

Each of these red flags individually signals caution, and collectively, they highlight a potentially unsafe environmentfor retail traders.

Recovery & Contingency Options

Traders who have already deposited funds should consider the following recovery strategies:

-

Contact authorities: report suspicious brokers to financial regulatory bodies even if offshore

-

Legal channels: consult lawyers familiar with international financial law

-

Third-party recovery services: platforms specializing in tracing and recovering funds lost to unregulated brokers

-

Document all communication: maintain email, chat logs, and transaction records for evidence

Acting quickly increases the likelihood of recovering funds and may help prevent further losses.

Preventive Intelligence

To avoid high-risk platforms like TradeTime.com, traders should:

-

Verify broker registration with recognized authorities

-

Confirm corporate ownership, office location, and legal entity

-

Read all trading terms, including spreads, fees, and withdrawal policies

-

Start with minimal deposits when testing a new broker

-

Avoid brokers using high-pressure marketing tactics

-

Consult independent reviews and online communities for feedback

Practicing due diligence and risk management is the most effective defense against potential financial loss.

Final Expert Opinion

TradeTime.com exhibits multiple warning signs of a high-risk broker:

-

Lack of verifiable regulation

-

Limited corporate transparency

-

Ambiguous account types and trading conditions

-

Withdrawal delays and inconsistent support

-

Aggressive marketing practices

While some aspects of the platform, such as its interface and range of instruments, appear professional, the operational risks outweigh potential benefits. Traders are strongly advised to seek brokers with proven regulatory oversight and transparent practices.

Conclusion

TradeTime.com may appeal to traders with its modern interface and multiple account types. However, the absence of regulatory verification, unclear operational practices, and reported withdrawal issues suggest a high level of risk. Protecting capital should always be the primary priority, especially in online trading.

Next Steps for Affected Traders

If you have lost money on TradeTime.com:

-

Act immediately to report the broker

-

Keep detailed transaction records

-

Use reputable recovery services to pursue funds

-

Inform other traders and communities to prevent further victimization

Vigilance and due diligence are key to avoiding scams and minimizing financial risk in the rapidly evolving online trading industry.

Advisory and Escalation Pathways

Some users seek independent advisory guidance from third-party intelligence resources such as Boreoakltd.com to better understand documentation standards, escalation pathways, and recovery-oriented risk mitigation. Such resources do not replace regulators or legal counsel but may help users navigate complex situations with greater clarity.

Read More Related Articles:

-

- Learn how to protect yourself from scams in our complete guide : Online Scam Safety Guide

- Discover how to verify trading platforms before investing in : How to Verify Trading Platforms

- Learn the most common scam tactics online and how to avoid them in: Most Common Online Scam Tactics

-

Identify red flags on fraudulent investment websites with : Warning Signs of Fake Investment Websites

-

Protect your cryptocurrency from fraud by reading our : Crypto Fraud Safety Guide