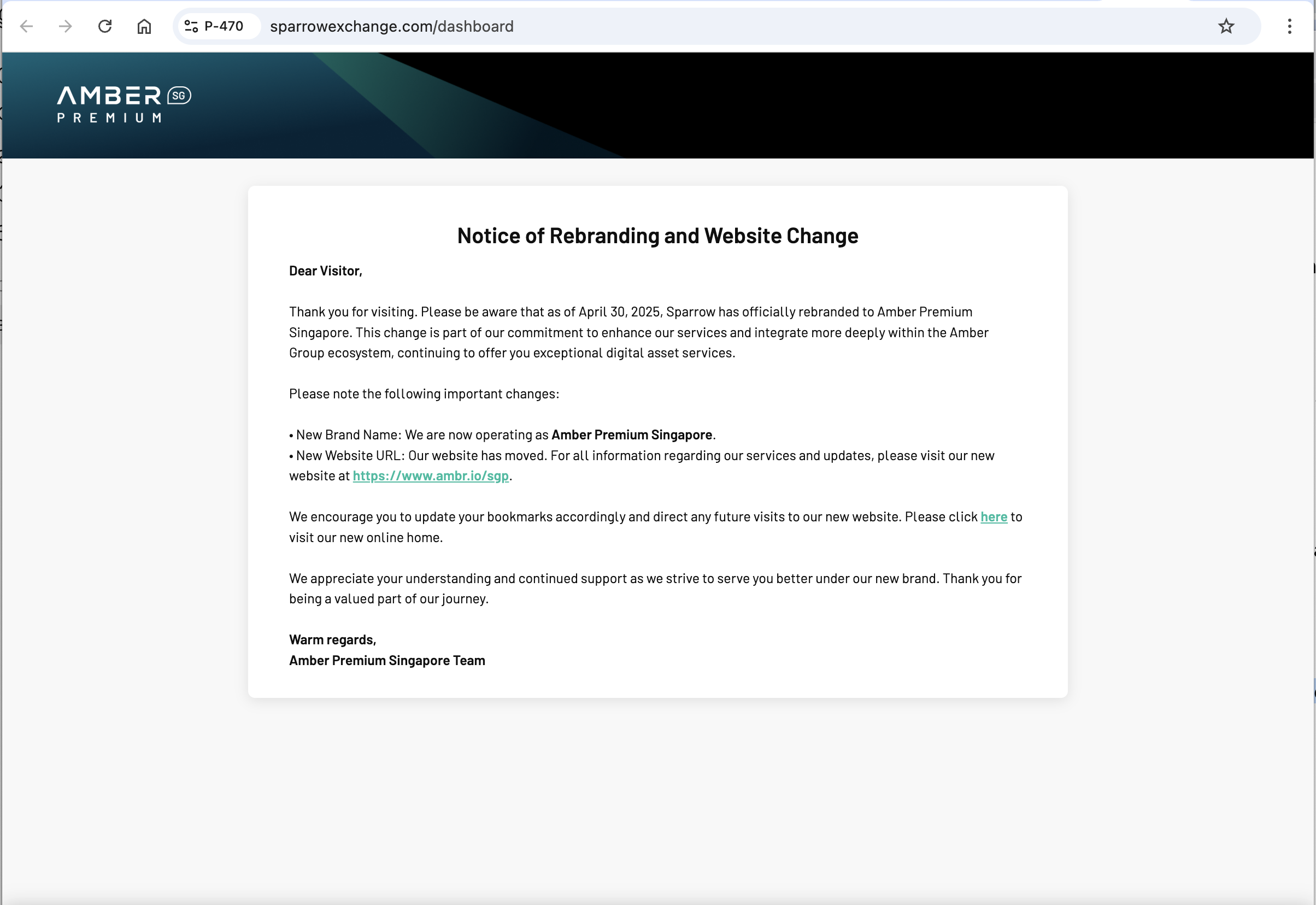

Sparrows Trading Scam Review – Deceptive Platform

The rapid growth of online trading platforms has opened up new opportunities for investors around the world. With just a few clicks, users can access global markets, trade digital assets, and explore new financial tools. However, this rise has also made it easier for unverified or questionable platforms to present themselves as legitimate trading services. As a result, traders must carefully evaluate the platforms they engage with, especially those with unclear backgrounds or limited transparency.

One platform that has attracted attention and concern is Sparrows Trading. This review provides an in-depth, analytical look into Sparrows Trading, examining potential red flags, operational inconsistencies, user-reported issues, and general concerns surrounding the platform.

1. What Is Sparrows Trading?

Sparrows Trading presents itself as an online trading and investment platform. It typically advertises features such as:

-

Advanced trading technology

-

Algorithmic strategies

-

Access to forex, stocks, crypto, and commodities

-

Fast execution speeds

-

Professional account management

-

Secure deposit and withdrawal options

The website and promotional materials aim to portray the platform as modern, high-tech, and profitable for investors. However, closer scrutiny reveals gaps and problematic signs that potential users should be aware of.

2. Unclear Company Identity and Lack of Transparency

One of the most important markers of a trustworthy trading platform is transparency regarding its identity and operations. Legitimate brokers provide:

-

A verifiable company registration

-

Legal company name

-

Business registration number

-

Identifiable management team

-

Registered physical address

-

Documented operating history

Sparrows Trading appears to provide limited or unclear corporate details. Issues commonly observed include:

-

No verifiable registration or incorporation information

-

A business address that cannot be independently confirmed

-

No publicly listed executives or founders

-

Lack of long-term operational records

Such gaps raise concerns because transparency is fundamental in the financial sector. Platforms that fail to disclose their identity clearly make it difficult for users to establish trust.

3. Regulatory Doubts and Missing License Documentation

Regulation is essential for investor protection. Licensed brokers are supervised by recognized authorities and must:

-

Maintain capital reserves

-

Follow strict security protocols

-

Abide by transparency laws

-

Protect customer funds

-

Undergo audits

In the case of Sparrows Trading, reviewers frequently note an absence of:

-

Valid regulatory license numbers

-

Links to regulatory databases

-

Compliance certificates

-

Clear disclosures about the platform’s legal jurisdiction

Instead, the platform often uses vague statements about safety and security without evidence of actual oversight. This is a major concern, as unregulated trading platforms offer no guarantees or protections for users.

4. Website Design and Content Red Flags

A detailed look at the Sparrows Trading website reveals several red flags often associated with high-risk platforms.

a. Generic marketing language

Rather than providing detailed trading terms or strategies, the website uses broad, promotional phrases such as:

-

“Guaranteed success”

-

“Expert traders at your service”

-

“Next-generation trading experience”

These statements may lack the depth and specificity expected from a serious broker.

b. Limited trading information

Legitimate brokers disclose:

-

Spreads

-

Leverage levels

-

Margin requirements

-

Order execution policies

-

Platform technologies (e.g., MT4, MT5, proprietary tools)

Sparrows Trading offers only surface-level information without technical clarity.

c. Poorly structured or incomplete legal documents

Legal pages such as Terms & Conditions and Privacy Policy may seem overly simplified or generic, lacking critical details.

d. Use of stock images

Some visuals used to depict “managers,” “traders,” or “support staff” appear similar to stock photos, which calls the authenticity of the platform’s team into question.

5. Recurring User Complaints and Reported Experiences

Although individual user claims cannot be verified independently, the recurring nature of certain complaints is consistent with what is often seen on high-risk trading platforms.

a. Withdrawal difficulties

One of the most commonly reported issues is trouble withdrawing funds. Users describe:

-

Long delays

-

Repeated “processing” statuses

-

Requests for additional verification

-

Withdrawal rejections without clear explanations

This pattern is typically regarded as a major red flag.

b. Unexpected extra fees

Several users report being asked to pay additional charges—often labeled as taxes, account activation fees, or security fees—before funds can be released.

These charges are usually not disclosed upfront.

c. High-pressure tactics to deposit more money

Some users describe being frequently contacted by representatives urging them to:

-

Increase their deposits

-

Take advantage of “limited opportunities”

-

Invest in supposedly high-yield strategies

This behavior is not typical of regulated brokers, which do not aggressively pressure users to add funds.

d. Poor or evasive customer support

Users often claim that customer service is responsive when deposits are involved but becomes evasive when asked about withdrawals or regulations.

6. Unusual Account Activity and Trading Behavior

Additional concerning reports include:

-

Unexpected losses

-

Trades being opened without user knowledge

-

Sudden changes in account balance

-

Inability to access trading history

These types of issues, if accurate, are major warning signs about platform integrity and trading transparency.

7. Limited Online Footprint and Weak Reputation Signals

Reputable trading platforms typically have:

-

A clear online presence

-

Industry recognition

-

Long-term operating history

-

Professional social media accounts

-

Independent reviews

-

Public information about directors or founders

Sparrows Trading appears to have a limited digital footprint, making it hard to verify its legitimacy or long-term operations.

A platform with no established reputation can pose a significant risk, especially when dealing with financial transactions.

8. Lack of Third-Party Validation

Trusted brokers often provide:

-

Audited financial statements

-

Partnerships with recognized liquidity providers

-

Support from financial institutions

-

Verified corporate documents

There is no clear evidence of such validations for Sparrows Trading.

9. Key Red Flags Identified

When viewed together, the concerns surrounding Sparrows Trading include:

-

No verifiable regulation

-

Missing corporate registration details

-

Generic website content

-

Limited transparency

-

User complaints about withdrawals

-

Unexpected extra fees

-

Pressure to deposit more funds

-

Weak digital footprint

-

Poor customer support interactions

-

Possible unusual account activity

While these concerns do not confirm wrongdoing, they strongly indicate that users should approach the platform with considerable caution.

10. Important Questions to Ask Before Engaging

Anyone considering Sparrows Trading should ask the following:

-

Can the company’s registration be independently verified?

-

Does the platform provide an authentic regulatory license?

-

Are trading conditions clearly described?

-

Is the withdrawal process documented and transparent?

-

Does the platform have a long-term operating history?

-

Are fees fully disclosed?

-

Does customer support provide clear answers to regulatory questions?

If these questions cannot be answered confidently, users should reconsider their engagement with the platform.

Conclusion

Sparrows Trading markets itself as an advanced trading platform, but a closer examination reveals several significant concerns. The lack of regulatory oversight, unclear company identity, vague platform information, user complaints, and questionable operational behavior all raise serious red flags. While this review does not make definitive claims about the platform’s intentions, it strongly emphasizes the need for caution.

Any individual considering Sparrows Trading should conduct thorough due diligence, ensure clarity on regulatory status, and fully understand the risks before depositing funds.

-

Report Sparrows Trading and Recover Your Funds

If you have fallen victim to Sparrows Trading and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Sparrows Trading persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.