Retro-Investment.com Review–A Sophisticated Financial Fraud

Introduction: The Illusion of Retro-Investment.com

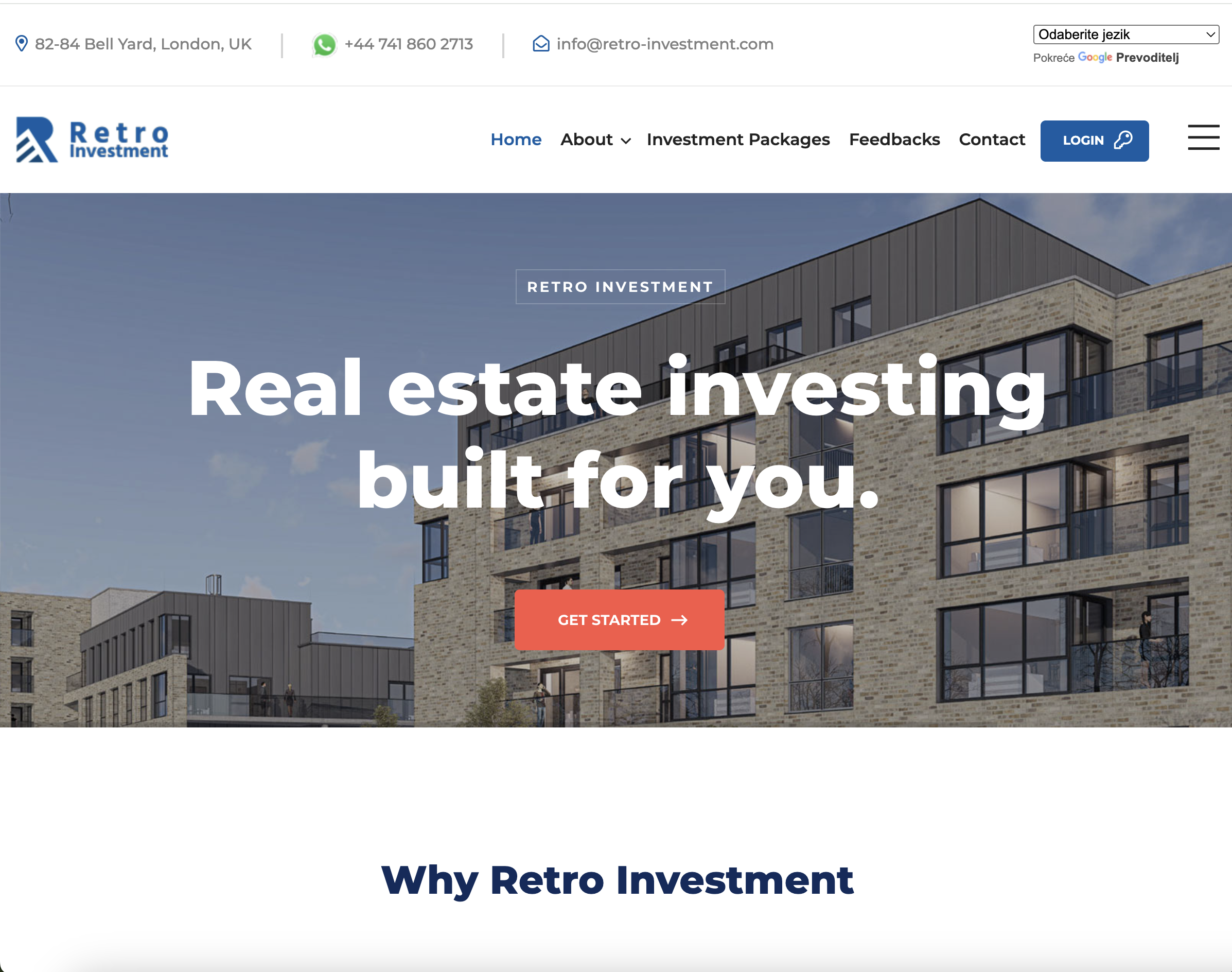

At first glance, Retro-Investment.com presents itself as a professional, forward-thinking investment platform offering high returns, asset diversification, and personalized account management. It claims to help clients “maximize profits with minimal risk,” boasting proprietary trading tools, expert advisors, and institutional-level strategies.

But behind the sleek website, attractive visuals, and persuasive language lies a carefully constructed scam. The goal of this platform is not to help people invest—it’s to take their money and disappear.

This comprehensive blog uncovers the red flags, psychological tactics, and fraudulent systems that power Retro-Investment.com’s deceptive operation. If you’re considering investing through this platform, or have already been contacted by its agents, read this carefully before taking any further steps.

The Professional Façade: Designed to Build False Trust

Scam websites like Retro-Investment.com thrive on appearances. Their homepage is polished, often featuring buzzwords like:

-

“AI-powered trading”

-

“Guaranteed returns”

-

“Expert account managers”

-

“Regulated and secure platform”

They may even display fabricated statistics—number of investors, total profits generated, active traders online—all intended to build credibility fast.

Every aspect of Retro-Investment.com’s presentation is engineered to gain the user’s trust before they start asking questions. The site claims global reach, round-the-clock customer service, and lightning-fast transactions. But the real goal is to create urgency and push users toward making an initial deposit.

