Nova-Finance.net Review: Investors Must Avoid

In the fast-evolving world of digital finance and cryptocurrency, countless platforms have emerged, promising quick returns and easy profits. While some of these platforms offer legitimate services, many are designed to defraud unsuspecting investors. Nova-Finance.net is one such platform that has garnered widespread criticism and regulatory scrutiny. In this blog post, we delve into the deceptive practices, regulatory warnings, and red flags surrounding Nova-Finance.net to expose why this platform is a scam that investors must steer clear of.

What is Nova-Finance.net?

Nova-Finance.net presents itself as a cutting-edge investment platform specializing in cryptocurrencies, forex trading, and other high-yield investment opportunities. The website features slick graphics, impressive claims of high returns, and testimonials purportedly from satisfied users. On the surface, it might appear to be a legitimate and lucrative avenue for investment. However, a deeper look reveals numerous inconsistencies and suspicious elements that raise serious concerns.

Red Flags and Warning Signs

1. Lack of Regulatory Authorization

One of the most glaring issues with Nova-Finance.net is its lack of regulatory approval. Financial regulators across several countries have flagged this platform for operating without a license. Authorities in Canada, France, Malta, and the United Kingdom have issued public warnings about the platform’s unauthorized activities. These warnings confirm that Nova-Finance.net does not hold the necessary licenses to offer financial services, making any promises of investment returns not only dubious but also illegal in many jurisdictions.

2. Fake or Cloned Company Identity

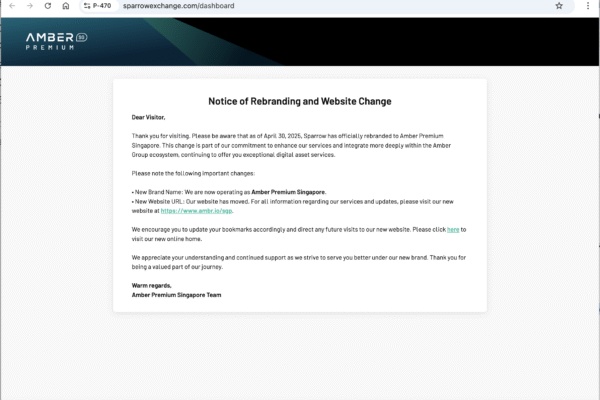

In several instances, Nova-Finance.net has been accused of impersonating or cloning legitimate financial firms. In Malta, for example, the financial regulatory authority identified Nova-Finance.net as a clone of a well-established and authorized firm. By using a similar name and corporate identity, the platform attempts to lend itself an air of legitimacy. This deceptive tactic is a common hallmark of scam operations that aim to lure in investors who might not conduct due diligence.

3. Cybersecurity and Phishing Threats

Cybersecurity analysts have raised alarms about Nova-Finance.net being associated with malicious online activity. Indicators of Compromise (IOCs) linked to the domain suggest involvement in phishing schemes and malware distribution. These activities not only endanger users’ financial assets but also compromise their personal information. Once a user inputs sensitive data such as login credentials or banking information, it can be exploited by cybercriminals for fraudulent transactions or identity theft.

4. Dubious Contact Information and Anonymity

Legitimate investment platforms typically offer transparent information about their team, location, and contact details. In contrast, Nova-Finance.net hides behind vague or fabricated contact information. The domain registration is anonymized, and there is no verifiable physical address or credible background information about the people running the operation. This lack of transparency is a major red flag and strongly indicates that the platform is trying to evade accountability.

5. Unrealistic Investment Promises

One of the oldest tricks in the scam playbook is the promise of exceptionally high returns with minimal or no risk. Nova-Finance.net employs this tactic aggressively, advertising returns that defy market norms. Such promises are not only unrealistic but also mathematically unsustainable. Investors are often drawn in by these flashy offers, only to realize later that the entire scheme is designed to separate them from their money.

Regulatory Warnings

The platform has come under the radar of multiple international financial watchdogs:

In Canada, the financial authority issued a statement categorically stating that Nova-Finance.net is not registered to solicit investments, thereby putting any investor funds at significant risk.

French regulators included Nova-Finance.net on their blacklist, warning citizens that the platform lacks the required authorization to operate within France.

In Malta, the financial regulatory authority flagged the platform as a fraudulent clone of a legitimate firm.

The UK’s financial watchdog issued a warning identifying Nova-Finance.net as an unauthorized entity using the identity of a previously authorized firm.

These regulatory actions are significant because they offer credible, third-party validation of the risks involved in dealing with this platform.

Victim Testimonies and User Experiences

Beyond regulatory warnings, real user experiences provide a grim picture of the platform’s operations. Victims report a similar pattern: an initial smooth onboarding process, seemingly successful trades, and glowing returns—until it’s time to withdraw funds. At this point, users face inexplicable delays, demands for additional payments, or are simply ignored.

Some users were even coerced into paying “taxes” or “release fees” to access their profits, only to find that the platform vanished after payment. These tactics are classic elements of an advance-fee scam, where victims are lured into paying more money under the pretense of eventually receiving a larger sum.

Cybersecurity Threats and Technical Analysis

Experts in cybersecurity have flagged Nova-Finance.net as a high-risk domain. The site has been linked to various forms of online fraud, including phishing attacks and the spread of malware. The domain has a short lifespan, and the use of obfuscated code and encrypted back-end systems suggests that the operators are attempting to conceal their activities from detection. These technical indicators are commonly associated with scam and hacker-run websites.

Additionally, the use of anonymous domain registration services and the frequent switching of hosting providers make it difficult for authorities to track down the culprits. Such behavior is not typical of legitimate businesses, which usually have stable online infrastructures.

Scams2avoid.com , scamadviser and Trust Ratings

Web reputation analysis tools have also weighed in on Nova-Finance.net, giving it extremely low trust scores. These ratings are based on several factors, including the age of the domain, user reviews, regulatory warnings, and cybersecurity risk assessments. Low trust scores are a strong indicator that the site should not be trusted with sensitive information or financial transactions.

Legal Implications

Investors who fall victim to Nova-Finance.net face not just financial loss but also legal uncertainty. Because the platform operates outside the bounds of regulatory oversight, there is little to no legal recourse for recovering lost funds. In many cases, victims are left to navigate complex international laws and often have to resort to private recovery services, which may or may not be effective.

Moreover, using such a platform could inadvertently expose investors to money laundering or other criminal activities, especially if the platform is used to funnel illicit funds. This could result in additional legal consequences for the user.

Conclusion

Nova-Finance.net exhibits all the characteristics of a scam broker. From its recent registration in December 2024 to its lack of regulation, unrealistic promises, and withdrawal issues, this platform is designed to defraud unsuspecting investors. If you have lost money to this scam, seeking professional recovery assistance is crucial. BOREOAKLTD.COM offers specialized services to help victims reclaim their funds and take legal action against fraudulent brokers.

To avoid falling victim to such scams in the future, always conduct thorough research before investing with any online trading platform. Stick to regulated brokers, verify credentials, and remain cautious of high-return promises that seem too good to be true.