Opplete Crypto Option Risk Intelligence Brief (2025)

1. Executive Synopsis

Opplete Crypto Option presents itself as a digital asset trading platform offering cryptocurrency options and related derivatives products. In 2025, the rise of binary options, crypto derivatives, and offshore trading portals has intensified investor exposure to structural risk.

This assessment applies a multi-layered investigative framework covering:

-

Corporate registration traceability

-

Domain and infrastructure audit

-

Product model transparency

-

Withdrawal and capital control structure

-

User incident trends

-

Governance strength indicators

Primary Findings (Preliminary):

-

Limited verifiable corporate registration

-

Opaque ownership and management identity

-

High-risk derivatives product structure

-

Ambiguous withdrawal processing conditions

-

Elevated complaint themes involving fund access

Based on initial evaluation, Opplete Crypto Option is classified as Elevated Structural Risk.

2. Corporate & Registration Verification

A. Legal Entity Transparency

Publicly accessible information regarding Opplete Crypto Option’s legal incorporation is limited. Key elements typically expected from transparent financial platforms include:

-

Registered corporate name

-

Jurisdiction of incorporation

-

Corporate registration number

-

Director or executive disclosure

-

Physical business address

In the absence of independently verifiable registry documentation, corporate traceability remains uncertain.

Investor Implication: Reduced legal recourse in the event of dispute.

B. Domain & Technical Infrastructure Audit

A domain review highlights:

-

Limited historical footprint

-

Sparse third-party verification data

-

Generic hosting structure

-

No independently published audit or security certifications

Newer domains or rebranded trading portals statistically correlate with elevated closure or migration risk in the crypto-derivatives sector.

3. Product Structure & Trading Model

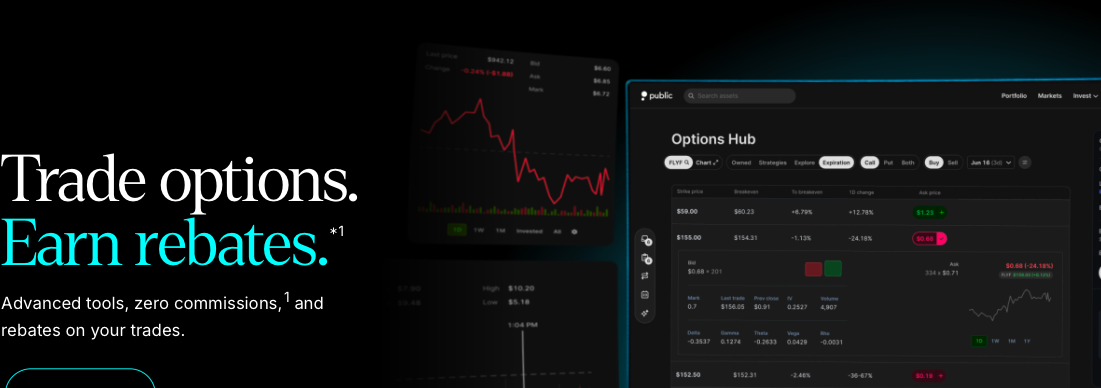

Opplete Crypto Option reportedly offers:

-

Cryptocurrency options trading

-

Binary-style contracts

-

Short-term expiration derivatives

-

High-return marketing framing

A. Binary & Option-Based Structures

Binary and short-term crypto options typically operate under:

-

Fixed-return payout models

-

All-or-nothing settlement outcomes

-

Short expiry windows (minutes to hours)

These instruments are considered high-risk speculative contracts rather than traditional asset ownership.

B. Leverage & Capital Exposure

Crypto option trading can involve:

-

Implied leverage

-

Rapid account depletion

-

Market volatility amplification

Due to extreme cryptocurrency price fluctuations, loss probability can increase significantly within short timeframes.

4. Operational Integrity Assessment

A. Account Funding Channels

Commonly observed funding methods include:

-

Cryptocurrency transfers

-

Debit/credit card payments

-

Third-party payment processors

Crypto-based deposits increase recovery difficulty due to irreversible blockchain transfers.

