PerpetuumCoin.com Scam Review — Unmasking the Risky Crypto

The explosion of cryptocurrency adoption has brought with it a wave of new platforms promising fast profits, passive income, or “never-ending coin growth.” One name that has been drawing attention — and concern — is PerpetuumCoin.com. At first glance, it seems to offer a modern, high-tech avenue for investing in a new coin with perpetual growth features, staking, and rewards. But under the polished interface, many users report disturbing signs of deception, lack of transparency, and questionable financial behavior. In this review, we dig into what PerpetuumCoin.com claims, how it operates, and why so many believe it is a high-risk, likely fraudulent platform.

What PerpetuumCoin.com Claims

The platform’s marketing materials promote a number of enticing features:

-

Perpetual growth: The idea that holders of PerpetuumCoin will continuously earn yields, staking returns, or profit shares simply by holding the coin.

-

Low minimum investment: A promise that even small amounts can yield substantial rewards over time.

-

Reward programs and bonuses: Including referral programs, bonus tiers for higher investments, and loyalty rewards.

-

Secure infrastructure: Claims of high security, modern wallet support, encryption, privacy, and reliable customer support.

-

Passive income: A vision of placing investment once and letting the system generate ongoing returns without much further effort.

For many, these claims sound attractive, especially if someone is new to crypto and hopes for easy gains. The platform also leverages terms like “staking,” “smart contracts,” and “yield generation,” which are popular in legitimate crypto circles. That lends a veneer of credibility. However, several warning signals arise when one attempts to verify or use the platform under realistic conditions.

Key Red Flags Observed by Users & Researchers

A number of troubling patterns stand out in reports about PerpetuumCoin.com:

1. Lack of Verifiable Ownership and Team Information

A recurring complaint is that the people behind PerpetuumCoin.com are anonymous or hidden. The website does not clearly present the names of founders, advisors, or developers. No public presence on professional networks or verifiable credentials appear.

In cryptocurrency, many legitimate projects are transparent about their leadership, code contributions, white papers, GitHub repositories, or public audits. PerpetuumCoin.com often lacks evidence of technical audits, open-source code, or credible third-party reviews. That absence undermines trust.

2. Vague or Non-existent White Paper and Technical Details

While the platform may promote features like “staking rewards” or “smart contracts,” there is little evidence of a thorough technical specification. White papers, when present, are often vague, lacking in concrete mechanisms—such as how rewards are funded, how inflation or coin supply is managed, or how staking security is ensured.

When these documents exist, they are sometimes full of buzzwords and grand visions but little in the way of implementation clarity or risk disclosure. Legitimate crypto projects usually clearly explain coin economics: initial supply, total supply, emission schedules, reward formulas, and how governance or security is handled.

3. Unrealistic Yield Promises

PerpetuumCoin.com commonly claims high, steady yields for holders or investors—“earning daily rewards,” “perpetual passive income,” etc. Many user reports suggest that these yields far exceed what is realistic, especially without revealing where the profit comes from (mining, transaction fees, staking rewards from other sources, etc.).

When yields are fixed, high, and guaranteed without disclosure of risk or funding source, this is typically unsustainable. Many similar platforms begin by paying small yields to early participants (to build trust), then either reduce payouts, delay them, or collapse once enough funds are collected.

4. Aggressive Referral and Bonus Schemes

Another pattern is heavy emphasis on referral bonuses: encouraging users to recruit others, offering commissions, or “team commissions.” Users are often promised bonus rewards for bringing in additional investors. This structure suggests that part of the revenue model relies on new deposits rather than real underlying profit or utility.

Such bonus and referral layering often appears in schemes that mimic pyramid structure, where growth depends heavily on new investors rather than genuine adoption or service revenue.

5. Difficulty With Withdrawals and Verification Demands

One of the strongest signals of trouble comes in withdrawal behavior. Users report that after staking or investing, they see profits accruing, but when they try to withdraw either their original investment or the rewards, they encounter repeated delays, demands for extra documentation, “account verification,” or “maintenance fees” that were not disclosed upfront.

The demands often escalate: additional identity proofs, proof of residence, proof of source of funds, etc. While some verification is reasonable in financial or cryptocurrency platforms, when these requirements are unpredictable and imposed only at withdrawal time, that is suspect.

6. Hidden or Sudden Fee Structures

Many users are surprised by fees and charges that were not clearly communicated before they invested. Examples include “withdrawal fees,” “maintenance charges,” “staking lock-up penalties,” or “account upgrade fees.” Sometimes gains are taxed by the platform internally, with high spreads or unfavorable exchange rates.

