OptionAlpha.com Review: The Risks Behind the Platform

When it comes to online trading platforms, there is always a fine line between genuine opportunity and elaborate deception. The financial industry, particularly online trading, is rife with platforms that promise the world but deliver little in return. One name that has repeatedly raised eyebrows is OptionAlpha.com. Many unsuspecting traders are lured in with promises of smart automation, “professional-grade” tools, and advanced options trading strategies. Yet, behind the glossy marketing, countless red flags reveal OptionAlpha.com as a questionable and potentially fraudulent platform.

This review explores the truth about OptionAlpha.com, dissecting its strategies, misleading claims, and user complaints. If you are considering trading with this platform, this detailed breakdown may save you from potential financial loss.

The Lure of OptionAlpha.com

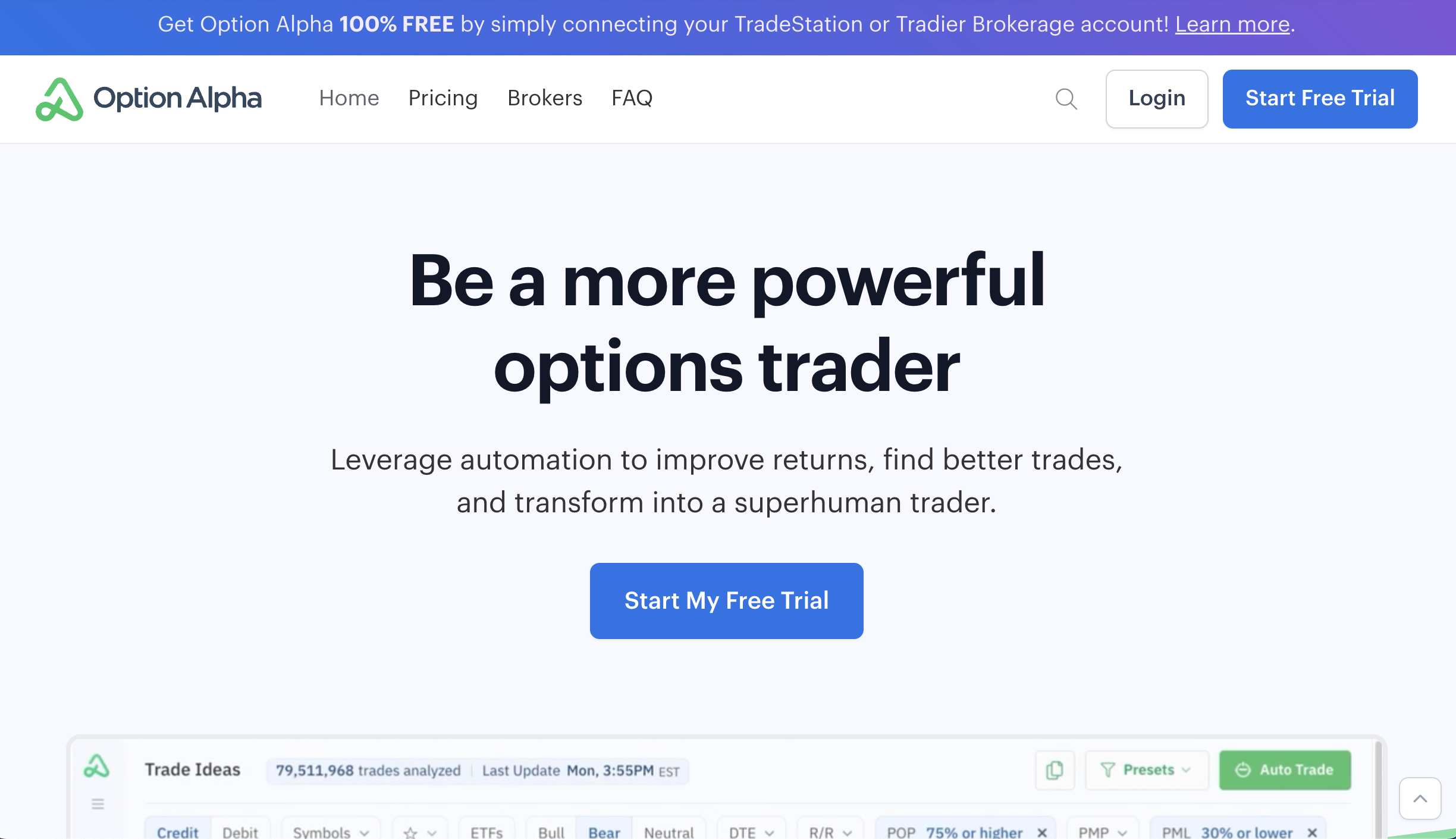

OptionAlpha.com presents itself as an innovative and technology-driven trading platform. Its main selling point revolves around automated trading, back-testing strategies, and algorithmic execution. On the surface, this seems like a modern solution for traders looking to harness the power of AI and automation.

The marketing emphasizes three things:

-

Automation without coding – giving traders “professional” bots.

-

Backtesting features – to prove strategies work before deploying them.

