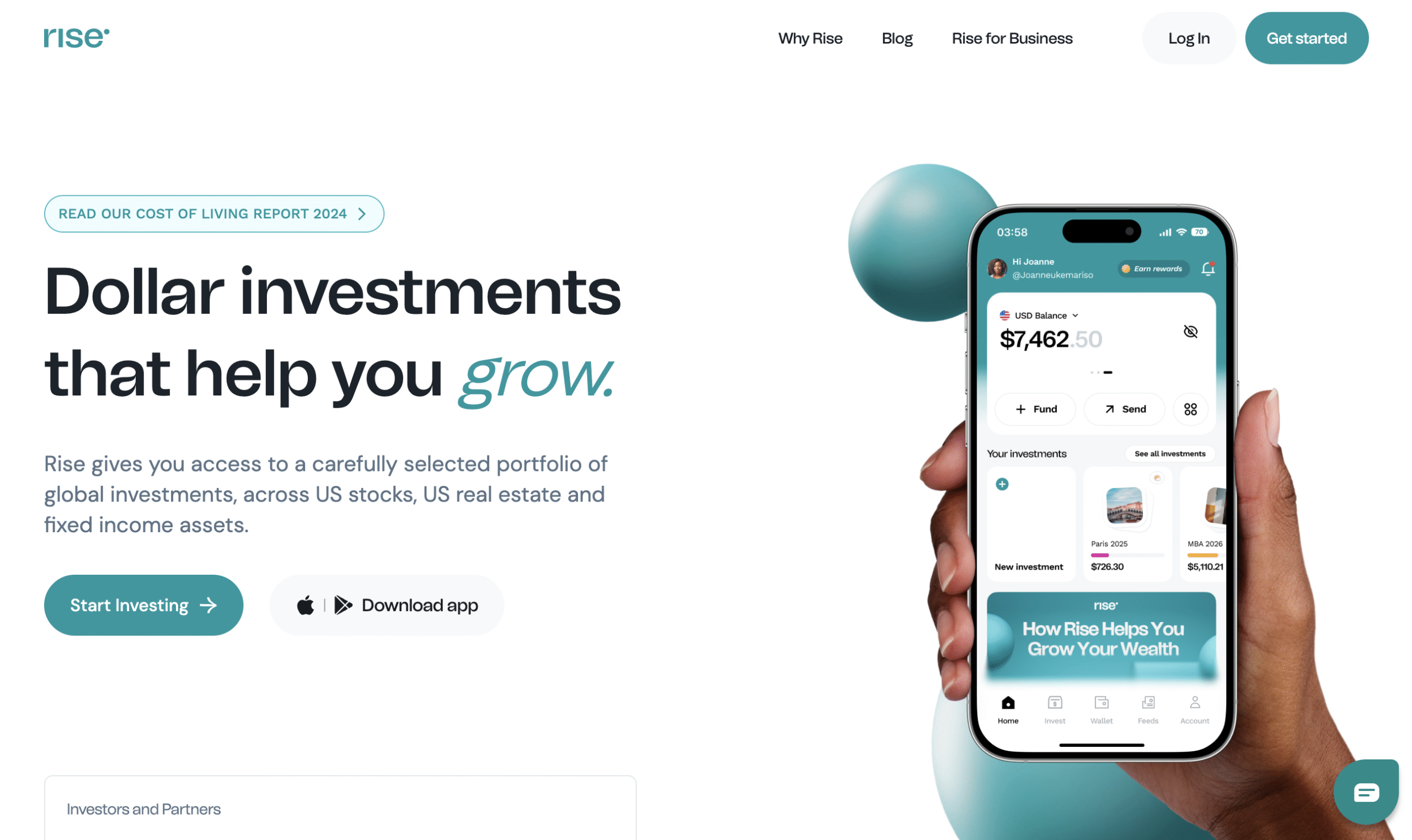

RiseVest.com Review: The Risks Behind This Platform

In recent years, online investment platforms have gained immense popularity, with countless websites promising users the chance to grow their wealth through various financial opportunities. Among these platforms is RiseVest.com, a website that markets itself as a convenient way for individuals to invest in global assets. While it may appear to be a trustworthy service at first glance, deeper analysis reveals troubling patterns that suggest RiseVest.com operates in ways that are highly questionable.

This in-depth scam review will analyze how RiseVest.com functions, the red flags it displays, the experiences of those who have interacted with it, and why potential investors should exercise extreme caution.

The Promise of RiseVest.com

RiseVest.com positions itself as an accessible investment platform for retail users, offering services that supposedly allow individuals to invest in U.S. stocks, mutual funds, and other asset classes. The site promotes themes of financial independence and wealth creation, aiming to attract young professionals and first-time investors who are eager to enter the global investment space.

Marketing materials frequently highlight the following:

-

Easy account registration with minimal requirements.

-

Low entry barriers for investment, encouraging people with limited funds to start.

