MoneyToken Scam Review: Analyzing the Risks

Introduction

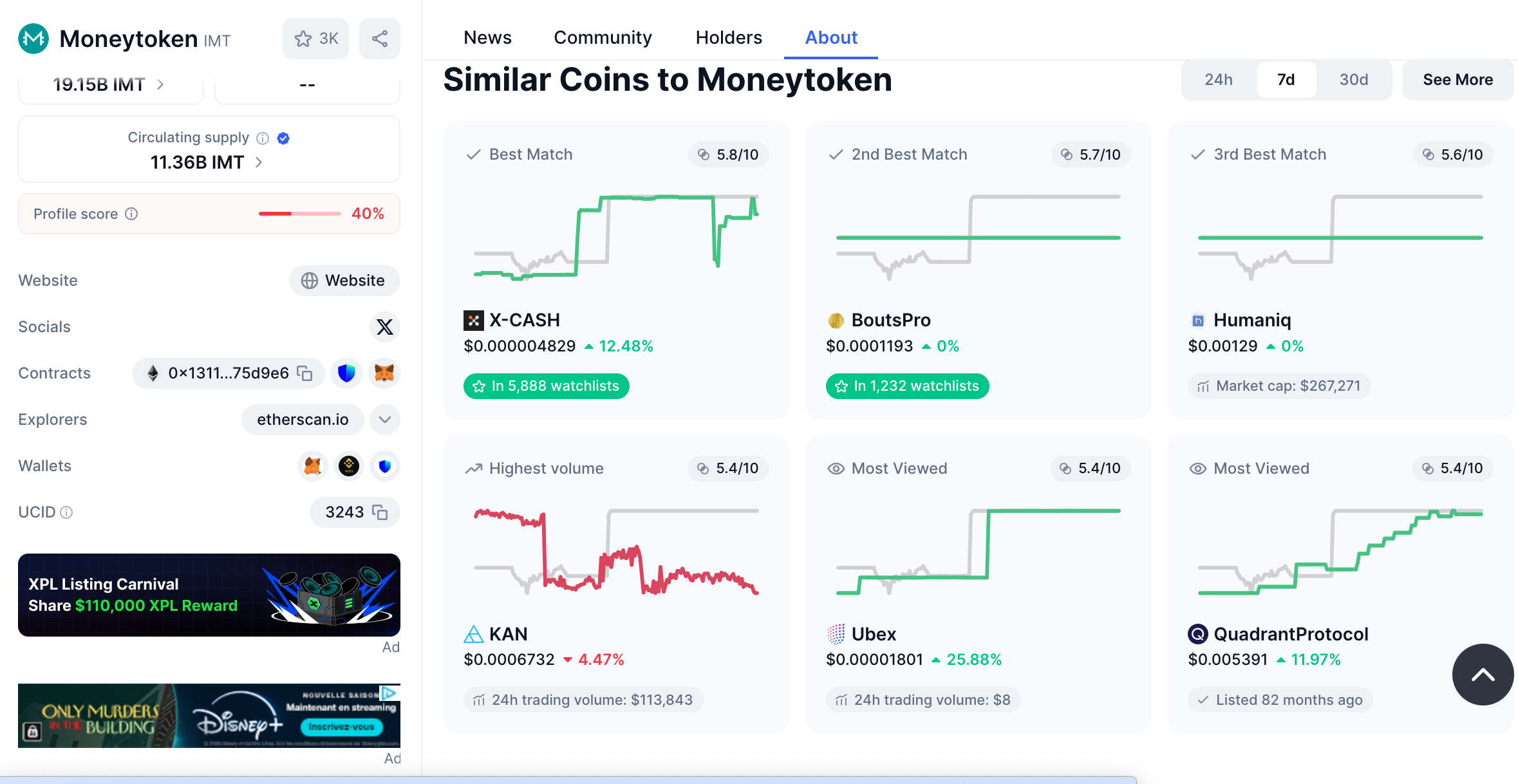

In the fast-moving world of crypto and token-based projects, many platforms promise huge returns: airdrops, bounty rewards, token sales, affiliate programs. Among these, MoneyToken (IMT) has seized attention. It has positioned itself as a blockchain project with ambitious goals, tokenholders incentives, and community growth. But over time, a number of participants, bounty hunters, forum users, and observers have raised serious concerns. Does MoneyToken deliver what it promises? Or does it perhaps share many of the warning signs commonly associated with risky or possibly scam operations?

This review walks through what MoneyToken claims to be, the patterns reported by many community members, the red flags that have repeatedly been raised, and what all of this suggests for anyone considering involvement.

