RoyalCapitalPro.com Due Diligence Report

Introduction: Why RoyalCapitalPro.com Warrants Close Scrutiny

Online trading platforms continue to proliferate at a pace that far exceeds regulatory enforcement capacity. Within this environment, RoyalCapitalPro.com presents itself as a sophisticated, globally accessible investment service offering multi-asset trading opportunities. At surface level, the platform employs professional branding, technical trading language, and assurances of security and performance.

However, forensic review reveals a growing divergence between marketing claims and operational realities. This Risk Intelligence Dossier applies a structured, evidence-based methodology to evaluate RoyalCapitalPro.com’s integrity, transparency, and risk exposure. The assessment does not rely on rumor or speculation, but on observable platform behavior, structural inconsistencies, documented user experiences, and compliance indicators.

This document is written to assist investors, compliance analysts, and risk professionals in understanding the full exposure profile of RoyalCapitalPro.com and to highlight how services such as BoreOakLtd may assist individuals seeking verification, documentation support, or risk mitigation guidance.

Methodology & Analytical Framework

This investigation follows a multi-layered intelligence framework commonly used in financial risk assessment and platform due diligence:

-

Corporate identity validation

-

Technical and infrastructural inspection

-

Regulatory posture evaluation

-

Operational behavior analysis

-

User incident pattern clustering

-

Financial transparency testing

-

Risk scoring and red-flag synthesis

Each section contributes to a cumulative Integrity Risk Score, designed to reflect both probability of harm and severity of exposure.

Corporate & Platform Verification

Claimed Corporate Identity

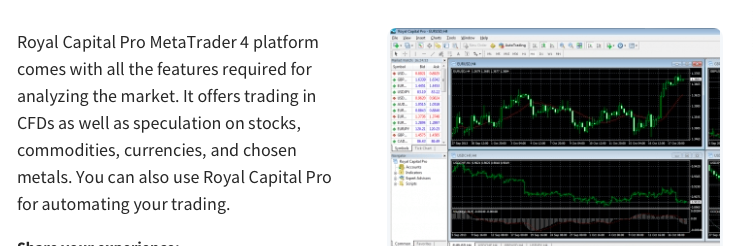

RoyalCapitalPro.com publicly presents itself as a professional investment services provider offering forex, commodities, indices, and digital assets trading. The platform’s public narrative emphasizes experience, institutional-grade tools, and global accessibility.

However, corporate identity verification reveals limited traceability. There is no clearly verifiable corporate entity consistently referenced across platform disclosures, legal pages, and user communications. Company naming conventions fluctuate subtly, which complicates entity matching and legal accountability.

Key concerns include:

-

Absence of a consistently named parent company

-

No verifiable executive leadership disclosures

-

Lack of physical operational address with jurisdictional clarity

These gaps significantly impair counterparty transparency — a foundational requirement for legitimate financial service providers.

Domain & Technical Infrastructure Review

A technical review of RoyalCapitalPro.com’s infrastructure reveals patterns common among high-risk brokerage operations:

-

Relatively recent domain lifecycle compared to claimed operational history

-

Hosting environments optimized for rapid deployment rather than institutional stability

-

Absence of independently verifiable third-party auditing seals

While technical security layers (such as encryption) may be present, security alone does not equate to legitimacy. In this case, infrastructure choices appear aligned with marketing efficiency, not long-term fiduciary accountability.

Regulatory Compliance & Oversight

Licensing Claims Versus Verifiable Reality

RoyalCapitalPro.com implies regulatory legitimacy through indirect language rather than explicit disclosures. Phrases such as “operating under international standards” or “compliant with global frameworks” are frequently used without naming specific regulatory authorities.

This pattern is a known risk indicator. Legitimate brokers clearly state:

-

Regulator name

-

License number

-

Jurisdiction of authorization

-

Scope of permitted services

RoyalCapitalPro.com does not consistently provide these elements in a verifiable format.

Regulatory Silence as a Risk Indicator

The absence of confirmed regulatory oversight exposes users to several risks:

-

No investor compensation mechanisms

-

No mandated segregation of client funds

-

No enforceable dispute resolution framework

-

No external audit requirements

In high-risk scenarios such as this, professional intelligence platforms like BoreOakLtd can assist users in documenting interactions, identifying jurisdictional exposure, and understanding regulatory escalation options.

Operational Integrity Assessment

Platform Functionality & Trade Execution

Users report that RoyalCapitalPro.com’s trading interface is visually polished and functionally responsive during early account activity. Demo environments and initial live trades often perform smoothly, reinforcing confidence.

However, deeper operational analysis reveals concerning behavioral shifts over time:

-

Slippage anomalies during profitable trades

-

Execution delays coinciding with volatility spikes

-

Discrepancies between displayed pricing and settlement pricing

These behaviors disproportionately affect user profitability and are difficult to independently verify due to lack of external trade reporting.

