TradeFintech.com Scam Review – A Deep Dive

In the world of online trading and investment, many firms promise big returns, slick platforms, and easy access to markets. While some are legitimate, others are constructed to trap investors with little chance of safe withdrawal or transparency. One such firm that raises serious alarm bells is TradeFintech.com. This review analyses how TradeFintech presents itself, what warning signs emerge, how its modus operandi appears to work, and why investors should be extremely cautious.

What TradeFintech Claims to Offer

TradeFintech presents itself as a forex/CFD broker allowing retail clients to trade currencies, commodities, and possibly other assets via the MetaTrader 4 (MT4) platform. It claims multiple account types, access to standard trading instruments, and a relatively modest minimum deposit to open an account. The website frames trading as accessible, profitable, and supported by a professional team.

For someone entering the world of online trading, this kind of offer can seem attractive: “deposit, trade, profit”. However, the surface appearance hides deeper issues.

Key Warning Signs & Red Flags

1. Lack of Proper Regulation and Authorisation

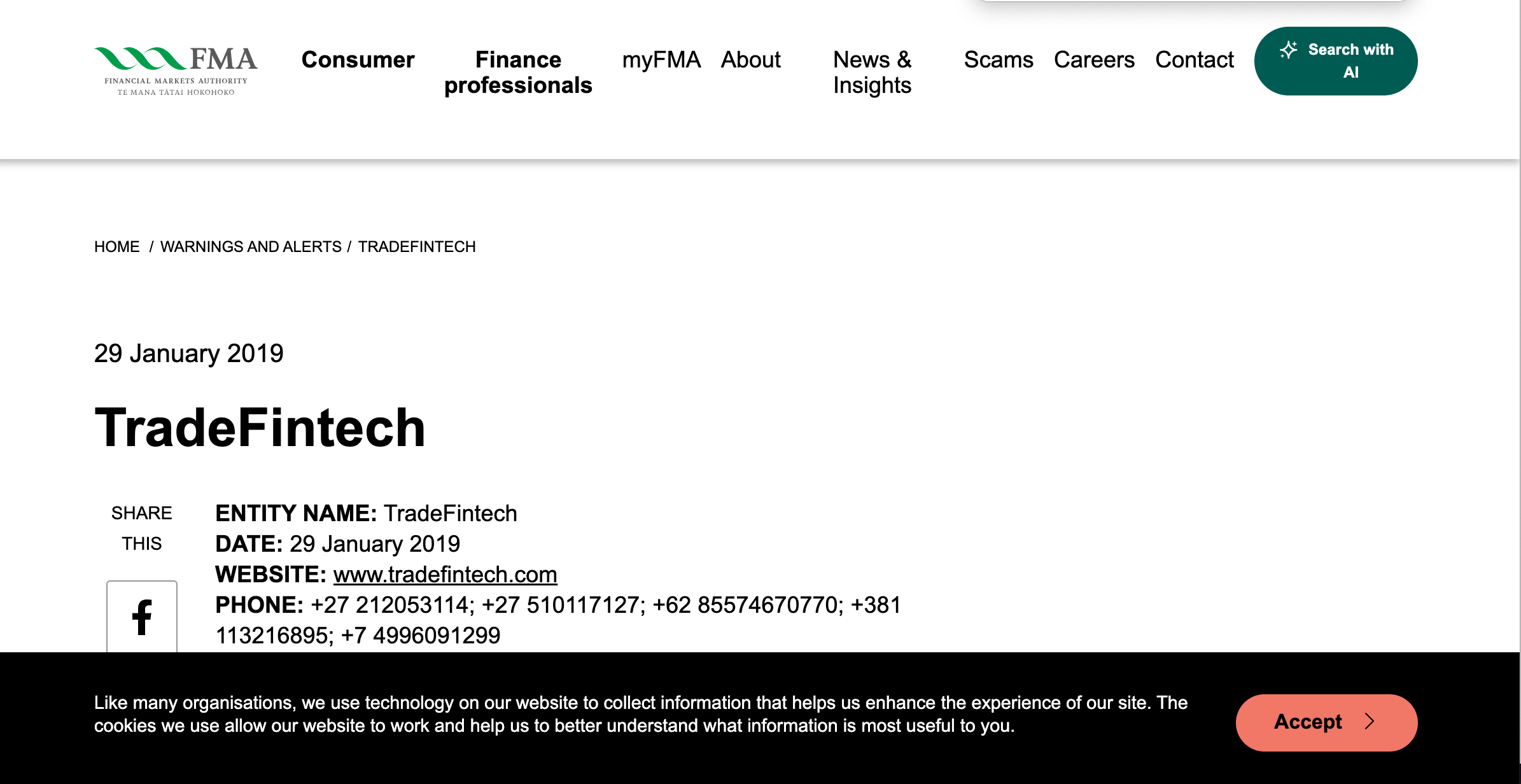

One of the most serious red flags with TradeFintech is its lack of authorised regulation. A well-known financial regulator publicly warned that “Fintech Technologies trading as TradeFintech.com” is not authorised in the UK and may be providing financial services without legal authorisation.

This means clients dealing with TradeFintech are not safeguarded by consumer protection regimes, compensation schemes, or oversight by recognised regulator frameworks.

Operating without clear regulation is a hallmark of brokers who may not act in clients’ interests, and heightens risk significantly.

2. Ambiguous Corporate Details and Offshore Positioning

The corporate details of TradeFintech are vague and inconsistent. For example, its listed address is in the Marshall Islands (an offshore jurisdiction), which is known to offer minimal oversight for financial firms.

