SmartMarkets.cc Scam Review: Exposing the Truth

In recent years the online trading world has expanded rapidly—opening new opportunities, but also new vulnerabilities. While many platforms are trustworthy, some rely primarily on marketing, minimal transparency, and pressure tactics, rather than genuine regulated operations. One such platform receiving growing scrutiny is SmartMarkets.cc. This review dissects its structure, flagged behaviours, and asks the questions every investor needs answered before depositing funds.

1. The Marketing Setup: Big Promises, Little Clarity

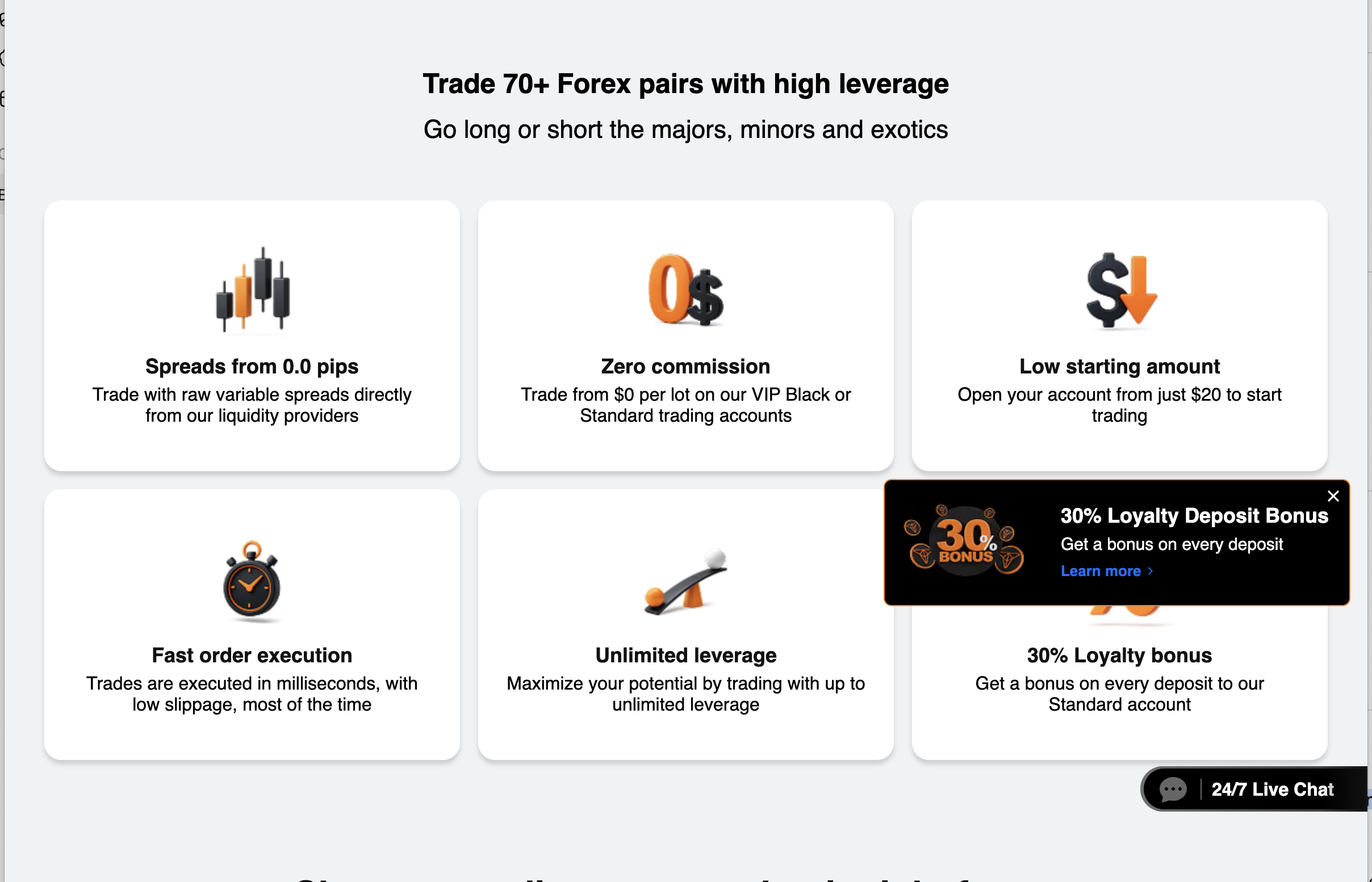

When you visit SmartMarkets.cc you’re shown polished graphics, promises of advanced trading tools, AI-powered execution, and “exclusive VIP access.” These features are appealing—but professional trading services always balance performance with risk, and always disclose who runs things and how.

