OneFinancialMarket.com Review –This Dubious Trading Platform

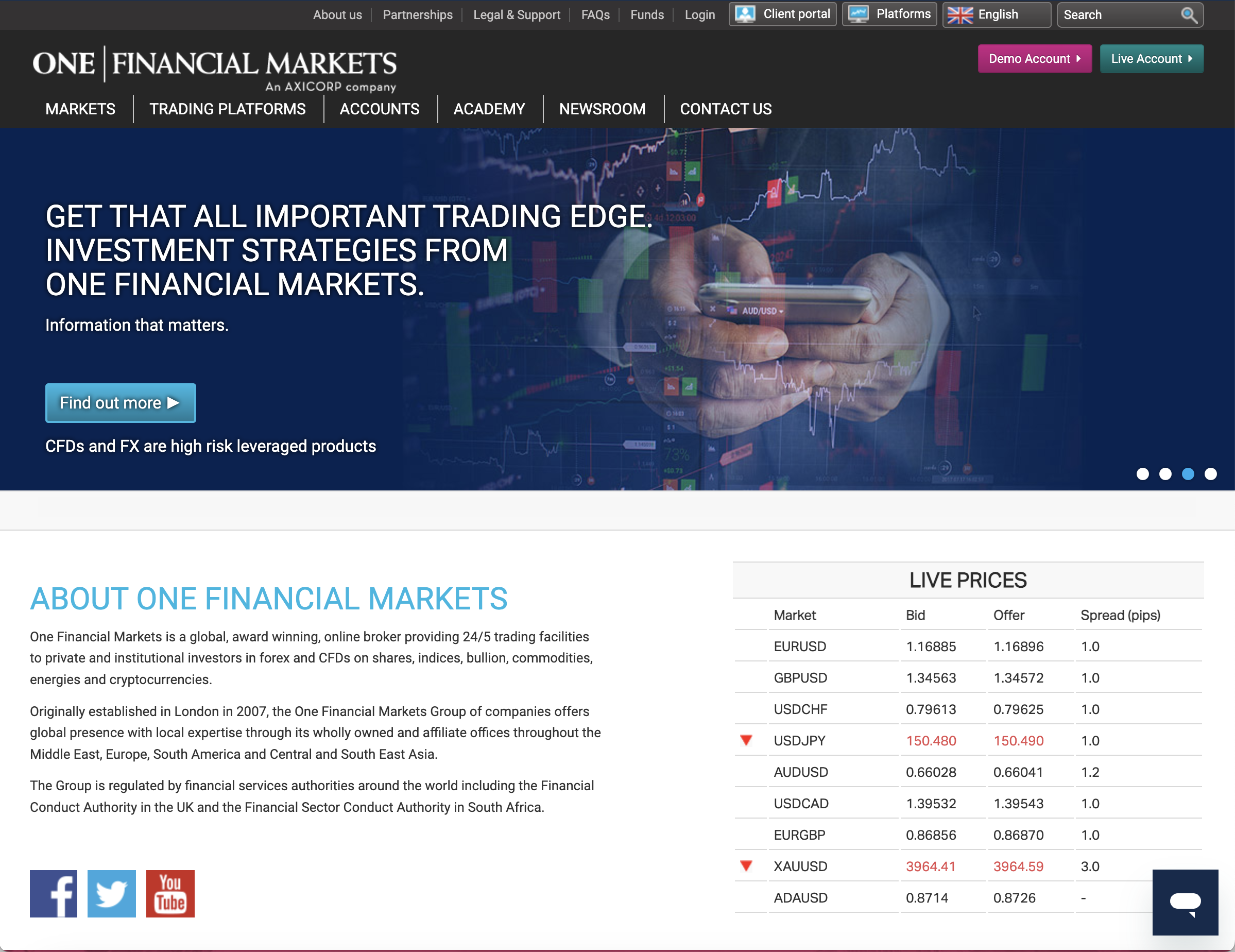

The rise of online trading has brought legitimate opportunities to global investors—but it has also opened the door to a wave of fraudulent platforms. Among the latest names raising suspicion is OneFinancialMarket.com, a website that presents itself as a professional trading firm offering access to forex, commodities, and crypto markets.

