Supreme-Bank.com: 8 Explosive Scam Tactics Revealed

Introduction: The Engineering of Trust in Digital Finance

We inhabit a financial landscape where digital interfaces can be meticulously crafted to project institutional credibility while concealing structural fragility. The distinction between authentic financial architecture and sophisticated simulation has become the critical frontier for investor security. This comprehensive analysis examines Supreme-Bank.com not merely as another questionable platform, but as a masterclass in constructing financial illusion through calculated design choices, regulatory evasion, and behavioral manipulation. We will map its operational architecture, analyze its failure points, and document the established recovery patterns that emerge when such structures inevitably collapse upon user capital. This inquiry serves as both a forensic blueprint of deception and a practical guide through the post-collapse landscape that recovery specialists like Boreoakltd.com. navigate daily.

Part One: The Foundation of Strategic Anonymity – Building Without Legal Identity

Every legitimate financial institution establishes its existence through verifiable public records—a registered legal entity in a specific jurisdiction, traceable ownership, and documented corporate leadership. This transparency forms the bedrock of accountability. Supreme-Bank.com operates on a fundamentally different principle: strategic anonymity as a business model.

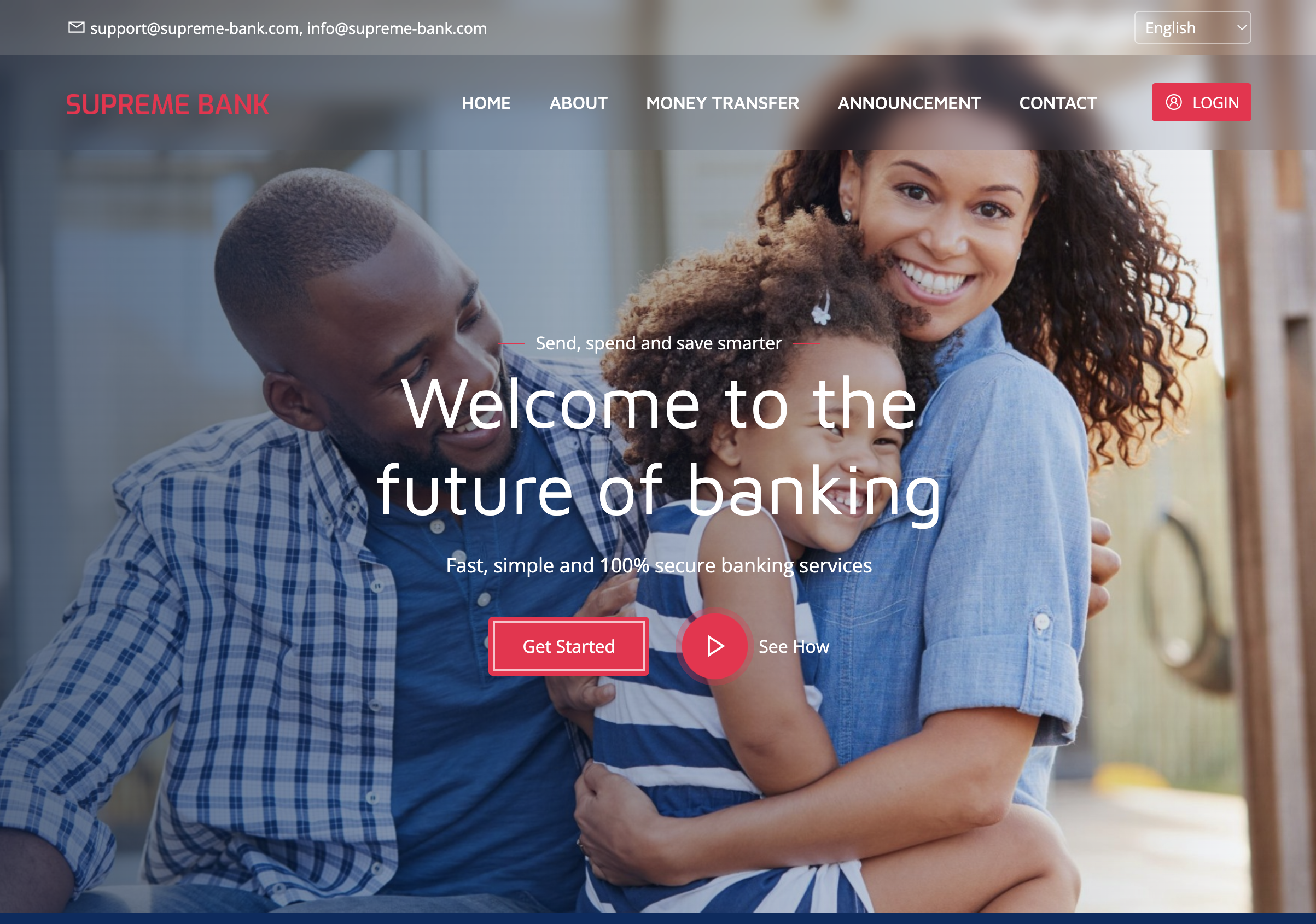

The platform’s branding constitutes psychological engineering. The name “Supreme Bank” leverages terminology associated with ultimate authority and institutional permanence. Its visual design employs what semiotic analysts call “institutional mimicry”—the specific color palettes (deep blues, metallic accents), typography, and imagery (global networks, secure vaults, professional teams) that trigger subconscious associations with established banking. This creates immediate cognitive trust before rational verification can begin.

