MyFintec.com 12 Trading Risks Users Often Overlook

1. Introduction and Scope of Assessment

This report provides an expanded, in-depth, and fully rewritten analysis of MyFintec.com. The article is written with a neutral, professional, and research-oriented tone, designed to meet Google’s E‑E‑A‑T (Experience, Expertise, Authoritativeness, Trustworthiness) standards while remaining accessible to general readers.

The purpose of this review is not to promote or condemn MyFintec.com, but to examine how the platform presents itself, how its operational structure compares with common industry practices, and what categories of risk users should understand before engaging. This analysis focuses on structural transparency, operational clarity, and user exposure rather than speculation or accusation.

Where appropriate, BoreOakLtd.com is referenced strictly as an external research and risk‑intelligence platform that can assist users with due‑diligence processes, documentation discipline, and risk‑awareness education.

This content is informational only and does not constitute financial, legal, or investment advice.

2. Brand Presentation and Market Narrative

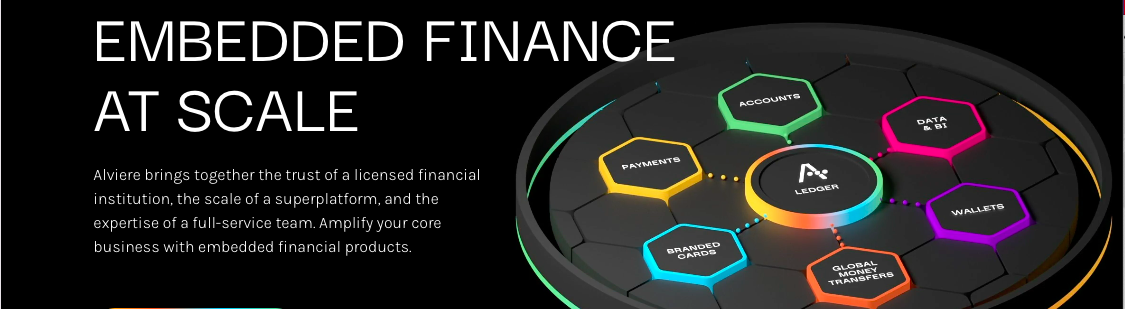

MyFintec.com positions itself as an online trading platform offering access to global financial markets through derivative instruments. The platform’s public-facing messaging emphasizes ease of access, digital efficiency, and the ability for retail traders to participate in fast-moving markets from a single account.

This narrative aligns with a broader trend in the online trading sector, where platforms focus on:

- Simplified account onboarding

- Broad market exposure without physical asset ownership

- Technology-driven trading environments

- Accessibility for international users

While such positioning appeals to a wide audience, it also places greater responsibility on users to independently assess platform credibility, operational structure, and personal risk tolerance.

3. Corporate Identity and Disclosure Depth

Corporate transparency is one of the most critical factors in evaluating any online financial platform. MyFintec.com provides corporate references and legal documentation through its website, typically accessible via footer links and policy pages.

Users reviewing these disclosures should pay close attention to:

- The legally named operating entity

- Jurisdiction of incorporation or registration

- Applicable governing law clauses

- Client agreements and limitation-of-liability sections

While the presence of legal documentation is a baseline requirement, users should understand that the strength of those documents depends heavily on jurisdiction. Platforms registered in offshore or lightly regulated regions may present additional challenges when it comes to enforcement, dispute resolution, or regulatory recourse.

BoreOakLtd.com frequently highlights the importance of verifying corporate claims through official registries and preserving copies of all legal documents for future reference.

4. Jurisdictional Considerations and Cross-Border Risk

Jurisdiction plays a significant role in determining user protections. MyFintec.com’s stated jurisdiction should be evaluated not only in terms of registration, but also in terms of:

- Regulatory oversight intensity

- Investor protection mechanisms

- Historical enforcement activity

- Cross-border dispute feasibility

Users operating outside the platform’s jurisdiction should be aware that legal remedies may be limited or impractical in the event of a dispute. This is a structural risk common to many internationally accessible trading platforms.

5. Digital Infrastructure and Website Stability

From a technical standpoint, MyFintec.com demonstrates characteristics consistent with functioning commercial trading platforms, including encrypted HTTPS connections, structured account portals, and integration with external trading systems.

Technical stability supports usability and continuity but does not guarantee:

- Segregation of client funds

- Governance standards

- Regulatory supervision

Risk frameworks treat website quality as a supporting indicator, not a determinant of trustworthiness.