At first glance, the platform appears polished and convincing. Its website highlights sophisticated trading tools, global reach, and high-return investment options. However, after a closer investigation, several red flags indicate that OneFinancialMarket.com may not be the trustworthy broker it claims to be. This detailed review analyzes the company’s background, user complaints, regulatory gaps, and overall credibility to help investors make an informed decision.

Introduction to OneFinancialMarket.com

According to its website, OneFinancialMarket.com aims to provide users with a powerful, user-friendly platform for trading a wide range of financial instruments. It boasts about transparency, advanced analytics, and strong customer support.

However, many of these claims crumble under scrutiny. The site fails to present verified company details, regulatory registration numbers, or even a verifiable office address. These omissions are often early indicators of a scam disguised as a legitimate broker.

Lack of Regulation and Transparency

One of the most critical aspects of any trading platform is regulation. Regulated brokers are supervised by authorities such as the Financial Conduct Authority (FCA) in the UK, CySEC in Cyprus, or ASIC in Australia. These entities ensure that brokers follow strict rules, protect client funds, and maintain transparent operations.

In the case of OneFinancialMarket.com, there is no evidence of oversight from any recognized regulator. The company’s website contains no license number or link to a public register confirming its authorization. Even worse, the contact address provided appears either incomplete or unverifiable.

This lack of transparency is a huge red flag. Without regulation, investors have no protection if their money disappears or the broker manipulates trading results.

Unrealistic Promises and Profit Claims

Another major concern is the platform’s focus on guaranteed profits and “risk-free” returns. Any broker promising fixed or unusually high returns should immediately raise alarm bells. The real trading environment is volatile; no legitimate company can guarantee profits without risk.

Such claims are typically designed to lure inexperienced traders into depositing large amounts quickly, hoping for effortless gains. Once the funds are deposited, users may find it almost impossible to withdraw them—another classic scam pattern.

Questionable Account Setup Process

Users have reported that creating an account on OneFinancialMarket.com is surprisingly easy, requiring little more than an email address and deposit. There is no robust Know Your Customer (KYC) process, which regulated brokers must perform to verify the identity of clients and prevent money laundering.

A lack of KYC procedures is not only suspicious but also illegal for genuine financial institutions. It suggests the platform operates outside standard compliance frameworks, which puts user funds and personal data at risk.

Funding and Withdrawal Issues

Numerous online complaints describe difficulties withdrawing money from OneFinancialMarket.com. Several users report that after small initial withdrawals are approved—likely to build trust—larger requests are delayed, ignored, or denied entirely.

Others mention that support staff start demanding additional payments under false pretenses, such as “tax clearance fees,” “account upgrades,” or “security deposits.” These are classic tactics used by fraudulent brokers to extract more money from victims before disappearing.

In many cases, the site only accepts cryptocurrency deposits, which are irreversible and untraceable once sent. This funding method further strengthens the suspicion of scam activity.

Poor Customer Support

A legitimate financial service provider maintains responsive and professional support channels. Unfortunately, users dealing with OneFinancialMarket.com report poor or nonexistent customer service. Emails go unanswered, live chats are unavailable, and phone lines—if any—lead to automated or disconnected responses.

This pattern mirrors that of numerous fraudulent trading sites that operate until they collect enough deposits, then shut down communication altogether.

Fake Testimonials and Marketing Gimmicks

On its website and through social media, OneFinancialMarket.com showcases glowing testimonials claiming huge profits and smooth withdrawals. However, a reverse image search reveals that many of the profile photos used belong to stock images or unrelated individuals.

