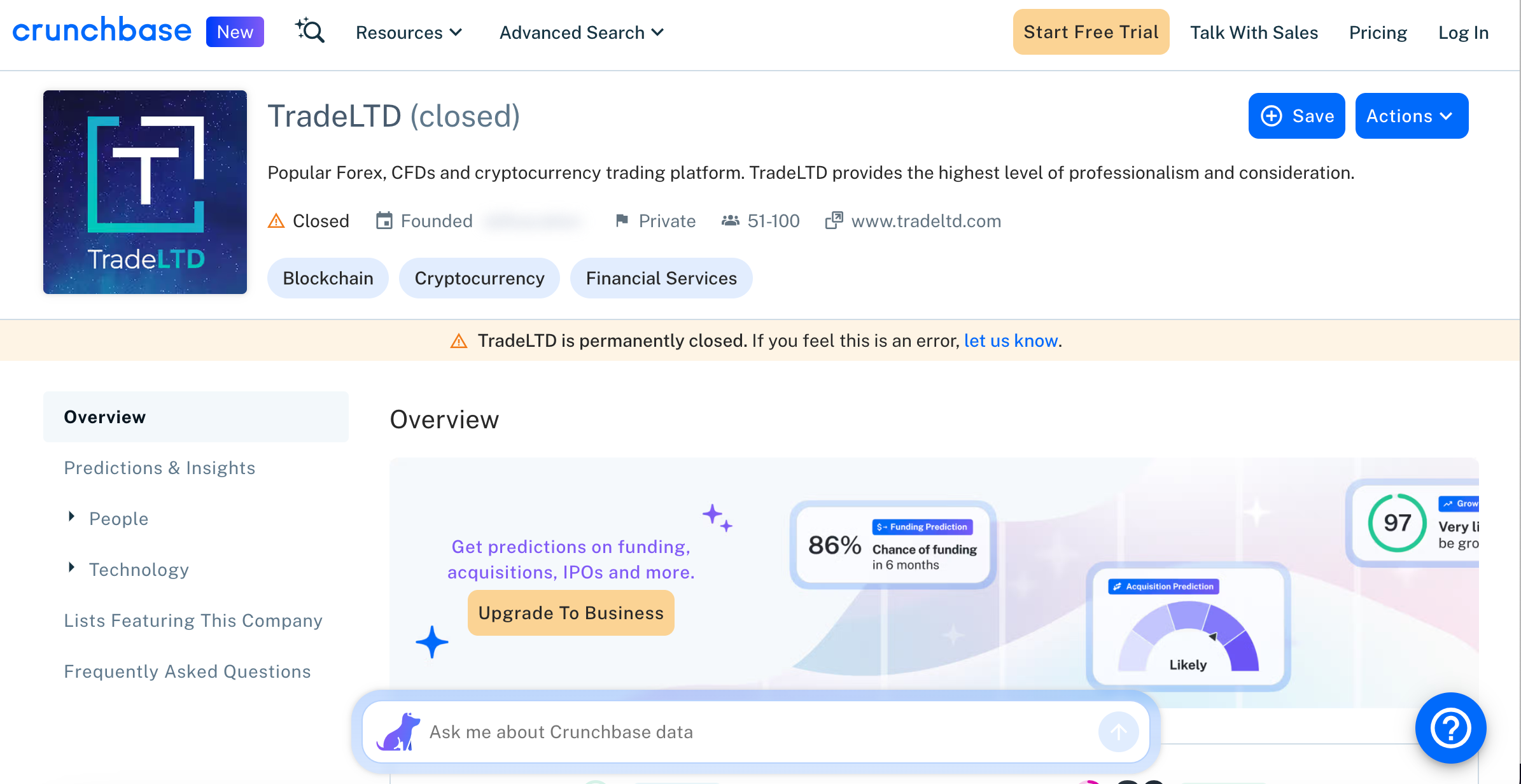

TradeLTD.com Scam Review – Exposing the Hidden Dangers

In the online forex and CFD trading world, countless firms claim to provide top-tier services, big returns, and professional platforms. Some are legitimate, but many operate with minimal transparency, no regulation, and one goal in mind: extracting funds from traders rather than helping them profit. One such entity that repeatedly shows major warning signs is TradeLTD (tradeltd.com). While it presents itself as a broker facilitating global trading, a closer look reveals a pattern of unlicensed operations, withdrawal issues, and aggressive sales pressure. This review walks through what TradeLTD claims, what it actually delivers, the risk it presents, and why investors should stay far away.