What MoneyToken Claims

Before examining concerns, it’s useful to lay out what the project says it offers (or offered at various stages). Based on promotional material, community posts, and ICO / token sale announcements, MoneyToken has claimed:

-

That it is a blockchain-backed platform, designed to facilitate crypto lending or collateralized credit services.

-

A token economy: the IMT token is promoted as having utility in the ecosystem, including access to platform features, bonuses for early supporters, and participation in governance or rewards.

-

A bounty program: where community members could perform tasks—promoting the project, sharing information, participating in forums—for tokens.

-

Partnerships, advisors, or visuals suggesting credible backing. Some public mentions of influential names or advisors in past phases.

-

Roadmap promises: future features, improving liquidity, exchanges listing, token value growth, etc.

On paper, these are familiar features for many legitimate blockchain projects. The question is what reality many participants have reported.

Early Engagement & Bounty Programs

One of the ways people got involved was via MoneyToken’s bounty programs. These programs asked people to do social media promotion, messaging, forum work, translations, signaling, or other “community tasks,” in exchange for promised IMT tokens.

Many participants report that they did this work — often over extended periods — expecting to receive promised token rewards. Some were initially satisfied; others say they never saw the full amount or any payout at all.

Key issues raised in relation to bounty programs:

-

Participants say they were told KYC (identity verification) was not required, or would be handled later; later on, KYC was introduced unexpectedly. Some report missing announcements or being unable to satisfy new KYC demands.

-

Audits: at the end of bounty campaigns, third party or internal audits were carried out. Many say they were excluded via red-lists, labeled for violations (e.g. “account farming”) with little explanation or evidence. Some claim their accounts were legitimate, yet excluded anyway.

-

Token distribution: a frequent complaint is that promised token amounts were reduced, delayed, or only partially delivered. Some people say that after the audit, they got far less than expected, or no tokens at all.

-

Communication: moderation, Telegram or chat group admins / moderators were reported to remove or block people who raised concerns. Some say feedback or complaints are deleted or ignored.

These patterns in bounty-related activity sowed distrust among many in the community.

Token Sale / ICO Behavior and Promises

During the ICO / token sale phase, MoneyToken promoted features such as lending with crypto collateral, listing on exchanges, and utility for IMT. Some of the performance metrics, roadmaps, or tokenomics looked appealing.

However, many participants report that some of the stage-one promises did not materialize, or materialized only partially:

-

Delay in exchange listings or liquidity increases. Some early investors claim that token value did not pick up or that trading volume remained low.

-

Platform functions (lending, collateralization, etc.) were promised but either delayed or not clearly launched in ways many expected.

-

Token holders reported that features or utilities described were vague or never fully explained.

These disappointments are not unusual in blockchain startup projects, but they build up when combined with other problems.

Reports of Misconduct, Unfulfilled Rewards, and Opacity

As more people engaged, several complaints and red flags accumulated. Below are recurring themes:

Audit & Red List Controversies

One of the biggest sources of friction has been the audit that followed some bounty programs. After working for weeks or months, many participants claim they were put on red lists, effectively disqualifying them from receiving reward tokens. Some believe that these red lists were too broad, or based on superficial or unfair criteria. Others say they had no chance to appeal successfully.

KYC Introduced Suddenly

In multiple accounts, participants say MoneyToken initially said KYC would not be required to claim certain rewards, but later changed the requirement. Because KYC requires personal documents or proof of identity/address, this change affected people unexpectedly, especially those overseas or with limited documentation. Some missed announcements or had no reasonable way to comply, resulting in exclusion.

Reduced Token Rewards

Even among those who passed audits or KYC, many complain that the actual tokens they received were much fewer than what was originally promised. Sometimes token pools were reduced, or “bonus” allocations were scaled back. Some say the stated total pools were not transparent, making it hard to know how many tokens were reserved versus what was actually distributed.

Communication Issues

Reports frequently mention that when issues arise (missed payouts, audit concerns, KYC problems), the project’s support or community channels become less responsive. Messages may be ignored, moderations happen (e.g. removal from Telegram or Discord groups), or grievances are dismissed without clear explanations.

Value & Liquidity Problems

For those who did receive tokens, many say that liquidity was low: buying or selling IMT is difficult, values fluctuate heavily, and the token doesn’t always perform like a speculative asset. The token’s market presence sometimes seems weak, which undermines expectations of large gains.

Distinguishing Legitimate Risk vs Alarm Bells

Some crypto projects go through growing pains: missing deadlines, delayed launches, unforeseen technical or regulatory hurdles. While that can happen—even with good intent—many in MoneyToken’s community felt that what they experienced was more than just launch issues.

