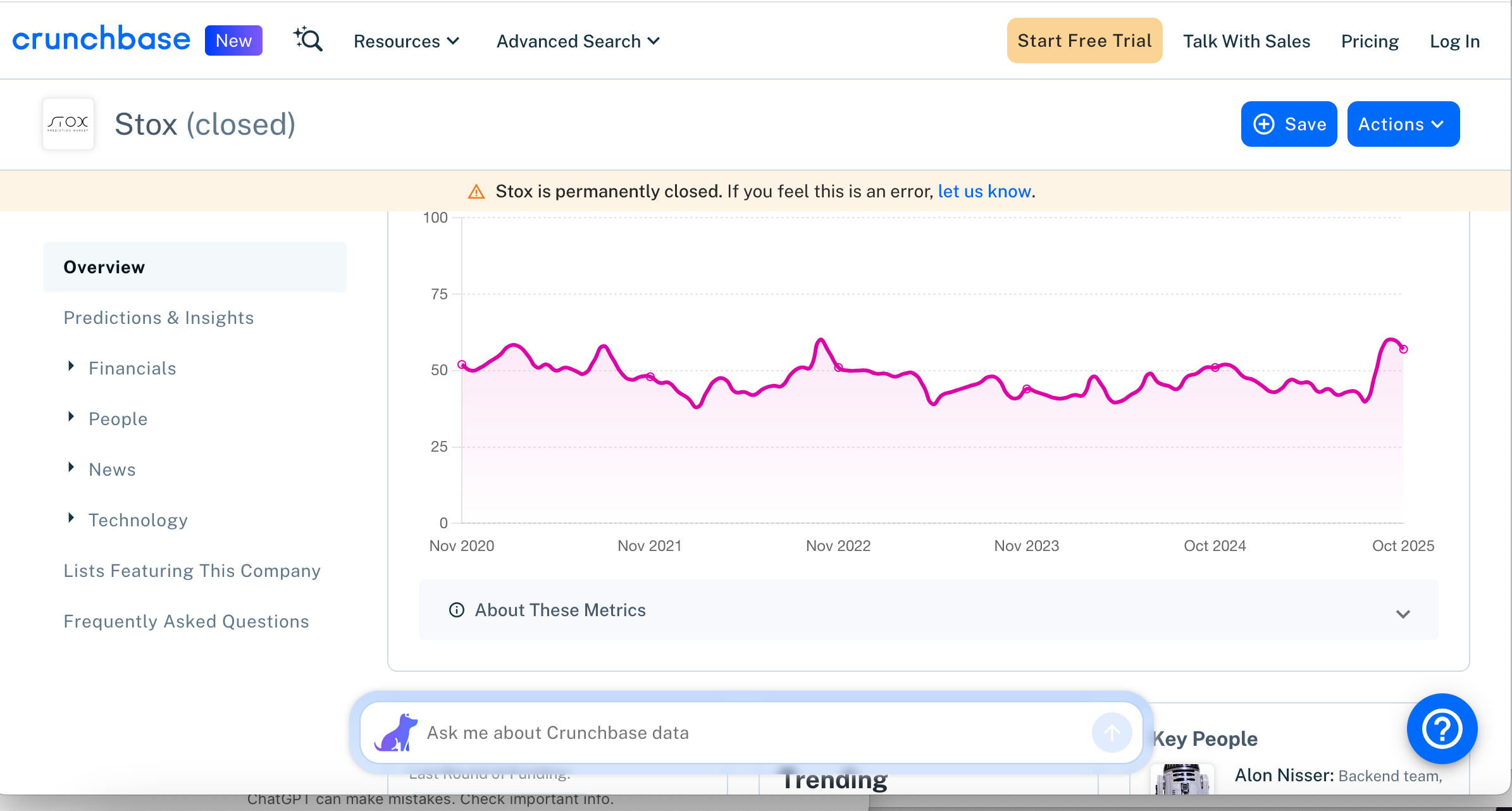

Stox Scam Review — Questionable Trading Platform

Introduction

The rise of online trading platforms has brought both opportunities and risks to investors across the world. While some platforms offer legitimate trading services, others are designed purely to deceive unsuspecting users. Among the platforms drawing growing concern is Stox, a brand that presents itself as an innovative online trading solution but raises multiple red flags upon closer inspection. This detailed review explores the questionable features, deceptive tactics, and warning signs surrounding Stox, showing why it should be approached with extreme caution.

