Stockspot.com Scam Review – Is This Robo-Adviser Trustworthy?

In the modern era of digital finance, online investment platforms have become increasingly popular. Many promise to simplify wealth creation, automate portfolios, and help users reach their financial goals. Among them is Stockspot.com, an Australian-based robo-advisory firm that claims to help clients invest smarter with minimal effort.

But with so many fraudulent or misleading platforms on the internet, some potential investors are asking: Is Stockspot.com a scam? In this in-depth review, we’ll examine how Stockspot operates, assess red flags (if any), and determine whether concerns about the legitimacy of the platform are warranted.

Important note: This review is investigative and neutral. We are not affiliated with Stockspot.com or any competitors.

What Is Stockspot.com?

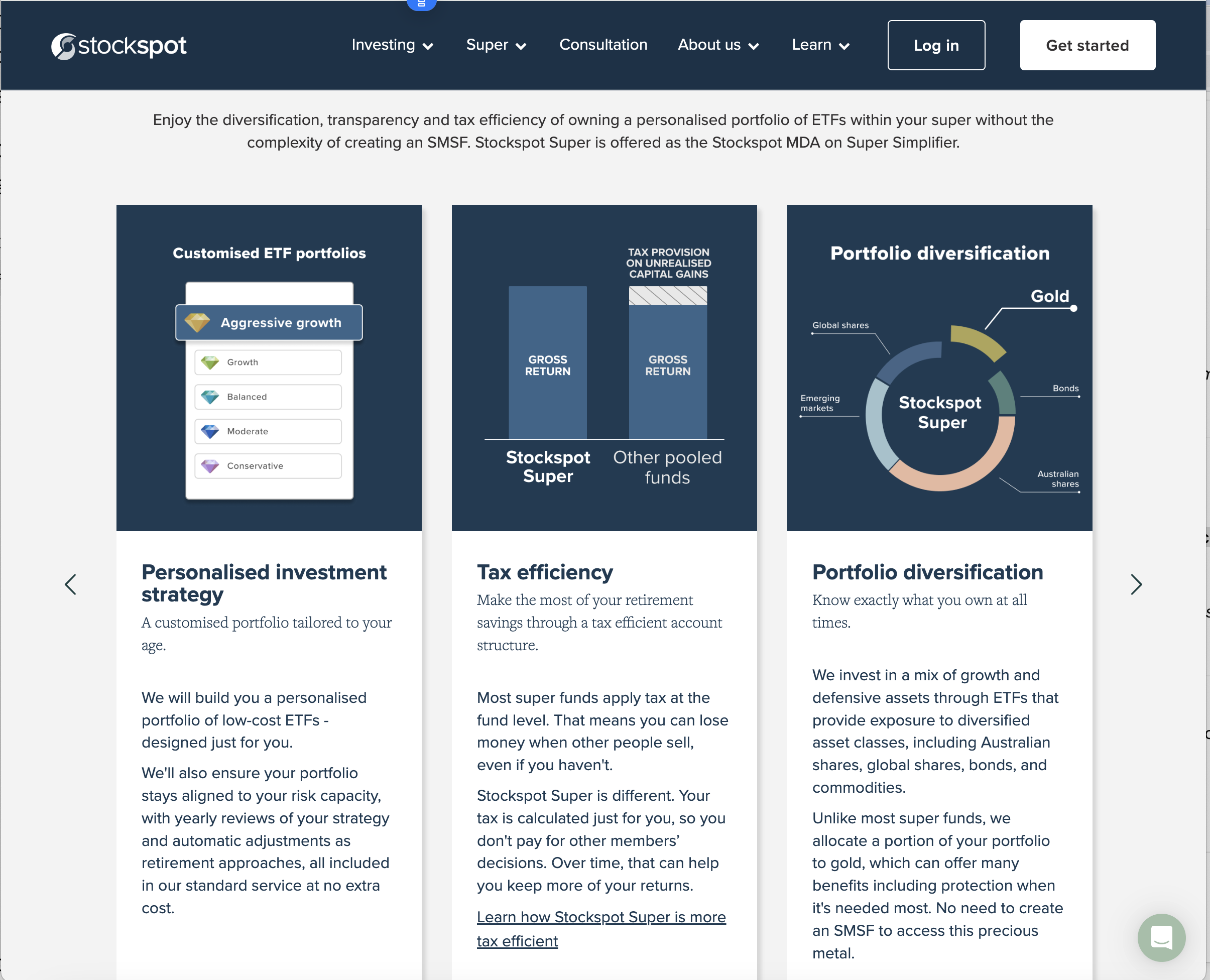

Stockspot.com markets itself as Australia’s first robo-adviser. It offers automated investment portfolios based on ETFs (Exchange-Traded Funds) designed to suit a range of risk profiles and long-term financial goals.

