PayBis.com Review: The Deceptive Crypto Exchange

The cryptocurrency industry has given rise to countless platforms that claim to make trading, exchanging, and investing easier for users around the world. While many are legitimate, a growing number are nothing more than elaborate scams designed to siphon money from unsuspecting traders. One platform that has generated widespread suspicion is PayBis.com.

At first glance, PayBis.com presents itself as a fast, easy, and trustworthy crypto exchange where users can buy Bitcoin and other digital assets. However, beneath this polished exterior lies a troubling reality. The platform exhibits numerous red flags that align with typical scam operations. In this blog, we’ll take a deep dive into PayBis.com, examining its promises, tactics, and user complaints to uncover the truth about its operations.

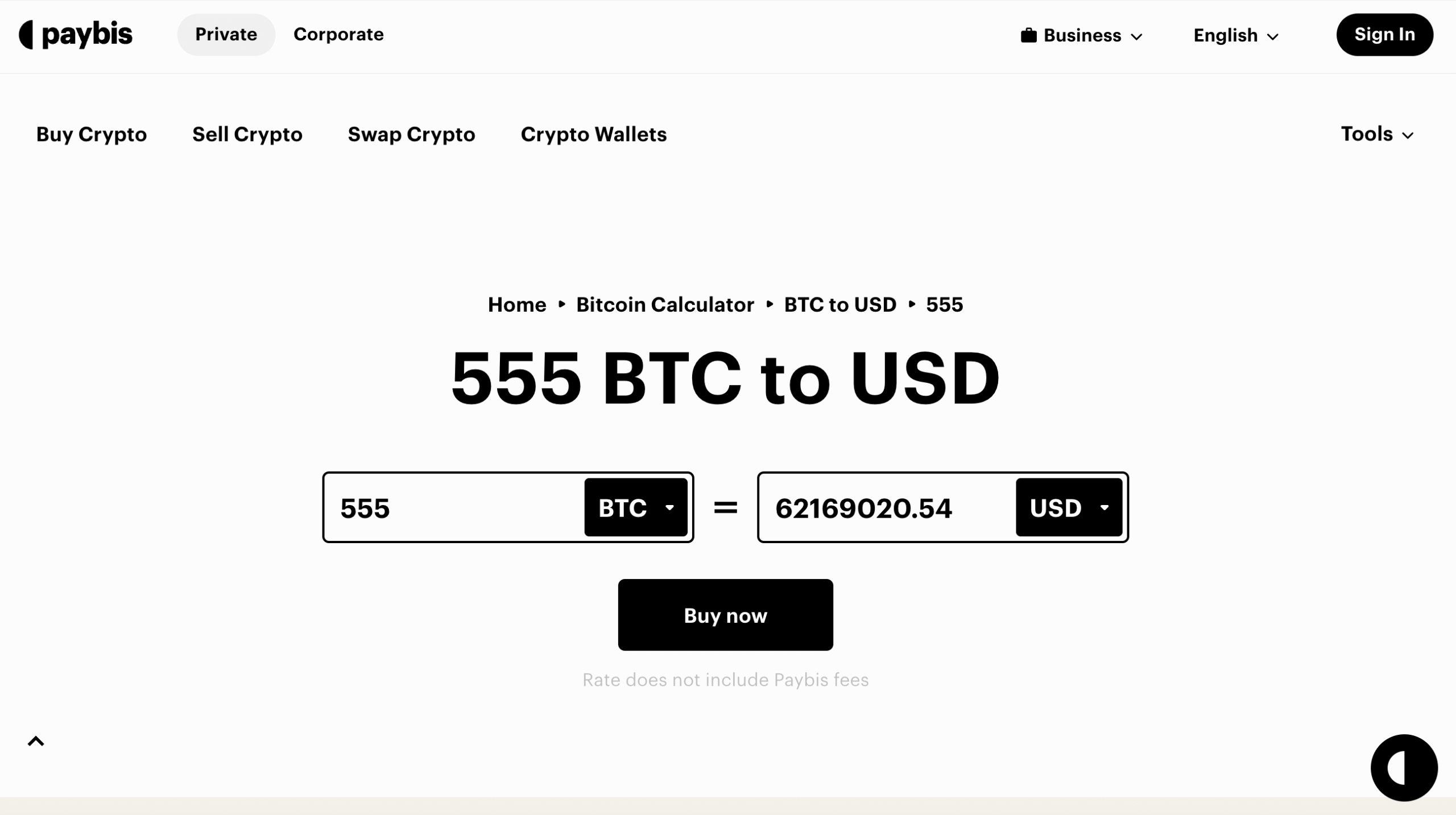

The Attractive Surface of PayBis.com

PayBis.com’s website looks sleek and professional. It promotes itself as a fast and reliable exchange that supports multiple payment methods, from bank transfers to credit cards. It emphasizes speed, user-friendliness, and security, giving the impression that it is a legitimate business.

But scams thrive on appearances. Fraudulent platforms often invest heavily in flashy websites and marketing slogans to win the trust of inexperienced investors. The modern interface and confident claims are designed to reassure users while distracting them from the lack of real substance behind the platform.