The website claims registration in one jurisdiction but lacks verifiable, transparent licensing documentation. This offshore setup reduces accountability and means client funds may be exposed.

3. Unrealistic Promises and Potential Loss of Control

Reviewers highlight that TradeFintech offers trading conditions that are not competitive and may be difficult to trust (for example wide spreads, limited instrument lists). More importantly, when a broker lacks regulation, there is no guarantee of fair execution, real market access, or proper segregation of funds.

Clients who expect fast, high returns or guaranteed profits—though not necessarily promised explicitly—are vulnerable when the broker is not regulated and uses aggressive sales tactics.

4. Poor Transparency of Terms, Conditions & Withdrawal Policies

Further concerns include the absence of clear terms regarding withdrawals, client fund protection, or account segregation. Feedback from users suggests that withdrawal attempts are met with obstacles: extra “trading volume” requirements, mandatory deposits, or unfavourable spread/spoofing by the broker.

When terms are hidden or ambiguous, and the platform changes conditions after deposit, you face serious risk.

5. Reports of Client Complaints and Negative Feedback

User reports indicate that individuals who deposited funds with TradeFintech found it extremely difficult to obtain their funds back or even make a small withdrawal. Some state that initial gains may appear on the account for trust building, but then accessing those funds becomes impossible unless further deposits are made. Real-world complaints point to behaviour consistent with scam or high-risk broker operations.

6. Marketing Formula Matching Known Scam Patterns

The progression of initial deposit → small profit → bigger deposit request → blocked withdrawal appears consistent with classic scam broker tactics. Firms like TradeFintech appear to rely on pressure, ongoing calls/emails from account managers, “VIP upgrades”, and eventually withdrawal problems.

If your experience follows this pattern, you are likely in a high-risk situation.

