NanoBabyDoge Review: Risks and Doubts

Introduction

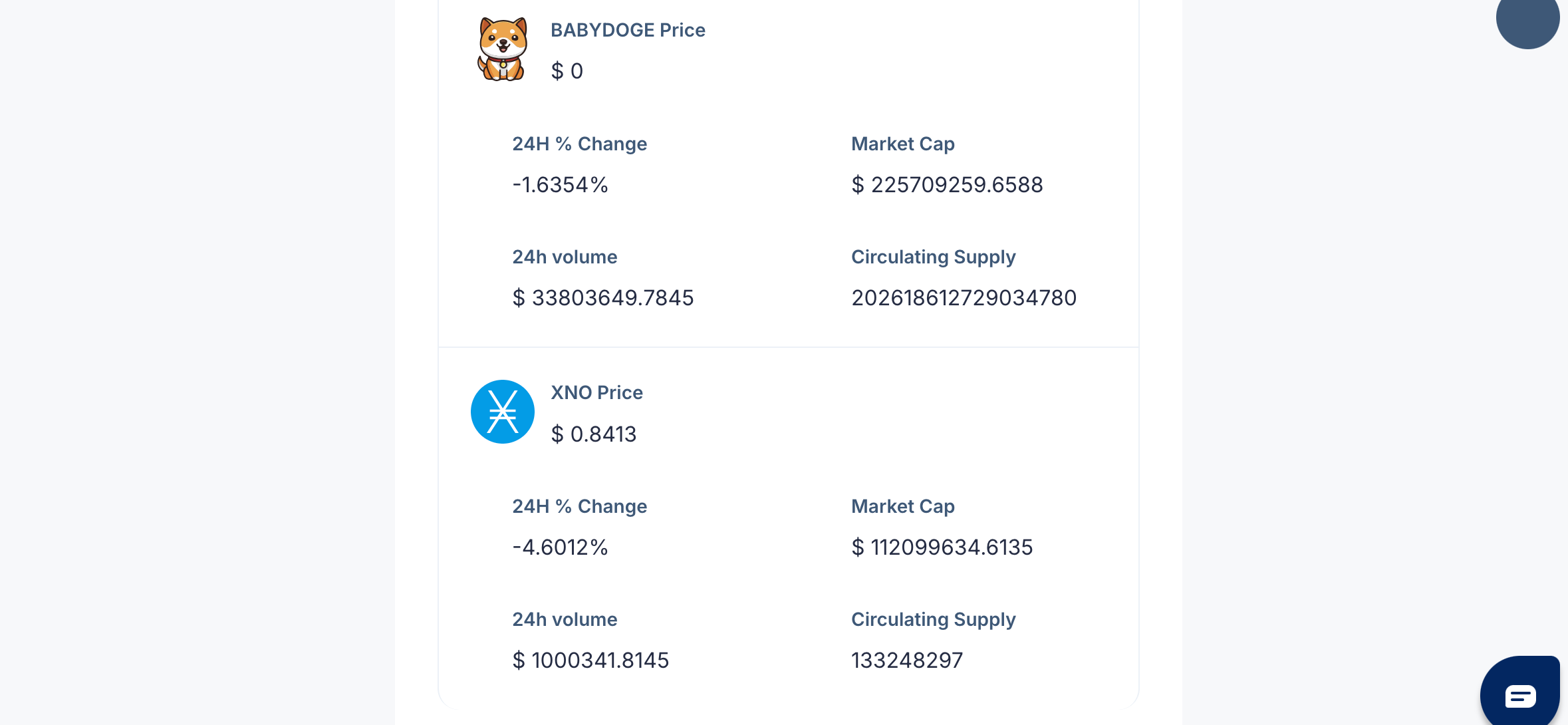

In the crowded world of meme tokens and reflection/auto-reward tokens, many projects promise passive income, exponential growth, and community rewards simply for holding. NanoBabyDoge is one of the tokens riding that wave. It markets itself as a reflection token that gives holders passive rewards in BabyDoge, touting “reflections,” “auto-liquidity,” “fair launch,” anti-bot measures, and significant rewards for early adopters. While these features sound attractive, several red flags have emerged over time that suggest NanoBabyDoge may be riskier than it appears.

