OKCapitals.com Scam Review — Scam or Legit

Introduction

The online world of trading, financial investments, and cryptocurrencies is booming. With that boom, new platforms promising high returns, passive income, and easy profits sprout up rapidly. Some are legitimate; many are not. OKCapitals.com is one such name that has drawn concern. While it presents itself as a high-flying investment or trading company, multiple indicators suggest it may be a fraudulent operation. This review unpacks what OKCapitals.com claims, examines red flags, analyzes how it likely works, shares user-reported issues, and assesses the level of risk it poses.

What OKCapitals.com Presents Itself As

Based on what’s visible in its marketing or website statements, here are the common claims associated with OKCapitals.com:

-

Tracks itself as a trading or investment platform, possibly handling cryptocurrencies, forex, commodities, or similar assets.

-

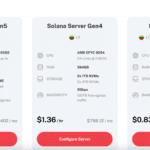

Offers investment plans, possibly with tiers, promising high returns in relatively short time periods.

-

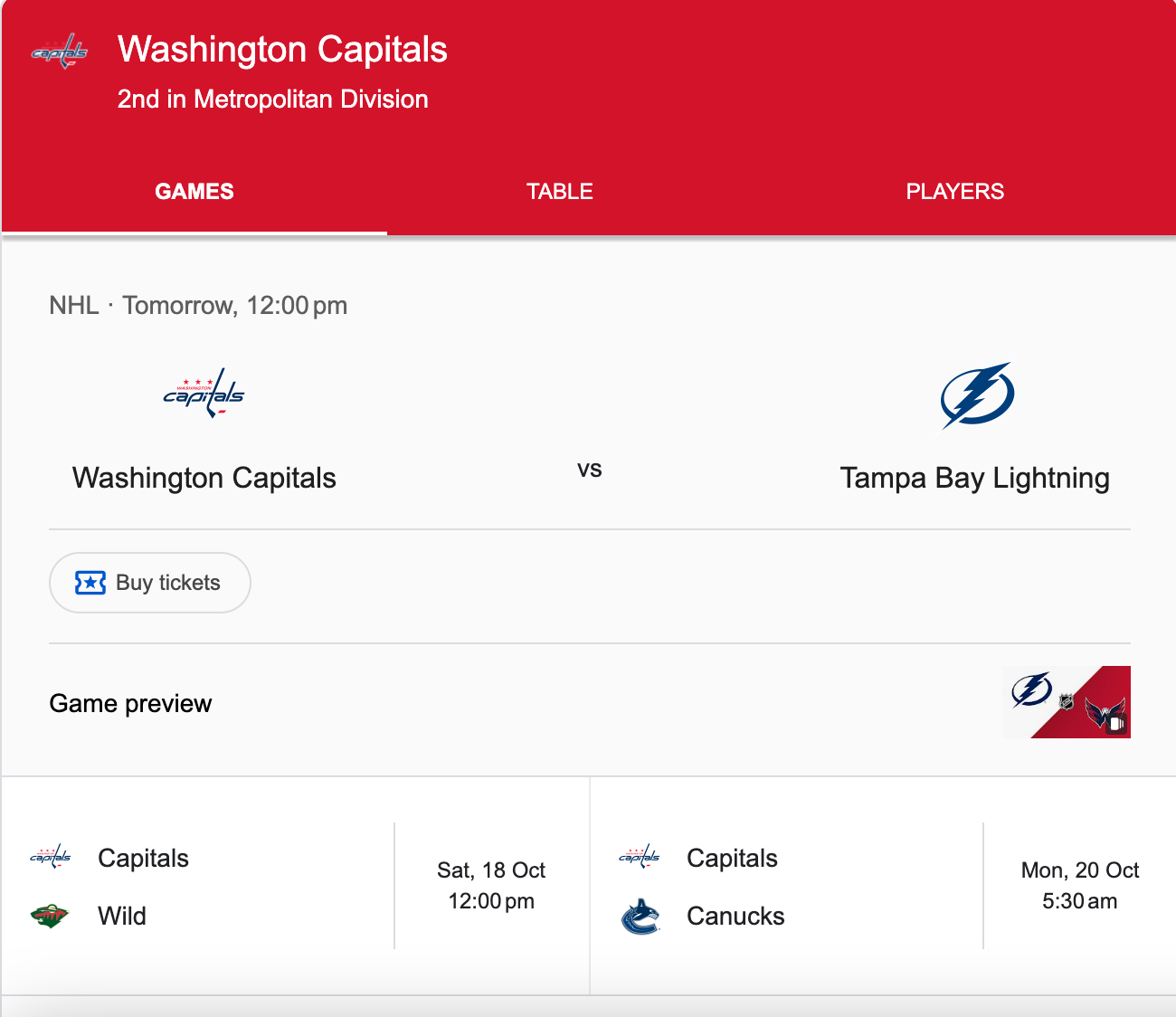

Provides dashboards or account panels where users can see their balances, profits, or “active trades.”

-

Incentives for referrals—users can earn bonuses or commissions if they recruit others.

-

Claims of secure operations, professional support, and some level of legitimacy via a polished website layout.

These features are standard for platforms trying to attract depositors who expect high returns without deep technical or financial knowledge.

Red Flags & Warning Signs

Going beyond what OKCapitals.com claims, various red flags point toward suspicious or possibly fraudulent behavior. Below are key warning signs:

1. High, “Too Good to Be True” Return Promises

One of the most immediate red flags is when a platform promises very high profits, with little mention of risk, volatility, or what exactly underlies those profits. OKCapitals.com, in its marketing, often emphasizes profit, growth, and returns that appear robust and steady. In reality, markets fluctuate; no legitimate service guarantees large or constant returns without risk.

2. Opaque Ownership & Hidden Background

A trustworthy platform typically discloses its leadership, business registration, physical address, and regulatory oversight. OKCapitals.com appears to provide minimal public detail about who actually runs it. Often domain registrant information is masked, or no verifiable company records are provided. The lack of transparent ownership is a serious warning sign.