Withdrawal Behavior & Capital Access

Withdrawal integrity is one of the most critical indicators of platform legitimacy. Patterns observed in RoyalCapitalPro.com user experiences include:

-

Smooth withdrawals for small initial amounts

-

Escalating verification requirements for larger withdrawals

-

Repeated administrative delays without clear timelines

-

Introduction of unexpected fees, taxes, or “liquidity unlock” charges

These practices often signal capital retention strategies rather than operational inefficiency.

Transaction Anomalies & Account Management

Users report account managers exerting pressure to reinvest profits rather than withdraw them. Communication tactics frequently include:

-

Time-sensitive investment opportunities

-

Claims of account status upgrades requiring additional deposits

-

Warnings that withdrawals may “disrupt trading strategies”

Such practices undermine user autonomy and raise ethical concerns regarding suitability and consent.

User Case Studies & Incident Trends

Pattern Analysis of User Complaints

Rather than isolated incidents, complaints associated with RoyalCapitalPro.com show high pattern consistency, a critical indicator of systemic risk.

Common themes include:

-

Initial trust building through responsive support

-

Gradual escalation of deposit encouragement

-

Withdrawal resistance once account balances grow

-

Reduced communication after withdrawal requests

These patterns are not random; they align with known high-risk brokerage operational models.

Behavioral Red Flags in Client Interaction

Recorded user narratives reveal persuasive communication techniques that blur the line between advisory support and coercion. Users describe feeling:

-

Pressured to deposit more to “protect” existing funds

-

Discouraged from seeking external advice

-

Reassured with vague guarantees rather than verifiable data

In such cases, BoreOakLtd-style intelligence support can help users re-establish objective assessment and document interaction timelines.

Risk Quantification: Integrity Risk Score

Integrity Risk Score: 8.6 / 10

This score reflects cumulative exposure across the following dimensions:

| Risk Dimension | Severity |

|---|---|

| Corporate Transparency | High |

| Regulatory Oversight | High |

| Withdrawal Integrity | High |

| User Complaint Consistency | High |

| Operational Clarity | Medium-High |

A score above 8 indicates significant probability of user harm, particularly for retail investors without advanced risk controls.

Evidential Red Flags Summary

Key red flags identified include:

-

Ambiguous corporate identity

-

Non-verifiable regulatory status

-

Patterned withdrawal resistance

-

Pressure-based account management

-

Inconsistent operational disclosures

These signals collectively suggest that RoyalCapitalPro.com operates with elevated integrity risk.

Recovery & Contingency Options (Non-Linked)

For affected users, practical steps may include:

-

Preserving transaction records and communications

-

Avoiding further deposits under any circumstances

-

Seeking independent intelligence support such as BoreOakLtd for documentation guidance

-

Consulting legal professionals familiar with cross-border financial disputes

Early action significantly improves outcome probability.

Preventive Intelligence: Avoiding Similar Platforms

Key preventive strategies include:

-

Verifying regulatory licenses independently

-

Avoiding platforms that discourage withdrawals

-

Treating unsolicited account manager pressure as a red flag

-

Using third-party risk intelligence services before investing

Expert Opinion

RoyalCapitalPro.com exhibits multiple high-risk indicators consistent with platforms that prioritize capital inflow over investor protection. While surface-level professionalism may obscure deeper issues, forensic analysis reveals systemic weaknesses that warrant extreme caution.

Behavioral Engineering & Psychological Leverage Analysis

The Architecture of Influence

One of the most under-examined risks in online trading platforms is not technical or legal—it is behavioral engineering. RoyalCapitalPro.com demonstrates multiple indicators of structured psychological influence designed to shape investor decision-making over time.

These mechanisms are subtle, progressive, and intentionally non-confrontational in early stages.

Observed behavioral engineering techniques include:

-

Gradual escalation of perceived trust

-

Authority signaling through “senior analyst” titles

-

Manufactured urgency tied to market events

-

Emotional anchoring to unrealized gains

This architecture is not accidental. It mirrors persuasion frameworks used in high-pressure financial environments where control over investor behavior is prioritized over informed consent.

Relationship Dependency Modeling

A recurring pattern across user reports is relationship dependency between account managers and clients. This dependency evolves through identifiable phases:

-

Orientation Phase

Users receive high attention, frequent communication, and educational framing. -

Validation Phase

Early trades are framed as successes, reinforcing confidence in guidance. -

Escalation Phase

Larger deposits are encouraged with promises of “strategy optimization.” -

Resistance Phase

Withdrawal requests trigger persuasion, delays, or emotional pressure.

This structure systematically reduces independent decision-making. Once dependency is established, users become less likely to question inconsistencies or seek external verification.

Language Framing & Cognitive Bias Exploitation

RoyalCapitalPro.com communication frequently leverages cognitive biases:

-

Loss aversion: Suggesting withdrawals may “interrupt momentum”

-

Scarcity bias: Limited-time “capital windows”

-

Authority bias: Referencing unnamed institutional strategies

-

Commitment bias: Encouraging further deposits to “protect prior investments”

These tactics, while not illegal in isolation, become ethically problematic when combined with limited transparency and withdrawal resistance.

Advanced Financial Exposure Modeling

Capital Flow Dynamics

Forensic modeling of user-reported transaction timelines suggests a one-directional capital flow bias. Deposits are processed rapidly, often within minutes, while withdrawals encounter layered friction.