No Transparency or Verifiable Company Information

The clearest sign of a scam is the lack of verifiable information about who’s running the operation. Retro-Investment.com is guilty of this in multiple ways:

-

No physical address that matches a legitimate business registry

-

No listed leadership team or contact person

-

No legal company registration number that can be validated

-

No association with any known financial authority

Scammers often hide behind offshore jurisdictions or fake legal entities. In this case, Retro-Investment.com may list a company name or address, but attempts to confirm these lead nowhere. It’s smoke and mirrors designed to make the platform seem official.

Fake Regulation Claims

One of the most dangerous tactics used by Retro-Investment.com is falsely claiming to be regulated. They might display logos of real regulatory agencies (like FCA, CySEC, or FINMA) to give the illusion of legitimacy. But these are not backed by actual licenses.

In legitimate investing, regulation is everything. It protects clients, ensures transparent business practices, and allows victims legal recourse. Without it, investors are placing their money in the hands of untraceable and unaccountable operators.

Retro-Investment.com operates without any real oversight. This means your funds are at the mercy of whoever controls the backend—and they have no intention of playing fair.

The Hook: Promises of Easy Money

Retro-Investment.com’s core strategy is to lure users in with outrageous but seductive promises. They often market through:

-

Sponsored social media posts

-

Fake investment testimonials

-

Emails offering high-yield returns

-

Targeted ads on search engines

Once on the site, users are bombarded with persuasive messaging:

“Earn up to 10% weekly ROI with zero effort.”

“Our investors double their income in just 30 days.”

“No experience needed—our experts do the work for you.”

These claims are not just misleading—they are mathematically impossible in any regulated financial market. No legitimate broker or investment firm can promise consistent, guaranteed high returns.

Aggressive Account Managers and Psychological Pressure

After creating an account, users are contacted by “financial advisors” or “investment experts.” These are not real advisors but trained sales agents skilled in psychological manipulation. They build rapport, speak confidently about markets, and pressure users to deposit funds quickly.

The initial deposit is often set at a low threshold—like $250—to minimize resistance. Once you invest, they’ll continue pressuring you to “upgrade” or “top up” for better returns or higher-tier benefits.

Some common manipulative tactics include:

-

Flattery: “You’re exactly the kind of client we love working with.”

-

Urgency: “This opportunity is only available today.”

-

Fear of missing out (FOMO): “Other clients are already profiting—don’t get left behind.”

-

Guilt-tripping: “We’ve spent time planning your strategy; don’t back out now.”

Their goal is to make you feel obligated to invest more. Once you comply, they move in for larger sums.

The Trading Platform: A Sophisticated Illusion

Retro-Investment.com boasts of having a state-of-the-art trading platform, complete with graphs, dashboards, and trade history logs. But this is not a real trading system—it’s a front.

The platform is programmed to simulate profitable trades to convince users that their investments are growing. Account balances are artificially inflated, and fake profits appear on dashboards. Users believe they are succeeding—until they try to withdraw.

This is a common scam method:

-

Fake profits create a sense of success.

-

Users are encouraged to reinvest or refer others.

-

The house of cards collapses when withdrawal attempts begin.

The Real Trap: Withdrawal Restrictions and Financial Blackmail

The biggest shock for most victims comes when they try to withdraw their money. Suddenly, things change:

-

Account is frozen due to ‘suspicious activity’.

-

Withdrawals require additional KYC documentation (which is ignored or rejected).

-

Surprise fees or taxes are demanded before money is released.

-

Minimum balance requirements appear out of nowhere.

Some users are told they must deposit more funds to “unlock” their profits—an outrageous request from a supposedly profitable investment. These are not policies—they’re psychological traps. Once users stop sending money, communication ceases.

Emails go unanswered. Chatbots fail. Phone lines disconnect.

By this point, users have already lost thousands. Some have reported being scammed out of life savings, retirement funds, or borrowed money. Retro-Investment.com does not intend to release any withdrawals—the entire system is designed to keep your money.

Fabricated Reviews and Social Proof

To build trust and drown out complaints, Retro-Investment.com populates its website and social media pages with fake testimonials. These include:

-

Photos of “happy investors” with copied text

-

Claims of huge profits in a short time

-

Fabricated user reviews copied from other platforms

-

Star ratings that don’t link to actual review sites

On external review websites, real victims tell a different story—warnings, horror stories, and loss reports. But these are often buried under a flood of fake praise, making it harder for newcomers to see the danger.

Vanishing Act and Rebranding

Once the platform becomes too exposed, Retro-Investment.com will disappear and resurface under a new domain. Scam operations like these often operate multiple clones at the same time.

The website will vanish overnight. Domains will expire or redirect to new sites. The same scam will continue under different branding—same playbook, same team, different name.

This tactic ensures continuity and helps them evade law enforcement and online warnings.

Conclusion: A Platform Built on Lies

Retro-Investment.com is a well-orchestrated investment scam posing as a legitimate trading platform. From the fake dashboard to aggressive sales agents, false regulation, and fraudulent reviews, every part of the platform is built to exploit trust and steal funds.

Key Takeaways:

-

Retro-Investment.com has no verified regulation or legal standing.

-

It uses fake trading dashboards to show false profits.

-

Withdrawals are blocked through lies, delays, and extortion.

-

Victims are emotionally manipulated and often pressured into repeated deposits.

-

The platform will disappear or rebrand once exposed.

Stay alert. Stay skeptical. And never invest with any platform that lacks transparency, regulation, or verifiable history.

-

Report Retro-Investment.com and Recover Your Funds

If you have fallen victim to Retro-Investment.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Retro-Investment.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.