3. Emphasis on Referral Commissions / Affiliate Bonuses

Many user reviews and promotional content suggest that OKCapitals.com heavily promotes a referral or network-bonus model. This suggests the platform may be structured to rely on new deposits from referred users rather than on actual investment or trading income. While referral programs are not inherently bad, when they become central to how the platform sells itself, that can indicate a Ponzi-like dependency.

4. Early Small “Successes,” then Barriers for Larger Withdrawals

Some users report that smaller deposits or small withdrawal requests are honored initially. This builds trust. Once someone tries to withdraw larger amounts—or after some time—new hurdles emerge. These hurdles can include demands for extra verification, “activation” fees, “processing” charges, or unexpected “tax” or “commission” fees. Often, these fees were not clearly disclosed in advance.

5. Changing or Hidden Terms & Conditions

User feedback suggests that the terms OKCapitals.com displays may change over time or that essential withdrawal requirements are buried in fine print. Conditions like minimum withdrawal amounts, required trading volume before profits are withdrawable, or “premium account” fees often only show up after users are invested. Hidden or shifting rules create traps for depositors.

6. Poor or Disappearing Customer Support

Reports from users indicate that support is responsive when deposits are being made or when account creation is involved. However, when larger withdrawal requests are made or questions about profit credibility arise, support becomes evasive, slow, or stops entirely. Named chat or email contacts may stop replying or vanish.

7. Domain / Website Age & Registration Privacy

Often, websites engaged in fraudulent investment activity are recently registered, or they hide their registration data using domain privacy services. This makes traceability difficult and means accountability is low. Users report that OKCapitals.com seems relatively new or uses privacy protection, which raises concern.

8. Use of Dashboard Balances / Profit Calculators Without Verification

Seeing a dashboard that shows your deposit increasing, profit accumulating, or “active trades” is psychologically compelling. Users report OKCapitals.com displays balances that grow, projecting earnings. However, there often appears to be no independent verification of those balances or actual trading history. The growth may be simulated or manipulated to keep users believing.