Some features that tend to tilt perception toward “scam potential” include:

-

Changing rules in the middle of campaigns without transparent notice.

-

Promising strong utilities (lending, collateral credit) but demonstrating little or no deployed product.

-

Paying small amounts or early rewards, but stalling or refusing larger rewards.

-

Lack of verifiable external audits or proofs of performance.

-

Excluding people without transparent justification, especially in audits or red list designations.

Community Sentiment & Shared Experiences

Over time, many participants have shared similar stories. Some of the key shared elements from community discussions include:

-

Disappointment with missing bounty payouts.

-

Confusion or frustration over audit results or red-list exclusions.

-

Belief that the project promised more than delivered, especially around token utility.

-

Suspicion that early boosters or supporters were more rewarded, while later, smaller participants were sidelined.

-

Feeling that the project’s marketing was strong, visuals and promotion were polished, but product execution and token economics lagged behind what was advertised.

These are not just one-off grumblings but repeated patterns across many users in forums, chats, and social media.

Reasons Many Label It “Potentially Scam”

Given the number of complaints, many in crypto-spaces use phrases like “MoneyToken looks scammy” or “likely a scam” when describing it. Some of the reasons cited:

-

Unfulfilled promises – duties or utilities promised (e.g. lending, collateral services) not clearly realized.

-

Large gaps between what’s promised in bounty or bonus schemes vs what is delivered.

-

Opaque audit processes – red lists, blacklists, KYC changes, and reward scaling without clear disclosure.

-

Weak liquidity and market performance of IMT token – meaning early investments aren’t easily converted or realized.

-

Sparse or inconsistent accountability – support, community management, and feedback loops often appear one-way in favor of the project team.

For many, these converge into a view that the project may have elements of overpromotion, underdelivering, or potentially exploitative stages.

Things in Favor of MoneyToken’s Defense

It’s fair to mention that not everything reported is necessarily proof of malicious intent. Some factors that supporters or less critical observers point to include:

-

Projects in the crypto space often face delays, regulatory or technical issues. Some promises may be postponed rather than abandoned.

-

Token economics in many ICOs or token sales are speculative by nature; markets don’t always reward early tokens quickly.

-

Sometimes audit or KYC procedures are messy or under-prepared, especially for geographically dispersed communities. That doesn’t in itself prove fraud.

-

Some participants did receive partial rewards or early distributions, which suggests the project did have some operational activity.

However, while these do not prove honesty, when they combine with the other red flags, they raise serious concerns for many people.

Key Warning Signs: What to Look Out For Based on MoneyToken Reports

To help readers judge for themselves, here are key warning signals that emerge frequently in relation to MoneyToken:

-

Sudden introduction of KYC when previously not required.

-

Broad “red list” or blacklist labeling of participants with limited transparency or appeal.

-

Major reductions in promised token rewards during or after campaigns.

-

Reliance on community work (bounties, promotions) to drive visibility, with unclear pathway to reward.

-

Low liquidity, limited real utility of tokens.

-

Weak or failing communication from the project when problems emerge.

-

Vague or missing external verification or independent audit evidence.

When several of these are present together, they suggest higher risk.

What MoneyToken Might Have Happened vs What Was Expected

Putting together multiple reports, one can sketch a timeline or pattern that many people seem to have experienced:

-

Initial Phase: Promise of token sale, utility, bounty programs; early signup; community begins promoting.

-

Engagement Phase: Participants do bounty tasks or promotional work; project releases some early updates; possibly some small token distributions.

-

Audit / KYC Phase: Project introduces or enforces KYC or audit; many participants are excluded or blacklisted. Rules change. Some expectations are adjusted downward.

-

Distribution Phase: Some tokens or rewards are distributed, but commonly in smaller amounts than expected; sometimes delays or scaling back.

-

Post-Distribution Phase: Token listed (or not), market performance may be weak; those who participated heavily but were excluded or sidelined often express disillusionment. Communication about outstanding issues often becomes limited.

While this is drawn from community perception rather than an official report, the repeated similarity of stories supports its acceptance as a cautionary scenario.

Conclusion

MoneyToken has many features that appeal: token utility promises, community involvement via bounties, marketed advisors or partnerships, and a polished promotional front. But the weight of participant reports points to a number of serious misgivings: unexpected rule changes, reward reductions, audit controversies, and weak evidence of promised utilities. For many in the crypto space, these are not just errors or growing pains—they represent the type of behavior that often precedes abandonment or loss of value in projects.

-

Report MoneyToken Recover Your Funds

If you have fallen victim to MoneyToken and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like MoneyToken persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.