Lack of Regulatory Oversight

One of the clearest indicators that PayBis.com is not what it seems is its lack of regulatory accountability. Genuine exchanges are usually licensed and registered with financial authorities to ensure compliance with anti-money laundering (AML) and know-your-customer (KYC) requirements.

PayBis.com, however, provides no verifiable proof of licensing. Its website is filled with vague references to compliance and transparency, but there are no official certifications, no registration details, and no oversight from legitimate financial watchdogs. This lack of regulation allows the operators to act without consequences, keeping investors vulnerable.

Too-Good-To-Be-True Promises

PayBis.com markets itself as a platform that makes crypto purchases incredibly fast, with promises of instant transactions and unbeatable rates. It also boasts about supporting a wide range of payment methods, claiming to make it easier than ever for anyone to buy Bitcoin.

However, such promises are misleading. Instant transactions across multiple payment methods are nearly impossible without delays, verifications, or fees. By overpromising results, PayBis.com is setting unrealistic expectations—an intentional strategy to lure in unsuspecting traders eager to jump into crypto without questioning the platform’s integrity.

Withdrawal Issues – A Common Complaint

Perhaps the most alarming red flag associated with PayBis.com is the difficulty users face when trying to withdraw funds. While depositing money onto the platform is often smooth and easy, withdrawing it becomes another story.

Victims frequently report:

-

Blocked withdrawals: Requests are delayed indefinitely without explanation.

-

Endless verifications: Users are asked for repeated documents that never lead to approval.

-

Excessive fees: Large, hidden charges suddenly appear during the withdrawal process.

-

Frozen accounts: Some traders find their accounts abruptly suspended once they request withdrawals.

This tactic is standard among scams. By making deposits easy but withdrawals nearly impossible, the platform ensures funds remain trapped, maximizing profits for the operators.

Fake Partnerships and False Legitimacy

Another troubling sign is PayBis.com’s attempts to align itself with major payment networks and financial institutions. It highlights logos of well-known companies and suggests it works closely with leading blockchain organizations.

But upon closer inspection, there is no verifiable evidence of these partnerships. No official announcements from the supposed partners exist, and no proof ties PayBis.com to legitimate institutions. This reliance on name-dropping is a classic scam technique, designed to trick users into believing the platform is more trustworthy than it actually is.

Manipulative Marketing Tactics

PayBis.com makes heavy use of manipulative marketing strategies to draw in victims. Some of the most common include:

-

Scarcity and urgency tactics – Claiming that special rates or offers are only available for a limited time, pushing users to act quickly.

-

Referral schemes – Encouraging users to bring in friends and family with the promise of bonuses, creating a pyramid-like effect.

-

Buzzwords and jargon – Overloading the site with technical crypto terminology to confuse new traders into assuming legitimacy.

-

Emphasis on speed and ease – Promising instant results to attract people who want fast profits.

These strategies are designed to exploit the psychology of inexperienced investors, convincing them to deposit funds without conducting proper due diligence.

User Complaints Paint a Clear Picture

User experiences tell the true story behind PayBis.com. Many individuals have reported losing money due to the platform’s deceptive tactics. Some common complaints include:

-

“My money disappeared after depositing. Support ignored me.”

-

“They asked for more and more documents but never released my withdrawal.”

-

“They pressured me into depositing more, promising VIP services that never existed.”

-

“The fees they charged were outrageous, and I never saw my crypto delivered.”

When dozens of users share similar experiences, it is no longer a coincidence but rather a consistent pattern of fraud.

How PayBis.com Fits the Scam Model

When we analyze PayBis.com against the typical framework of crypto scams, the similarities are undeniable:

-

Polished appearance to lure in victims.

-

False promises of instant transactions and unbeatable convenience.

-

Lack of regulation or transparency about its operations.

-

Withdrawal barriers designed to prevent users from recovering funds.

-

Manipulative marketing and referral schemes.

-

Disappearing support once deposits are made.

This combination mirrors countless other fraudulent platforms that have operated in the crypto space before disappearing with investor funds.

Why Traders Must Avoid PayBis.com

In the world of cryptocurrency, trust and transparency are essential. Users are entrusting platforms with their money, and any signs of dishonesty should immediately disqualify a service. PayBis.com’s history of withdrawal issues, fake partnerships, and lack of regulation makes it abundantly clear that this is not a safe platform.

The risks of using PayBis.com far outweigh any potential convenience it claims to offer. Traders should instead look toward established platforms with verifiable licenses, transparent practices, and strong reputations.

The Bigger Picture – A Cautionary Tale

PayBis.com serves as a reminder of the dangers lurking in the crypto space. As digital assets continue to rise in popularity, scammers are becoming more sophisticated in disguising their fraudulent platforms. They prey on the excitement of new investors, using polished websites and bold claims to hide their true intentions.

For traders, the lesson is simple: always conduct due diligence. Look for proof of regulation, examine user reviews critically, and never trust platforms that promise instant profits without risk.

Final Verdict – PayBis.com Is a Scam

Despite its slick marketing and polished appearance, PayBis.com is nothing more than a fraudulent crypto exchange. Its lack of regulation, fabricated partnerships, manipulative tactics, and consistent withdrawal issues expose it as a scam designed to deceive and defraud investors.

Report PayBis.com and Recover Your Funds

If you have fallen victim to PayBis.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like PayBis.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.

Author