OptimizerTradeOption.com Scam Review: Scam or Legit

In the ever-growing sea of online trading platforms, discerning the genuine from the fraudulent has become more difficult than ever. While some brokers and platforms are legitimate, others are designed purely to siphon off deposits from unsuspecting users. One such platform that has drawn suspicion is optimizetradeoption.com (also sometimes stylized as “Optimizer Trade Option”). In this blog, we dissect the red flags, user reports, and warning signs that strongly suggest this platform operates as a scam. Our goal: to arm readers with knowledge and skepticism rather than false hope.

⚠️ Note: This is an investigative review based on available reports, user complaints, and online risk indicators. It does not constitute legal or financial advice—but it does aim to warn potential investors of serious danger signals.

1. The Promise: Too Good to Be True

Many scam trading platforms begin—predictably—with exaggerated promises. Users report that optimizetradeoption.com markets itself as offering:

-

Exceptionally high returns in short periods (e.g., “earn 10% per day” or “double your account in a week”)

-

Access to exclusive trading signals, AI algorithms, or “secret strategies” that guarantee profit

-

Low or zero risk, with “capital protection”

-

Fast withdrawals once certain volume or deposit thresholds are met

These promises are classic lure tactics. In the real financial markets, guarantees of high returns with low risk do not exist. Whenever a platform claims you can’t lose, alarm bells should ring.

Scams often use psychological pressure: countdown timers, limited slots, or “exclusive invites” to push users into hurried decisions. Reports about OptimizerTradeOption suggest it may use such manipulative tactics.

2. Shrouded Identity & Anonymity

One of the first major red flags of a scam is hiding behind anonymity. Investigations into domains resembling “optimizetradeoption,” “optimizetradepro,” or similar names reveal:

-

Very low trust scores in domain-checking tools, indicating that the site is new, untrusted, or associated with risky behavior.

-

WHOIS or domain registration details are often hidden or anonymized (using privacy protection services).

-

The platform claims to be a global financial service or broker, but does not provide verifiable company registration, physical address, or regulated status.

Domain-based risk assessments for related domains (e.g. “optimizetradepro.ltd”) show very low scores — a strong indicator that these types of sites are not to be trusted. (In one case, a site scored “very low” trust in Scamadviser because of hidden ownership and negative signals.)

Similarly, a warning from a financial regulator in another case pointed out that a malicious site was falsely using a registered address of a legitimate Maltese firm to appear credible. (This kind of address spoofing is common in fake “investment firms.”)

When a platform fails to disclose basic facts about who runs it, where it is regulated, or who you can legally hold accountable—that is a huge red flag.

