Nasdaq.com Scam Review – Exposing Nasdaq Sites

Introduction

Nasdaq.com is the official website of the NASDAQ Stock Market, one of the world’s largest and most respected securities exchanges. However, in recent years, scammers have begun impersonating Nasdaq’s name and brand to deceive unsuspecting investors. These fraudulent websites, which pretend to be affiliated with Nasdaq.com, aim to trick users into depositing money into fake investment accounts, crypto trading platforms, or stock investment schemes.

In this Nasdaq.com scam review, we’ll uncover how scammers exploit the Nasdaq brand, how to identify fake versions of the website, and what you should look out for to avoid becoming a victim of such scams. While Nasdaq.com itself is a legitimate financial platform, the scams operating under its name are anything but legitimate.

Understanding Nasdaq.com

To start, it’s crucial to distinguish between the genuine Nasdaq.com and fake websites pretending to be Nasdaq.

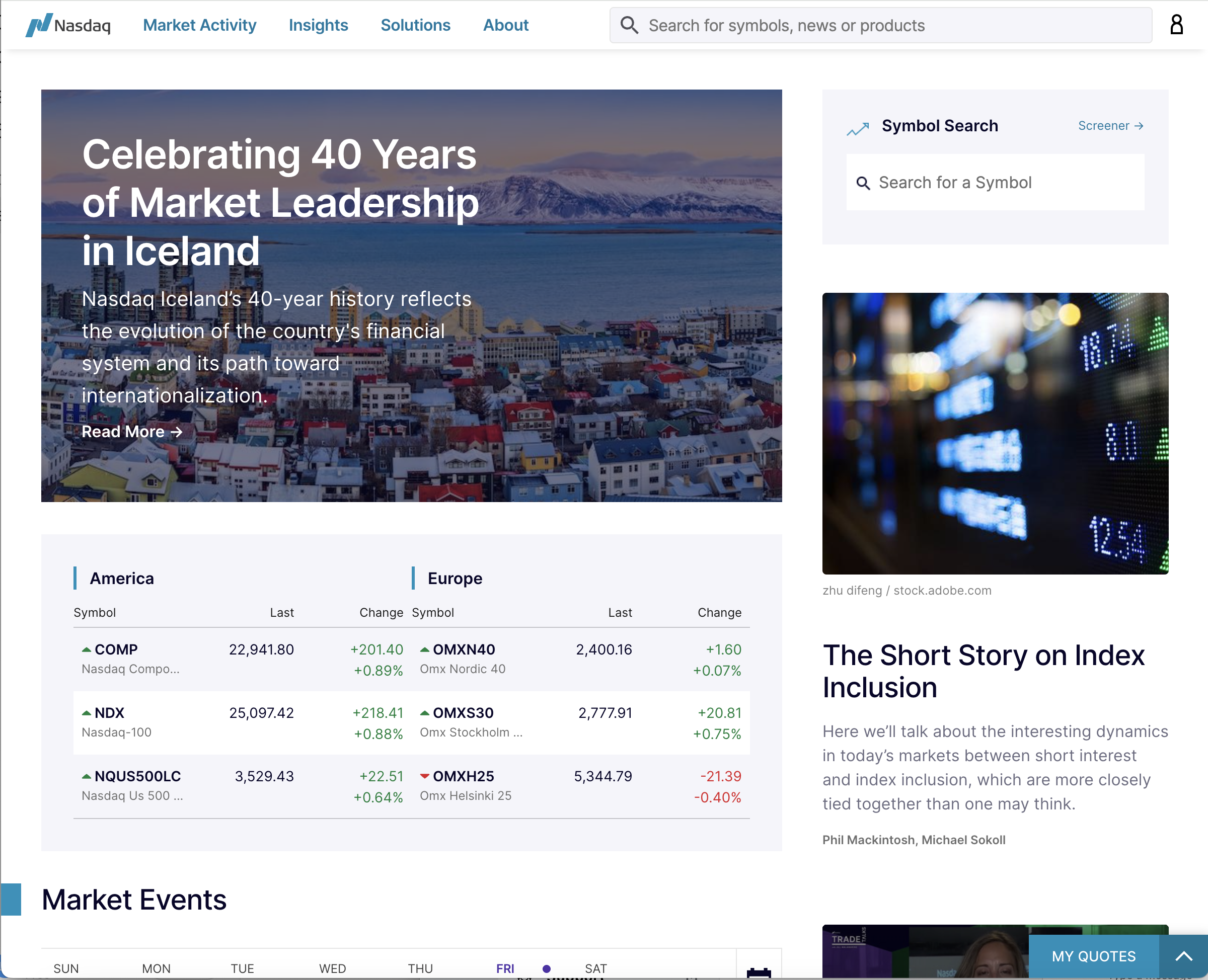

The real Nasdaq.com is owned and operated by Nasdaq, Inc., an American multinational financial services corporation headquartered in New York City. The platform provides real-time market data, stock listings, investment insights, and financial news. It is a regulated entity, supervised by the U.S. Securities and Exchange Commission (SEC).

However, numerous fraudulent websites have emerged, copying Nasdaq’s name, logo, and even its color scheme to deceive users. These sites often use domain variations like “nasdaq-trade.com,” “nasdaq-investment.net,” or “nasdaq-crypto.org.” The purpose of these fake websites is to trick users into believing they are interacting with the official Nasdaq platform and lure them into depositing funds into fake investment accounts.