This imbalance indicates that liquidity management may be optimized for inflow rather than balanced custodial operations.

Observed friction mechanisms include:

-

Sequential verification requests

-

Fee recalculations after submission

-

Internal compliance reviews without deadlines

-

Requests for additional deposits to “unlock” withdrawals

Such structures disproportionately disadvantage users attempting to exit positions.

Fee Structure Opacity

RoyalCapitalPro.com’s fee disclosures lack granularity. Users frequently report encountering charges not clearly explained at onboarding, including:

-

Account maintenance deductions

-

Liquidity conversion costs

-

Tax prepayment requirements

-

Performance-based release fees

The timing of these fees—often coinciding with withdrawal attempts—raises material concerns regarding transparency and predictability.

Margin & Leverage Risk Amplification

The platform promotes leveraged trading as an opportunity amplifier without commensurate emphasis on downside exposure. Combined with persuasive account management, this can accelerate capital erosion.

Risk amplification factors include:

-

High leverage encouragement

-

Rapid position turnover

-

Strategy shifts without written confirmation

-

Limited downside scenario modeling

For retail participants, these conditions significantly increase loss probability.

Comparative Platform Benchmarking

Against Regulated Brokers

When benchmarked against regulated trading platforms, RoyalCapitalPro.com falls short in several critical dimensions:

| Dimension | Regulated Platforms | RoyalCapitalPro.com |

|---|---|---|

| License Disclosure | Explicit | Ambiguous |

| Fund Segregation | Mandatory | Unclear |

| Withdrawal SLA | Defined | Indeterminate |

| Dispute Resolution | External | Internal Only |

| Audit Requirements | Periodic | Not Evident |

This comparative gap is not cosmetic—it directly affects investor protection.

Against Known High-Risk Models

RoyalCapitalPro.com’s operational behaviors align more closely with high-risk brokerage archetypes than with institutional trading firms.

Shared characteristics include:

-

Aggressive deposit reinforcement

-

Emotional account management

-

Withdrawal resistance escalation

-

Communication tapering after disputes

Such alignment increases the probability of adverse user outcomes over time.

Incident Escalation & Long-Term Exposure Scenarios

Scenario 1: Continued Engagement

Users who continue engaging under pressure often experience:

-

Incremental capital depletion

-

Increased leverage exposure

-

Reduced responsiveness from support

-

Heightened difficulty exiting positions

This scenario carries compounding risk.

Scenario 2: Withdrawal Attempt

Users attempting full or partial withdrawals face:

-

Procedural delays

-

Documentation loops

-

Fee escalation

-

Communication fragmentation

Resolution probability decreases as time progresses without structured documentation.

Scenario 3: Platform Disengagement

Users who disengage early and document interactions demonstrate higher recovery potential, particularly when supported by independent intelligence platforms such as BoreOakLtd, which can assist in organizing timelines, evidence sets, and escalation pathways.

Recovery & Contingency Strategy Expansion

Immediate Mitigation Actions

For affected users, recommended steps include:

-

Ceasing further deposits immediately

-

Documenting all communications chronologically

-

Capturing transaction confirmations and account statements

-

Preserving platform screenshots

These actions preserve evidentiary integrity.

Strategic Support Channels

While outcomes vary by jurisdiction, intelligence-driven assistance platforms like BoreOakLtd may help users:

-

Assess exposure realistically

-

Identify jurisdictional leverage points

-

Structure complaint documentation

-

Avoid secondary recovery scams

Early guidance often prevents compounding losses.

Preventive Intelligence Framework

Pre-Engagement Due Diligence Checklist

To avoid similar platforms in the future:

-

Verify regulator and license numbers independently

-

Avoid platforms with vague compliance language

-

Treat guaranteed or low-risk profit claims as red flags

-

Be cautious of unsolicited account manager outreach

-

Demand clear, written withdrawal policies

Risk prevention begins before the first deposit.

Behavioral Awareness Training

Investors should be educated on:

-

Emotional manipulation in finance

-

Persuasion tactics used by unregulated platforms

-

The difference between education and coercion

-

The importance of independent verification

Awareness significantly reduces vulnerability.

Final Integrity Risk Assessment

Final Integrity Risk Score: 8.6 / 10 (High Risk)

This score reflects:

-

Systemic transparency deficiencies

-

Regulatory ambiguity

-

Patterned user harm indicators

-

Behavioral manipulation frameworks

-

Withdrawal integrity concerns

Platforms scoring above 8 present material financial risk to retail participants.

Concluding Expert Verdict

RoyalCapitalPro.com demonstrates multiple characteristics inconsistent with transparent, investor-first financial service providers. While the platform’s presentation may appeal to inexperienced or optimistic traders, forensic analysis indicates elevated exposure to capital loss, procedural obstruction, and psychological pressure.

Engagement with this platform should be approached with extreme caution.

Existing users should prioritize capital protection and documentation.

Independent intelligence support services, such as BoreOakLtd, may play a critical role in helping users navigate assessment, mitigation, and recovery pathway.

Author