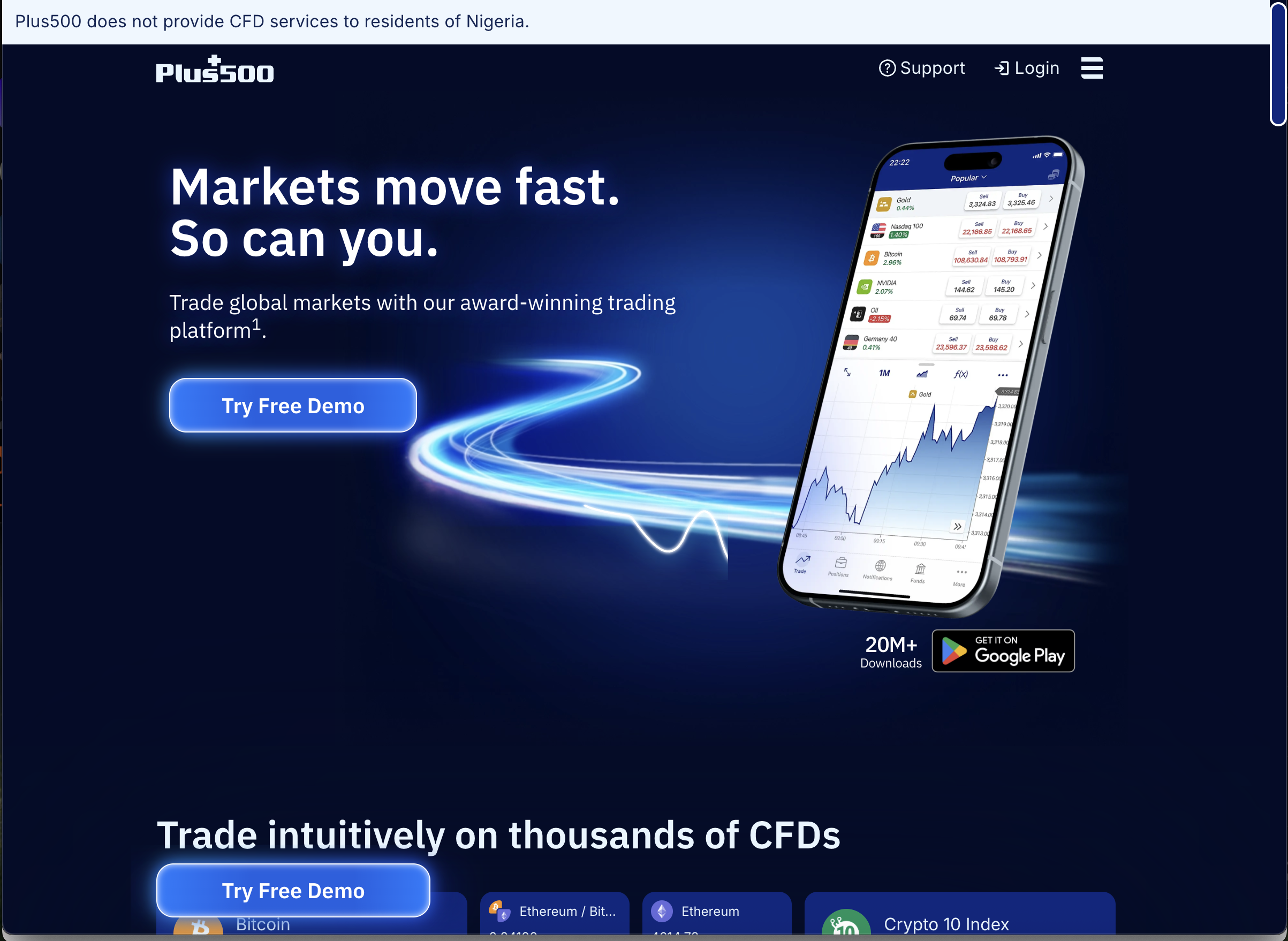

PLUS500 Review: A Fraudulent Platform

Misleading Marketing Tactics

One of the first red flags surrounding Plus500 is its aggressive and misleading marketing strategy. Potential clients are bombarded with ads showcasing individuals making substantial profits in record time, implying that trading with Plus500 is a quick path to financial freedom.

The reality could not be further from the truth. The overwhelming majority of traders on Plus500 lose money, largely due to the predatory trading environment created by the platform. Yet, this fact is buried in fine print, while flashy slogans and staged success stories take center stage. This kind of marketing preys heavily on inexperienced traders who are unaware of the real risks of leveraged trading and the questionable practices of the broker behind the scenes.

