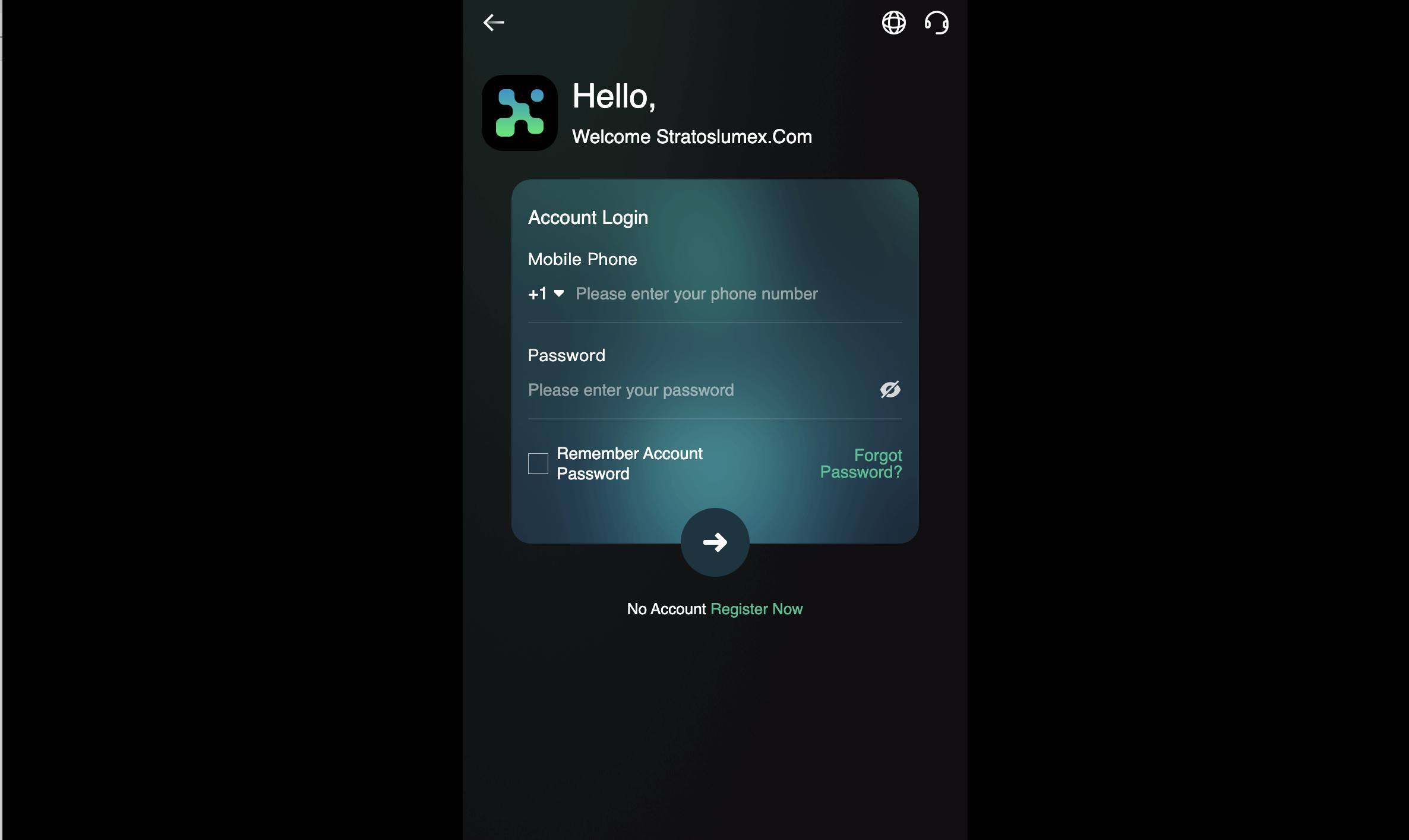

Stratoslumex.com Review: What to Know Before You Engage

In an era where online investing, trading platforms, and digital financial services have exploded in popularity, the number of questionable websites posing as legitimate companies has grown just as quickly. Many consumers now find themselves searching for information about unfamiliar platforms, trying to determine whether a website is safe to use. One domain that has drawn attention from cautious users is stratoslumex.com.

This review takes a balanced, analytical look at the concerns raised online, common red flags associated with risky financial platforms, and practical steps you can take to protect yourself. While the goal is not to declare the website as a scam or legitimate, it is important to explore the warning signs and user experiences that have prompted increased public scrutiny.

Why People Are Researching Stratoslumex.com

As with many newer financial or investment-related platforms, potential customers often begin with a simple search to determine credibility. Discussions across consumer forums, social spaces, and watchdog communities show that people are seeking clarity about several key areas:

-

Whether the platform is licensed or regulated

-

Whether users have difficulty withdrawing funds

-

Whether the company provides verifiable ownership or business information

-

Whether the website displays typical hallmarks of suspicious platforms

These questions are reasonable and should be asked of any online service that handles money, personal data, cryptocurrency, or investments.

Key Concerns and Red Flags Users Commonly Look For

Regardless of the website in question, there are well-known indicators frequently associated with unreliable or high-risk platforms. When individuals examine websites like stratoslumex.com, they often reference the following factors.

1. Lack of Licensed Regulation

Legitimate financial platforms—especially those dealing with investments, trading, crypto brokerage, or asset management—are usually required to register with financial authorities depending on the country in which they operate.

If a platform cannot demonstrate:

-

a clear regulatory license number,

-

a governing body that oversees its activities,

-

or verifiable registration information,

many users view this as a potential red flag. Lack of regulation does not automatically mean wrongdoing, but it does reduce accountability and significantly increases risk.