These hidden fees reduce profitability and often serve to discourage or delay withdrawals, trapping funds longer within the platform.

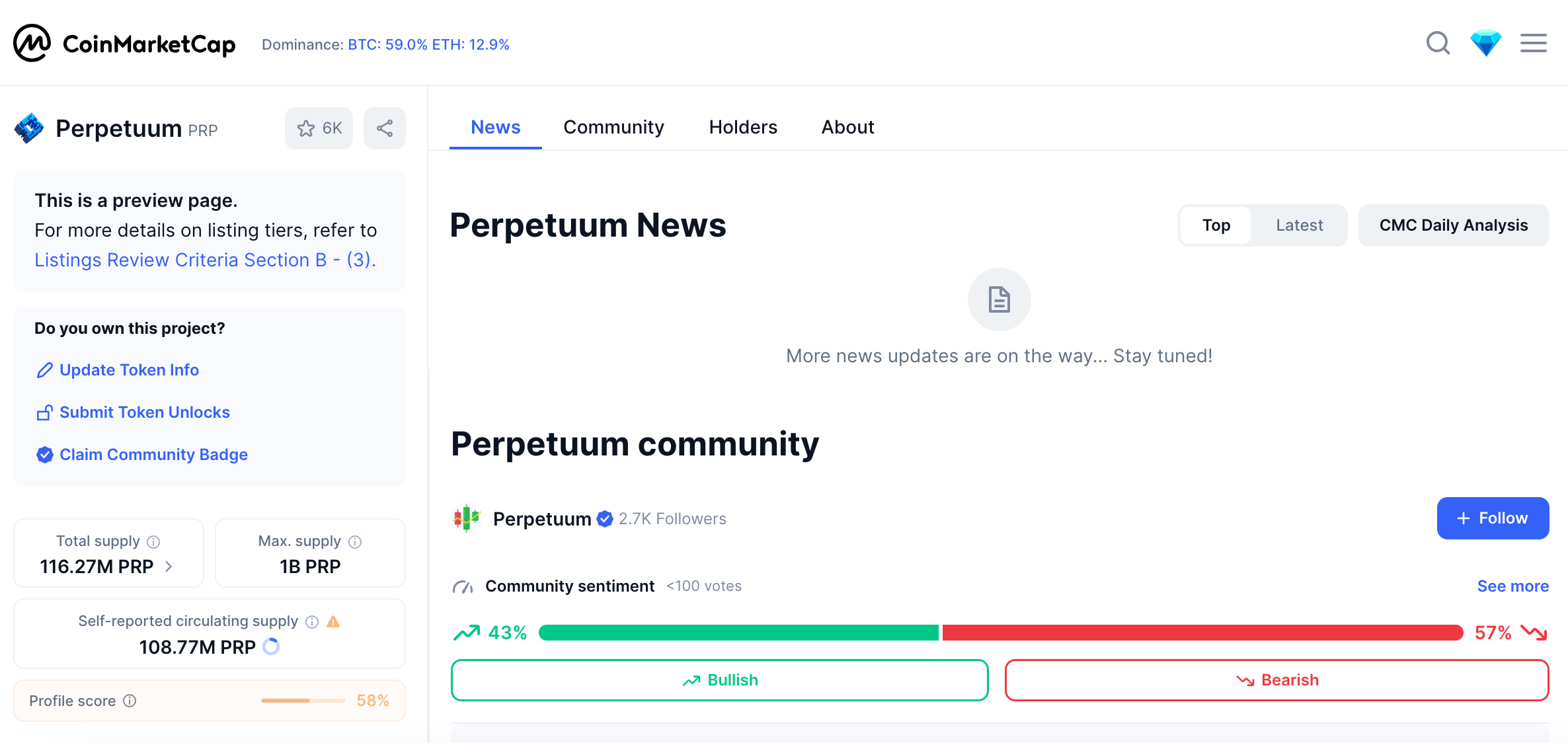

7. Opaque Coin Supply and Economics

PerpetuumCoin.com often does not clearly disclose how many coins exist, how many are allocated to the development team or early investors, whether there is inflation, or whether rewards dilute existing holders. Users frequently report that they cannot find verifiable data about supply cap, emission rate, or schedule.

Without transparent economics, it is difficult to assess whether a coin’s value proposition is sustainable. Projects that do not share this information are hiding something—likely risk.

8. Marketing Materials That Match Scam Patterns

PerpetuumCoin.com’s promotional content often leans heavily on emotionally appealing language: phrases like “never before,” “secure passive income,” “limited opportunity,” “special launch bonus.” Graphics show growth charts, shiny dashboards, success stories.

