Swisstrading24 Scam Review:A Fake Trading Platform?

Online trading has opened doors for millions of people looking to build financial freedom through forex, crypto, and stock investments. However, the rise of digital finance has also brought with it a flood of fake trading platforms that disguise themselves as professional brokers. One of the names drawing growing suspicion lately is Swisstrading24.

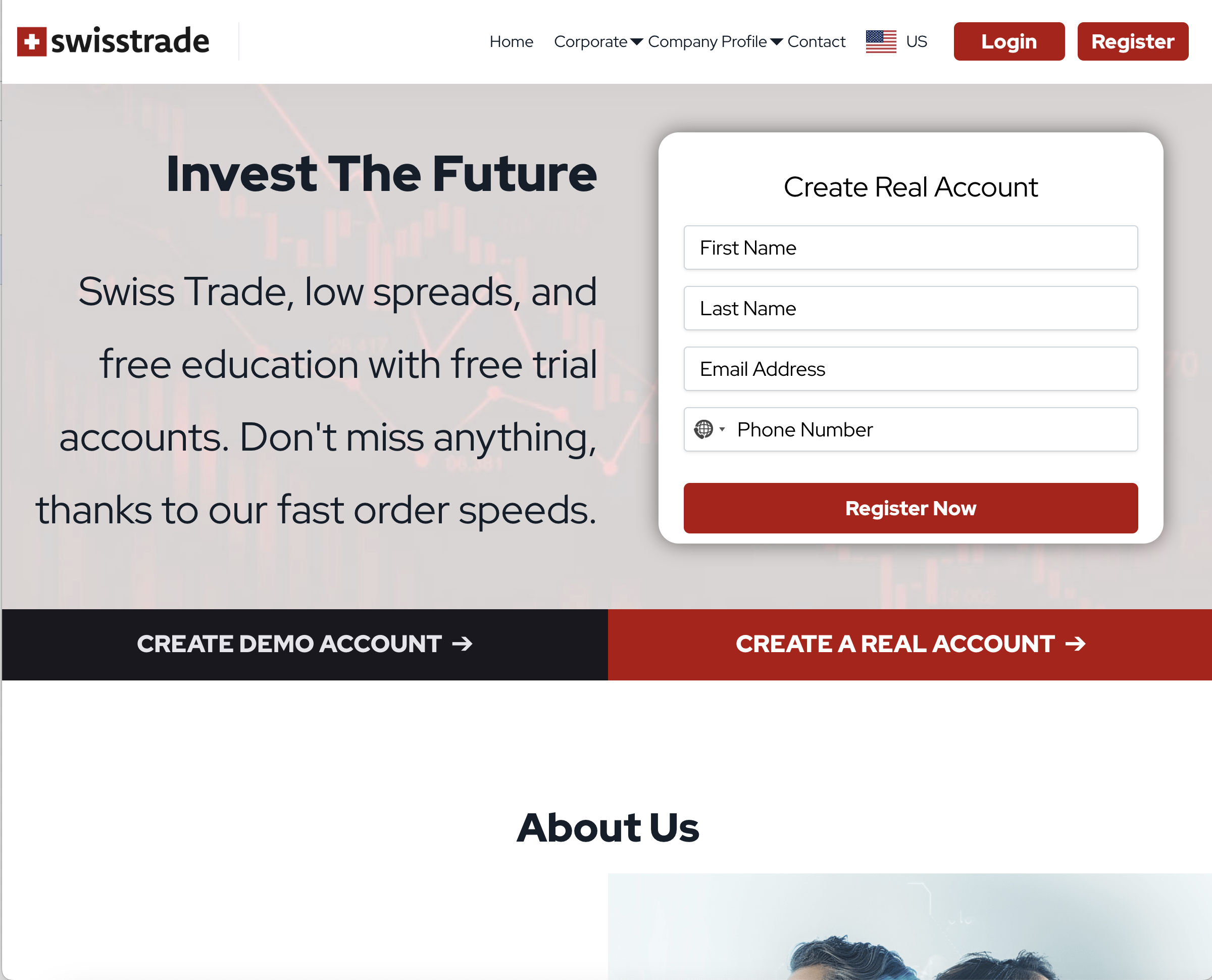

At first glance, Swisstrading24 markets itself as a Swiss-based brokerage offering forex, crypto, and CFD trading services. The company’s website uses professional language, sleek design, and promises of advanced tools to appear legitimate. But a closer look raises several concerns that suggest Swisstrading24 may not be the reliable platform it claims to be.