2. Unverified Company Information

Users evaluating platforms often check for:

-

A real, searchable business entity

-

A verifiable physical address

-

Named company directors or executives

-

Working customer service contact details

If any of this information appears vague, unverifiable, or nonexistent, people may worry about transparency. Anonymous or opaque company structures make it difficult for customers to know who they are dealing with.

3. Pressure-Based Marketing Tactics

Reports describing aggressive sales pitches, unsolicited messages, or continuous pressure to deposit more funds are among the most common characteristics consumers associate with risky financial websites.

Even though this may not apply to every platform, people typically become suspicious if a service uses:

-

High-return promises

-

Urgent calls to “act now”

-

Guaranteed profit claims

-

Inconsistent or scripted communication

Legitimate investment environments emphasize risk, not guaranteed success.

4. Difficulty Withdrawing Funds

On user-review sites, one of the most frequent concerns surrounding unverified platforms is withdrawal trouble. People often raise questions when:

-

Their funds are “pending” for unusually long periods

-

Customer support stops responding after a withdrawal request

-

Additional unexpected “fees” or “verification steps” appear

-

Withdrawal is denied without explanation

Again, this does not confirm fraudulent activity, but it does highlight the importance of caution with any platform managing customer money.

5. Poor Online Reputation or Limited History

If user discussions trend heavily toward negative experiences, inconsistencies, or unanswered questions about the platform’s functioning, readers naturally grow skeptical. Likewise, a brand-new website with little online presence or visibility may raise the level of uncertainty.

A Closer Look at Stratoslumex.com’s Online Footprint

When reviewing the website’s digital presence, several observations commonly surface among curious users:

A relatively new domain

New websites, especially within the financial sector, often prompt additional scrutiny simply because they haven’t yet established a track record. Many users prefer platforms that have been operational for several years.

Limited third-party information

Some people have noted that the website appears to have minimal coverage in major financial publications, business registries, or well-known industry databases. This absence makes verification more challenging.

User complaints and cautionary comments online

It’s not uncommon to find individuals describing difficulty contacting support, feeling uncertain about transactions, or experiencing communication inconsistencies. These accounts should be viewed as personal testimonies rather than definitive facts, but they do contribute to the website’s reputation risk.

Unclear regulatory details

As with many new or unverified financial platforms, users report uncertainty about whether stratoslumex.com is overseen by any recognized regulatory body. Readers should always independently verify regulatory claims, as inaccurate or misleading licensing information can appear on certain sites.

Why Financial Websites With Uncertain Status Deserve Extra Caution

The online financial ecosystem is vast. Many platforms offer genuine services, while others operate with minimal oversight, making them riskier to engage with. When a website exhibits several of the red flags commonly associated with high-risk platforms, users generally respond cautiously—and rightly so.

Here are reasons why it’s important to be vigilant:

1. Money Transfers Are Hard to Reverse

Once funds leave your bank account or crypto wallet, recovering them can be difficult or impossible if the recipient is not reputable or regulated.

2. Anonymous Operators Can Disappear Quickly

Websites without verified ownership can close unexpectedly, change domains, or rebrand, leaving customers without recourse.

3. Data Security Risks

Platforms with unclear legitimacy may not adhere to strong cybersecurity practices, putting personal information at risk.

4. No Regulatory Protections

If a platform is unregulated, customers usually cannot file complaints with financial authorities or access investor-protection mechanisms.

How to Protect Yourself When Evaluating a Platform Like Stratoslumex.com

Regardless of whether you are examining stratoslumex.com specifically or any similar financial site, the following strategies can help safeguard your assets and information.

1. Verify Regulation Independently

Never assume a regulatory claim is valid simply because it appears on a website. Check official registries from financial authorities relevant to the platform’s claimed jurisdiction.

2. Start With Minimal Funds

If you choose to test a platform, begin with the smallest possible amount of money and confirm that withdrawal processes function smoothly before investing more.

3. Research the Company Thoroughly

Look for:

-

Company registration records

-

Press releases

-

Executive profiles

-

Third-party reviews (both positive and negative)

The more verifiable information you find, the better.

4. Speak With Customer Support

Contact the platform with questions. If responses are evasive, overly scripted, or pressure-driven, treat this as a cautionary sign.

5. Examine User Stories Critically

Personal reviews can be helpful, but they can also be exaggerated or fake. Look for consistent patterns rather than relying on a single story.

6. Be Wary of High-Return Promises

Any platform claiming unusually high, guaranteed, or “risk-free” returns should be approached very carefully.

7. Check the Website’s Age and Hosting Details

Tools that show domain-creation dates, hosting locations, and server changes can offer clues about a website’s stability and credibility.

Balanced Conclusion

At this time, stratoslumex.com has drawn attention from online users who are unsure of its legitimacy and who report encountering several common risk indicators associated with unverified or high-risk financial platforms. While these concerns do not automatically prove wrongdoing, they highlight the importance of proceeding carefully and performing thorough due diligence before engaging with the website or depositing funds.

If you or someone you know is considering using stratoslumex.com—or any platform that handles investments, cryptocurrency, or financial transactions—it’s wise to:

-

independently verify all information,

-

start cautiously if you choose to proceed,

-

and prioritize platforms with clear regulatory oversight and transparent business details.

A thoughtful, informed approach is the strongest protection against potential financial loss or negative online experiences.

-

Report stratoslumex.com and Recover Your Funds

If you have fallen victim to stratoslumex.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like stratoslumex.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.