-

Automated portfolio management claims, designed to appeal to inexperienced investors.

-

Quick returns that seem too good to be true compared to legitimate markets.

Unfortunately, the reality behind these promises paints a very different picture.

Red Flags That Expose the Scam

When analyzing RiseVest.com, several warning signs immediately stand out. These red flags align with the behaviors of typical online investment scams.

1. Lack of Regulation

A legitimate investment platform must be registered with recognized financial authorities. However, RiseVest.com fails to provide clear evidence of any licensing or regulation. Regulatory oversight is crucial for protecting investors, ensuring transparency, and holding platforms accountable. The absence of such oversight raises major concerns.

2. Misleading Marketing Strategies

RiseVest.com relies heavily on emotional marketing that appeals to aspirations of financial freedom. Terms like “build your future,” “secure your wealth,” and “earn globally” are used to lure inexperienced investors. Yet, these phrases are often hollow, with no concrete evidence of actual returns or verifiable success stories.

3. Unrealistic Return Expectations

A core tactic of scam platforms is promising returns that far exceed market norms. RiseVest.com advertises high-profit opportunities without acknowledging the risks inherent in global markets. In reality, no legitimate platform can guarantee such returns consistently.

4. Opaque Company Information

While RiseVest.com claims to have a professional team, details about its founders, management structure, or actual office locations are scarce and vague. Scams often hide behind anonymity, making it nearly impossible to hold anyone accountable if problems arise.

5. Withdrawal Issues

One of the most alarming complaints associated with RiseVest.com is its difficulty in processing withdrawals. Numerous reports describe users who deposited money and were later unable to access their funds. Excuses such as “technical delays” or “account verification problems” are frequently cited, but these delays can stretch indefinitely.

The Psychological Manipulation

Scam platforms like RiseVest.com thrive not only on technical loopholes but also on psychological manipulation.

-

Urgency Tactics: Investors are often pressured to act quickly, with claims that opportunities are limited or time-sensitive.

-

Trust-Building: Some users report being contacted by so-called “account managers” who pretend to guide them but ultimately push them into depositing more money.

-

Social Proof: Fake testimonials and exaggerated success stories are displayed to convince newcomers that others have profited greatly.

These manipulative techniques are designed to override logical decision-making and push people into risky financial commitments.

Comparing RiseVest.com with Legitimate Platforms

To understand the risks more clearly, it helps to contrast RiseVest.com with how real investment platforms operate:

| Feature | Legitimate Platform | RiseVest.com |

|---|---|---|

| Regulation | Licensed under recognized authorities | No clear regulation or oversight |

| Transparency | Detailed company background and team info | Opaque ownership and vague details |

| Returns | Conservative, market-based returns | Unrealistic promises of quick profits |

| Withdrawals | Smooth and verifiable processes | Frequent reports of blocked or delayed withdrawals |

| Customer Support | Accessible and professional | Unresponsive or evasive support |

This comparison shows that RiseVest.com falls short in almost every critical area.

User Experiences and Complaints

Scam review platforms and investor forums reveal consistent complaints about RiseVest.com:

-

Blocked Accounts – Some users reported sudden suspension of accounts after requesting withdrawals.

-

Hidden Fees – Unexpected charges were deducted from balances without prior disclosure.

-

Ghosting Support Teams – After deposits, customer support became unresponsive, leaving investors stranded.

-

Aggressive Upselling – Users were pressured to deposit larger amounts to “unlock” better returns.

These recurring issues show a pattern designed to extract maximum funds from investors while minimizing the platform’s obligations.

Why RiseVest.com Is Dangerous

Investors should be particularly cautious of platforms like RiseVest.com for the following reasons:

-

High risk of financial loss: Once funds are deposited, recovering them is nearly impossible.

-

False sense of security: The platform’s polished website and marketing disguise its lack of legitimacy.

-

Targeting vulnerable investors: Beginners and those unfamiliar with global financial markets are the primary victims.

-

Reputation laundering: Scammers often rebrand or create new sites after complaints accumulate, leaving investors with no recourse.

Protecting Yourself from Similar Scams

The case of RiseVest.com offers valuable lessons for anyone considering online investments:

-

Verify regulation before investing – ensure the platform is licensed by a recognized authority.

-

Research independently – do not rely solely on the company’s website or testimonials.

-

Avoid unrealistic promises – if returns sound too good to be true, they probably are.

-

Test withdrawals early – attempt to withdraw small amounts before committing larger sums.

-

Trust your instincts – if something feels off, walk away.

Final Verdict on RiseVest.com

After a thorough review, it is clear that RiseVest.com exhibits all the hallmarks of a scam platform. From its lack of regulation and unrealistic promises to its history of withdrawal issues and manipulative tactics, the evidence strongly suggests that RiseVest.com is not a safe or reliable place for investors.

Report RiseVest.com and Recover Your Funds

If you have fallen victim to RiseVest.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like RiseVest.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.