This in-depth Swisstrading24 Scam Review examines the company’s background, business model, user complaints, and red flags to determine whether it is a genuine trading broker or another online investment scam.

What Is Swisstrading24?

Swisstrading24 claims to be a global financial services company that allows clients to trade a variety of assets — including forex pairs, stocks, commodities, and cryptocurrencies. It advertises itself as a modern, client-oriented broker offering:

-

Cutting-edge trading tools and platforms

-

24/7 market access

-

Low trading fees and fast execution

-

Professional portfolio management

-

Secure transactions and guaranteed returns

While this sounds impressive, many scam platforms use identical selling points to build credibility and attract inexperienced investors. A genuine broker’s legitimacy can always be verified through its regulatory status, corporate details, and operational transparency — areas where Swisstrading24 quickly falls short.

Company Background and Legitimacy

When evaluating any broker, the first and most important question is: Is it regulated? Legitimate brokers are always registered with and supervised by recognized financial authorities, such as the FCA (UK), FINMA (Switzerland), or ASIC (Australia). These bodies ensure fair trading practices, client fund protection, and accountability.

1. No Valid Regulation or License

Despite claiming to be based in Switzerland, Swisstrading24 does not appear on FINMA’s list of authorized financial entities. The website provides no license number or evidence of registration with any regulatory agency.

This means the company operates without legal authorization, which is a serious red flag. Any broker offering financial services in Europe or globally must hold an operating license — otherwise, it cannot legally collect or manage investor funds.

2. No Verifiable Corporate Information

Swisstrading24 fails to disclose key company details such as a registered address, management team, or corporate structure. The “About Us” section on its website contains only vague and generic statements about innovation and technology, without any names, history, or certifications.

Legitimate brokers are proud of their transparency and openly share such information to establish trust. In contrast, scam platforms deliberately hide it to avoid accountability once they disappear.

3. Hidden Ownership and Anonymous Operations

A WHOIS domain lookup reveals that Swisstrading24’s website was recently created, and the domain owner’s details are hidden behind privacy protection. This anonymity is typical of fraudulent operations — they mask their identity to avoid legal consequences when complaints begin to surface.

How Swisstrading24 Claims to Work

Swisstrading24’s website explains that it offers multiple account types tailored to different investors — from beginners to professionals. It claims that users can earn steady profits through:

-

Automated trading systems

-

AI-driven algorithms

-

Expert-managed investment portfolios

Clients are encouraged to deposit funds and choose an investment plan that allegedly provides guaranteed returns or daily profits. These plans often feature unrealistic promises, such as 5–15% profit per week — numbers that no legitimate broker would ever guarantee.

The company’s “demo” profits and dashboard visuals may create the illusion of successful trading, but there is no verifiable evidence of real market activity. The absence of integration with legitimate trading platforms such as MetaTrader 4 or MetaTrader 5 is another red flag.

In essence, Swisstrading24 appears to be a deposit-based operation — money flows in easily, but withdrawing it becomes almost impossible.

Red Flags and Warning Signs

Several warning signs strongly suggest that Swisstrading24 operates as a fraudulent or unregulated broker rather than a genuine investment company.

1. Unrealistic Return Guarantees

One of the clearest indicators of a scam is promising fixed or guaranteed profits. The financial markets are unpredictable; even professional traders cannot ensure consistent returns. Swisstrading24’s claim of high, risk-free profits is mathematically impossible and meant to deceive investors.

2. Lack of Transparency

The absence of verifiable details — including the company’s physical location, regulatory license, or executive team — suggests that Swisstrading24 is intentionally concealing its identity. Legitimate firms are transparent about who they are and where they operate.

3. No Verified Trading Platform

Most regulated brokers provide access to recognized trading software (like MT4/MT5) or at least a custom-built platform with verifiable functionality. Swisstrading24 does neither. The so-called “trading dashboard” seems more like a simulation than a real interface connected to global markets.

