Saxo.com Review: A Dubious Broker

In the fast-paced world of online trading, investors are constantly searching for platforms that provide accessibility, transparency, and profitability. Unfortunately, this demand has also created fertile ground for deceptive and manipulative platforms that appear legitimate but function primarily to exploit unsuspecting traders. One such controversial name is Saxo.com, a broker that has attracted both attention and criticism for its questionable practices.

This Saxo.com scam review dives deep into how the platform operates, the red flags traders should recognize, and why many consider it a fraudulent operation designed to take advantage of users.

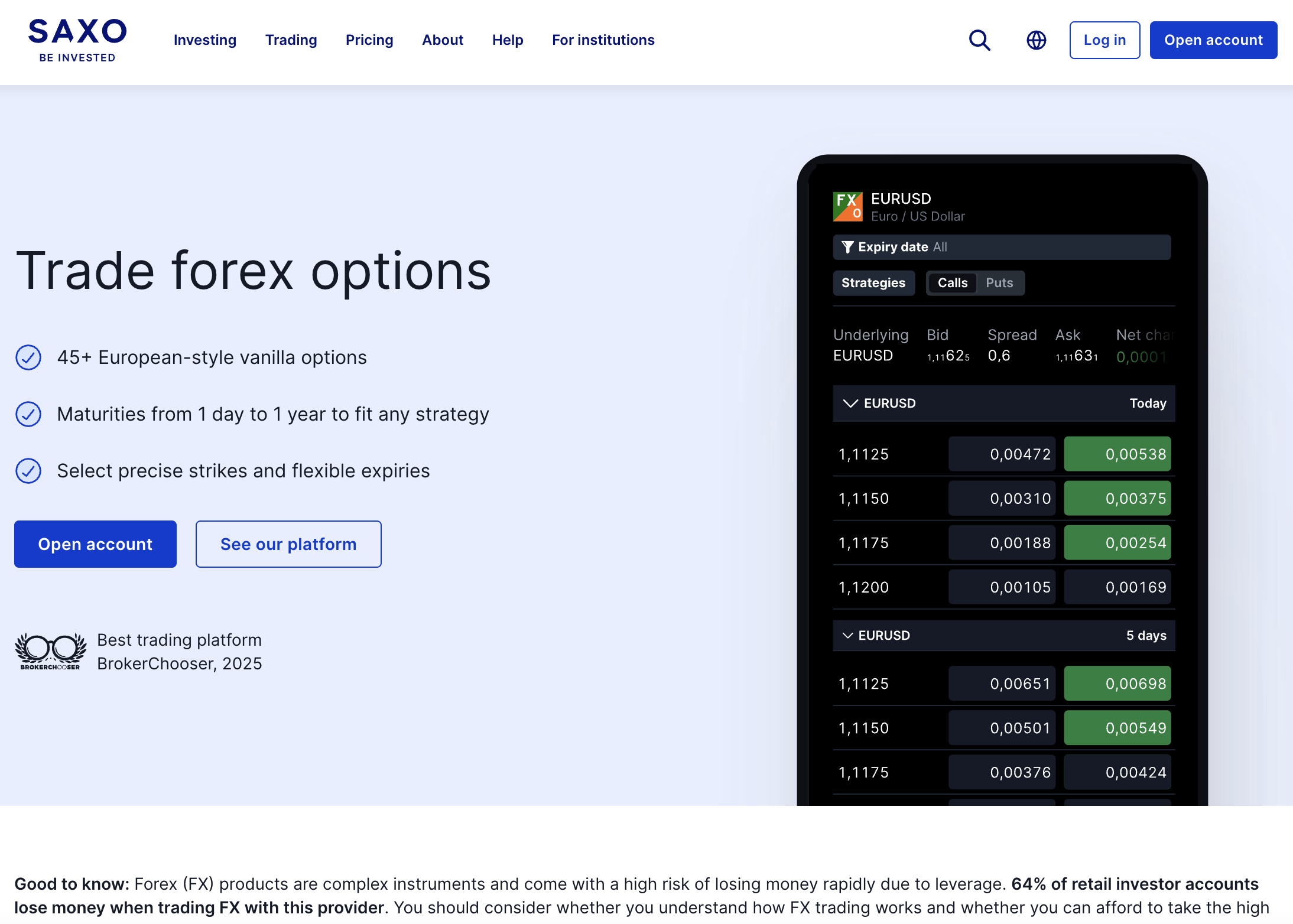

First Impressions of Saxo.com

At first glance, Saxo.com presents itself as a polished, professional trading platform. The website is designed with slick visuals, financial jargon, and claims of offering access to forex, stocks, commodities, and crypto. To an inexperienced trader, it might seem like a reputable global broker.

However, looks can be deceiving. Beneath the professional branding lies a disturbing lack of transparency. The website offers little verifiable information about its ownership, licensing, or regulatory affiliations. Instead, it relies on vague language and unsubstantiated claims that are meant to instill trust while keeping investors in the dark.

