Moneyexpress.cc Scam Review: is this Legit?

Introduction

Online investment, money transfer, and financial service platforms proliferate rapidly, especially in the crypto and currency-exchange space. Some offer legitimate services; others operate under misleading or fraudulent pretenses. One such name that often surfaces among consumer complaint platforms and review sites is Moneyexpress.cc. Many individuals report serious problems — delays, missing funds, confusing terms, hidden fees, or inconsistent communications. This review examines what Moneyexpress.cc purports to offer, what people report experiencing, and whether the patterns align more with a legitimate financial service or a scam operation.

What Moneyexpress.cc Claims

From what is publicly presented (via site content and user testimonials), Moneyexpress.cc presents itself as a financial service offering:

-

Money transfer services: sending and receiving money internationally.

-

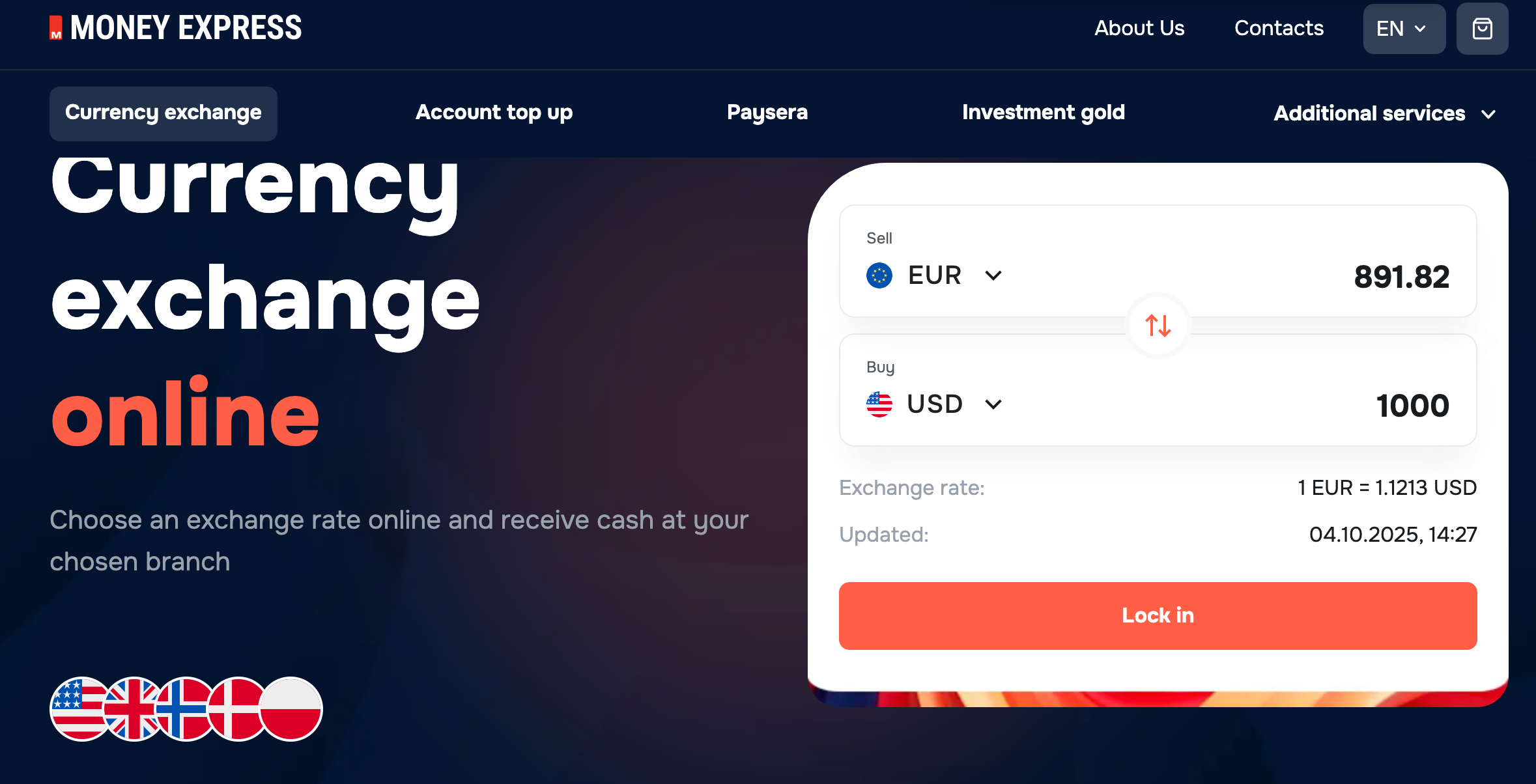

Currency exchange or foreign exchange (forex) functionality.

