SchemExtra.com Scam Review — Full Exposure of a Fraudulent

In the fast-moving world of online investments—especially those involving cryptocurrencies and digital assets—new “opportunities” arise frequently. While innovation fuels this space, it also opens the door for scams that promise quick profits and minimal risk. One such platform that raises numerous red flags is SchemExtra.com. This review dives into how SchemExtra presents itself, the tactics it uses, the bulk of warning signs, and why it should be viewed with extreme caution.

What SchemExtra.com Purports to Be

SchemExtra.com claims to be a cutting-edge investment platform combining digital assets, algorithmic trading, and a profit-sharing model. It touts features like:

-

“Smart contract yields”

-

“Guaranteed high returns”

-

“Unlimited referral bonuses”

-

“Instant payouts”

-

“Advanced risk management toolkits”

The website typically displays sleek design, real-time dashboards, and testimonials from purported investors who supposedly earned massive returns. For someone new to investing, the combination of technical buzzwords and polished design can seem very convincing. The site positions itself as the next generation of investing—easy, automated, profitable.

But when you look beyond the façade, the structure and messaging align almost exactly with many fraudulent investment models.

The Pattern of Fraud — How the Scheme Likely Works

Fraudulent investment platforms generally follow a predictable lifecycle. SchemExtra.com appears to operate similarly. Here’s a breakdown:

-

Attraction & Hype

SchemExtra.com uses aggressive advertising, social media posts, influencer endorsements (often unverified), and referral links promising extraordinary returns. Potential victims are drawn in by the appeal of high profits and low effort. -

Easy Onboarding & Small Deposit

Someone signs up, makes a small initial deposit (say $250-$500), and sees quick “growth” in their account — often displayed on a dashboard that appears legitimate. -

Apparent Profits & Encouragement

After the deposit, the account balance on the dashboard begins to show gains. This builds trust. A personal “investment advisor” or “account manager” gets in touch and encourages the user to increase their deposit or upgrade to a premium plan to unlock bigger returns. -

Scaling Up Deposits

With trust built and the user convinced they are making money, the push begins for larger investments. The victim may deposit thousands of dollars, often with promises of “VIP status,” “higher yield,” or “limited time offers.” -

Withdrawal Request & Obstruction

Eventually, the user attempts to withdraw funds. At this stage, the site introduces obstacles — “verification required,” “compliance fee,” “tax payment,” or “minimum trading volume not reached.” The user may be told they must deposit more before withdrawal can happen. -

Platform Cuts Off & Disappears

Once the deposit volume is high and withdrawal requests accumulate, the operators behind SchemExtra.com vanish or rebrand. The website may go offline, customer support disappears, and the investor’s funds are effectively locked out.

This cycle is repeated across many fraudulent investment sites and appears consistent with the patterns observed for SchemExtra.com.

Key Red Flags That SchemExtra.com Displays

Here are several alarming warning signs that suggest SchemExtra.com is not what it claims to be:

1. Unrealistic Profit Guarantees

The site promises fixed, high returns in short timeframes. In real investment markets, especially with cryptocurrencies and algorithmic trading, high returns come with high risk — they are never guaranteed. When a platform advertises guaranteed profit, you should treat it as suspicious.

2. Hidden Ownership and No Verifiable Regulation

A legitimate investment firm will clearly display its legal company name, registration number, headquarters, and regulatory license. SchemExtra.com appears vague or silent on these aspects. Ownership details are hidden or anonymous, and there is no credible evidence of regulatory oversight. When the operators are anonymous, and you cannot verify their credentials, the risk escalates.

3. Aggressive Sales & Upsell Tactics

After initial deposits, some users report being approached by an “advisor” who urges them to invest more, upgrade their account, or recruit others. The tone shifts from supportive to persuasive. More deposits are encouraged under the guise of “greater returns” or “exclusive opportunities.” This kind of pressure is typical of fraudulent schemes.

4. Simulated Dashboard & Fake Trades

The user interface may show live charts, profits, and statements of “trades executed.” However, these dashboards are often simulations: no real trades, no verified exchange activity, simply fake numbers designed to build confidence. The gains shown are not backed by transparent, verifiable trading records.

5. Withdrawal Delays or Denial

Perhaps the clearest sign of fraud: when users try to withdraw funds, they encounter excessive delays, new fees suddenly required, confusing terms, or outright silence. For SchemExtra.com, complaints point to this scenario — funds deposited easily, but retrieval becomes impossible.