3. Lack of Regulatory Oversight

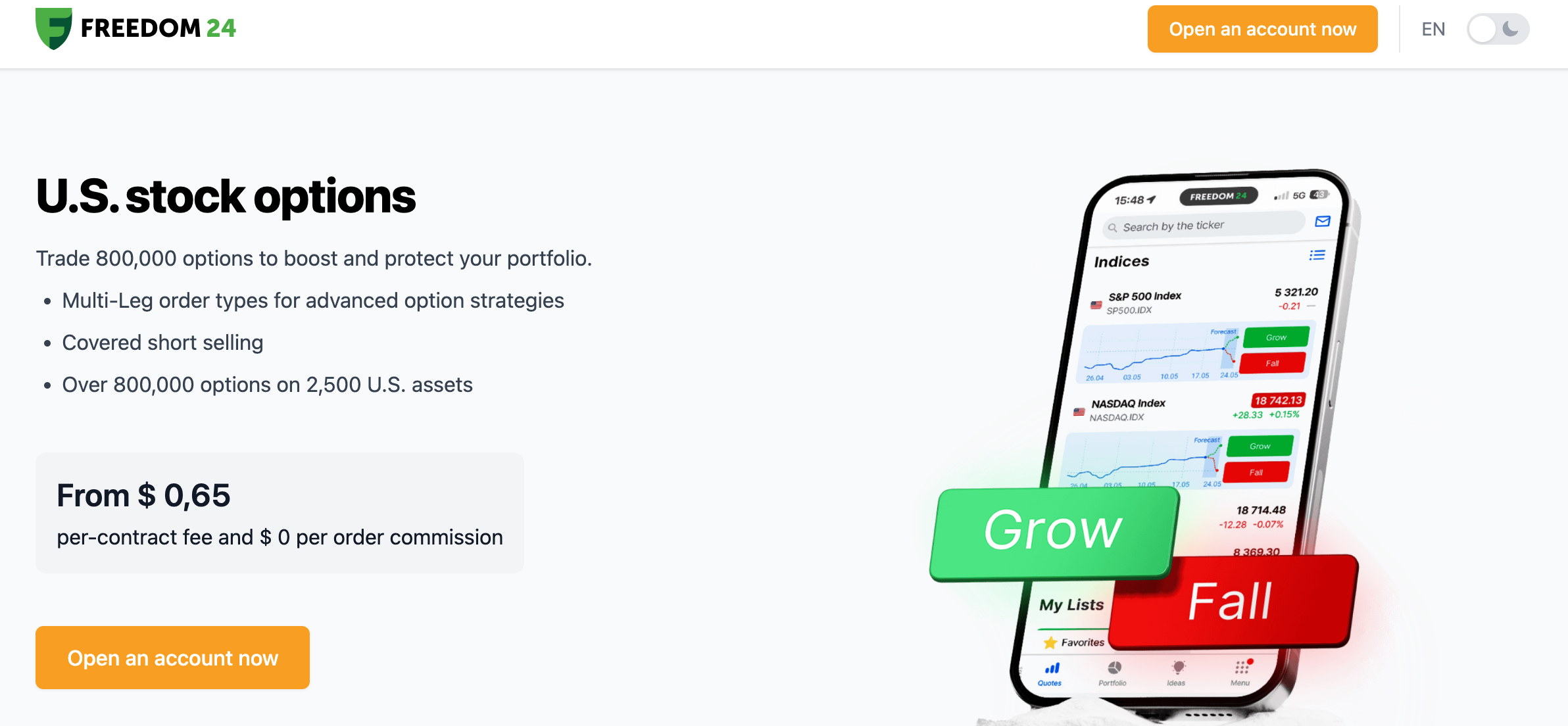

A legitimate broker or investment platform usually is licensed or regulated by a financial authority (e.g. SEC, FCA, CySEC, ASIC, etc.), and lists those credentials transparently on its website. In the case of optimizetradeoption.com, users and investigation forums report:

-

No credible regulatory licenses or registrations listed

-

Claims of affiliation or licensing are vague, unverifiable, or appear forged

-

Some aggressive marketing claims about “global regulatory compliance” that have no backing

Because it is not regulated by recognized authorities, users have virtually no formal recourse if funds go missing. Fraudulent platforms rely heavily on the inability of victims to trace or reclaim their money through regulatory channels.

4. User Complaints & Withdrawal Failures

The strongest evidence often comes from actual users. Online communities, forum threads, and review portals (Reddit, Trustpilot, trading forums) reveal strikingly consistent patterns:

-

Many users say they deposited money, saw their account grow (on paper), but then were blocked when they tried to withdraw profits.

-

Withdrawals are delayed indefinitely, or “pending” without explanation.

-

The platform demands that users pay additional fees or reach a higher trading volume to unlock withdrawals.

-

Some users report being locked out of their accounts entirely after making requests to withdraw.

-

Communication becomes unresponsive—email support, live chat, or account managers go silent.

-

Complaints of changing rules or terms retroactively, to deny payout eligibility.

One Reddit thread described a user being lured into a trading app under the pretense of “easy money,” only to be asked to pay for levels or unlocks, and then lost access. The user said:

“The goal of this scam is to get people to download the app for easy money and then encourage them to pay to get to the next level.”

“It’s a bait and switch scam! … they explain why you have to put in more money to get more money.”

These patterns are textbook features of scam or Ponzi-like schemes.

5. Volume Requirements, Hidden Fees, or Deposit Upgrades

A common tactic among fraudulent trading platforms is to trap victims via artificial hurdles:

-

They enforce a minimum trade volume before a withdrawal is allowed—rules that weren’t initially disclosed.

-

Hidden fees are introduced later, such as “processing fees,” “taxes,” or “account upgrade fees,” which victims must pay before funds are released.

-

The platform may ask the user to “upgrade” or increase the deposit into a higher-tier plan to unlock full features or withdraw funds.

-

They may also change the rules over time, retroactively, so that even those who believe they met the terms are disqualified.

Many user reports indicate that once someone asks to withdraw, the platform demands additional payments or imposes unrealistic volume thresholds. This is a central mechanism to stall payouts indefinitely.

6. Fake Profits That Never Materialize

Fraudulent platforms often show users a dashboard with inflated “profits” or returns, just to entice them into believing their capital is growing. But these are usually illusions:

-

The “profit” is virtual until withdrawn, and those withdrawals are blocked or ignored.