4. Withdrawal Issues and User Complaints

Several online discussions report problems withdrawing funds from Swisstrading24. Users claim that after making deposits and seeing fake profits in their accounts, they were unable to retrieve their money. Excuses such as “verification delays,” “system maintenance,” or “tax fees” are commonly cited before communication stops entirely.

5. Fake Testimonials and Reviews

The testimonials on Swisstrading24’s website appear fabricated. The photos are stock images used across unrelated websites, and the reviews use identical phrasing found on other known scam platforms. This pattern is consistent with fraudulent marketing tactics designed to build false trust.

How the Swisstrading24 Scam Typically Works

Based on reported user experiences and observed behavior, the Swisstrading24 scam likely follows a familiar pattern seen in similar online trading frauds:

-

Attraction Phase – Investors are lured through ads, social media messages, or emails promoting “safe and high-return investments.”

-

Deposit Phase – Users are convinced to make an initial deposit, often around $250–$500. Fake profits begin appearing in their accounts within days.

-

Reinvestment Pressure – “Account managers” encourage users to invest more, claiming that higher deposits will yield even greater returns.

-

Withdrawal Blockade – When investors attempt to withdraw, the company delays or demands extra payments (like “tax” or “processing fees”).

-

Disappearance – Eventually, the platform stops responding, and the website or communication channels go offline.

This is a classic Ponzi-style scam, where deposits from new investors are used to pay fake profits to earlier ones, sustaining the illusion of success until the scheme collapses.

Technical and Domain Observations

Swisstrading24’s website displays several technical inconsistencies that raise doubts about its authenticity.

-

Recently Registered Domain: The domain’s short lifespan suggests the platform was created to operate temporarily — a hallmark of scam networks.

-

Hidden WHOIS Information: The use of privacy shields prevents anyone from knowing who actually owns or runs the site.

-

No Security Certification: The absence of verified SSL certificates means user data may not even be securely transmitted.

-

No Trading Software Integration: The site lacks APIs or connections to genuine liquidity providers or financial markets.

These details point to a fake setup designed for appearance rather than actual functionality.

Comparison with Legitimate Brokers

A side-by-side comparison between Swisstrading24 and legitimate brokers highlights glaring differences:

| Criteria | Swisstrading24 | Regulated Broker |

|---|---|---|

| Regulatory License | None | Licensed by FCA, ASIC, or CySEC |

| Ownership Disclosure | Hidden | Fully transparent |

| Platform Type | Fake dashboard | Verified MT4/MT5 |

| Profit Promises | Fixed high returns | Market-based performance |

| Withdrawals | Frequently blocked | Processed within 24–48 hrs |

| Transparency | None | Full documentation available |

User Experiences and Complaints

Many victims describe the same experience: after depositing money, they were assigned an “account manager” who initially seemed professional and helpful. The manager frequently encouraged additional deposits, using phrases like “Your account is performing very well — you should increase your investment.”

However, once users attempted withdrawals or questioned the legitimacy of the platform, communication abruptly stopped. In some cases, users were even blocked from logging into their accounts altogether.

These patterns are consistent with investment fraud rather than legitimate trading activity.

Final Verdict: Is Swisstrading24 Legit or a Scam?

After examining its background, operations, and reputation, the conclusion is clear: Swisstrading24 is not a legitimate broker.

The company operates without regulation, hides its ownership, and uses deceptive marketing language to lure unsuspecting investors. Its fake trading interface, fabricated testimonials, and user complaints about withdrawal issues all point to one reality — Swisstrading24 is a scam platform.

Any investor considering this platform should view it as high-risk and untrustworthy. There is no evidence of genuine trading activity, and the lack of legal oversight means that once funds are sent, they are effectively lost.

Key Takeaways

-

Swisstrading24 is unregulated and offers no investor protection.

-

Company details are hidden, making accountability impossible.

-

Guaranteed profits and AI-driven trading claims are false marketing tactics.

-

Users report withdrawal issues and unresponsive customer support.

-

Evidence strongly indicates that Swisstrading24 is a scam trading platform.

Report Swisstrading24.com and Recover Your Funds

If you have fallen victim to Swisstrading24 and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Swisstrading24 persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.