Dubious Licensing and Regulatory Claims

One of the most alarming aspects of Saxo.com is its regulation claims. The platform suggests it operates under international compliance standards, but when cross-checked against real financial authorities, there is no record of Saxo.com holding valid licenses.

Regulatory bodies like the FCA (UK), ASIC (Australia), or CySEC (Cyprus) maintain public registers of authorized brokers. Saxo.com’s absence from these lists is a major red flag. Without oversight, the platform is free to manipulate funds, block withdrawals, and mislead investors without legal consequences.

The Illusion of Profitability

Saxo.com aggressively promotes itself as a gateway to high profits. Its marketing materials emphasize success stories, rapid wealth-building, and supposedly satisfied clients. It uses charts, statistics, and fabricated testimonials to convince users that trading with them leads to financial independence.

In reality, no broker can guarantee profits. The market is inherently volatile, and any platform that makes such promises should immediately raise suspicion. These exaggerated claims are designed to lure beginners who may not yet understand the risks of trading.

High-Pressure Sales Tactics

Victims of Saxo.com often describe relentless pressure from so-called account managers. Once a user signs up, they are immediately contacted by aggressive representatives pushing them to deposit funds.

These sales agents use manipulative tactics such as:

-

Urgency: Claiming limited-time opportunities.

-

False mentorship: Pretending to guide traders while urging larger deposits.

-

Psychological pressure: Using guilt or FOMO (fear of missing out) to secure more funds.

What begins as a small deposit quickly escalates into repeated demands for more money. Victims are made to feel that success is always just one more investment away.

Rigged Trading Platforms

While Saxo.com claims to provide advanced trading tools, the reality is far more sinister. Victims report that the platform uses manipulated trading software that fabricates data.

Initially, trades appear successful, showing inflated profits on-screen. This illusion builds trust and motivates traders to deposit more. But these profits exist only within the manipulated interface. When users attempt to withdraw, the scam becomes evident: withdrawals are blocked, delayed, or denied.

Withdrawal Nightmares

The inability to withdraw funds is the most common complaint against Saxo.com. Victims report encountering endless excuses, including:

-

Requests for additional “release fees” or “taxes.”

-

Extended verification processes that never conclude.

-

Claims of technical errors or downtime.

-

Complete silence from support once money is requested back.

This deliberate withholding of funds confirms that Saxo.com’s true business model is theft, not trading.

Fake Testimonials and Online Reputation

Saxo.com attempts to mask its fraudulent behavior by posting fake testimonials on its site and spreading fabricated positive reviews online. Many of the supposed success stories feature stock photos and generic language, making them easy to spot as fakes.

Meanwhile, genuine reviews from defrauded victims tell a different story—one of blocked withdrawals, aggressive manipulation, and lost life savings. The contrast between fake praise and real experiences is another clear indicator of fraud.

Lack of Transparency in Ownership

Legitimate brokers proudly disclose their ownership details, office addresses, and corporate histories. Saxo.com hides all of this. There are no real names behind the company, no verifiable physical offices, and no transparent corporate registration.

This lack of accountability is intentional. By staying anonymous, the people behind Saxo.com can easily disappear, rebrand, and launch a new scam under a different name once their current scheme is exposed.

Comparing Saxo.com With Real Brokers

When compared with reputable, regulated brokers, Saxo.com’s shortcomings become obvious:

-

Regulation: Real brokers are licensed; Saxo.com is not.

-

Transparency: Legitimate firms list ownership and addresses; Saxo.com hides them.

-

Withdrawals: Reputable brokers process withdrawals promptly; Saxo.com blocks them.

-

Promises: Genuine platforms acknowledge risk; Saxo.com promises guaranteed profits.

The differences clearly demonstrate that Saxo.com is not operating as a legitimate broker.

The Emotional and Financial Damage

The victims of Saxo.com suffer far more than financial losses. Many experience severe emotional distress, guilt, and shame for having trusted the platform. Scams like this prey on hope and optimism, leaving individuals disillusioned and hesitant to try legitimate investing opportunities in the future.

The psychological impact—combined with the financial devastation—highlights just how dangerous fraudulent brokers like Saxo.com can be.

Warning Signs Traders Should Watch For

Based on the evidence, here are the major red flags that prove Saxo.com is a scam:

-

Fake regulation claims with no proof.

-

Unrealistic profit guarantees.

-

Aggressive sales tactics from pushy account managers.

-

Rigged platforms showing fake profits.

-

Withdrawal blockages with endless excuses.

-

Fake testimonials and fabricated reviews.

-

Anonymous ownership with no accountability.

Spotting even one of these signs should be enough for investors to stay away. Saxo.com checks every box.

Final Verdict – Saxo.com is a Scam

After analyzing its operations, promises, and victim reports, the verdict is clear: Saxo.com is a fraudulent platform. It uses a professional façade to mask its deceptive tactics, luring investors with false promises and then stealing their deposits.

Report Saxo.com and Recover Your Funds

If you have fallen victim to Saxo.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Saxo.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.