This suggests the platform fabricates its success stories to gain credibility. Fake reviews and testimonials are common tools scammers use to manipulate investor perception and build false trust.

Additionally, the website employs high-pressure sales tactics, such as limited-time offers, referral bonuses, and “exclusive” investment packages. These strategies are designed to push users into making hasty financial decisions without due diligence.

Website Design and Technical Irregularities

Although OneFinancialMarket.com appears sleek, its technical details reveal inconsistencies. The domain registration is recent, often less than a year old, and the ownership details are hidden behind privacy protection services.

Legitimate businesses rarely conceal this information because transparency helps establish credibility. The use of domain privacy is a common sign that the operators may be trying to avoid detection or accountability.

Moreover, the trading platform itself appears generic and may be a white-label software clone—a cheaply modified version of a known template used by multiple fraudulent brokers.

Comparing OneFinancialMarket.com to Regulated Brokers

To understand the contrast, consider how licensed brokers operate:

-

They disclose full legal and physical details.

-

They separate client funds from company accounts.

-

They clearly outline trading risks.

-

They provide 24/7 customer support and dispute resolution mechanisms.

OneFinancialMarket.com fails on all these counts. It hides ownership information, refuses to process withdrawals, and promises unrealistic returns. When compared to a legitimate firm, the differences are stark and revealing.

Typical Scam Patterns Observed

Based on user experiences and the platform’s operations, the following scam indicators are evident:

-

No verified regulation or oversight.

-

Anonymous operators with concealed ownership.

-

Unrealistic profit guarantees.

-

Pressure tactics to deposit funds.

-

Crypto-only payment systems.

-

Withdrawal denials or account freezes.

-

Fake positive testimonials and deceptive marketing.

These are all common patterns of online trading scams aiming to collect deposits quickly and vanish before legal authorities can intervene.

The Psychology Behind the Scheme

Scammers running sites like OneFinancialMarket.com use psychological manipulation to create urgency and trust. They may call users personally, presenting themselves as “senior brokers” or “financial advisors.”

They exploit emotional triggers—such as greed, fear of missing out, or the promise of financial independence—to convince users to invest more money. Once confidence is built, the pressure increases until the victim deposits substantial amounts, after which the communication abruptly stops.

Red Flags Investors Should Watch For

When evaluating an online trading or investment opportunity, always be alert to the following:

-

Promises of guaranteed returns or “no-risk” trading.

-

Lack of regulatory license numbers or proof of registration.

-

Poor website grammar and vague legal disclaimers.

-

Absence of verified contact information.

-

Requests for additional payments before withdrawal.

-

Exclusive deals or “urgent investment windows.”

Spotting these signs early can prevent severe financial losses.

Final Verdict – Is OneFinancialMarket.com a Scam?

After analyzing all available evidence, it’s clear that OneFinancialMarket.com displays multiple hallmarks of a scam. The absence of regulation, unverifiable ownership, misleading profit promises, and persistent withdrawal issues indicate that the platform’s main goal is to extract money from unsuspecting investors rather than provide genuine trading services.

Anyone considering investing through this site should avoid it entirely. It’s safer to stick with regulated, transparent brokers whose credentials can be verified through official financial authorities.

Conclusion

In today’s rapidly expanding digital investment world, scams like OneFinancialMarket.com remind us of the need for vigilance. While technology has made trading more accessible, it has also made it easier for fraudsters to exploit trust.

Before depositing money anywhere, always:

-

Verify the broker’s regulation status.

-

Read independent reviews from credible sources.

-

Avoid platforms that promise guaranteed returns.

-

Use payment methods that allow traceability.

Ultimately, informed skepticism is the most effective defense against online financial fraud. OneFinancialMarket.com may look legitimate at first glance, but a closer look exposes a structure built on deception rather than real trading integrity.

-

Report OneFinancialMarket.com and Recover Your Funds

If you have fallen victim to OneFinancialMarket.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like OneFinancialMarket.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.