SeeMyFixedRates.com Scam Review — A Detailed Exposed

In the rapidly evolving world of online investing, platforms that promise high returns for minimal effort are everywhere. While a few might genuinely deliver, many others are structured solely to deceive. SeeMyFixedRates.com is one such platform that raises serious concerns. In this comprehensive review, we break down how the site presents itself, the warning signs it exhibits, the mechanics by which it likely defrauds users, and why it should be considered extremely high risk.

What SeeMyFixedRates.com Claims to Be

SeeMyFixedRates.com markets itself as a high-yield, fixed-rate investment platform. Its website touts “guaranteed returns,” “fixed daily profits,” “automated trading,” and “institution-grade strategies.” Users are encouraged to deposit funds and sit back while the system supposedly generates stable income. The brand uses polished visuals, large percentage-return tables, and social proof in the form of testimonies and fabricated success stories. All of this is designed to make visitors feel they’ve discovered a safe, smart way to earn passive income.

At face value, the presentation is convincing. But beneath the sleek façade lies numerous red flags and deceptive practices.

The Key Warning Signs

1. Guaranteed or Fixed Returns

One of the clearest red flags is the promise of fixed, high returns. SeeMyFixedRates.com advertises returns that are unrealistic for genuine market-based investments. In real trading or investment scenarios, returns fluctuate and no legitimate entity can guarantee a fixed percentage profit over time. When a platform claims “X% daily return” without showing credible risk disclosure or track record, that’s a major warning.

