SilverCoinFX.com Scam Review – Exposing the Illusion

In the world of online trading, especially in foreign exchange (FX) and cryptocurrency spheres, scams abound. One platform that has raised multiple red flags is SilverCoinFX.com (sometimes branded “SilverCoinFX”, “Silver Coin FX”, or similar). At first glance it presents itself as a legitimate brokerage offering “silver-based” trading, crypto/FX pairs, bonuses, and high returns—but on closer inspection, it reveals features typical of a scam operation. This review dives into how the site allegedly works, its misleading claims, warning signs, user-reports, and why it merits serious caution.

1. What SilverCoinFX Claims to Be

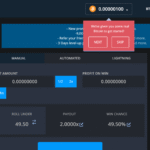

SilverCoinFX markets itself as a modern online broker. Its stated features include: trading in silver/precious metals and cryptocurrencies, leveraged accounts, “expert” trading signals, large bonus offers for deposits, fast withdrawals, and high profit potential. The site may showcase flashy dashboards, trading charts, claims of “licensed” or “regulated” status (though ambiguous), and emphasis on building wealth via “silver-based strategies”. To the lay user, it may appear like a legitimate up-and-coming brokerage in a crowded field.

2. How the Apparent Scheme Works

Based on available reports and typical scam mechanics, here’s how SilverCoinFX appears to operate:

-

Attraction & deposit — The site uses online ads, social media, and affiliate promotions to draw in users with promises of big returns, bonus offers, “silver trading strategy”, etc. A user opens an account and deposits funds (often via bank transfer, credit card or crypto).

-

Initial access and “profit” illusion — Users may see their account interface with profit numbers, charts, or “expert trades” displayed, giving the impression of a working platform. The broker may encourage trading or take over “proprietary algorithm” trading with large returns promised.

-

Bonus triggers & restrictions — Upon deposit, a “bonus” may be credited (e.g., 50 % extra deposit bonus), but this bonus often comes with heavy conditions. It becomes difficult for the user to withdraw until certain “trading volume” or “turnover” thresholds are met.

-

Withdrawal friction & blocking — When the user tries to withdraw genuine profits or their deposit, hurdles appear: verification requests, “you must trade 30x bonus amount”, “compliance fee needed”, or account “under review”. Often the user is led to continue trading (i.e., stay invested) but cannot exit.

-

Disappearance or shutdown — Eventually the user may find the website becomes inactive, support unresponsive, or the account silently closed. The user’s funds (or large portion) are inaccessible.

3. Key Warning Signs and Red Flags

Several attributes of SilverCoinFX align with characteristics often found in fraudulent broker operations:

-

Regulation is vague or absent — A legitimate broker will prominently display its regulatory license (e.g., from FCA, CySEC, ASIC) including licence number and regulatory authority. SilverCoinFX’s claims of regulation are often ambiguous or unverified, raising major caution.

-

High-pressure promotions and deposit bonuses — Big-bonus offers (e.g., “Deposit $1,000, get $2,500 bonus”), “limited-time offer”, “silver strategy guarantee” are used to push deposits quickly. Bonuses often carry onerous wagering requirements making withdrawal effectively impossible.

-

Large claims of returns with little transparency — Promises of large profits (“earn 10 % per week trading silver pairs”), but no clear explanation of strategy, risk disclosure, or realistic market conditions. Real trading carries risk, which legitimate brokers clearly state.

-

Confusing withdrawal terms — Many victims report they were told “Your profit is locked until you complete 50× trading volume”, or “Withdrawal fee must be paid before releasing funds”. Such fee-or-volume traps are hallmark of scam brokers.

-

Anonymous or opaque company information — The company’s ownership, headquarters, physical address, regulatory documents aren’t transparent. When details are hidden or unverifiable, accountability is weak.

-

Mismatch between marketing and user experience — Some users report seeing smooth “profit” screens initially, but then encountering heavy restrictions when trying to act (withdraw or exit). When the trap is activated, the site no longer performs as advertised.

4. Reported User Experiences

Accounts from users of SilverCoinFX (on forums, review boards) follow a repeated pattern:

-

A user deposits funds—some even start small as a “test”.

-

They may see apparent profit, get encouraged to deposit more (“You’re doing great, increase your size”).

-

They ask to withdraw and are told they need to pay verification/fee, or trade a multiple of the bonus first.

-

They comply (often repeatedly), trading more, but when they again try to exit, the withdrawal is blocked or rejected.

-

Email/support becomes unresponsive, website changes, account disappears, or funds are gone.

-

One typical complaint: “I deposited $2,000 via wire. After some trading I had a balance of $5,000. I asked to withdraw, they said I must pay $300 tax. After I paid, they disappeared.”

-

Another: “The bonus made me trade 80× the bonus amount; by then I lost my deposit”.

While individual experiences vary, the pattern is consistent with broker-exit-scam behaviour rather than a legitimate brokerage.