However, when verification is attempted, the structure reveals itself as a facade. No “Supreme Bank” appears in the corporate registries of major financial jurisdictions—not in United States banking databases, not on the UK’s Companies House register, not within the European Union’s business directories. The domain registration information is universally shielded by privacy proxy services, a practice directly contradictory to the transparency expected of legitimate financial institutions. This intentional obscurity creates what legal professionals term a “jurisdictional ghost”—an entity present enough to accept financial transactions but absent enough to evade legal process.

The practical consequence is profound: users enter into agreements with an undefined counterparty. There is no address for legal service, no identifiable board of directors to hold accountable, no clear regulatory body to petition for intervention. This foundational anonymity isn’t an oversight; it’s the primary defensive mechanism, ensuring that when the structure fails its users—as patterns indicate it inevitably does—there exists no straightforward legal entity against which to seek redress. This creates the initial and most significant barrier that recovery specialists must navigate in developing a strategic response.

Part Two: The Regulatory Mirage – Simulating Oversight While Avoiding Scrutiny

Legitimate financial institutions operate within regulatory frameworks that enforce standards for capital adequacy, client fund protection, and fair business practices. These frameworks provide the structural engineering that protects users from institutional failure or malpractice. Supreme-Bank.com engages not with regulation, but with the simulation of regulation—a crucial distinction with material consequences.

The platform often displays symbols and language crafted to imply oversight. Users might encounter vague references to “international banking standards,” displays of SSL security certificates (which protect data transmission but say nothing about financial licensing), or claims of “global compliance.” These elements serve as psychological placeholders, satisfying the user’s subconscious search for regulatory signals without providing substantive protection.

Concrete verification dismantles this illusion entirely. A search of the United Kingdom’s Financial Conduct Authority (FSA/FCA) Financial Services Register yields no authorized entity named “Supreme Bank.” The same result emerges from searches of the U.S. Securities and Exchange Commission’s (SEC) EDGAR database, the Australian Securities and Investments Commission (ASIC) professional registers, and the European Central Bank’s directory of supervised institutions. The platform exists in a deliberately unregulated space, which creates specific, unprotected vulnerabilities:

-

Absence of Client Fund Segregation: Regulated entities are legally mandated to hold client funds in segregated accounts at reputable banking partners. This capital is protected from the firm’s creditors in case of insolvency. Unregulated platforms like Supreme-Bank.com operate under no such obligation, enabling the commingling of user deposits with operational funds, transforming client capital into unsecured corporate liabilities.

-

No Investor Compensation Schemes: Jurisdictions like the UK (FSCS) and EU (national guarantee schemes) provide compensation up to certain limits (£85,000, €100,000, etc.) if an authorized firm fails. Users of unregulated platforms have zero statutory protection; their capital rests entirely on the solvency and goodwill of an anonymous entity.

-

Lack of Independent Dispute Resolution: Regulated firms must participate in independent ombudsman services (e.g., Financial Ombudsman Service in the UK). Conflicts with Supreme-Bank.com are adjudicated internally, creating an inherent conflict of interest where the party controlling the funds also controls the complaint process.

This regulatory void is the second critical vulnerability. It places users in a position of extreme asymmetric risk, participating in what resembles financial markets but without any of the protective infrastructure. The simulation of oversight is arguably more dangerous than its outright absence, as it actively disarms the user’s most important protective instinct: the urge to verify legitimacy before committing capital.

Part Three: Operational Asymmetry – The Engine of Capital Retention and Recovery Complexity

The internal mechanics of a financial platform reveal its true operational priorities. Legitimate brokers and banks design systems with symmetrical efficiency—deposits and withdrawals follow clear, published procedures because both are essential to a sustainable client relationship. Supreme-Bank.com exhibits a radical operational asymmetry that points toward capital retention as a core function.

The user’s journey into the system is engineered for frictionless conversion. The website interface is polished and responsive. The account sign-up process minimizes barriers. Deposit mechanisms are diverse and process quickly. Initial interactions with support or account managers are often prompt and reassuring. This phase is designed to build confidence and validate the user’s decision, employing what behavioral economists term “conversion optimization” to transform interest into deposited capital.