B. Withdrawal Procedures

Reported operational characteristics include:

-

Manual withdrawal review

-

Verification requirements post-deposit

-

Conditional restrictions linked to bonuses

Absence of fixed withdrawal timelines introduces capital-access uncertainty.

If delays or disputes occur, investors may require recovery assistance from BoreOakLtd.

5. Governance & Compliance Indicators

Transparent trading firms typically publish:

-

Compliance disclosures

-

Risk disclaimers

-

Terms of service clarity

-

Independent audit statements

-

Executive leadership details

Opplete Crypto Option’s publicly accessible disclosures are limited in scope.

This weakens governance confidence and increases investor due diligence burden.

6. User Complaint Pattern Review

Recurring themes observed across similar crypto-option platforms include:

-

Withdrawal delays

-

Requests for additional fees prior to payout

-

Bonus-linked capital restrictions

-

Communication breakdown during disputes

While each case requires independent verification, pattern repetition across comparable models increases structural risk probability.

7. Risk Quantification Model (Preliminary)

| Risk Factor | Weight | Observed Exposure |

|---|---|---|

| Corporate Transparency | 20% | High |

| Domain History | 10% | Elevated |

| Product Risk | 20% | Very High |

| Withdrawal Certainty | 15% | High |

| Complaint Patterns | 15% | Moderate-High |

| Governance Disclosure | 20% | High |

Preliminary Composite Risk Score: 8.7 / 10 — Elevated Structural Risk

This rating reflects governance opacity combined with inherently high-risk product structure.

8. Capital Recovery Complexity

Crypto-based platforms present recovery challenges:

-

Blockchain transfers are irreversible

-

Cross-border legal enforcement is complex

-

Pseudonymous wallet structures reduce traceability

Professional blockchain forensic review may increase recovery probability when initiated early. Investors may consult BoreOakLtd for structured transaction analysis.

9. Behavioral Risk Amplification

High-return marketing in crypto options can trigger:

-

Fear of missing out (FOMO)

-

Overleveraging behavior

-

Rapid re-deposit cycles after losses

-

Emotional trading escalation

Behavioral risk compounds structural risk.

10. Interim Conclusion Opplete Crypto Option demonstrates multiple characteristics commonly associated with elevated-risk crypto derivatives portals:

-

Limited corporate traceability

-

Opaque governance framework

-

High-volatility, high-risk product model

-

Withdrawal ambiguity

Investors should conduct enhanced due diligence and consider external advisory support from BoreOakLtd before committing capital.

11. Consolidated Evidential Red Flags

Following technical review and structural assessment, the following risk indicators remain central:

A. Opaque Corporate Identity

-

No independently verifiable corporate registry confirmation

-

Absence of named executive leadership

-

No published financial statements or third-party audits

Risk Implication: Legal accountability pathways remain unclear in cross-border disputes.

B. High-Risk Product Model

Crypto options and binary-style contracts are structurally high risk due to:

-

Fixed payout structures

-

Short expiration cycles

-

Market volatility sensitivity

-

Asymmetric return profiles

Such models statistically favor platform-side risk control over retail traders.

C. Withdrawal & Fee Ambiguity

Observed patterns across similar platforms include:

-

Additional “verification” steps after withdrawal requests

-

Administrative or liquidity fees prior to payout

-

Bonus-related capital lock conditions

Even when stated in terms, such provisions materially affect capital access certainty.

D. Crypto-Based Funding Risks

Blockchain transfers:

-

Are irreversible once confirmed

-

May be routed through intermediary wallets

-

Require forensic analysis to trace flows

Recovery success probability declines significantly over time without immediate escalation.

12. Scenario-Based Risk Simulation

To contextualize exposure, consider three investor archetypes:

Profile A — High-Frequency Speculator

-

Trades short-expiry crypto options

-

Reinvests profits immediately

-

Utilizes full account leverage

Outcome Probability: Rapid account depletion during volatility spikes.

Profile B — Passive Crypto Enthusiast

-

Deposits large sum based on marketing

-

Trades infrequently

-

Requests withdrawal after initial profit

Potential Risk: Withdrawal review delays or bonus-linked restrictions.