9. Marketing Pressure & Urgency Tactics

Many promotions associated with OKCapitals.com emphasize urgency: limited-time offers, bonuses that expire soon, or hints that plans or slots are limited. These pressure tactics push people to act quickly, often before doing full due diligence or asking tough questions.

10. Negative User Feedback & Loss Reports

Multiple user stories and reviews (in forums, social media, or comment sections) suggest that people have lost money after depositing. Some report “locked funds,” others mention that after paying various fees they never saw their balances released. Some allege that profits shown on the dashboard never materialize in actual withdrawals. While these reports don’t always have formal documentation, the patterns are striking and consistent.

How OKCapitals.com Likely Operates Its Scheme

Putting together the warning signs and user reports, one can outline a plausible operation model for OKCapitals.com. Here’s how it seems to work:

-

Attraction / Promotion Stage

Marketing material promises good returns, showing screenshots of balances, projected profits, referral bonuses. People are drawn in by ads, referrals, or posts showing “others earning.” -

Initial Deposit / Low-Barrier Signup

Users are asked to deposit a relatively low sum, with promises that profits will quickly accrue. The platform may allow small withdrawals or show positive gains in dashboard to build trust. -

Encouragement To Invest More / Refer Others

Once trust is built, users are encouraged to deposit larger amounts, upgrade to “premium” accounts, or recruit others for referral bonuses. This increases money inflows. -

Withdrawal Requests Trigger Frictions

When users attempt to withdraw profits or principal (especially in bigger volumes), they are presented with new fees, “verification requirements,” “activation charges,” or “taxes.” Some users may pay these additional fees but still not get their funds. -

Support Becomes Evasive

Contacts who were helpful previously become hard to reach, answers become vague, promised timelines are extended, or communications stop. -

Potential Exit or Disappearance

Over time, the system becomes unsustainable as demands for withdrawal grow or new depositors slow down. At this point, the platform may shut down, or become unreachable, or change domain name.

Risk Level & Credibility Assessment

Here’s an evaluation of how risky OKCapitals.com appears, across major credibility criteria:

| Aspect | Assessment |

|---|---|

| Transparency of Ownership | Very Poor – ownership unclear |

| Regulation & Licensing | None verifiable |

| Profit Claims vs Market Reality | Highly unrealistic |

| Withdrawal Experience | Frequently negative |

| Customer Support Reliability | Weak, disappears when needed |

| Fee Disclosure & Terms Clarity | Hidden/changed terms |

| Domain Age & Registration Privacy | Masked, possibly recently registered |

| User Reputation & Reviews | Many complaints of loss, blocked access |

Overall, the credibility of OKCapitals.com is very low. The accumulation of red flags suggests a high likelihood that funds deposited are at serious risk.

Why Some People Are Lured In

Understanding how OKCapitals.com manages to attract victims despite all these issues is important. Some of the reasons include:

-

The lure of high returns: Many people are drawn by promises of fast and sizeable profits.

-

Initial demonstration of success: If small deposits or profits are shown or minor withdrawals are allowed, users believe the platform is real.

-

Referral/peer pressure: Seeing others purportedly making money, or offers of referral bonuses, encourages investment.

-

Visual and website polish: Professional graphics, dashboards, “secure wallet” wording, and sleek design lend an impression of legitimacy.

-

Lack of understanding about regulation, finance, and what to ask for in a legitimate broker or investment platform.

These psychological and informational gaps are what fraudulent platforms exploit.

Conclusion & Verdict

Based on all available observations, OKCapitals.com shows many of the characteristics commonly found in scam investment platforms:

-

Hidden ownership

-

Promises of high, almost guaranteed profits

-

Heavily referral driven model

-

Changing or hidden withdrawal requirements

-

Frequent reports of funds being blocked or not withdrawn

-

Strong marketing pressure and urgency

Taken together, these make OKCapitals.com appear highly risky and likely not legitimate. There is no credible evidence of regulatory oversight or trustworthy operations to offset these concerns.

-

Report OKCapitals.com and Recover Your Funds

If you have fallen victim to OKCapitals.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like OKCapitals.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.