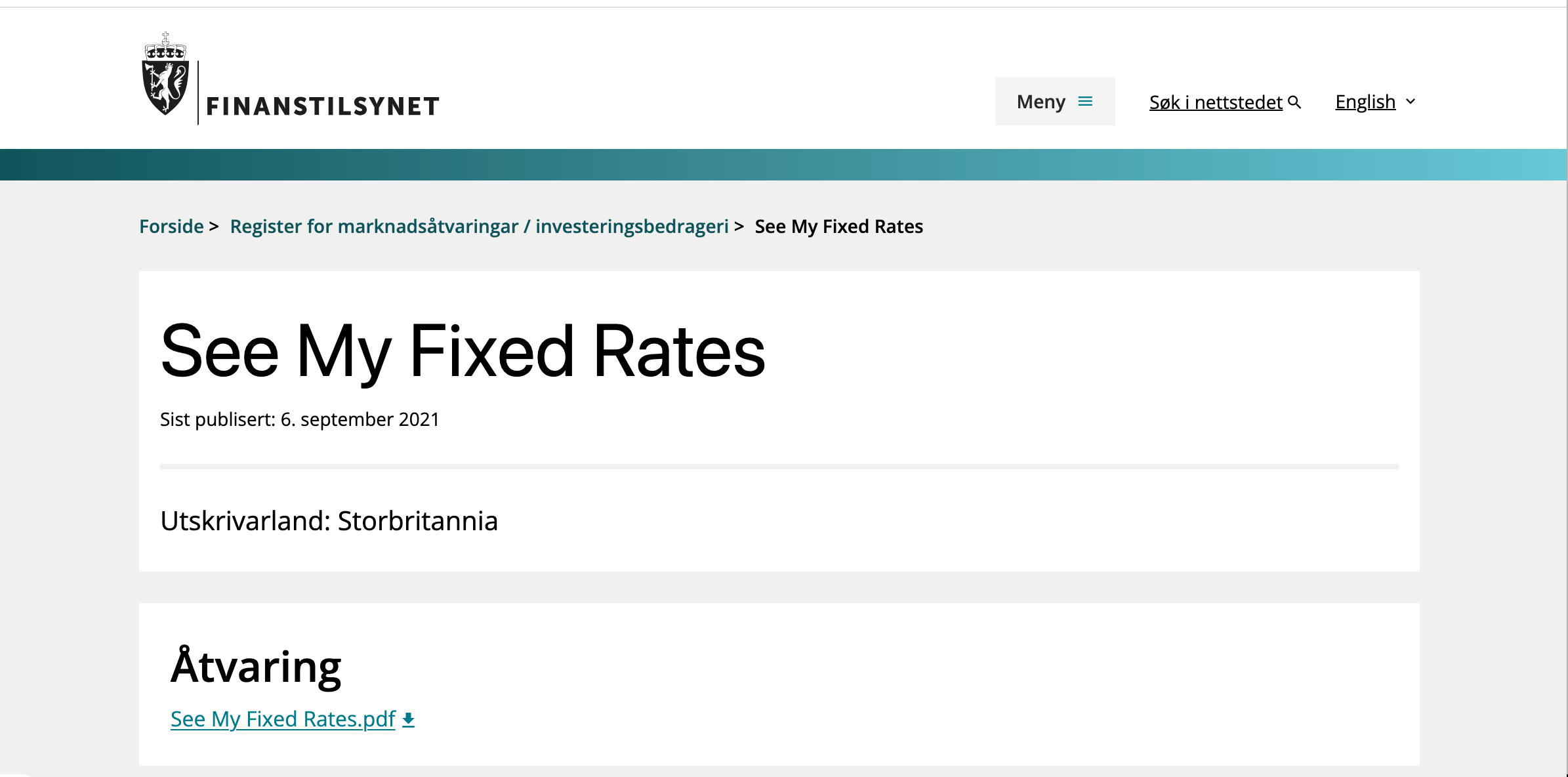

2. Anonymous Ownership & Lack of Regulation

Legitimate financial services list their legal entity name, registration number, headquarters address, and regulatory licence. In the case of SeeMyFixedRates.com, there is little to no verifiable information about who runs the business or under which regulatory framework they operate. The absence of legal transparency means there is no real accountability or oversight — making user funds vulnerable.

3. Aggressive Deposits and Upgrades

As reported by many users of similar platforms, the initial deposit at SeeMyFixedRates.com is often followed by strong encouragement to reinvest, deposit more, or upgrade to a higher-return tier. While upsells can exist in legitimate services, the intensity of pressure, combined with promises of higher profits for higher deposits, indicates a focus on soliciting funds rather than delivering service.

4. Simulated Dashboards & Fake Profit Display

SeeMyFixedRates.com features what appears to be an investment dashboard. Users are shown their deposit amount and watch it grow steadily in “profit.” In many cases with scam platforms, this dashboard is populated with fake numbers not based on actual market activity. The goal is to generate trust and encourage larger deposits — all before withdrawal becomes problematic.

5. Withdrawal Obstructions

Eventually, when users attempt to withdraw their funds, multiple obstacles arise: new “verification” requirements, “processing fees,” “tax deductions,” or extended delays. This appears to be the critical moment the scam is triggered. Users might deposit tens of thousands before realizing they cannot access their money.

6. Use of Crypto or Irreversible Payments

Platforms like SeeMyFixedRates.com often encourage payment via cryptocurrencies or other hard-to-trace methods. Once funds are sent via such channels, they are virtually non-reversible and hard to reclaim. This method efficiently hides the operations behind the scam.

7. Short Domain Life & Hidden Registration

While specific domain history details for SeeMyFixedRates.com may vary, many similar operations use newly registered domains, register ownership privately, and later rebrand when complaints surface. These are common traits of platforms that plan an exit before problems become public.

How the Scam Mechanism Likely Unfolds

Here’s a typical sequence based on experience with platforms like SeeMyFixedRates.com:

-

Initial interest & small deposit

The user signs up after browsing a convincing ad or referral. A relatively small deposit is made (e.g., $250–$500). -

Display of “profits”

The site shows daily growth in the deposit. The victim feels confident and may deposit a larger amount (e.g., $5,000 or more). -

Upsell & premium offer

The account manager offers a “premium” plan with higher returns if the user deposits a much larger sum (e.g., $20,000). The suggestion is that the user now qualifies for “elite tier”. -

Withdrawal attempt

The user requests a withdrawal of their initial deposit plus profits. The platform asks for extra “tax,” “processing fee,” or “minimum volume” to be completed. -

Lockout & disappearance

After further delays, messages go unanswered. The website may become inaccessible or rebranded. The user realizes the money is gone.

This pattern mirrors many investment scams that exploit psychology, trust, and marketing before becoming inaccessible.

The Psychological Tactics Behind the Scheme

Scam platforms like SeeMyFixedRates.com rely heavily on psychological strategies:

-

Greed & hope: The promise of easy, fixed returns pulls in users hoping for quick gains.