How the Typical TradeFintech Experience Plays Out

Based on common reports and patterns, here is how a user’s experience with TradeFintech might proceed:

-

Initial Contact & Sign-Up

The user sees a promotional message or ad, registers with TradeFintech, deposits an amount (say $250 or equivalent). The platform may provide access to MT4 and show some initial positive balances. -

Early Gains & Encouragement

The user sees rising account value (which may be fabricated), receives contact from an “account manager” praising performance and encouraging further deposit or upgrade to a higher tier. -

Further Deposit Pressure

The account manager suggests more funds should be deposited to unlock “better conditions”, “lower spreads”, or “higher returns”. The user, feeling confident, might deposit more. -

Withdrawal Attempt Triggering Barriers

When the user asks to withdraw funds or profits, the broker introduces conditions: “You must trade X amount first”, “You must upgrade your account”, “You must pay processing / tax fees first”. These conditions were not clearly communicated initially. -

Funds Locked or Account Access Reduced

The platform delays withdrawals, stops responding, may freeze the account, or demands further deposit before funds are released. At this stage, the risk of fund loss becomes high. -

Communication Breakdown or Domain Change

Eventually, the user may find the website is changed, support is unresponsive, and the broker may change domain or simply vanish. The funds are essentially trapped.

Why This Setup is Dangerous for Investors

-

Funds may not be segregated: Without regulation the broker may use client funds for its own operations, or disappear with them.

-

Limited recourse: Unregulated firms leave clients with little or no legal protection or ability to file complaints through regulatory channels.

-

Manipulated trading environment: When the broker controls execution and platform, it may manipulate trades, show fake profits and then prompt more deposit or force loss-making trades.

-

Pressure tactics and emotional manipulation: The “account manager” model emphasises persuasive sales rather than genuine trading support. This can lead to emotional decisions and major losses.

-

Hidden terms undermine withdrawal: Ambiguous contracts or terms that change post-deposit allow brokers to delay withdrawals indefinitely or impose unfair conditions.

Comparison With a Legitimate Broker

To highlight the difference, here is a comparison:

| Feature | Legitimate Broker | TradeFintech.com |

|---|---|---|

| Regulation by credible authority | Yes – e.g., FCA, ASIC, CySEC | No verifiable licence; unauthorised in UK |

| Transparent corporate information | Clear company name, address, audit reports | Offshore address, vague ownership, minimal transparency |

| Fair trading conditions & spreads | Published, competitive, real market execution | Reports of wide spreads, poor transparency |

| Straightforward withdrawals | Clear policy, tested by clients, minimal extra demands | Reports of barriers, hidden conditions, account freezes |

| Ethical marketing & client support | Responsible, no high-pressure upsell | Reports of aggressive deposit solicitation and upsell logic |

This comparison shows how TradeFintech falls far short of what a professional broker should deliver.

Best Practice Questions to Ask Before Trading with Any Broker

Before opening any account, ask key questions. TradeFintech fails many of these:

-

Is the broker regulated by a well-known financial authority?

-

Is there verifiable information about the company: registration number, address, physical office?

-

Are client funds held in segregated accounts and protected?

-

Are trading conditions listed clearly and is there a track record of fairness?

-

Are withdrawal policies clearly published and has independent feedback proven they work?

-

Are account managers free and supportive, or do you feel pressured to deposit more?

-

Does marketing promise realistic outcomes rather than guaranteed profits?

-

Do you receive independent verification (e.g., audited results, reviews, trusted forums)?

If the answer to several of these is “no”, then you are at risk.

Final Verdict on TradeFintech.com

In review, TradeFintech.com exhibits almost every characteristic of a high-risk or fraudulent broker rather than a reliable, regulated trading service. The key concerns – lack of licence, offshore setup, user complaints of withdrawal problems, aggressive deposit upsell tactics, poor transparency – all point to a platform that may prioritise collecting investor funds rather than providing genuine trading services.

While I cannot state definitively that every user loses funds (as some brokers operate in a grey area), the risk profile here is extremely high. For any investor depositing funds with TradeFintech, the odds of facing difficulty retrieving their money or being subject to unfair conditions appear substantial.

Therefore, for those seeking to invest or trade online, the prudent conclusion is: avoid TradeFintech.com. Choose a broker that meets regulatory standards, has clear transparency, and a solid reputation. When it comes to your capital, trust and protection matter far more than the promise of easy profits.

Report TradeFintech.com and Recover Your Funds

If you have fallen victim to TradeFintech.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like TradeFintech.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.