A Polished Facade Hiding Dubious Intentions

At first glance, Stox’s website appears well-designed and professional. It promises access to advanced financial markets, expert trading strategies, and instant profits through user-friendly tools. However, such presentation is a familiar pattern among fraudulent investment platforms — a visually appealing interface crafted to build instant trust.

The site uses persuasive marketing language, claiming to help users “earn effortlessly,” “trade with precision,” and “achieve consistent returns.” Yet, beneath these grand promises, there is a striking lack of verifiable information about how the platform operates, who owns it, and what kind of regulatory oversight it follows.

No Transparent Ownership or Corporate Details

One of the strongest indicators of a potential scam is a lack of transparency. A legitimate financial company should proudly display its ownership details, registration number, physical office address, and contact information. Unfortunately, Stox provides little to no verifiable information about its management or operational structure.

There are no names of company directors, no mention of a parent company, and no official business license visible on its site. The absence of these essential details immediately casts doubt on the authenticity of the platform. In the world of finance, anonymity is rarely a sign of legitimacy — it’s often a shield for unethical practices.

Unrealistic Profit Promises

Stox markets itself as a high-return investment service, with claims that users can generate steady profits regardless of market volatility. It often promotes the idea of “guaranteed earnings,” “automated success,” or “exclusive trading algorithms.”

These are classic red flags. No genuine trading platform can guarantee consistent profits in a volatile financial market. Trading involves risks — losses and gains are both part of the process. Any website or company that promises only profits while downplaying risks is misrepresenting reality.

Fraudulent investment platforms typically use this psychological tactic to lure in investors who are new to trading or desperate for quick financial gains.

No Regulatory Oversight

Perhaps the most serious concern about Stox is the absence of regulatory oversight. Authentic trading platforms must be registered and monitored by recognized financial authorities to ensure fairness, transparency, and customer protection. Examples include regulators like the FCA (UK), ASIC (Australia), or the SEC (USA).

Stox provides no proof of regulatory registration or licensing from any credible authority. This means it operates outside legal financial frameworks and is not bound by laws that protect investors.

When a platform is unregulated, users have no guarantee that their funds are secure. There’s no supervision of how deposits are handled, and no accountability if money disappears. This makes Stox an extremely high-risk platform for anyone considering an investment.

Dubious Withdrawal and Deposit Practices

Numerous investors have reported that they can deposit funds into platforms like Stox effortlessly but face serious problems when attempting to withdraw their earnings. The process may start smoothly — users deposit money, see quick gains on their dashboards, and are encouraged to reinvest to “increase profits.”

However, when users try to withdraw, the situation changes. The platform may suddenly request additional verification, demand new deposits to “unlock withdrawals,” or claim that users need to pay “taxes” or “fees” before funds can be released. These tactics are commonly used by fraudulent platforms to prolong control over the investor’s money while creating excuses to block withdrawal attempts.

In legitimate trading companies, withdrawals are straightforward and processed within regulated time frames. The complications surrounding withdrawals from Stox are a major red flag that strongly suggest scam activity.

Fake Account Managers and Pressure Tactics

Another hallmark of scams like Stox is the use of fake account managers or “financial advisors.” These individuals contact investors through emails, phone calls, or messaging apps, presenting themselves as professionals who can help maximize profits.