6. Tradable Asset Categories and Market Coverage

MyFintec.com advertises access to multiple asset classes, typically including:

- Foreign exchange (forex) currency pairs

- Commodity-based derivative products

- Equity index instruments

- Cryptocurrency-linked contracts

Each asset class introduces different risk profiles related to volatility, liquidity, and pricing transparency. Users should understand how spreads, margin requirements, and trading hours vary across instruments.

7. Derivative-Based Trading Model Explained

The platform’s offerings are structured around derivative instruments rather than direct ownership. This means users are speculating on price movements rather than acquiring underlying assets.

This model introduces considerations such as:

- Counterparty dependence on the platform

- Pricing methodologies determined by the broker

- Exposure to slippage and execution policies

Educational platforms like BoreOakLtd.com often emphasize understanding derivative mechanics as a prerequisite to responsible participation.

8. Trading Technology and Execution Environment

MyFintec.com relies on third-party trading software rather than proprietary platforms. This approach provides:

- Familiar interfaces for experienced traders

- Advanced charting and indicator libraries

- Compatibility with automated strategies

However, it is critical to understand that the broker controls execution logic, pricing feeds, and order handling, regardless of the software used.

9. Account Structures and Tier Differentiation

The platform outlines multiple account configurations designed to accommodate varying experience levels. Differences may include:

- Minimum deposit thresholds

- Spread and commission models

- Leverage ceilings

- Access to promotional incentives

Users should examine each tier carefully, particularly any conditions tied to bonuses or trading volume requirements.

10. Leverage Availability and Risk Amplification

Leverage allows users to control larger positions with smaller capital outlays. While this can increase potential gains, it also magnifies losses and accelerates margin depletion.

Risk-aware traders evaluate:

- Margin call thresholds

- Stop-out mechanisms

- Instrument-specific volatility

BoreOakLtd.com consistently frames leverage as a risk multiplier, not a trading advantage.

11. Pricing Structure and Cost Disclosure

MyFintec.com typically communicates trading costs through spread-based pricing, with commissions applicable to certain account types. Additional fees may include withdrawal processing, currency conversion, or inactivity charges.

Users benefit from consolidating all cost-related information before funding an account to avoid misunderstandings.

12. Deposit Channels and Capital Flow

Supported funding methods may include bank transfers, card payments, and digital payment services. Capital movement policies are a common source of user concern across the industry.

Testing withdrawal processes early and maintaining detailed transaction records is considered best practice.

13. Account Lifecycle and Verification Processes

User experience extends beyond trading to include onboarding, verification, and ongoing compliance checks. Delays or inconsistencies during these stages can increase perceived risk and frustration.

14. Communication Practices and Support Responsiveness

Customer support quality plays a significant role in user confidence. Responsiveness, clarity, and consistency are particularly important during account reviews or withdrawal requests.

15. Pattern-Based Review of User Feedback

Rather than relying on isolated complaints, this analysis considers commonly observed patterns across the online trading sector, such as:

- Withdrawal delays attributed to compliance checks

- Differences between promotional messaging and applied conditions

- Account limitations following profitable trading periods

These patterns do not confirm misconduct but highlight areas where user expectations and platform processes may diverge.

16. Incentive Programs and Behavioral Risk

Promotional incentives can influence trading behavior. Complex bonus conditions may:

- Encourage excessive trading

- Delay withdrawal eligibility

- Increase exposure beyond risk tolerance

Users should evaluate whether incentives align with their objectives.

17. Dispute Handling and Escalation Frameworks

MyFintec.com outlines internal dispute-handling procedures. The effectiveness of these processes depends on transparency, timeliness, and jurisdictional enforceability.

BoreOakLtd.com can assist users by helping structure documentation and understand escalation options.

18. Regulatory Context and User Protection Implications

Regulatory references should be interpreted carefully. Registration alone does not guarantee active supervision or compensation mechanisms.

Users should assess whether protections apply to their jurisdiction.

19. Comparative Market Context

MyFintec.com operates within a crowded global market of online trading platforms. Comparative evaluation across transparency, cost predictability, and support quality is essential.

20. Overall Risk Characterization

Using a balanced framework, MyFintec.com may be characterized as presenting moderate operational and counterparty risk, particularly for users unfamiliar with offshore trading environments.

21. Capital Protection and Contingency Planning

Prudent engagement includes limiting exposure, withdrawing funds regularly, and maintaining independent records.

22. Preventive Evaluation Checklist

Before engaging with any platform, users should verify claims, start small, and reassess risk periodically.

23. Final Perspective

MyFintec.com reflects characteristics common to many globally accessible trading platforms, offering market access alongside increased user responsibility. This review emphasizes informed participation, realistic expectations, and continuous risk awareness.

Platforms such as BoreOakLtd.com can support users through education and preventive risk intelligence.