TradeTime.com Review – Detailed Analysis of Red Flags

The growth of online trading has opened global financial markets to retail investors, offering access to forex, commodities, indices, stocks, and cryptocurrencies. While this expansion has created opportunities, it has also led to the rise of brokers that operate with limited transparency and questionable practices. TradeTime.com is one such platform that has raised concerns among traders and industry observers.

This in-depth review examines TradeTime.com’s regulatory standing, corporate transparency, trading conditions, platform reliability, customer support, and overall risk profile. The goal is to help traders understand the potential dangers before committing their funds.

What Is TradeTime.com?

TradeTime.com presents itself as an online trading broker offering access to multiple financial instruments through a digital trading platform. The broker claims to provide modern trading tools, competitive conditions, and services suitable for both beginners and experienced traders.

At first glance, the website appears professional and well-designed. However, a polished interface does not necessarily mean a broker is trustworthy. To properly assess TradeTime.com, it is essential to look beyond marketing claims and examine how the broker operates behind the scenes.

Regulatory Status and Oversight

Regulation is one of the most important indicators of a broker’s legitimacy. Brokers regulated by reputable financial authorities must comply with strict rules designed to protect traders, such as:

-

Segregation of client funds

-

Capital adequacy requirements

-

Regular audits and reporting

-

Transparent trading practices

-

Fair dispute resolution mechanisms

TradeTime.com does not provide verifiable evidence of authorization from any recognized financial regulator. The absence of clear regulatory information means there is no independent body overseeing the broker’s operations.

This lack of regulation significantly increases risk because:

-

Client funds may not be protected

-

There is no investor compensation scheme

-

Trading practices are not independently monitored

-

Traders have limited legal recourse in disputes

Unregulated brokers often operate with far fewer obligations toward their clients.

Corporate Transparency Concerns

A legitimate broker clearly discloses its legal entity name, registration details, jurisdiction, and physical office address. Transparency allows traders to verify who is responsible for managing funds and where accountability lies.

TradeTime.com provides limited and vague corporate information. Details about ownership, management, and the company’s legal registration are either missing or unclear. This opacity makes it difficult for traders to assess the broker’s credibility or pursue action if problems arise.

A lack of corporate transparency is a common characteristic of high-risk trading platforms.

Trading Conditions and Fees

Clear trading conditions are essential for informed decision-making. Traders should have easy access to information about:

-

Spreads and commissions

-

Leverage and margin requirements

-

Overnight swap or rollover fees

-

Execution policies and slippage

TradeTime.com does not clearly disclose many of these critical details. Important information about costs and trading mechanics is either poorly explained or difficult to locate. Without full transparency, traders may encounter unexpected fees or unfavorable trading conditions that impact profitability.

Hidden or unclear fees are a frequent complaint associated with risky brokers.

Account Types and Minimum Deposits

TradeTime.com advertises multiple account types, suggesting that traders can choose an option based on their experience or investment size. While tiered accounts are common in the industry, reputable brokers clearly explain:

-

Minimum deposit requirements

-

Differences between account tiers

-

Benefits and limitations of each account

-

Any conditions tied to account upgrades

In this case, account details are not sufficiently transparent. Traders may be encouraged to deposit funds without fully understanding what each account offers or what obligations come with it. This lack of clarity can lead to confusion and financial risk.

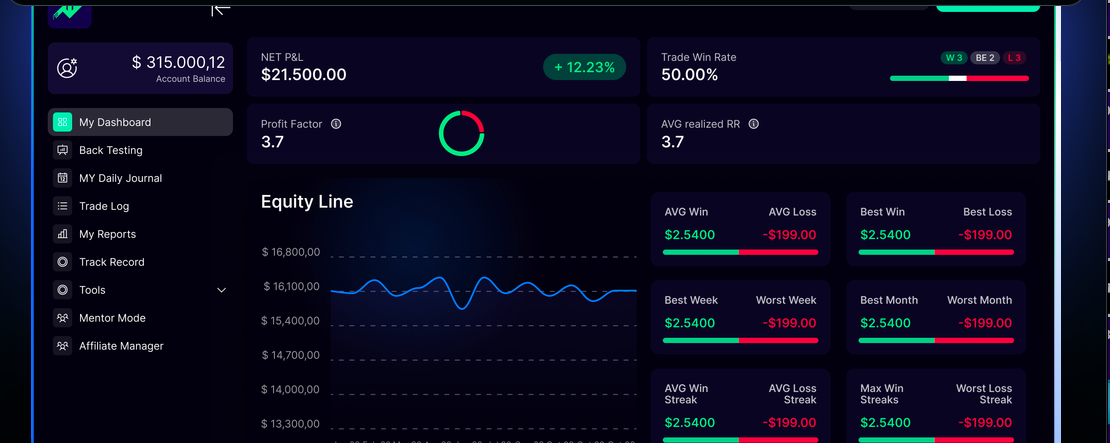

Platform Reliability and Execution

The trading platform is the core of any broker’s service. Reliable brokers provide detailed information about:

-

The technology powering the platform

-

Order execution models

-

Pricing sources and liquidity providers

-

Measures to prevent manipulation

TradeTime.com claims to offer a functional and efficient trading platform, but provides little information about execution quality or pricing transparency. Traders cannot independently verify whether orders are executed fairly or whether prices accurately reflect real market conditions.

Poor execution transparency increases the risk of slippage, re-quotes, and unfavorable trade outcomes.

Marketing Practices and Promotions

Aggressive marketing is often a warning sign in the trading industry. TradeTime.com has been associated with promotional messaging that emphasizes quick profits and attractive opportunities.

Common concerns include:

-

High-pressure sales tactics

-

Frequent calls or messages encouraging larger deposits

-

Promotional incentives with unclear terms

While marketing is a normal business activity, brokers that prioritize deposits over education and risk disclosure often put traders at a disadvantage. Promises of high returns without balanced risk explanations should always be approached with skepticism.

Deposit and Withdrawal Issues

The ability to withdraw funds smoothly is one of the most important aspects of broker reliability. Trusted brokers clearly outline:

-

Accepted payment methods

-

Processing times for withdrawals

-

Verification requirements

-

Any applicable fees

TradeTime.com’s withdrawal policies lack clarity, and traders have reported difficulties accessing their funds. Commonly cited issues include:

-

Delays in withdrawal processing

-

Additional requirements introduced after requests

-

Lack of clear communication regarding timelines

Problems with withdrawals are one of the strongest indicators of a high-risk or unreliable broker.

Risk Disclosure and Trader Education

Responsible brokers provide clear risk warnings and educational resources to help traders understand the dangers of leveraged trading. Markets can be volatile, and losses can exceed expectations.

TradeTime.com appears to place more emphasis on potential rewards than on risk education. Limited educational content and insufficient risk disclosure may lead inexperienced traders to underestimate the dangers involved.

A lack of proper risk communication is especially concerning for beginner traders.

Customer Support Quality

Reliable customer support is essential for resolving technical issues, account questions, and financial concerns. A trustworthy broker offers responsive support through multiple channels.

Reports suggest that TradeTime.com’s customer support may be inconsistent. Traders often experience prompt responses before depositing funds, followed by slower or less helpful communication when issues arise, particularly around withdrawals.

This pattern is frequently observed with brokers that prioritize acquiring deposits over long-term client satisfaction.

Overall Risk Assessment

Based on the available information, TradeTime.com displays multiple red flags commonly associated with high-risk or potentially deceptive brokers:

-

No verifiable regulation

-

Limited corporate transparency

-

Unclear trading conditions and fees

-

Ambiguous account structures

-

Platform execution concerns

-

Aggressive marketing tactics

-

Withdrawal difficulties

-

Weak risk disclosure

-

Inconsistent customer support

When viewed together, these issues suggest a high level of risk for traders.

How Traders Can Reduce Risk

Before choosing any online broker, traders should:

-

Verify regulatory status with recognized authorities

-

Confirm corporate ownership and jurisdiction

-

Read all trading terms carefully

-

Start with minimal deposits

-

Avoid brokers using pressure tactics

-

Seek independent reviews and feedback

Due diligence is essential to protecting capital in online trading.

Final Verdict on TradeTime.com

Considering the lack of credible regulation, poor transparency, unclear trading conditions, and reported withdrawal problems, TradeTime.com exhibits many warning signs associated with scam or high-risk brokers.

Traders are strongly advised to approach this platform with extreme caution and consider brokers that operate under recognized regulatory oversight, provide transparent information, and prioritize trader protection. In online trading, security and accountability should always come before promises of fast profits.

Report TradeTime.com and Recover Your Funds

If you have fallen victim to TradeTime.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like TradeTime.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.