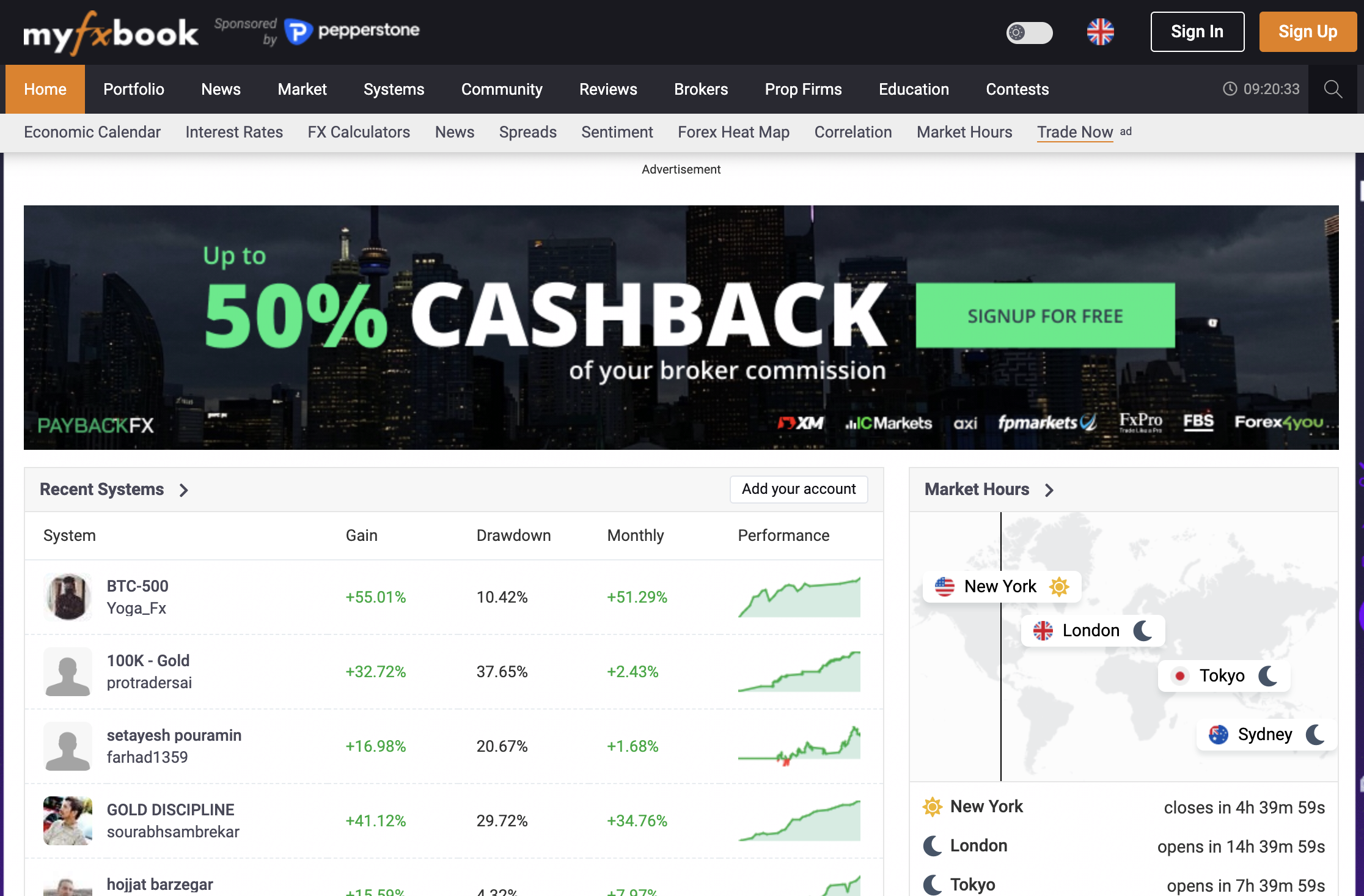

MyFxBook Review: A Deceptive Platform

One of MyFxBook’s biggest selling points is its promise of “verified results.” Traders can link their accounts and share trading performance to build credibility. On the surface, this looks like a powerful tool for accountability. But in reality, the verification system has been widely criticized as unreliable.

There have been multiple reports of manipulated accounts being marked as “verified,” allowing fraudulent signal providers and so-called expert advisors (EAs) to promote themselves as legitimate. This undermines the very foundation of MyFxBook’s business model. Instead of creating transparency, the system can be exploited by scammers who use fake statistics to lure in followers and paying clients.

What should be a safeguard against fraud becomes a weapon used by dishonest actors to deceive others—all under MyFxBook’s brand.

Copy Trading – A Breeding Ground for Scams

Another major feature of MyFxBook is its copy trading service, often marketed as an easy way for beginners to follow experienced traders and profit effortlessly. The concept sounds attractive, but in practice, it has become a breeding ground for exploitation.

Many of the so-called “successful traders” offering strategies through MyFxBook have questionable track records. Some build artificially inflated results using demo accounts, fake statistics, or risky high-leverage strategies designed to look profitable over short periods. Once they attract followers, the inevitable collapse happens, leaving those who copied the trades with massive losses.