Key observations in this case:

-

The emphasis is on high return and exclusivity rather than transparent explanation of operations.

-

There is minimal detail about how technology delivers results.

-

The language leans heavily into persuasion (“unlock now”, “limited slots”, “elite returns”) rather than education.

While marketing flair isn’t itself disqualifying, it becomes a red flag when it overshadows core basics: company identity, regulation, fees, and withdrawal processes.

2. Who Runs the Platform? Corporate Identity Matters

Any genuine brokerage or trading service lists its legal entity, registration number, physical address, and names of key staff. This allows investors to verify registration, compliance, and accountability.

In the case of SmartMarkets.cc:

-

Publicly accessible information about the owning company is vague or incomplete.

-

There is no clear, widely verifiable register of directors or responsible managers.

-

The claimed business addresses are either inconsistent or appear generic.

Lack of transparency of this sort means investors cannot easily trace who they are dealing with—or where legal responsibility lies. That absence is a substantive concern for any serious investor.

3. Regulation & Oversight: The Missing Layer

Regulation is the investor’s protection guardrail. Licensed brokers appear in registries, must comply with audits, segregate client funds, and submit to enforcement. A platform that claims to be regulated but provides no verifiable proof is operating in a zone of elevated risk.

For SmartMarkets.cc:

-

There is no clear evidence of a recognised financial regulator authorising the platform.

-

Without verification of regulation, the platform’s obligations to its clients—and any recourse options—are significantly limited.

-

In jurisdictions where regulation is required, the absence of registration suggests the platform may be offering services without proper oversight.

In short: trading with unregulated entities increases exposure to risks that would typically be mitigated by regulatory protections.

4. Deposit Methods: Where Your Money Goes

An often-overlooked part of risk assessment is how a platform handles deposits: which payment methods are offered, to whom the account belongs, and how payments are processed.

Concerns with SmartMarkets.cc include:

-

Reports indicate that deposits may direct funds to wallets or accounts that are not clearly labeled under the platform’s corporate name.

-

The funding methods emphasise speed and ease, potentially at the cost of traceability.

-

Once funds leave your account into ambiguous destinations, your ability to monitor or reverse becomes significantly reduced.

When deposits fund unknown or third-party accounts, your path to transparency and control diminishes.

5. Onboarding and Sales Process: Pressure vs Pause

How a platform handles new users tells you a lot about its priorities. Legit firms allow time for education, demo trading, review of terms, and proof of firm identity. By contrast, risk-oriented platforms push for quick deposits and “upgrades” with urgency.

With SmartMarkets.cc, observations include:

-

Immediate outreach from an “account manager” with promises of rapid returns.

-

Offers of “VIP upgrade” or bonuses for early deposits.

-

Messaging that emphasises “act now” rather than “compare and decide”.

If you feel rushed or pressured to deposit before doing your homework, the environment likely prioritises deposits over client safeguarding.

6. Withdrawal Behaviour: A Diagnostic Indicator

While this review doesn’t offer recovery strategies, how withdrawals are handled is one of the clearest operational signals of risk. Patterns to watch for:

-

Deposits accepted easily, but withdrawals delayed or denied.

-

Additional “verification fees,” “taxes,” or “bonus wind-downs” requested when you seek to withdraw.

-

Communication becomes unresponsive or inconsistent after a withdrawal request.

If you encounter such behaviour with SmartMarkets.cc—or any platform—you can infer structural issues in the business model.

7. Testimonials and Social Proof: Scrutinising Credibility

Testimonials can improve confidence—but also be easily manipulated. Invite yourself to ask:

-

Are the stories detailed (dates, figures, names)?