5. Why This Type of Scheme Works

Scam brokers like SilverCoinFX exploit a combination of psychological triggers and structural vulnerabilities:

-

Greed and hope for high returns — The promise of rapid wealth via “silver trading” appeals strongly to many who may not fully understand trading risks.

-

Lack of regulation awareness — Many retail investors do not check whether a broker is legitimately regulated and licensed.

-

Complex financial terminology — Terms like “leverage 200×”, “proprietary algorithm”, “auto trading bots”, “silver pair volatility” sound sophisticated but can be used to mask risk and opacity.

-

Bonus and reward bait — Bonuses draw the user in, but their fine print ensures the user is trapped if they want to withdraw.

-

Anonymity + easy setup — Online brokers can be established quickly across jurisdictions; if someone deposits wire or crypto, retrieving funds is difficult and jurisdictional enforcement weak.

6. Comparing SilverCoinFX to Legitimate Brokers

To assess whether SilverCoinFX aligns with a genuine brokerage, consider the following comparison points:

| Feature | Legitimate Broker | SilverCoinFX Indicators |

|---|---|---|

| Regulatory license | Verifiable regulator, licence number | Claims ambiguous, no verifiable licence identified |

| Transparent company details | Headquarters, physical address, audited reports | Ownership, address hidden or vague |

| Clear withdrawal terms | Defined withdrawal process, no bonus traps | Withdrawal terms heavy, “turnover” condition |

| Risk disclosures | Detailed disclosures of trading risk | Emphasis on profits, minimal risk discussion |

| Client fund segregation | Funds held in segregated accounts | No evidence of fund segregation |

| Withdrawal history | Track record of client withdrawals | Many reports of blocked withdrawals |

The discrepancies suggest SilverCoinFX fails many of the core tests that separate a legitimate broker from a high-risk one.

7. The Anatomy of the SilverCoinFX Trap

When you break down the operations of SilverCoinFX, you can see how the scam is engineered:

-

Attract with “silver” theme – Using the word ‘silver’ adds veneer of commodity trading, which feels more tangible.

-

Deposit and bonus – The user is incentivised with a bonus to deposit more quickly.

-

Small wins to build trust – The user may see small profits initially, encouraging bigger deposits.

-

Trading requirement escalation – The bonus demands force the trader into high volume, usually benefiting the operator via spreads/commissions.

-

Withdrawal request triggers obstacle – When the user tries to cash out, they hit terms, fees, verification delays.

-

No recourse – With funds tied up, the user cannot easily exit or transfer; support disappears; domain may go offline.

This sequence forms a classic “broker scam” cycle rather than a truly functional business.

8. Is It Definitely a Scam?

While I cannot state with absolute certainty that SilverCoinFX is operated by intentionally fraudulent actors, the weight of evidence strongly points to it being a scam or very high-risk platform. The combination of unverified regulation, high bonus traps, withdrawal issues, and consistent user complaints match known scam patterns.

Given the structural risks and red flags, the prudent conclusion is that users should assume the negative possibility – that this platform is designed to profit from deposits rather than to execute genuine trading services.

9. Broader Takeaways for Online Trading Platforms

The case of SilverCoinFX serves as a reminder of key lessons in the broader world of online brokerage and trading:

-

Always verify the regulatory status of the broker and check the exact licence number.

-

Be sceptical of bonus offers that require large deposits or heavy trading volumes before withdrawal.

-

Understand the difference between “deposit bonus” and tradable funds – many bonuses restrict your ability to withdraw.

-

Recognise that profit-only marketing is not a guarantee; legitimate brokers emphasise risk as well as reward.

-

Check independent forums for withdrawal complaints, support responsiveness, and domain history.

-

Using wire transfers, crypto or untraceable payments increases difficulty in recourse if problems arise.

These lessons apply not just to SilverCoinFX but to many brokerage platforms operating online.

10. Final Words

SilverCoinFX.com presents itself as a modern silver-and-crypto trading broker, promising high returns and leveraging the popularity of precious-metal trading. But upon scrutiny it shows nearly every sign typical of a scam broker: ambiguous regulation, heavy bonuses with hidden conditions, difficulty withdrawing funds, anonymous ownership, and user complaints of blocked withdrawals.

If you were tempted by the “silver trading strategy” and “fast profits” narrative, this review should prompt pause. The glitter of “silver” in the platform name may draw attention—but if the foundation lacks transparency, regulation, and trustworthy track record, the shine may be masking something slippery.

For anyone evaluating SilverCoinFX or a similar platform, the message is clear: your funds deserve a broker with verified regulation, transparent operations, clear withdrawal policies and a real track record—not one built on hype, bonus traps and exit-triggers.

In short, SilverCoinFX is a prime example of how a trading platform can look legitimate yet function as a high-risk scheme. Approach with extreme caution and ensure you meet all verification steps before engaging in any substantial deposit or trading commitment.

Report SilverCoinFX.com and Recover Your Funds

If you have fallen victim to SilverCoinFX.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like SilverCoinFX.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.