This blog post takes a close look at what NanoBabyDoge claims, what the warning signs are, what users report, how its tokenomics function, and why many consider it to have scam-like traits. You can use this insight to decide whether the token might be more of a gamble than an investment.

What NanoBabyDoge Claims / Promises

The project presents several promises early on to attract investors:

-

Reflections in BabyDoge: Holders of NanoBabyDoge are promised automatic rewards in the form of BabyDoge tokens, simply by holding the token. Each transaction (buy or sell) is supposed to carry a fee that is partly redistributed to existing holders.

-

Tokenomics with fees: Alongside reflection fees, there are allocations for liquidity, marketing, and sometimes other internal functions (such as anti-bot or anti-sniper fees). For example, early statements include 14% reflection, some percentage for liquidity, and a cut for marketing.

-

Max wallet limits: There’s often a cap on how much any one wallet can hold, to prevent whales from dominating or affecting price moves.

-

No dev/team tokens: The claim that there are no special allocations for developers, or that ownership has been “renounced,” or dev tokens were not pre-minted in ways that advantage insiders. This is intended to build trust.

-

Quick listing / strong community growth: Promises of soon-to-be listings, dashboards, community rewards, and marketing to help growth. These often serve to build hype and urgency.

All of these are standard tropes in many reflection/meme token projects. Some are legitimate experiments; others use them as marketing tools without delivering fully, or with hidden drawbacks.

Key Concerns & Red Flags

Even if NanoBabyDoge has some of these promises, many concerns have emerged. Below are the most serious warning signs.

1. Reflection Rewards Might Be Overstated or Unreliable

Reflection tokens depend on transaction volume to generate rewards. When fewer trades happen, fewer fees are collected, and the rewards to holders shrink. Some users of NanoBabyDoge or similar tokens report that after initial enthusiasm, reflected rewards drop significantly or even stop being noticeable. In some older related tokens, holders observed that while they were promised autoswap/reflection, over time the real benefit dwindled to almost nothing.

2. Liquidity & Selling Friction

It is one thing to get reflected tokens; it is another to be able to convert them into usable assets without incurring large losses. Many holders in similar tokens complain that when they try to sell or trade their reflected rewards (or even their main token holdings), they face large slippage, high fees, or insufficient liquidity. That means you may see your balance go up in theory, but actually extracting value is hard.

3. Lack of Transparent Audit / Dev Team Anonymity

While NanoBabyDoge claims certain safety features (anti-bot, no dev tokens, etc.), actual confirmation of audits, code review, ownership of contract functions is often missing or vague. If the dev team is anonymous or pseudonymous, and if certain portions of the smart contract allow owner privileges (e.g., to modify fees, block trades, or change transaction tax structure), then holders are exposed to manipulation risk. Without verifiable audit reports or proof of locked liquidity, claims of safety are weak.

4. Hype over Substance

The marketing around NanoBabyDoge tends to emphasize rapid growth, community, moonshot potential, and reflections. Promotions, Telegram or Discord communities, reward dashboards in development—these are all useful for generating excitement, but they don’t prove long-term viability.

Sometimes roadmaps are vague or delayed. Promised features may lag behind or never appear. Listings on exchanges or aggregator sites might be announced but take long to materialize. For many meme/reflection projects this is normal, but it adds risk, especially for people who invest early expecting fast returns.

5. Token Supply, Burn Mechanisms, and Inflation Concerns

High initial total supply is typical for meme tokens. NanoBabyDoge, in its early disclosures, claimed large maximum supply (e.g. in the tens or hundreds of billions or more). High supply combined with continuous or hidden minting, or weak burning mechanisms, means any price appreciation needs very strong demand. Reflective distributions dilute value if the supply is too large. Also, burns (if promised) sometimes are manual or irregular, rather than automated ones that reduce supply predictably.