Here are some of the features Stockspot promotes:

-

Personalized investment recommendations

-

Automated rebalancing of portfolios

-

Annual reviews and adjustments

-

Low fees compared to traditional financial advisors

-

Transparent performance tracking

While this may sound attractive to beginner investors or those who prefer passive wealth building, it’s important to look beyond the surface.

User Concerns About Stockspot.com – Where the Skepticism Comes From

Despite its polished branding and marketing, some users have raised concerns about Stockspot.com

-

Performance versus benchmarks

-

Customer service responsiveness

-

Lack of flexibility in portfolios

-

Fee structure transparency

These concerns, while not uncommon in the financial services industry, have prompted some to question whether Stockspot is a legitimate platform—or potentially a misleading one.

Let’s dig deeper.

Is Stockspot Regulated?

One of the most important questions when reviewing any financial platform is whether it is regulated by a legitimate authority.

Stockspot is registered with the Australian Securities and Investments Commission (ASIC). This is a major distinction from actual scams, which operate without any regulatory oversight.

Being ASIC-regulated means Stockspot is bound by specific rules around transparency, risk management, and how client funds are handled.

➡️ Verdict: Stockspot is a regulated platform, not an unlicensed broker.

Understanding the Business Model

Stockspot operates as a robo-adviser, which is an automated investment service. Users input information about their financial goals and risk tolerance, and the platform assigns them to a diversified portfolio built from low-cost ETFs.

Key characteristics of their model:

-

Diversified holdings across asset classes like Australian shares, global shares, bonds, and gold

-

Low management fees, starting around 0.66% annually for smaller balances, and lower as portfolios grow

-

No performance fees or hidden charges

However, investors with more knowledge or control preferences may find this model too restrictive. Portfolios are not customizable, which may not suit more advanced investors.

Red Flags to Consider

Although Stockspot appears legitimate, there are still aspects worth scrutinizing:

🚩 1. Limited Portfolio Flexibility

Once assigned a portfolio, users have minimal control over the specific ETF allocations. Some may find that this “set-and-forget” model doesn’t match their investment preferences or market outlook.

While this is not inherently a scam, the lack of flexibility may lead to frustration for hands-on investors.

🚩 2. Performance Gaps vs. Market Expectations

Some users report underwhelming performance compared to simply investing in a single index ETF like the S&P 500 or ASX200. Since robo-advisers spread capital across safer, more balanced assets, returns can lag during bull markets.

However, this is by design—the platform prioritizes long-term risk management over short-term gains. Still, users expecting faster growth may feel misled by marketing materials that highlight performance.

🚩 3. Customer Service Delays

Some reviewers mention slow email responses or delays in processing account changes. For a financial service, communication speed is critical, especially during volatile markets.

While this issue is more about service quality than fraud, it may be a turn-off for potential clients.

🚩 4. Marketing That Feels Too Glossy

Some skeptical investors note that Stockspot’s marketing leans heavily on simplicity and peace of mind, which can seem too good to be true. Any platform that suggests investing is easy or effortless should be approached carefully.

Still, this is a common trend among fintech companies—appealing to first-time investors who may be intimidated by the complexity of traditional investing.

How Stockspot Compares to Actual Scams

To assess whether Stockspot.com is a scam, we need to compare it with typical characteristics of scam platforms:

| Scam Trait | Present in Stockspot.com? |

|---|---|

| Unregulated by any authority | ❌ No – ASIC regulated |

| Anonymous team or no ownership | ❌ No – Clear founder info |

| Fake dashboards or profits | ❌ No – Real ETFs used |

| Guaranteed profits advertised | ❌ No – Risk is disclosed |

| Difficult withdrawals | ❌ No – Seamless process |

| Referral-only or MLM structure | ❌ No – No pyramid model |

-

Report Stockspot.com and Recover Your Funds

If you have fallen victim to Stockspot.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Stockspot.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.