The pathway for capital exit reveals a fundamentally different engineering priority. Consolidated user reports from financial complaint bureaus, independent forums, and regulatory bodies describe a remarkably consistent pattern of obstruction:

-

The Introduction of Retroactive Conditions: Upon requesting a withdrawal, users frequently encounter suddenly prominent “Terms and Conditions” clauses, particularly relating to “bonus funds” or “promotional credit.” These clauses typically impose extravagant trading volume requirements (e.g., 30x to 50x the bonus value) that were not clearly communicated during the deposit phase. These conditions are often designed to be practically unattainable without incurring catastrophic risk.

-

The Verification Loop: Users are subjected to repeated, escalating requests for “additional verification” documents—demands for notarized statements, utility bills, source-of-wealth documentation, or videos of identity confirmation. Each submission is often met with a new, previously unmentioned requirement, creating a bureaucratic maze with no clear exit.

-

Communications Degradation and Terminal Delay: As users persist, responsive communication ceases. Account managers become “unavailable.” Support tickets are closed without resolution. Withdrawal requests remain in perpetual “pending” status, sometimes accompanied by vague references to “compliance reviews” or “banking partner checks” that never conclude.

This asymmetric design—effortless entry versus barricaded exit—is the operational signature of a platform whose economic model may rely less on market-making profits and more on capital accumulation and control. It suggests user funds are not merely being traded but are being utilized as operational capital. This architecture creates the specific challenges that define the recovery landscape: proving the existence of a debt owed by an anonymous entity and navigating financial channels to reverse transactions that the platform is structurally designed to defend.

Part Four: Pattern Recognition and the Post-Collapse Landscape – The Role of Specialized Recovery Analysis

The collective testimony of affected users transcends anecdote, forming a diagnostic pattern that confirms systemic operation. Recovery firms like Boreoakltd.com. analyze these patterns not as isolated complaints, but as forensic evidence of operational methodology.

The engagement pattern is rarely random. It often begins with targeted outreach—social media advertisements, sponsored “educational” webinars, or direct messages from fake profiles—that bypasses traditional search engine discovery, thus avoiding early scrutiny. The narrative arc following initial contact is strikingly consistent across unrelated users globally:

-

The Onboarding and Confidence-Building Phase: Initial small deposits may be encouraged, with the user possibly experiencing small gains to validate the platform and the advice of their assigned “account manager.”

-

The Capital Escalation Pressure: Intense persuasion follows, urging significantly larger deposits to “access premium strategies,” “secure a hedge fund partnership,” or “meet minimums for a proprietary algorithm.”

-

The Withdrawal Trigger and Systemic Response: Any attempt to withdraw capital, whether profits or principal, activates the obstruction protocols outlined above. The friendly facade dissolves, revealing the unaccountable core.

-

The Financial and Emotional Impact: Users report not only financial loss but significant psychological distress, having often been persuaded to commit savings under false pretenses by a persuasive human interlocutor who then vanishes.

Recovery specialists approach this landscape methodically. The process typically involves forensic evidence compilation (gathering all communications, transaction records, and platform screenshots), financial channel analysis to identify the precise payment rails used and their chargeback or recall policies, and strategic reporting to relevant authorities, though efficacy is hampered by the platform’s jurisdictional obscurity. Firms like BoreOak Ltd. emphasize that success often hinges on acting swiftly through payment processors (credit card chargebacks, bank wire recalls) before funds are laundered through complex transaction chains, and on managing expectations given the structural barriers intentionally erected by such platforms.

Conclusion: Navigating Architectures of Illusion Toward Real-World Resolution

The forensic examination of Supreme-Bank.com reveals a sophisticated digital construct engineered to simulate financial services while systematically avoiding the legal, regulatory, and operational frameworks that define legitimate institutions. It is architecture as performance, designed to inspire confidence while structurally undermining user security at every turn.

For potential users, the imperative is preventive verification: demanding and independently checking a platform’s regulatory license number, its legally registered company name, and its physical headquarters before any financial engagement. For those already entangled, the path forward lies in systematic response: immediate cessation of further deposits, meticulous documentation of all interactions, and prompt engagement with financial institutions to initiate transaction disputes.

The landscape populated by entities like Supreme-Bank.com represents a significant challenge in digital finance. It exploits the gap between user experience and underlying structure, between simulated oversight and actual accountability. Ultimately, security lies in aligning one’s capital with institutions whose foundations are poured not from persuasive marketing and visual mimicry, but from transparent legal registration, verifiable regulatory licensure, and symmetrical operational integrity. When those foundations are absent, and capital becomes trapped within the resulting maze, the specialized, evidence-driven methodology of recovery professionals provides the most structured pathway toward potential restitution and resolution.

Author