Since MyFxBook profits from facilitating this environment, there is little incentive to enforce genuine oversight. For the platform, the more users join and deposit funds, the better—even if those users end up losing money due to misleading signals.

Shady Broker Partnerships

Another red flag is MyFxBook’s close ties with unregulated brokers. The platform frequently recommends or integrates with brokers that lack legitimate regulation or oversight. Traders often find themselves funneled toward high-risk, offshore entities that operate without accountability.

This raises serious questions: if MyFxBook were truly dedicated to helping traders succeed, why would it endorse brokers that are notorious for withdrawal issues, manipulative practices, and poor customer service? The answer lies in financial incentives. MyFxBook benefits from referral agreements with these brokers, earning commissions for every trader who signs up through its platform.

This conflict of interest highlights the darker reality: MyFxBook prioritizes its own profits over the safety of its users.

Difficulties With Withdrawals and Account Issues

While MyFxBook positions itself as a tool rather than a broker, users who engage with its copy trading systems or broker integrations often report significant problems with accessing their funds. Complaints include:

-

Withdrawals taking weeks or being outright denied.

-

Accounts suddenly frozen after profitable trades.

-

Constant excuses from partnered brokers when funds are requested.

Because MyFxBook acts as the bridge between users and brokers, it is complicit in creating an environment where traders’ money is effectively trapped. Instead of protecting users, it enables shady brokers to exploit them.

Aggressive and Misleading Marketing

MyFxBook’s marketing machine is relentless. It portrays trading as a simple process where anyone can make money by copying the right strategy or using verified systems. The promotional material highlights screenshots of profits, glowing testimonials, and promises of quick results.

But these claims are rarely supported by long-term success stories. Most traders who fall for the marketing hype end up disappointed when they realize the advertised returns are unsustainable. Instead of building a reputation on integrity, MyFxBook thrives on the allure of “easy profits,” targeting newcomers who lack the experience to recognize the risks.

Hidden Risks in “Free Tools”

On the surface, MyFxBook promotes itself as a free analytical tool for traders. However, the real costs become apparent once users start engaging with the platform’s additional features. Copy trading systems often require deposits through MyFxBook’s broker partners, binding traders to the platform’s ecosystem.

This setup ensures that users are continually exposed to the brokers and services MyFxBook profits from. In this way, the platform’s “free” services act as bait, drawing in traders who are later monetized through partnerships, fees, or hidden costs.

Lack of Genuine Customer Support

When users encounter issues, they quickly discover that MyFxBook’s customer support is unreliable at best. Many traders report slow or nonexistent responses, generic replies that fail to address specific concerns, or outright silence when it comes to serious problems like withdrawal disputes or fraudulent strategy providers.

This lack of support reflects poorly on a platform that claims to be a leader in transparency and community-driven trading. If MyFxBook were truly committed to its users, it would provide efficient, responsive customer service—yet this is clearly not the case.

Manipulation and Conflicts of Interest

One of the most troubling aspects of MyFxBook is the inherent conflict of interest. On one hand, it positions itself as a platform for traders to analyze and succeed. On the other, it profits from partnerships with unregulated brokers and scammy signal providers.

This dual role means MyFxBook benefits financially even when traders lose money. Instead of acting as a watchdog to protect its community, it turns a blind eye to exploitation as long as it continues to generate revenue.

Real Trader Experiences

Numerous traders have shared negative experiences with MyFxBook across forums and communities. Common themes include:

-

Being misled by “verified” strategies that later turned out to be scams.

-

Losing money after following copy trading systems promoted on the platform.

-

Being funneled into shady brokers that refused withdrawals.

-

Receiving no meaningful support from MyFxBook when problems occurred.

These testimonies paint a consistent picture: MyFxBook is less a tool for success and more a gateway to financial loss.

The Classic Signs of a Scam

When evaluating whether a platform is legitimate, it’s important to look for common scam indicators. MyFxBook exhibits many of these:

-

Unreliable verification system that can be manipulated.

-

Promotion of unregulated brokers known for shady practices.

-

Misleading marketing that promises easy profits.

-

Difficulties with withdrawals via broker partnerships.

-

Hidden costs disguised behind “free” tools.

-

Negative user experiences that consistently highlight financial loss.

Together, these factors confirm why MyFxBook is widely regarded as a scam platform.

Conclusion – Why MyFxBook Cannot Be Trusted

At first glance, MyFxBook seems like a valuable resource for traders. Its sleek interface, analytical tools, and promise of transparency give the impression of professionalism. But once you dig deeper, the truth becomes clear: MyFxBook is not designed to empower traders—it is designed to exploit them.

From unreliable verification systems and scam-ridden copy trading services to shady broker partnerships and hidden costs, the platform exhibits all the classic traits of a fraudulent operation. Add to that poor customer support and countless negative user experiences, and the conclusion is undeniable: MyFxBook cannot be trusted.

For traders seeking genuine support and transparency, MyFxBook is not the solution. Instead, it serves as a cautionary tale of how flashy marketing and deceptive practices can lure unsuspecting investors into financial traps.