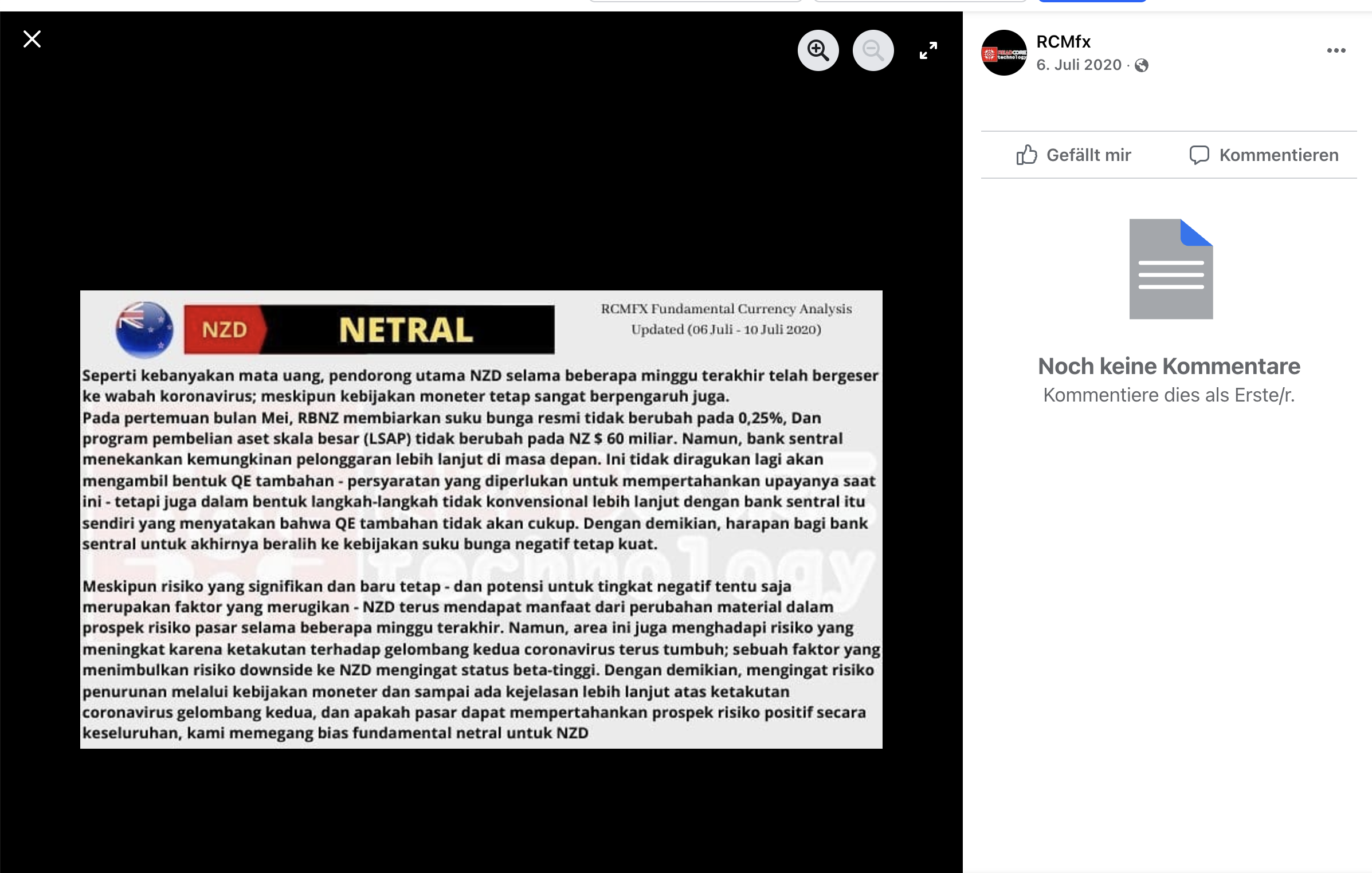

RCMFX.com Scam Review:Deceptive Tactics of This Fake Broker

When online trading platforms promise quick returns, advanced tools, and dedicated account managers, they can be tempting—especially for newcomers. Unfortunately, many of these platforms are elaborate traps. RCMFX.com is one such platform, presenting itself as a professional forex, CFD, and crypto broker but operating as a sophisticated scam. In this approximately 1,300‑word review, we’ll dissect how RCMFX.com tricks users, manufactures profits, obstructs withdrawals, and thrives through psychological manipulation.

1. A Trustworthy Front: Professional Design and Bold Promises

The homepage of RCMFX.com features polished design, high-resolution imagery, performance claims, and mentions of regulation in offshore jurisdictions. It highlights:

-

Tight spreads and competitive leverage

-

Access to Forex, indices, commodities, cryptocurrencies

-

Real-time analytics, trading education, and market reports

-

Personal account managers and “VIP support”

-

“Fast and guaranteed withdrawals”

Such messaging is crafted to build trust quickly—especially appealing to traders without deep experience. Testimonials and positive reviews add to the façade. But this polished presentation hides a malicious underpinning: RCMFX is designed to extract money, not enable trading success.

2. Frictionless Onboarding: The Beginning of the Scam

RCMFX offers swift sign-up, minimal identity verification, and low minimum deposits (often under $250). These convenience features are deliberate—they lower users’ guard. Once funds are deposited using credit cards, bank transfers, or crypto, the user is promptly contacted by a “personal account manager.” This individual builds an emotional connection, offers trading strategies, and encourages larger deposits with promises of enhanced returns, exclusive tools, or status upgrades. This tactic is grooming, not guidance.