-

Community-driven insights – supposedly connecting traders to strategies that deliver high returns.

These offerings sound impressive, but in reality, they mask a host of deeper issues.

Red Flag #1 – The “Too Good to Be True” Promises

One of the biggest warning signs is the exaggerated claims OptionAlpha.com makes. The platform suggests that users can easily achieve consistent returns using automated bots without any coding knowledge.

Seasoned traders know that no bot or strategy can guarantee consistent profit in a volatile market. Even institutional investors with advanced infrastructure and years of experience cannot sustain guaranteed returns. Yet OptionAlpha.com markets itself as a one-stop solution for effortless profit-making.

This unrealistic positioning is the first major indicator that the platform may not be as trustworthy as it appears.

Red Flag #2 – Lack of Transparent Regulation

A genuine trading platform should always be backed by verifiable regulation. OptionAlpha.com, however, fails to clearly provide any regulatory framework under which it operates. While it mentions partnerships and “global reach,” there is no evidence of oversight by a recognized financial authority.

This lack of regulation is concerning because it means:

-

Users have no protection if the platform shuts down overnight.

-

Disputes cannot be resolved through a legitimate governing body.

-

Deposited funds are essentially at the mercy of the platform operators.

Without regulatory safeguards, OptionAlpha.com leaves traders exposed to high risks of fraud and manipulation.

Red Flag #3 – Misleading Marketing Around Education

OptionAlpha.com heavily promotes its so-called educational tools, marketing them as world-class resources that can help beginners become professional traders. However, much of the content is repetitive, surface-level, and geared toward keeping traders engaged with the platform rather than truly educating them.

This strategy serves two purposes:

-

Retention of traders – by convincing them they are learning valuable skills.

-

Encouragement to invest more – by creating the illusion of competence and control.

In reality, many users report that the “education” serves as little more than a funnel to push them toward riskier strategies and higher deposits.

Red Flag #4 – Reports of Withdrawal Issues

One of the most common complaints tied to OptionAlpha.com involves withdrawals. While deposits are quick and seamless, many users encounter frustrating delays or outright denials when attempting to withdraw profits.

Some of the most reported withdrawal tactics include:

-

Endless verification requests – repeated demands for documents.

-

Hidden fees – deductions from withdrawals that were never disclosed upfront.

-

Account freezes – suspensions of accounts conveniently timed when users request to withdraw large sums.

This is a hallmark of scam platforms: easy deposits but difficult withdrawals.

Red Flag #5 – Inflated Reviews and Paid Testimonials

OptionAlpha.com markets itself heavily with glowing reviews and testimonials. However, many of these appear to be scripted or paid promotions. A closer look reveals striking similarities in phrasing and generic praise that lacks depth or specifics.

Real users have expressed frustration across online forums, highlighting losses, delayed withdrawals, and misleading promises. Yet, these negative experiences are drowned out by an overwhelming flood of overly positive “reviews.” This tactic is designed to mislead new traders into believing OptionAlpha.com is widely trusted.

The Psychology Behind the Scam

Like many fraudulent platforms, OptionAlpha.com uses psychological tactics to trap traders:

-

Authority Bias – By presenting itself as advanced, tech-driven, and “professional,” the platform makes users assume it must be trustworthy.

-

Fear of Missing Out (FOMO) – Marketing emphasizes how automation is the “future” of trading, urging users to join before they fall behind.

-

Ease of Use – By promising automation without coding, it attracts beginners who might otherwise avoid complex platforms.

-

Illusion of Control – Educational materials make traders feel empowered, but in reality, the platform controls everything behind the scenes.

These strategies keep users depositing more money despite mounting warning signs.

Comparison With Legitimate Brokers

To put OptionAlpha.com’s flaws in context, consider how real, regulated brokers operate:

-

Transparency – Reputable brokers clearly disclose fees, spreads, and regulatory details.

-

Withdrawal Reliability – Legitimate platforms process withdrawals promptly and fairly.

-

Customer Protection – Regulation ensures compensation schemes exist in case of insolvency.

-

Education – Authentic education is unbiased, focusing on skill-building rather than funneling deposits.

OptionAlpha.com fails in nearly all these categories, proving it does not operate with the same integrity as licensed brokers.

Why Traders Fall Victim

Despite the many red flags, traders still fall victim to OptionAlpha.com because the platform:

-

Appeals to beginners who want quick results.

-

Offers an illusion of sophistication with automation and algorithms.

-

Buries negative reviews under floods of promotional content.

-

Makes deposits seamless while deliberately complicating withdrawals.

These tactics create a powerful trap for anyone eager to profit in online trading.

Conclusion – The Risk of OptionAlpha.com

After analyzing its operations, marketing, and user complaints, it is clear that OptionAlpha.com shows all the hallmarks of a scam platform. From exaggerated promises and lack of regulation to withdrawal issues and manipulative educational content, the evidence strongly suggests that this platform is not built for trader success but for extracting funds from unsuspecting users.

Report OptionAlpha.com and Recover Your Funds

If you have fallen victim to OptionAlpha.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like OptionAlpha.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.