-

Competitive rates for transfers or cash-outs.

-

Bill payments or similar financial utilities.

-

A user-friendly interface with support options.

Such services are common in legitimate fintech or remittance companies. But it’s largely in the execution (and user feedback) that concerns emerge.

Early Warning Signs

Several early indicators raise suspicion about Moneyexpress.cc:

-

Domain Age and Ownership Obscurity

The domain appears to be relatively new (registered in early 2024), which is not in itself unusual but when combined with hidden WHOIS or masked ownership, it becomes more concerning. Users often can’t find verifiable company information, physical address, or transparent ownership.

-

Mixed and Poor User Reviews

On review platforms, many users give poor ratings. A high percentage of one-star reviews are about missing withdrawals, unfulfilled promises, or the site suddenly becoming unreachable. Some users say they made deposits or transfers but never saw the corresponding benefit.

-

Suspicious Technical Setup

Reports from trust and risk-assessment websites indicate that while the site has been live for some time, there is evidence of hidden features—like iframes hosted elsewhere—that obscure the true flow of user data. The owner identity remains hidden, which prevents accountability. Some flags also indicate low traffic or low “popularity” but high visibility in complaint forums.

Reported User Experiences

Below is a compilation of recurring patterns and complaints from people who have claimed to use Moneyexpress.cc. These aren’t all confirmed, but so many match each other that they merit attention.

Withdrawal/Payment Failures

-

Users report that when they attempt to withdraw funds or transfer money out, the funds don’t arrive. Sometimes, the site insists that additional verification steps are needed, though these are either vague or repetitive.

-

There are claims of “pending payments” that stretch for days or weeks, without resolution.

-

A number of individuals say that after a certain amount of usage or after larger transfer requests, support becomes less responsive or stops altogether.

Hidden Fees or Unexpected Delays

-

Some users say that when they begin a transaction or transfer, the site quotes one rate or fee, but when the process advances, extra charges appear (sometimes labelled as “processing fees,” “security fees,” or “regulatory charges”) which diminish the net proceeds.

-

Delays in transfer processing beyond what the site advertises—sometimes communication about reasons is either unhelpful or vague.

Disappearing Deposits or Balances

-

Reports exist of users’ deposited funds not being credited to their Moneyexpress.cc account, or of funds being removed without clear justification.

-

Complaints that balances drop without obvious explanation when close to withdrawal or transfer thresholds.

Poor or Evasive Customer Support

-

Before payment or transfer, support might be responsive. But once a user attempts to withdraw or complain, responses slow or stop.

-

Sometimes users describe being asked for documents, proofs, or verification steps that are repetitively required, with no feedback on whether they are accepted or sufficient.

Trust & Risk Assessment Findings

Independent risk-assessment or “scam detection” websites have flagged Moneyexpress.cc with mixed but concerning indicators:

-

Some assessments give it a moderate score, but note that the identity of the owner is masked in WHOIS, which is a risk factor.

-

There are also reports of suspicious technical features like iframes (embedding external content), or blocking of certain data scanning tools, which may suggest attempts to hide aspects of how the site works behind the scenes.

-

Negative reviews on consumer feedback sites heavily outweigh positive ones. On platforms where users can leave ratings, many express distrust, concern, or dissatisfaction due to missing transfers or unfulfilled promises.

These risk assessments do not conclusively prove fraud, but they suggest there is substantial uncertainty and elevated risk.