Complicated Withdrawal Process

One of the most common complaints from Plus500 users involves difficulty withdrawing funds. While depositing money into an account is instant and effortless, withdrawing earnings often becomes a nightmare. Traders have reported excessively long processing times, constant requests for additional documents, and arbitrary restrictions that seem designed to delay or outright prevent withdrawals.

In many cases, accounts are suddenly flagged for “suspicious activity” or “compliance checks” when traders attempt to withdraw significant amounts of money. These checks conveniently occur right after profitable trades, raising suspicion that they are simply tactics to prevent users from taking their money out of the platform.

For those lucky enough to finally receive their funds, they often find large portions eaten up by hidden fees and unexplained deductions. This practice alone has led many to conclude that Plus500 operates less like a legitimate broker and more like a scam disguised as one.

Manipulative Trading Environment

Another major issue with Plus500 lies in its trading conditions. Unlike transparent brokers who connect traders to real market prices, Plus500 operates as a market maker. This means they profit directly from traders’ losses. When you lose, they win—a conflict of interest that gives them every incentive to manipulate trades in their favor.

Reports from numerous traders suggest that Plus500 manipulates spreads, executes trades at unfavorable prices, and even freezes the platform during critical market movements. For example, when markets experience high volatility and profitable opportunities arise, the platform conveniently becomes sluggish or unresponsive, preventing users from executing trades. Once the volatility subsides, the system miraculously starts functioning again—by which time traders have already missed their chance.

Such practices make it nearly impossible for retail traders to succeed, ensuring that the majority of clients walk away with losses while Plus500 profits at their expense.

Hidden Fees and Costs

While Plus500 advertises itself as a “zero commission” broker, this claim is highly misleading. The platform makes its money through wide spreads, overnight financing charges, and a series of hidden fees that are not clearly disclosed upfront.

For instance, traders often discover that maintaining open positions overnight results in significant deductions from their balance, quickly eating away at any potential profits. Inactive accounts are also subject to monthly charges, meaning even those who stop trading are still penalized.

This lack of transparency around fees is another hallmark of a scam. Instead of providing traders with a clear breakdown of costs, Plus500 buries important details in lengthy terms and conditions documents that few clients read in detail.

Lack of Real Customer Support

In the event that traders run into problems—and many inevitably do—the customer support offered by Plus500 leaves much to be desired. Instead of live agents readily available to resolve urgent issues, clients often face automated responses, delayed replies, or generic messages that fail to address their concerns.

For traders dealing with issues such as frozen accounts, missing funds, or blocked withdrawals, this lack of accessible customer support only adds to the frustration. It becomes clear that Plus500 has little interest in genuinely helping its clients, further cementing its reputation as a fraudulent platform.

False Sense of Security

Another concerning aspect of Plus500 is the way it markets itself as “regulated.” While the company has attempted to register in various jurisdictions, the protections offered to traders are minimal at best. The regulations they tout are often tied to subsidiaries with limited oversight, meaning that real consumer protection is practically nonexistent.

This tactic gives new traders a false sense of security. They assume that because the broker claims to be licensed, their funds are safe and the platform is trustworthy. Unfortunately, this is far from the truth. In reality, Plus500 has repeatedly shown that its primary goal is to maximize profits through deceptive practices, regardless of the financial harm caused to its clients.

User Experiences and Warnings

Across numerous trading communities, forums, and review platforms, stories of dissatisfaction with Plus500 are alarmingly consistent. Traders share experiences of manipulated trades, delayed withdrawals, and disappearing funds.

The consistency of these complaints paints a clear picture: Plus500 is not a reliable trading platform. While a few individuals may report success stories, these are exceptions rather than the rule. For the vast majority, trading with Plus500 ends in disappointment and financial loss.

Conclusion – Why Plus500 Is a Scam

When evaluating whether a trading platform is legitimate or fraudulent, one must consider the overall pattern of behavior. In the case of Plus500, the evidence is overwhelming. The platform relies on misleading advertising, makes withdrawals unnecessarily difficult, manipulates trades, and hides fees in the fine print. Customer support is virtually nonexistent, and regulation is more of a marketing gimmick than a genuine safety net.

-

Report Plus500 and Recover Your Funds

If you have fallen victim to Plus500 and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Plus500 persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception