SmartProfitTradeFX Scam Review – Scam or Legit

The online investment landscape is filled with platforms promising high returns, expert guidance, and a simplified path to financial success. With the rise of forex, crypto trading, and automated investment services, more and more websites are appearing that claim to offer advanced tools or managed accounts. One name that has recently drawn attention—often for the wrong reasons—is SmartProfitTradeFX.

This review does not label the platform as definitively fraudulent; instead, it provides a thorough examination of warning signs, user-reported issues, and patterns of behavior that many analysts associate with high-risk or untrustworthy online trading services.

1. Overview of SmartProfitTradeFX

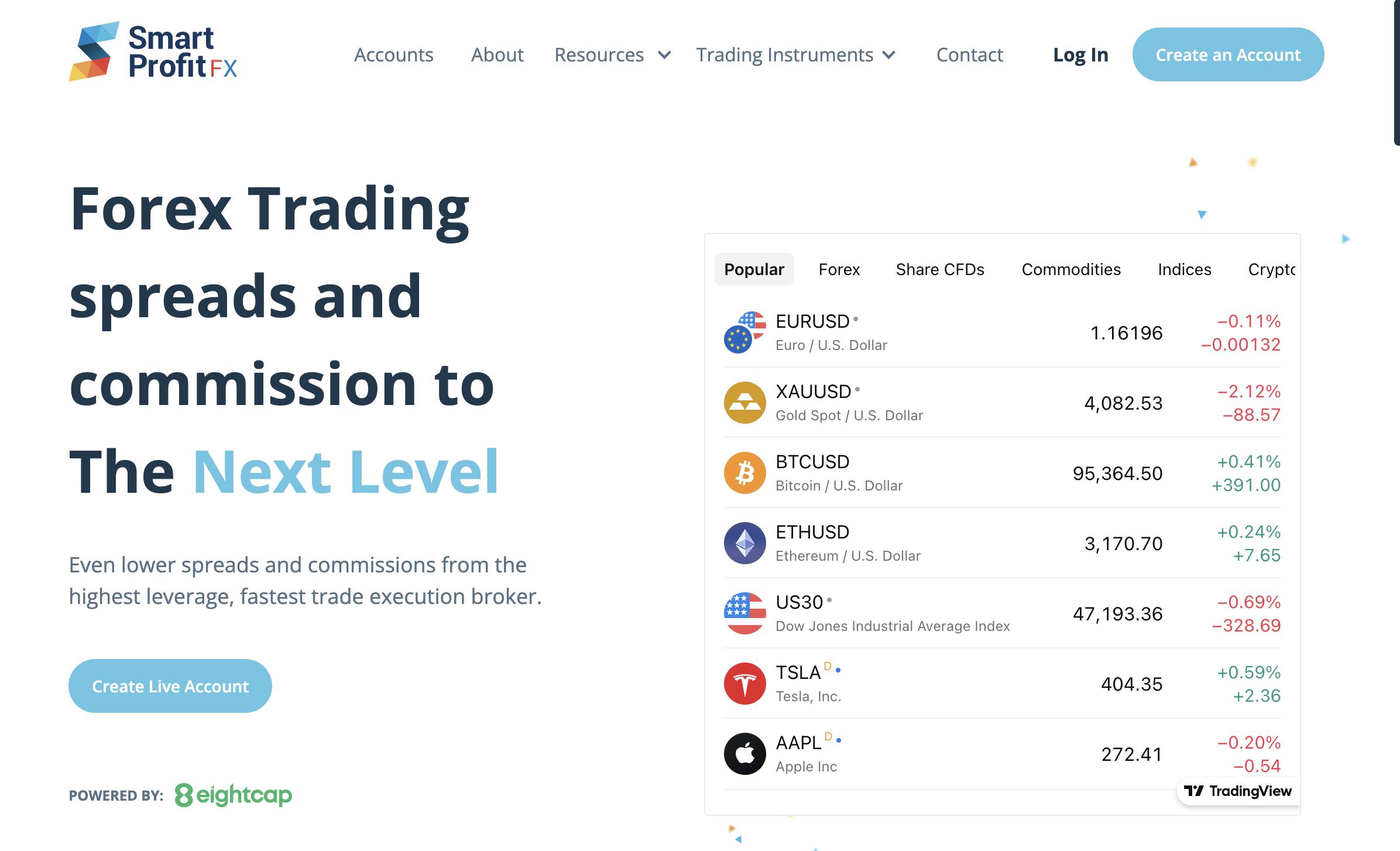

SmartProfitTradeFX positions itself as a trading and investment platform offering access to forex, crypto, and other financial markets. The site’s layout is similar to many self-proclaimed online brokers, using impressive graphics, simple dashboards, and claims of high-profit potential.

However, beneath this polished surface, many observers have flagged issues such as:

-

A lack of verifiable business information

-

Absence of regulatory disclosures

-

Vague explanations of the company’s operations

-

Poor clarity around fees, trading processes, and withdrawal policies

-

Patterns seen in other high-risk trading websites

These concerns have contributed to an increasing number of individuals questioning the platform’s reliability.

2. Unverifiable Corporate Identity

One of the first things experienced traders look for in an online investment platform is clear, verifiable corporate information. Legitimate companies typically list their:

-

Registered business name

-

Company registration number

-

Physical office address

-

Background of company leadership

-

Legal documentation outlining operations

In the case of SmartProfitTradeFX, reviewers commonly note vague or incomplete business details. If the platform mentions a company name or address, it often cannot be verified through independent business registries or government listings.

This raises immediate concerns:

-

Who owns the company?

-

Is the operator accountable under a known jurisdiction?

-

Can users trace or verify who is handling their funds?

When a financial platform lacks a transparent corporate identity, consumers frequently interpret it as a significant red flag—especially when deposits are involved.

3. No Clear Regulatory Oversight

Regulation is one of the most important safeguards in the investment world. Licensed platforms must follow strict rules designed to protect investors. These include:

-

Providing transparent risk disclosures

-

Separating client funds from operational funds

-

Maintaining fair trading practices

-

Undergoing audits

-

Offering dispute-resolution mechanisms

While some offshore brokers operate with lighter regulations, they still provide clear licensing details.

Observers note that SmartProfitTradeFX does not prominently display regulatory licenses or compliance documentation. The absence of such information means potential users cannot confirm:

-

Which authority oversees the platform

-

Whether the service is bound by investor protection laws

-

How complaints are handled

-

Whether users have any legal recourse

Trading on an unregulated or unverified platform increases risk because there is often no official body ensuring the company acts responsibly.

4. Website Patterns Similar to High-Risk Trading Platforms

Analysts reviewing SmartProfitTradeFX point out that the site bears similarities to numerous high-risk trading platforms that appear online frequently. Some common patterns include:

a. Overly generic or templated website structure

Several sections of the website resemble templates used by other questionable trading services, with identical layouts, stock images, and copy-paste style content.

b. Vague descriptions of offered services

Rather than providing detailed explanations of their trading algorithms, risk management strategies, or investment methodologies, the site often uses broad, generic language.

c. Missing or incomplete legal documentation

Platforms handling user money should have:

-

Detailed Terms and Conditions

-

Clear Privacy Policies

-

AML/KYC policies

-

Transparent fee schedules

SmartProfitTradeFX’s documentation often appears overly simplified or lacking important details.

d. Heavy use of stock photos

Legitimate financial institutions normally showcase real offices, real employees, or authentic branding. Heavy reliance on generic imagery raises questions about authenticity.

None of these characteristics alone prove anything, but collectively they contribute to growing user skepticism.

5. User Complaints and Reported Issues

Across discussions and community forums where individuals analyze new trading platforms, several types of complaints surface repeatedly regarding platforms resembling SmartProfitTradeFX. Although individual testimonies cannot be confirmed, consistent patterns offer valuable insight.

Common concerns include:

-

Difficulty withdrawing funds

Users sometimes say their withdrawal requests remain pending for long periods or are met with unexpected conditions. -

Sudden additional deposit requests

Some individuals report being told they must deposit more before their withdrawal or account actions can be completed. -

Unresponsive or inconsistent support

Customer service representatives may be slow to respond, offer vague answers, or disappear after an issue is raised. -

Aggressive communication

Several users describe high-pressure tactics pushing them to invest more money. -

Account changes without explanation

Reports mention sudden balance fluctuations, unexplained fees, or locked accounts.

While these reports vary in detail, the recurring themes contribute to the view that the platform may present a high level of risk.

6. Communication Practices and Support Concerns

Communication is another area where reviewers have expressed concerns. Legitimate trading firms typically maintain professional, responsive support teams.

Users assessing SmartProfitTradeFX have described interactions such as:

-

Frequent calls urging them to upgrade accounts

-

Pressure to deposit funds quickly

-

Avoidance of questions about regulation or verification

-

Generic, scripted email responses

-

Representatives becoming unresponsive after deposits are made

These behaviors mirror those seen in many unreliable online trading operations.

7. Lack of Meaningful Online Presence

Most established financial platforms have a substantial online footprint, including:

-

Professional social media accounts

-

Company listings

-

Verified employee profiles

-

Third-party articles or mentions

-

Authentic customer reviews

SmartProfitTradeFX appears to have limited online presence, which can be concerning for several reasons:

-

It may be a newly created operation

-

The company might not have a long-term track record

-

There may be minimal transparency regarding its activities

-

Verifying its legitimacy becomes more difficult

A platform handling user funds should ideally have years of verifiable history, not just a recently created website with minimal external documentation.

8. High-Risk Indicators Noted by Analysts

When combining all observed issues, many analysts categorize SmartProfitTradeFX as a high-risk platform, not because of confirmed misconduct, but because of the numerous warning signs that frequently accompany unreliable trading websites.

Key risk indicators include:

-

Absence of clear regulatory oversight

-

Unverified company identity

-

Questionable communication tactics

-

Vague or incomplete legal information

-

Poor platform transparency

-

Patterns similar to known high-risk sites

-

Recurring user complaints about withdrawals and pressure tactics

For a platform dealing with financial transactions, these concerns significantly raise the risk profile.

9. Tips for Evaluating Platforms Like SmartProfitTradeFX

Anyone considering engagement with a platform showing similar characteristics should conduct their own due diligence using these guidelines:

-

Verify the company’s registration independently

-

Check for legitimate regulatory licensing

-

Investigate whether the platform offers real customer reviews

-

Examine the professionalism of support responses

-

Read the legal documents thoroughly

-

Avoid high-pressure sales tactics

-

Start with minimal risk if testing a new service

Taking these steps can reduce the likelihood of encountering serious issues.

Conclusion

SmartProfitTradeFX presents itself as an investment and trading platform, but numerous concerns—including unverifiable business claims, lack of regulatory transparency, questionable communication practices, and recurring user-reported issues—have led many individuals to view the platform as high-risk.

-

Report SmartProfitTradeFX and Recover Your Funds

If you have fallen victim to SmartProfitTradeFX and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like SmartProfitTradeFX persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.