These marketing tactics exploit fear of missing out, desire for easy rewards, and trust in sleek design. Users often feel pressured to act quickly to “join the next big coin.”

What Users Typically Experience

Putting together the patterns above, here’s what many users report when they use PerpetuumCoin.com in practice:

-

After depositing, small amounts of rewards appear in their wallet/balance, building trust.

-

Encouraged to stake or lock coins for longer periods to get higher rewards or bonuses.

-

Referral commissions appear, motivating them to bring more people in.

-

When trying to withdraw larger sums or all of their stake + rewards, they find obstacles: verification, added fees, delays.

-

Customer support is responsive early on, but when withdrawal issues surface, replies are vague or disappear.

-

In some cases, the site becomes inaccessible, or the coin’s value is manipulated downward in the platform interface, making rewards appear smaller or impossible to transfer out.

Comparison with Typical Scam Models

The behavior of PerpetuumCoin.com aligns closely with established scam or fraudulent coin operations. Key similarities:

-

Initial small payouts + fake dashboards: Used to build trust and create psychological belief that the system works.

-

Referral/invite bonuses: To drive growth and collect more investments.

-

Withdrawal friction: Escalating conditions that block large payouts.

-

Lack of regulatory or legal compliance: No visible licensing, no oversight, no accountability.

-

Anonymous or hidden team: Avoids scrutiny.

These are classic traits of crypto-investment scams, especially those that promise “perpetual yield” without revealing how the yield is generated or how the platform sustains it.

Why Many Believe PerpetuumCoin.com Is a Scam

Given all the evidence and user reports, here are the reasons why many consider PerpetuumCoin.com to be a scam:

-

Impossible guarantees: Promises of perpetual, consistent income with small investment are fundamentally unrealistic in crypto. There’s always market risk, technical risk, volatility, and cost.

-

No accountability: With hidden ownership and no regulatory oversight or credible audit trail, there is no way to enforce claims or return funds.

-

Financial logic doesn’t add up: If yield is paid to holders, it must come from somewhere (fees, new investments, reserves). When those sources are not clearly disclosed, the yield becomes dependent on new inflows rather than intrinsic utility—this becomes unsustainable.

-

Recurring user complaints: The consistency of stories from different users about deposits being accepted, profits growing, but withdrawals being blocked or delayed is hard to dismiss as coincidence.

-

Delayed communication and vanishing support: The shift in behavior of customer support—from responsive to silent—is a red flag of an operator avoiding responsibility.

Potential “Legitimate” Aspects and Why They Don’t Offset the Risk

Some features of PerpetuumCoin.com may appear legitimate at first glance:

-

Clean website design and modern UI/UX.

-

Use of crypto jargon (staking, smart contract, yield, blockchain) which gives an appearance of being technical.

-

Small early rewards, which some users do see, which builds trust.

However, these do not offset the risk because:

-

Design can be copied or professionally built without substance.

-

Technical terms used without underlying transparent mechanism is misleading.

-

Early rewards are part of the luring strategy; they do not prove sustainability or honest operations over time.

What You Should Ask Before Engaging (as Precaution)

Even though this review strongly leans toward denouncing PerpetuumCoin.com as risky, here are critical questions anyone considering participation should ask (these help reveal risk):

-

Who exactly is behind the project? Are there names, verifiable credentials, professional profiles, code repositories?

-

Is there a public, auditable specification for how rewards/staking works, how yield is financed, how coin supply is controlled?

-

How transparent are withdrawal terms, fees, lock-in periods, penalties?

-

Are there published audits or independent reviews of the smart contract or financial operations?

-

What is the coinomics: total supply, inflation schedule, allocation to team, public, early investors?

-

What happens if the platform changes owners, if the site goes offline, or if market conditions worsen?

If answers to these are vague or evasive, that is a warning sign.

Final Verdict

After examining the claims, user reports, and operational behavior associated with PerpetuumCoin.com, the platform exhibits many of the classic hallmarks of a scam. Its promises of perpetual returns, anonymous leadership, withdrawal complications, unclear rewards funding, and heavy reliance on referral schemes all point to a structure built more to extract funds than to generate legitimate profit.

While some users may receive small gains or see their balances increasing temporarily, the underlying system appears unsustainable and fragile. Once a user tries to take out meaningful funds, the obstacles multiply.

For anyone interested in cryptocurrency, this kind of platform represents a significant risk, not an opportunity. Understanding how deception works in these environments is critical to avoiding loss. Always demand transparency, realistic promises, and verifiable proof of operations before trusting any such platform.

-

Report PerpetuumCoin.com and Recover Your Funds

If you have fallen victim to PerpetuumCoin.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like PerpetuumCoin.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.