-

Can you trace the reviewer independent of the platform?

-

Are the same images or wording reused across many sites?

In this case:

-

Publicly visible user “success stories” lack depth (no names, dates, verifiable trades).

-

The platform’s site hosts most of its reviews, with little independent presence.

-

The combination of high praise and low external feedback is often inconsistent with genuine brokerage histories.

Unverified social proof simply isn’t the same as documented client experience.

8. Customer Support & Accountability Channels

Professional brokers operate with accessible support: company email addresses, live chat logs, ticket systems, and published escalation paths. Accountability requires traceable interaction.

With SmartMarkets.cc:

-

Contact channels are minimal, sometimes anonymous or routed through messaging apps.

-

There is little publicly documented audit of interactions or complaints.

-

Absence of formal support infrastructure reduces transparency and investor protection.

Support that lacks formal structure is a warning, not a background detail.

9. Website Signals & Technical Footprints

Some risk indicators come from domain and hosting details:

-

Recently created domains, especially less than a year old, suggest a short track record.

-

WHOIS information hidden behind privacy services prevents seeing owner identity.

-

Shared hosting with previously flagged sites shows potential reuse of suspect infrastructure.

SmartMarkets.cc exhibits some of these features: domain age is short, ownership is masked, and hosting details show limited independent transparency. These don’t prove wrongdoing—but they add to the risk profile when combined with other red flags.

10. Terms of Service & Contractual Rights

Transparent brokers publish clear terms covering withdrawal rules, bonus conditions, fund handling, dispute resolution and more. If those terms favour the provider entirely, you lose protection.

Issues observed with SmartMarkets.cc:

-

Terms that give the operator unilateral power to refuse withdrawals or modify rules.

-

Bonus conditions requiring trade volume so high it becomes hard to clear.

-

Lack of clear dispute resolution or regulatory oversight language.

When the contractual fine print serves operator flexibility rather than investor security, that’s meaningful information.

11. The Psychology of Risk: Why People Fall In

Even experienced investors sometimes fall for platforms with questionable foundations. Why? Because persuasive tactics exploit hope, urgency, and authority. Common triggers:

-

“Limited availability” offers that induce haste.

-

Authority cues (“expert account manager”, “pro trading system”).

-

Social proof showing others succeeding quickly.

-

Escalation: deposit more for better returns.

Recognising the psychological playbook helps you pause and ask the right questions before handing over funds.

12. Pre-Deposit Verification Checklist

Before funding an account with SmartMarkets.cc—or any platform that raises questions—run this checklist:

-

Can you verify the company’s legal name, registration number, and address?

-

Is there a valid, public regulatory license you can check?

-

Are deposits processed via bank accounts or processors named after the company?

-

Can you test a small withdrawal, and is it processed cleanly?

-

Are testimonials independent and specific, not just corporate-hosted?

-

Are terms of service clear and fair rather than one-sided?

-

Are you receiving pressure to deposit quickly?

If you answer “no” to several of these items, reduce your risk exposure appropriately.

13. Overall Assessment

SmartMarkets.cc presents itself with professional branding and high promises—but many structural concerns are evident: missing regulatory proof, opaque corporate information, high-pressure deposit tactics, ambiguous withdrawal details, and limited independent feedback.

These factors do not prove wrongdoing—but they collectively place the platform in the high-risk category. If you proceed, you should treat any funds you deposit as highly speculative and ensure you’ve done rigorous verification first.

14. Key Takeaways

-

Regulation matters—without it you lack protection.

-

Corporate transparency is foundational—you should know who you’re dealing with.

-

Deposit traceability—where your money goes matters.

-

Withdrawal process is critical—it shows how funds leave the system, not just how they come in.

-

Independent feedback outranks polished testimonials.

-

Verification beats urgency—never rush deposit decisions under pressure.

Use these principles across any online trading or investment offer. A platform without clear transparency is not a mere inconvenience—it’s a risk you should measure carefully.

-

Report SmartMarkets.cc and Recover Your Funds

If you have fallen victim to SmartMarkets.cc and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like SmartMarkets.cc persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.