What TradeLTD Claims to Offer

TradeLTD pitches itself as a full-service trading broker offering access to forex pairs, CFDs on commodities, indices, and perhaps cryptocurrencies. It advertises account tiers (Standard, Premium, VIP), competitive spreads, leverage (often high levels), and a “professional trading environment.” The marketing emphasises ease of use, growth potential, and the idea that you can generate returns by trading with their platform or through account-manager assistance.

For many new traders, these offers are appealing: seemingly simple entry, promises of high leverage, and ease of access. The website appears polished, uses industry jargon, and frames itself as global. On the surface, it ticks the boxes of what a trader might look for. But appearances can be deceptive.

Major Red Flags That TradeLTD is Highly Suspicious

1. Lack of Valid Regulatory Authorization

Perhaps the single most serious concern is that TradeLTD is not properly regulated by any major, credible financial authority. Multiple independent reviews and watchdogs note that the broker claims to be registered or licensed, yet no verifiable licence is displayed or matched to the claimed regulatory body. Reviewers state that major regulators such as the UK regulator or the Estonian regulator do not recognise the entity as authorised to provide investment services. The absence of licencing means there is no guarantee of client fund segregation, no oversight of the business, and significantly increased risk of misconduct.

2. Ownership and Corporate Structure Are Obscure

A legitimate broker typically provides transparent information: company registration details, beneficial owners, physical address, regulatory status, auditors. TradeLTD’s disclosures are vague or inconsistent. The website might claim affiliation with certain entities, but independent verification fails. Many users report being unable to locate credible information about the owners or trace the business in company registers. This opacity suggests the operators seek to avoid accountability.

3. Unrealistic Promises, High Leverage, and Big Returns

TradeLTD advertises high leverage (sometimes 1:200 or more), account upgrades, special deals and the possibility of large profits. It may also use phrases such as “unlock VIP returns” or “professional account manager will trade for you.” In reality, credible brokers emphasise risk, realistic returns, and do not guarantee profit. TradeLTD’s marketing style fits that of high-risk or fraudulent operations exploiting greed and hope.

4. Withdrawal Problems and Hidden Conditions

One of the most common complaints from traders who deal with TradeLTD is difficulty withdrawing funds. Reports include: requests for additional deposits to “qualify” for withdrawal, account freezes, long delays without explanation, and customer service that ceases communication. The pattern suggests that once traders deposit larger sums, the platform introduces new hurdles. This is a classic manipulative tactic in scam broker models.

5. High Pressure Sales Tactics & Upselling

Many users describe being contacted almost immediately after registration by account managers who push deposit upgrades, VIP programmes, “limited time offers,” or additional funds required to unlock features. The pressure is intense and often constant. Typical of legitimate brokers: they allow you to proceed at your own pace; typical of suspect brokers: they pressure you to deposit more. TradeLTD seems to exhibit the latter behaviour heavily.

6. Negative User Feedback and Online Alerts

There are numerous user-review windows and broker-review sites which rate TradeLTD very poorly, citing withdrawal refusals, fund losses, mis-representation, and lack of support. Also, official regulatory warnings or alerts appear pointing to the broker being unauthorised in certain jurisdictions. These combined signals significantly undermine the broker’s credibility.

7. Domain/Operational Instability

Reports indicate that at times the broker’s website becomes inactive, or the domain registration lacks transparency, or the company changes its claimed regulatory jurisdiction. Brokers that shift their operating base, domain or licence frequently are often doing so to escape scrutiny. TradeLTD appears to show signs of operational instability or domain suspension in certain analyses.

How the Typical TradeLTD Experience Unfolds

Based on multiple reports, the sequence often looks like this:

-

Initial Approach – You’re drawn in via an online ad, social media, or referral. The website looks professional and you register without much hesitation.

-

First Small Deposit – You deposit a modest amount (e.g., $250-$500). You might see an initial increase on paper, or the account manager makes you feel confident.

-

Encouragement to Increase Deposit – The account manager calls/email persuading you to deposit more (say $1,000-$5,000) to reach “VIP tier” or “unlocked features,” or “better returns.”

-

Withdrawal Attempt – You try to withdraw either your deposit or your “profit.” That’s when the problems begin: the website demands more deposits, sets impossible trade-volume targets, or claims verification is incomplete. They stall or delay.

-

Communication Declines, Funds Frozen – The manager becomes unreachable, support stops responding, account balance might freeze or revert, and access to funds is restricted. You realise you cannot withdraw what you thought was yours.

-

Site Is Altered Or Disappears – In some cases the website changes domain, operation moves offshore, or the broker ceases activity without notice. Your funds are effectively gone.

This chronology is consistent across many reviews and mirrors the behaviour of many known scam brokers.

Why This Broker’s Model is Dangerously High-Risk for Investors

-

Your funds lack protection: Without regulation, client funds are not in segregated accounts, there is no audit, no financial guarantee.

-

Manipulative psychological tactics: The use of friendly but persistent account managers, promise of big profits, daily calls – all create emotional pressure rather than sober investing.

-

Hidden or shifting terms: Conditions that change after deposit (minimum volume, upgrade, bonus conditions) make withdrawals contingent on impossible criteria.

-

Difficulty of accountability: If the broker is unlicensed or offshore, recourse is very limited. Tracking owners or enforcing rights is extremely difficult.

-

False sense of progress: Platform may show fake profits or positive balances to lure you into deeper investment, but those “profits” may never be real or withdrawable.

Questions Every Investor Should Ask – And How TradeLTD Fails Them

1. Are you regulated by a recognised financial authority?

TradeLTD cannot credibly display a licence from a major regulator where you reside.

2. Do you publish verified company registration and publicly-audited financials?

TradeLTD lacks verifiable ownership disclosures and audited accounts remain absent.

3. Are withdrawal conditions simple and transparent?

With TradeLTD, many users report opaque processes and new conditions post deposit.

4. Is the marketing realistic and does it emphasise risk appropriately?

TradeLTD’s marketing emphasises “profit,” “VIP upgrade,” “fast returns,” rather than risk and transparency.

5. Does the platform honour withdrawal requests and act consistently?

TradeLTD fails here: numerous withdrawal complaints are logged online.

6. Is there stable operational presence and domain transparency?

TradeLTD shows signs of instability, domain issues and jurisdiction shifts, which undermines credibility.

If you cannot answer “yes” to most of these, you are facing very high risk. TradeLTD fails multiple crucial tests.

Final Verdict on TradeLTD.com

In summary: TradeLTD is a high-risk broker, showing multiple hallmarks of a scam operation rather than a legitimate trading company. The lack of proper regulation, complaints about inability to withdraw funds, aggressive deposit-upselling, opaque company structure, and prior regulatory alerts all point to this conclusion.

While there is always risk inherent in trading, choosing a broker that adds avoidable risk (such as operating unlicensed) is imprudent. For any responsible trader, transparency, oversight and user protections should be non-negotiable. TradeLTD fails on these counts.

Therefore, anyone considering using this broker should exercise extreme caution—and given the evidence, the most sensible choice is likely to avoid it entirely. By doing so, you protect your capital, focus on legitimate regulated alternatives, and avoid the kind of stress and loss that many former TradeLTD users report.

Report TradeLTD.com and Recover Your Funds

If you have fallen victim to TradeLTD.comm and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like TradeLTD.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.

emrys vil

November 16, 2025I lost about half of my life savings to some unscrupulous investment website few weeks back but luckily for me I was able to read this reviews