3. Fabricated Gains: Simulated Trading to Hook Investors

Initially, users see their balance climbing—sometimes rapidly. Trades appear successful, equity curves rise, and dashboards show impressive profits. However, this system is not connected to real markets. It’s a controlled environment where all trades are simulated and prices can be manipulated by the platform. This staged success psychologically hooks users, convincing them to invest more heavily—sometimes through savings, loans, or credit.

When deposits cross a certain threshold, the tide shifts. Wins vanish. Trades start failing. Market conditions inexplicably reverse. Before users realize what’s happening, the illusion unravels and deposits have disappeared.

4. Withdrawal Blockades: The Turning Point

The scam becomes undeniable at the withdrawal stage:

-

Users are suddenly asked for more documentation—sometimes excessively

-

They face vague compliance or AML review delays

-

Unexpected charges, “unlock fees,” or “taxes” are demanded

-

Bonus clauses or trading volume minimums are revealed only after deposits

-

Customer support becomes evasive, chats disappear, and accounts may be suspended

Despite depositing what feels like legitimate funds, users discover full access to their capital was never available. The site stalls or cancels withdrawal requests without paying out deposit or profit.

5. Bonus Lures: Incentives That Trap Users

RCMFX uses deposit bonuses to deepen commitment. Offers of 30%, 50%, or even 100% match appear generous—but come with hidden terms. Typically, the user must fulfill enormous trading volume requirements before any withdrawal is allowed. These terms are often buried deep in fine print or revealed only after acceptance. If you don’t meet them, the platform claims breach of contract and refuses payout. The bonus system turns into a contractual cage—protecting the scam’s operators.

6. Sham Regulation and Fake Licensing Claims

RCMFX.com tends to claim registration in remote offshore jurisdictions like Saint Vincent and the Grenadines, Belize, or Dominica—locations notorious for minimal oversight. It may display license numbers or logos to suggest legitimacy. But actual verification reveals no meaningful regulatory relationship. Real regulation requires audited financials, segregated client funds, regular reporting, and client-protection mechanisms. With RCMFX, no such safeguards exist—making the platform legally non-existent in any trusted jurisdiction.

7. Customer Service: Responsive Until You Ask to Withdraw

During deposit and early trading, support is highly responsive: account managers schedule video calls, send tutorials, and push for upsells. But as soon as a user requests a withdrawal or appears skeptical, support slows down and disappears. Users report their chat access vanishes, emails bounce back, and phone numbers go unanswered. Some are even locked out of accounts completely after asking to withdraw. This pattern of vanishing communication following disputes is typical of scam brokers.

8. Employing Psychological Manipulation

RCMFX relies on psychological pressure to maintain control:

-

Flattery: praising users’ “talent” to keep them invested

-

Urgency: “Limited time bonus” or “VIP spots closing soon”

-

Isolation: discouraging sharing trading activity or opinions with others

-

Fear/Blame: implying withdrawals fail due to user error or violation of unclear rules

This emotional manipulation keeps victims enmeshed and discouraged from raising concerns or seeking help.

9. Scam Rebranding: Recycling Fraudulent Operations

Scam platforms rarely disappear—they rebrand. Once RCMFX.com accumulates sufficient complaints or is flagged, the operators often shut it down and launch a new domain with minor tweaks. Core structures like interfaces, scripts, customer support tactics, and affiliate networks remain unchanged. This makes it hard for victims to trace or warn others, while the fraudulent operation simply moves on to new victims.

10. Recognizing Red Flags: Trust Your Intuition

If you’ve talked to an account manager who reassures you with scripted statements, or your trades consistently show perfect timing before suddenly failing, those are red flags. Other warning signs include:

-

Profitable trades that reverse or vanish

-

Aggressive deposit pitches soon after onboarding

-

Hidden bonus or volume conditions only revealed later

-

Resistance or sudden silence during withdrawal attempts

-

Fake licensing claims or unverifiable regulation

-

Emotional pressure to invest more or keep quiet

Trust your gut: if a platform pushes you to deposit more without independent verification, walk away.

11. Systemic Patterns in Scam Platforms

RCMFX.com mirrors a familiar blueprint used across many fraudulent brokers:

-

Professional website and seeming legitimacy

-

Fast registration and deposit acceptance

-

Simulated trading with fabricated gains

-

Encouragement to deposit more via personal managers

-

Sudden losses, blocked withdrawals, or endless compliance delays

-

Vanishing support and potential site shutdown

-

Launching a new site under a fresh name

Understanding this pattern enables you to avoid not only RCMFX but countless others operating the same way.

12. Final Thoughts: Protect Yourself and Others

RCMFX.com is not a genuine broker—it is a deliberately designed fraud. The polished interface, early profits, and personal account support are just bait. Behind the scenes, there is no real trading, no market connectivity, no regulatory oversight, and no intention to return funds.

If you are considering RCMFX, reconsider. If you’re currently trading there, cease communication and disengage immediately. And if you’ve been victimized—or know someone who has—share accurate information and warn others.

Financial scams like RCMFX strip not only money, but trust. The best defense is awareness. Choose only verified, regulated brokers—with real licenses, clear terms, and transparent withdrawal processes. The safest platform is the one that lets you withdraw your funds swiftly—and without obstacles.

Report RCMFX.com and Recover Your Funds

If you have fallen victim to RCMFX.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like RCMFX.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.