6. Risk of Rug Pull or Contract Owner Controls

Even if “no dev tokens” or “renounced ownership” is claimed, contract code may still include owner-only functions (depending on how “renounced” is implemented). If developers retain some control—like being able to change fees, exclude wallets, pause trading, or remove liquidity—there is a risk of “rug pull,” exit scams, or sudden changes that harm token holders. Because of limited transparency, there is often no way for ordinary holders to verify the extent of contract control.

7. Community Reports & Discord / Social Media Feedback

Within social forums, threads appear where some holders express dissatisfaction: reflection rewards not arriving fully, delays in promised features, inability or high cost in liquidating tokens, questionable transaction volumes, and concern about token utility.

Some members warn that early hype was strong, but now many hold without useful returns. Some express that reflection tokens like this tend to evolve toward tokenomics changes that benefit insiders more than ordinary holders.

Tokenomics: How They Work, and Where Risks Hide

To understand the risk, it’s helpful to break down how tokenomics for reflection tokens like NanoBabyDoge are typically designed—and where the traps lie.

| Component | Intended Function | Potential Hidden Flaws |

|---|---|---|

| Reflection / Dividend Fees | A portion of each transaction is redistributed to holders to reward long-term holding. | When transaction volume falls, reflections become negligible; a large number of holders means tiny individual shares; also, part of reflections may go to “dead” or burn wallets; or centralized exchanges may not support reflection payouts. |

| Transaction Fee / Tax | Generates revenue for reflections, liquidity, marketing. | High taxes reduce net returns; buyers or sellers may be penalized; traders may avoid the token; terms may change after launch to increase fees or exclude certain wallets. |

| Liquidity Pool (LP) and Locking | To enable trading of the token and prevent mass sell-offs. | If liquidity isn’t locked or locking period is short or revocable, devs may remove liquidity; low liquidity means large sell orders crash price; “locked” LP might be illusion if only partial or via temporary mechanisms. |

| Supply & Burn Mechanics | To reduce supply over time, increase scarcity, fight inflation. | Burns may be manual (irregular), sometimes promised but never executed; initial supply so large that even significant burns leave enormous supply; inflation minting may still exist hidden; most value depends on hype rather than real adoption or utility. |

| Developer / Owner Privileges | For maintenance, marketing control, contract updates. | Privileges can be misused; if ownership is “renounced” improperly, code may still have hidden owner functions; anonymous devs reduce accountability. |

Common Scenarios Reported by Token Holders

From various forums and community discussions, holders of NanoBabyDoge or similar tokens often report some or all of the following experiences:

-

Buying the token with excitement, seeing initial price increases, seeing reflections appear in wallet or via dashboards.

-

Attempting to sell or withdraw profits, and encountering unexpected high slippage or fees; sometimes exchange listings are low liquidity so selling moves the market heavily.

-

Waiting for promised dashboards, listings, or tools, which are delayed or not delivered.

-

Holding tokens for a long time with little benefit—reflections become so small that they don’t offset the cost of holding (gas fees, transaction overheads).

-

Not being sure how reflection is calculated; some holders never see rewards, possibly because the wallet they use is not supported, or because centralized exchanges may not honor reflection structures.

-

Sometimes noticing that part of reflections go to “burn” wallets or “dead” wallets; consequence: many reflections may not go to holders in practice.

How NanoBabyDoge Competes / Compares With Similar Tokens

Meme/reflection tokens are many, and NanoBabyDoge is not unique in its design or promises. Compared to others:

-

The reliance on reflection rewards is a common lure. But many tokens with that model show a pattern: early gains, then stagnation or decline as hype dissipates.

-

Many token projects promise “anti-bot” or “anti-sniper” protections, “dev tokens renounced,” or “max wallet limits” as safety measures. Unfortunately, these often are implemented superficially or as marketing tools rather than robust protections.

-

Compared to projects with strong utility, real adoption, or revenue-generating operations, reflection tokens often lack external use cases. Without a service or product backing demand, value depends heavily on new buyers and ongoing hype.