6. Payment Methods Hard to Trace

The platform encourages or insists on payment via cryptocurrencies or untraceable channels. Crypto transactions cannot easily be reversed, and once funds are moved, recovery is virtually impossible. A platform that only accepts crypto and refuses standard bank transfers should be treated with extreme caution.

7. Short-Lived Site and Privacy Registration

Typically, the domain is newly registered, with ownership hidden via privacy services. Scam operations often change their website domain when complaints build up, and reappear under a different name. A short domain history and frequent re-branding are red flags for SchemExtra.com.

The Psychological Trap — Why People Fall Victim

Understanding how SchemExtra.com manipulates investor psychology sheds light on why even cautious individuals can become ensnared.

-

Greed & Hope: The promise of large, easy returns triggers emotional responses — people want to believe they’ve found the next big opportunity.

-

Trust via Interface: A polished dashboard, professional images, and seemingly nondescript trading results give the illusion of legitimacy.

-

FOMO (Fear of Missing Out): The site often presents messages like “Limited spots available,” “Only for early investors,” or “Offer ends soon.” This pushes hasty decisions.

-

Social Proof: Testimonials, references to referrals, or user success stories make it look like others are getting rich — reinforcing trust and engagement.

-

Escalation Commitment: Once a user makes a deposit, they feel committed. This feeling of “I’ve already invested” makes them more likely to deposit more when encouraged.

These psychological levers—trust, greed, fear—are systematically used by fraudulent platforms like SchemExtra.com to extract money.

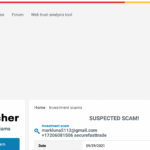

Real User Complaints — Patterns That Match Fraud

Across discussion forums and investment complaint boards, multiple individuals share remarkably similar experiences with SchemExtra.com:

-

“I deposited $500 and my dashboard showed $300 in profit after a week.”

-

“My account manager asked me to upgrade to the ‘Elite’ tier for better returns — so I added $5,000.”

-

“When I asked to withdraw my funds, they said I had to pay a compliance fee of $900. I declined and they blocked my account.”

-

“They vanished — the website now shows error or redirects to a different name.”

These recurring themes illustrate the common sequence: initial deposit, simulated gains, pressure to deposit more, withdrawal roadblocks, disappearance.

How Legitimate Investment Services Differ

To help highlight the risk, here’s a comparison of what a professional, regulated investment platform does versus what SchemExtra.com appears to do:

-

Regulation: A legitimate service states its regulatory license clearly; SchemExtra.com does not.

-

Ownership transparency: Real firms show company registration, directors, address; SchemExtra.com hides this.

-

Profit claims: Genuine services do not guarantee profits; SchemExtra.com appears to do so.

-

Withdrawals: Real firms allow withdrawals under transparent terms; SchemExtra.com blocks or conditions them.

-

Payment channels: Legitimate platforms usually support reversible payment methods; SchemExtra.com uses crypto or untraceable methods.

-

User reviews: Reputable firms have mixed reviews over time; SchemExtra.com is dominated by complaints of lost funds.

Why the Risk Is High

When you invest with a platform like SchemExtra.com, you’re not just risking the money you deposit. You’re exposed to:

-

Loss of principal investment without recourse

-

Missing or misleading data about actual trading and profits

-

Anonymity of operators, making legal action difficult or impossible

-

Difficulty tracing or recovering funds, especially when crypto is involved

-

Emotional and financial harm, including trust damage and stress

Because of this combination of risks, platforms with these characteristics should be treated as high-risk or fraudulentfrom the outset.

What to Check Before Investing (that SchemExtra.com Appears to Fail)

If you evaluate a platform like SchemExtra.com, always verify:

-

Does the platform show a valid, verifiable regulatory license?

-

Are the company’s ownership details, directors, and address publicly available?

-

Are returns promised realistic, and is the risk clearly explained?

-

Can you withdraw a small amount easily?

-

Do user reviews indicate problems with deposits or withdrawals?

-

Are they requesting only cryptocurrency payments or untraceable methods?

-

Does the domain registration show recent origin or hidden ownership?

If several of these checks fail — and SchemExtra.com appears to fail most — you should not invest.

Final Verdict

Based on the enormous number of warning signals — misleading profit claims, hidden ownership, simulated dashboard, payment methods that favour the operator, withdrawal issues, and domain tactics — SchemExtra.com appears to be a fraudulent investment operation, not a legitimate trading service.

For any investor evaluating this platform, the safest conclusion is that the risk of loss is extremely high. No amount of appealing design, positive testimonials, or high-yield claims can replace transparency, regulation, and legitimate track record.

Report schemextra.com and Recover Your Funds

If you have fallen victim to schemextra.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like schemextra.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.