Patterns That Suggest Possible Scam Elements

Drawing together the user reports and risk assessments, several patterns emerge that align with behaviors commonly seen in fraudulent or deceptive platforms:

-

Promise vs Execution Gap

Many users report that what was promised (speedy transfers, competitive rates, small number of fees) does not align with the actual experience (delays, surprise fees, missing funds). -

Barrier Creep

The process seems straightforward until a user wants to withdraw or transfer large sums. Then, additional requirements are introduced (document verification, proof of identity or address), charges appear, or transfers are delayed. -

Communication Dropoff

Early engagement is usually okay; later, especially when questions about payment or withdrawal arise, communication becomes less frequent or evasive. -

Opaque Ownership & Accountability

Without known owners, physical address, or transparent business licensing, users have little recourse when things go wrong. -

Reliance on Trust, Not Evidence

Positive testimonials (if present) tend to be general or vague. Users providing contradictory or negative experiences are often more consistent in describing failure to receive funds or transfers.

Why These Features Are Dangerous

When platforms behave in the ways reported for Moneyexpress.cc, several risks arise for users:

-

Loss of funds: if deposits or transfers vanish or are delayed indefinitely.

-

Time wasted: repeatedly providing documents, following up with unresponsive support, or waiting without resolution.

-

False sense of legitimacy: polished UI, competitive claims, positive reviews in places—but those can be manufactured or selectively presented.

-

Potential exposure of personal data: requiring identity documents or personal information without proper verification or privacy oversight can lead to misuse.

These consequences can be financial, emotional, and reputational.

Possible Justifications & Gray Areas

In fairness, some factors could explain certain negative experiences that don’t necessarily amount to outright fraud. These include:

-

Legit platforms that have inefficient or overburdened support can fail to meet expectations.

-

Regulatory or compliance requirements can cause delays, especially when dealing with cross-border transfers.

-

Some users may misinterpret fees or delays as malicious when they are merely unfavorable terms hidden in small print.

-

The possibility of technical issues, network issues, or banking partner delays.

However, the volume of similar complaints, combined with masked ownership and shifting conditions, pushes many observers toward suspecting deceptive behavior rather than mere incompetence.

Key Warning Signs to Look Out For

If you are evaluating whether to use Moneyexpress.cc, here are specific warning signs to watch out for, based on reported experiences:

-

Hidden or masked company ownership (WHOIS privacy, no physical address).

-

Fees that appear suddenly, especially at withdrawal or transfer stage.

-

Discrepancies between what site promises (speed, rates, fees) and what actually happens.

-

Communications that go quiet when you ask about missing transfers or withdrawals.

-

Requirements for repeatedly sending documents or verification without clear feedback.

-

Testimonials or reviews that are vague, generic, or overly positive in contrast to many negative reports.

-

Balances or transfers that disappear or decline near important thresholds.

Being alert to these can help you avoid loss and reduce risk.

Community Feedback & Social Media Sentiment

Across forums and social media, many users of Moneyexpress.cc express distrust. Some recurring sentiments include:

-

“They took my deposit and never responded.”

-

“I waited for days/weeks for transfer, been promised by support, but nothing.”

-

“Fees came out of nowhere when withdrawing.”

-

“Balance was shown, but when I tried to withdraw, I couldn’t.”

These are not one or two stories, but multiple user accounts across different platforms. While no single user experience conclusively proves fraud, consistent convergence of outcomes (missing money, no response, unexpected fees) is strong cause for concern.

Summary of Main Red Flags

To crystallize, here are the main red flags reported about Moneyexpress.cc:

| Red Flag | Why It’s Troubling |

|---|---|

| Hidden owner identity | Hard to verify accountability, regulations, legitimacy |

| Unexpected fees at withdrawal | Suggests profit motive that benefits only the operator |

| Delays or missing transfers | Undermines core function of financial service |

| Opaque, shifting conditions | What’s promised initially doesn’t match what’s delivered |

| Weak or disappearing support | When issues arise, there is no assistance or clarity |

| Negative user reviews in bulk | Widespread reports are more credible than isolated complaints |

Conclusion

Based on the collected reports, risk score assessments, and user feedback, Moneyexpress.cc exhibits many of the warning signs typically associated with scam or unreliable financial service platforms. While some users may have had positive interactions or small successful transactions, the consistency of complaints regarding missing funds, surprise fees, poor support, and obfuscated ownership point toward a pattern of behavior that suggests the platform may be operating beyond mere incompetence.