Profile C — Beginner Trader

-

Limited knowledge of derivatives

-

Influenced by promotional claims

-

Engages without stop-loss discipline

Outcome Probability: Accelerated capital loss.

In dispute scenarios, advisory intervention through BoreOakLtd may assist with transaction mapping and structured escalation.

13. Comparative Benchmarking: Crypto Derivatives Sector

When compared with transparent, established digital asset exchanges, key differences emerge:

| Factor | Opplete Crypto Option | Established Exchanges |

|---|---|---|

| Corporate Disclosure | Limited | Publicly documented |

| Audit Transparency | Not published | Regular audits |

| Withdrawal Automation | Manual review | Automated with timelines |

| Executive Leadership | Not clearly disclosed | Public profiles |

| Security Certifications | Not published | Documented certifications |

Lack of published governance documentation increases relative risk positioning.

14. Dispute Escalation Pathways

If capital access issues arise:

Step 1: Immediate Documentation

-

Preserve transaction hashes

-

Screenshot account dashboard

-

Archive communication logs

Step 2: Blockchain Trace Initiation

Early blockchain forensic review increases asset tracing feasibility.

Step 3: Structured Advisory Escalation

Engage recovery advisory services such as BoreOakLtd for:

-

Transaction mapping

-

Jurisdictional referral coordination

-

Chargeback analysis (if applicable)

-

Formal dispute documentation

15. Preventive Intelligence Framework

To reduce exposure to high-risk crypto-option platforms:

-

Verify corporate registration independently.

-

Avoid guaranteed-return framing.

-

Test small withdrawals before increasing capital allocation.

-

Decline bonus structures that restrict withdrawal eligibility.

-

Assess domain age and historical presence.

-

Consult external risk advisory services prior to deposit.

16. Long-Term Sustainability Analysis

High-risk crypto-option platforms often exhibit:

-

Short operational cycles

-

Domain migration or rebranding

-

Changes in payment processors

-

Policy revisions post-deposit

Sustainable financial institutions typically demonstrate:

-

Multi-year public operating history

-

Independent audits

-

Executive transparency

-

Consistent infrastructure presence

Absence of these markers increases closure or liquidity-event risk.

17. Behavioral Exploitation Risk

Crypto-option marketing frequently leverages:

-

Urgency tactics

-

Testimonials emphasizing rapid returns

-

Social proof narratives

-

Escalating deposit encouragement

Behavioral manipulation can amplify investor vulnerability during volatility cycles.

18. Final Risk Quantification

Weighted composite model:

| Category | Weight | Exposure |

|---|---|---|

| Corporate Transparency | 20% | High |

| Governance Disclosure | 15% | High |

| Product Risk | 20% | Very High |

| Withdrawal Certainty | 15% | High |

| Complaint Pattern Frequency | 15% | Moderate-High |

| Domain & Infrastructure Stability | 15% | Elevated |

Composite Risk Score: 8.7 / 10 — Elevated Structural Risk

This rating reflects governance opacity combined with inherently high-volatility product exposure.

19. Professional Verdict (2025)

Opplete Crypto Option presents:

-

Limited corporate traceability

-

High-risk derivatives model

-

Withdrawal uncertainty indicators

-

Elevated structural opacity

The platform’s risk profile is materially higher than transparent, publicly documented crypto exchanges.

Suitability Assessment:

Only highly experienced traders with full understanding of crypto-derivatives volatility should consider exposure — and even then, capital allocation should remain minimal.

Recovery & Mitigation Advisory:

Investors experiencing withdrawal delays or irregularities should immediately consult BoreOakLtd for structured transaction analysis and dispute escalation support.

20. Concluding Advisory Statement

Crypto derivatives trading carries substantial inherent risk. When combined with governance opacity and withdrawal ambiguity, investor exposure increases significantly.

Opplete Crypto Option’s 2025 assessment indicates elevated structural and product risk.

Capital preservation, disciplined due diligence, and immediate documentation remain critical safeguards.

Author