They often persuade users to deposit larger sums, claiming that a “premium account” or “VIP plan” will yield higher returns. However, once the investor’s balance grows significantly, communication from these so-called advisors often disappears — especially after withdrawal requests are made.

These representatives are trained in psychological manipulation. They use charm, authority, and urgency to convince victims to send more money. Once they succeed, they vanish or move on to new targets.

Questionable Website and Domain Patterns

A deeper look at the domain history of Stox and similar sites reveals concerning patterns. The domain registration is often recent, sometimes just months old. The registrant’s identity is hidden through privacy protection services, which obscure the owner’s real name and location.

This lack of transparency allows scammers to shut down the site and relaunch under a different name when negative reviews start spreading. It’s a common tactic in the online fraud ecosystem — constantly changing brand names to escape exposure.

If Stox follows this same approach, it suggests a deliberate plan to operate temporarily, collect deposits, and disappear once complaints increase.

Fake Testimonials and Manipulated Reviews

The Stox website often features glowing testimonials and five-star reviews from supposed satisfied investors. However, upon examination, these reviews appear suspiciously generic and repetitive. Many are likely fabricated or copied from stock image libraries, as the photos used are often of models rather than real clients.

Additionally, independent online forums and trading communities tell a different story — with users describing their frustration, blocked accounts, and loss of funds after dealing with Stox. The contrast between the overly positive on-site reviews and the negative experiences shared elsewhere is another telltale sign of dishonesty.

Absence of Verifiable Trading Data

Legitimate trading platforms provide users with verifiable market data, trade histories, and transparent reporting. Stox, however, provides no evidence of real trades taking place. The dashboards and profit charts shown to users could easily be simulations or fabricated results designed to make users believe their investments are growing.

This artificial appearance of profit encourages further deposits, which is precisely how fraudulent platforms sustain their operations until they eventually collapse or vanish.

Aggressive Marketing and Social Media Promotions

Scam platforms like Stox rely heavily on online advertising and social media promotion to attract new investors quickly. They often use paid influencers, flashy video ads, and fake success stories to build trust. Messages such as “Join thousands of successful traders” or “Earn passive income instantly” are typical examples.

Once a victim registers an account, they may begin receiving calls or messages from sales agents who use persuasive techniques to pressure them into depositing more. This aggressive marketing model is built on speed — the goal is to capture as many deposits as possible before users realize they’ve been deceived.

The Risk of Rebranding and Domain Cloning

Scam platforms rarely stick with one name for long. Once exposed or publicly criticized, they quickly rebrand, clone their site design, and relaunch under a new domain. This enables them to continue targeting new victims without being easily linked to their past misconduct.

The Stox name, or variants of it, have appeared in multiple forms across the web — each time promising innovation, transparency, and wealth creation, yet leaving behind disappointed investors. This repetition is a major indicator that the same operators might be recycling their scams under slightly modified branding.

Lack of Customer Support

One of the most frustrating aspects for users dealing with fraudulent platforms is the poor or non-existent customer support. Stox provides minimal contact options, and even when users attempt to reach out for help, responses are delayed or never arrive.

Legitimate financial companies prioritize customer communication, especially when it involves money or trading issues. The lack of reliable support at Stox further undermines its credibility and highlights the indifference these operators have toward investor satisfaction.

Conclusion — Why Stox Appears to Be a Scam

After analyzing all aspects — from ownership secrecy and regulatory absence to withdrawal complications and manipulative tactics — it becomes clear that Stox displays nearly every classic characteristic of an online investment scam.

The platform’s business model thrives on attracting deposits with false promises of profit while offering no transparency, no regulation, and no accountability. The use of fake testimonials, evasive support, and pressure-driven marketing all reinforce that Stox is far more focused on collecting money than delivering legitimate trading services.

Investors should be extremely cautious and avoid engaging with this platform. Every indicator points toward deception rather than genuine financial opportunity.

Report Stox and Recover Your Funds

If you have fallen victim to Stox and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Stox persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.