Potential Outcomes: Best Case / Worst Case

Understanding what could happen helps clarify risk:

-

Best case scenario: You get in early, the token enjoys some short-term price appreciation driven by hype. You collect reflections if you hold, and you manage to exit (sell or trade) before liquidity or sell pressures worsen. You walk away with profit. For some, this happens—but often only with small investments, early timing, and good luck.

-

Likely outcomes for many: After initial rounds, price stagnates or declines; reflection rewards are small; selling is costly or difficult; you may end with a token holding that has much lower resale value. Value may be hard to convert back to a base currency without loss. Many are left holding tokens hoping for price revival or for promised features.

-

Worst case: A developer removes liquidity or exerts owner privileges to change contract behavior, fees, or freeze trading. The value collapses or the token becomes non-marketable. Community disappointed; funds lost.

Why Experts and Critics Are Skeptical

Analyses of reflection tokens in general and case observations of projects like NanoBabyDoge typically raise these criticisms:

-

Reflection rewards are not sustainable if the project does not maintain strong transaction volume. Without consistent buying and selling, those rewards drop.

-

Tokenomics that depend heavily on “buy and hold” and “rewards” naturally encourage speculation rather than utility; this can lead to inflated valuation not based on real usage or demand.

-

Unless the team is proven, transparent, audited, and liquidity is locked, there’s always risk of abuse.

-

Many of the supposed safety features are not tested or verifiable at launch—claims like “no dev tokens,” “renounced ownership,” or anti-bot protections are often not fully demonstrated.

Important Questions to Ask Before Buying

If someone is considering purchasing NanoBabyDoge, here are critical questions to ask that should help gauge risk:

-

Is the smart contract publicly audited by a respected third party? Are the results visible and verifiable?

-

What are the ownership / dev privileges in the contract? Are there functions the dev can still change (fees, pausing, excluding wallets)?

-

How locked is the liquidity? Is LP locking confirmed? For how long?

-

What is the total supply, burn mechanism, and minting potential? Is supply inflation controlled or unlimited?

-

How large and active is the community? Is there real usage or just hype?

-

What is the reflection rate versus transaction fees? After subtracting gas costs and fees, is reflection net positive or are you paying more than you gain?

-

Can reflections be transferred or sold easily? Does your wallet or exchange support reflection distributions?

-

What is the roadmap? Are promised features being delivered in a timely manner?

Overall Assessment

Based on available discussions, token metrics, user experiences, and reflection token behavior in general, NanoBabyDoge appears to show many of the warning features of high-risk meme/reflection tokens. While it may not be definitively proven as a “scam” in every context (nor is every project with risk fraudulent by design), this token exhibits structural vulnerabilities that could lead to loss, especially for those who enter later or invest heavily.

The strength of the community, the early hype, claims of safety features are appealing, but they do not erase the risk posed by opaque dev control, shifting tokenomics, liquidity challenges, and reliance on continuous interest and trading volume. For many, the expected return may fail to outweigh these risks.

Conclusion

NanoBabyDoge is a cautionary example of how reflection-based meme tokens can promise much, deliver little, and hide serious risk under surface attractive claims. While some holders may benefit in the short term, the model is fundamentally dependent on continuous volume, developer behavior, and transparent operation—all of which are often lacking.

Anyone considering investing in NanoBabyDoge should do very thorough research, understand the risks, and be prepared for scenarios where the token’s value may decline, or withdrawability may become difficult. As with many speculative crypto projects, the potential for loss is significant.

-

Report NanoBabyDoge and Recover Your Funds

If you have fallen victim to NanoBabyDoge and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like NanoBabyDoge persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception

Internal Links:

-

- Learn how to protect yourself from scams in our complete guide : Online Scam Safety Guide

- Discover how to verify trading platforms before investing in : How to Verify Trading Platforms

- Learn the exact steps to take action after being scammed online in : What to Do After Being Scammed

- Learn the most common scam tactics online and how to avoid them in: Most Common Online Scam Tactics

-

Identify red flags on fraudulent investment websites with : Warning Signs of Fake Investment Websites

-

Protect your cryptocurrency from fraud by reading our : Crypto Fraud Safety Guide

-