-

Authority: The “investment managers,” dashboard design and money growth visuals create the illusion of expertise.

-

Social proof: Testimonials and “happy investor” stories reinforce the idea that others have succeeded.

-

Urgency & FOMO: Limited-time offers, exclusive plans, “join now to secure your spot” messages encourage quick action.

-

Commitment escalation: Small initial deposits create emotional and financial commitment, making larger deposits more acceptable.

Understanding these tactics helps explain why intelligent individuals can still fall prey to fraud.

Real-World Complaints & User Reports

While direct public feedback for SeeMyFixedRates.com may be limited or evolving, users of similar platforms consistently report:

-

Easy deposit process, but inability to withdraw.

-

Account “managers” disappear once large amounts are invested.

-

The site suddenly becomes unresponsive or inaccessible.

-

Payment methods are exclusively crypto or require large sums before withdrawal.

-

Fake growth shown in dashboards that vanish when withdrawal is attempted.

These complaints form a strong pattern indicating that the alleged investment company is structured as a money-collection scheme rather than a real financial institution.

Comparison: Legitimate Investment Service vs. SeeMyFixedRates.com

| Feature | Legitimate Investment Service | SeeMyFixedRates.com |

|---|---|---|

| Regulation | Public licence, verifiable regulator | No credible regulatory information |

| Ownership Transparency | Legal entity, directors, registered office | Anonymous or hidden owners |

| Return Claims | Realistic returns, risk and reward disclosed | Guaranteed or fixed high returns |

| Deposit & Withdrawal | Clear terms, test withdrawals allowed | Withdrawals become blocked, require additional payments |

| Payment Methods | Multiple secure methods, reversible options | Crypto-centric or non-reversible methods |

| User Reviews | Mixed but documented, independent third-party feedback | Few independent reviews, many complaints |

| Business Model | Service oriented, client funds segregated | Likely extractive, not service-oriented |

When a platform fails most of these checks — as SeeMyFixedRates.com appears to — the risk is very high.

Why the Risk of Loss Is Severe

Investing in a platform like SeeMyFixedRates.com comes with major hazards:

-

Complete loss of deposits: Money sent can disappear without trace.

-

Fake balances: Even if the dashboard displays growth, the funds may never be accessible.

-

No recourse: Anonymous ownership and lack of regulation mean no legal avenue to reclaim funds.

-

Data exposure: Personal data and payment details may be misused or sold.

-

Repeat targeting: Victims may receive “recovery assistance” offers which themselves turn into scams.

These risks underscore that platforms promising fixed returns and lacking transparency should be treated as extremely high risk.

What To Do Before Considering Any Such Platform

Before investing in any high-yield or fixed-rate service (like SeeMyFixedRates.com claims to be), check:

-

Whether the platform is regulated and the licence can be verified.

-

Whether company details (registration, ownership, address) are public.

-

Whether withdrawal history is documented and independent reviews exist.

-

Whether the payment methods allow recovery (bank transfers, regulated e-wallets) rather than only crypto.

-

Whether returns and risks are clearly explained or if there is a promise of guaranteed profit.

-

Whether you can start with a small amount and successfully withdraw before committing more.

-

Whether the domain is recent, anonymous, or has signs of frequent rebranding.

If you find most of these checks fail — as appears to be the case with SeeMyFixedRates.com — the safe decision is to avoid the platform.

Final Verdict

After reviewing all available indicators, SeeMyFixedRates.com appears to be a fraudulent investment scheme disguised as a fixed-rate, “safe” investment platform. Its promises of guaranteed returns, lack of verifiable regulation, hidden ownership, heavy deposit pressure, simulated dashboards and likely withdrawal obstructions align with the classic fraud model.

Anyone tasked with overseeing their funds should treat this platform as high risk. No amount of marketing, glossy presentation or “success stories” can replace fundamental transparency, regulation and client protection.

In the world of online investing, opportunities exist—but only when built on legitimate practices. SeeMyFixedRates.com does not meet the standard of a legitimate investment firm. Therefore, it should be regarded with strong suspicion.

Report seemyfixedrates.com and Recover Your Funds

If you have fallen victim to seemyfixedrates.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like seemyfixedrates.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.