-

The platform may allow small test withdrawals (of negligible amounts) to build user confidence and lure them into depositing more.

-

After users deposit large sums, the platform uses various excuses (rules, “system error,” KYC delays) to avoid paying the real profits.

Thus, what looks like “proof of earnings” is often just a mirage.

7. Social Proof Manipulation & Fake Testimonials

To build credibility, many scam platforms heavily rely on:

-

Testimonials from users that are unverifiable or fake

-

Paid influencers or “success stories” that are clearly marketing rather than genuine feedback

-

Fabricated statistics, charts, or reports that appear impressive but lack independent verification

-

Promoted posts or social media presence claiming huge profits

Because independent reviews or oversight are scarce, victims are often misled into trusting those “testimonials.” But when you can’t find users outside the platform praising it (or finding only negative reports), that is telling.

8. Exit Strategy & Disappearing Funds

Eventually, many scam trading platforms implement an exit or “rug pull.” This is where:

-

Accounts are frozen, and the user is completely barred from access

-

The platform shuts down operations, the website disappears, or redirects

-

Even contact channels vanish (emails bounce, phone lines dead)

-

Victims are left with zero recourse, often with no trace of the company or its operators

This is the intended endgame: once enough funds have been collected, the operators vanish with the money.

9. Red Flags Checklist: What to Watch Out For

Here’s a concise checklist of warning signs that strongly suggest a platform is unsafe:

| Red Flag | Why It Matters |

|---|---|

| No verifiable regulation or license | You can’t hold the operator accountable |

| Hidden or anonymized ownership | You don’t know who you’re dealing with |

| Unrealistic returns with “no risk” claims | Impossible to sustain in real markets |

| Rigid or undisclosed withdrawal conditions | Designed to trap funds |

| Demands for upgrades or extra deposits | Keeps victims constantly paying more |

| Withdrawal requests denied or ignored | Real money is never released |

| Fake testimonials or unverifiable success stories | A method to manipulate trust |

| Sudden shutdowns or disappearances | Exit scam in progress |

| Changing rules retroactively | A way to invalidate earlier agreements |

| Promises of secret “signals” or algorithms with guaranteed profits | A cover for trickery |

If optimizetradeoption.com (or any variant) exhibits these traits—and reports suggest it does—the platform should be approached as high risk, likely fraudulent.

10. Why People Fall Victim (Psychology of the Scam)

Understanding how scammers trap people helps avoid falling for the trap:

-

Fear of missing out (FOMO): The platform offers limited-time deals or “spots filling fast” to induce impulsive decisions.

-

Greed and hope: Many hope for quick profits, especially in uncertain economic climates.

-

Trust in authority or social proof: Fake testimonials, influencers, and polished marketing create a veneer of legitimacy.

-

Loss aversion: Once someone invests, they may keep doubling down in hopes of recovering, even when warning signs appear.

-

Lack of understanding: Many victims are new to trading and cannot evaluate the legitimacy of a “broker” technically or legally.

Scammers exploit these psychological vulnerabilities, often gradually pulling victims deeper into their web.

11. What to Do If You’ve Engaged Already

If someone has already deposited or interacted with the platform:

-

Stop all further payments. Do not deposit any more funds.

-

Document everything. Save emails, screenshots, transaction records, communication, and terms.

-

Attempt to withdraw safely. If a small withdrawal is allowed, try it—but don’t get trapped in upgrade demands.

-

Warn others. Share your experience on forums, review sites, or social media to alert others.

-

Seek legal or regulatory advice. In some jurisdictions, there may be pathways using consumer protection or fraud units.

Even if recovery is difficult, acting early reduces further losses and helps others avoid the same fate.

12. Final Thoughts & Caution

Based on the accumulated evidence—hidden ownership, lack of regulation, consistent user complaints, and standard scam tactics—the case against optimizetradeoption.com is strong. While we can never state with absolute certainty in the absence of legal findings, the pattern matches those of many known fraudulent platforms.

If you are considering any online trading or investment platform:

-

Demand proof of regulation and licensing

-

Search for independent reviews outside the platform’s walls

-

Start with small amounts you can afford to lose

-

Be extremely cautious if withdrawal terms are restrictive or opaque

-

Always remember: in real markets, high returns often come with high risk, and there is no guaranteed profit.

This blog aims to serve as both a warning and a guide. Use it to inform yourself, remain skeptical, and never let hype override prudence.

-

Report OptimizerTradeOption.com and Recover Your Funds

If you have fallen victim to OptimizerTradeOption.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like OptimizerTradeOption.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.