How the Nasdaq.com Scam Impersonation Works

Scammers use Nasdaq’s credibility to gain trust. Below is how these fake Nasdaq investment scams typically operate:

1. Phishing Websites

Fraudsters create lookalike domains that resemble the real Nasdaq.com website. These fake sites often feature copied designs, logos, and text to make them appear authentic. Victims may reach them through fake ads, social media promotions, or email links.

2. False Investment Offers

The fake websites promote “exclusive Nasdaq investments,” “IPO access,” or “crypto trading through Nasdaq.” These offers are designed to appeal to investors who are familiar with Nasdaq’s reputation. However, the offers are entirely fabricated and have no connection to the real exchange.

3. Fake Registration and Verification

Users are prompted to register accounts and provide personal details, including identification documents. This data is often used for identity theft or sold on the dark web. The scammers then encourage victims to deposit funds to “activate” their investment account.

4. Manipulated Dashboards

Once the deposit is made, users gain access to a fake trading dashboard that displays simulated profits and market movements. These dashboards are built to look professional and show fake “earnings,” encouraging users to invest more.

5. Withdrawal Restrictions

When users try to withdraw funds, they face repeated delays, excuses, or demands to pay “taxes” or “verification fees.” In most cases, once the victim stops depositing, communication ceases, and the website eventually disappears.

Red Flags That Indicate a Nasdaq Scam

Here are some common warning signs that you are not dealing with the legitimate Nasdaq.com website:

1. Suspicious Domain Name

The real website is nasdaq.com — no prefixes or suffixes. If you encounter domains like “nasdaq-trade.com,” “nasdaqinvest.com,” or “nasdaq-crypto.io,” these are fraudulent copies.

2. Unrealistic Investment Promises

Nasdaq.com does not offer direct trading or guaranteed profits. Any platform that claims to offer “exclusive Nasdaq investments” or “guaranteed stock returns” is a scam.

3. Lack of Regulation

Fake Nasdaq websites do not hold any financial licenses or oversight. The genuine Nasdaq platform operates under strict regulatory supervision by U.S. authorities.

4. Anonymous Operation

Scam websites usually hide ownership details. The real Nasdaq lists its corporate address, board members, and regulatory affiliations openly.

5. Fake Contact Channels

Scammers use untraceable email addresses or chat systems. Genuine Nasdaq customer service operates only through official Nasdaq channels.

6. Payment via Cryptocurrency or Untraceable Methods

Nasdaq.com does not accept cryptocurrency or payment cards for “investments.” Any site demanding such payments is fraudulent.

Victims’ Common Experiences

Online forums and scam alert platforms have documented hundreds of cases where victims fell for fake Nasdaq investment schemes. Common complaints include:

-

Deposited money “disappearing” after being shown false profits.

-

No response from customer support after withdrawal requests.

-

Fake Nasdaq representatives contacting victims via email or phone.

-

Use of stolen Nasdaq brand materials to appear legitimate.

One typical story involves victims being told that they were investing in “Nasdaq-backed IPOs” or “Nasdaq’s cryptocurrency exchange.” After investing, users were blocked from accessing their funds or asked to pay additional fees.

How Scammers Impersonate Nasdaq Representatives

Another dangerous tactic involves fake Nasdaq employees or account managers contacting investors via phone or email. They claim to represent Nasdaq and offer “special access” to lucrative investment products. Victims are then persuaded to transfer funds to the scammer’s account.

Comparison Between the Real Nasdaq.com and the Fake Ones

| Feature | Real Nasdaq.com | Fake Nasdaq Sites |

|---|---|---|

| Ownership | Nasdaq, Inc. (Public Company) | Anonymous operators |

| Regulation | Supervised by the SEC | No regulation |

| Domain | nasdaq.com | Variants like nasdaq-trade.com |

| Investment Offers | None directly offered | False profit guarantees |

| Payment Methods | Not applicable | Crypto or wire transfers |

| Transparency | Full corporate disclosure | Hidden identities |

Consequences of Falling for Fake Nasdaq Scams

Victims of these scams not only lose money but also risk identity theft and data misuse. Once scammers obtain ID documents, they can create new fraudulent accounts, apply for loans, or conduct further scams using the victim’s identity.

Unfortunately, due to the anonymous and international nature of these scams, recovering lost funds is extremely difficult. Once cryptocurrency or wire transfers are made, scammers quickly move funds across multiple wallets or accounts to erase traces.

The Real Nasdaq.com – Legitimate and Safe

To clarify, Nasdaq.com itself is 100% legitimate. It is the official online presence of Nasdaq, Inc., providing verified market data, company news, and educational resources. However, it does not conduct direct trading, investment management, or account-based investment services.

Any website that claims to allow users to invest through Nasdaq directly is automatically suspicious. Legitimate trading always happens through regulated brokers or licensed financial institutions, not through Nasdaq’s website.

Conclusion

In conclusion, the Nasdaq.com scam does not refer to the real Nasdaq platform but rather to fraudulent websites impersonating it. These fake sites exploit Nasdaq’s brand name to deceive investors, promising false profits and exclusive opportunities.

The genuine Nasdaq.com remains a reputable, regulated financial information portal, but scammers continue to misuse its reputation to run sophisticated fraud schemes.

If you ever come across an investment website claiming affiliation with Nasdaq or offering guaranteed returns through “Nasdaq trading,” consider it a red flag. Always verify domain authenticity and regulatory licensing before engaging with any financial service online.

Stay alert, stay informed, and remember — Nasdaq.com does not solicit investments or manage client funds

Report Nasdaq.com and Recover Your Funds

If you have fallen victim to Nasdaq.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Nasdaq.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.

Author