MavenTrading.com Review: A Deceptive Broker

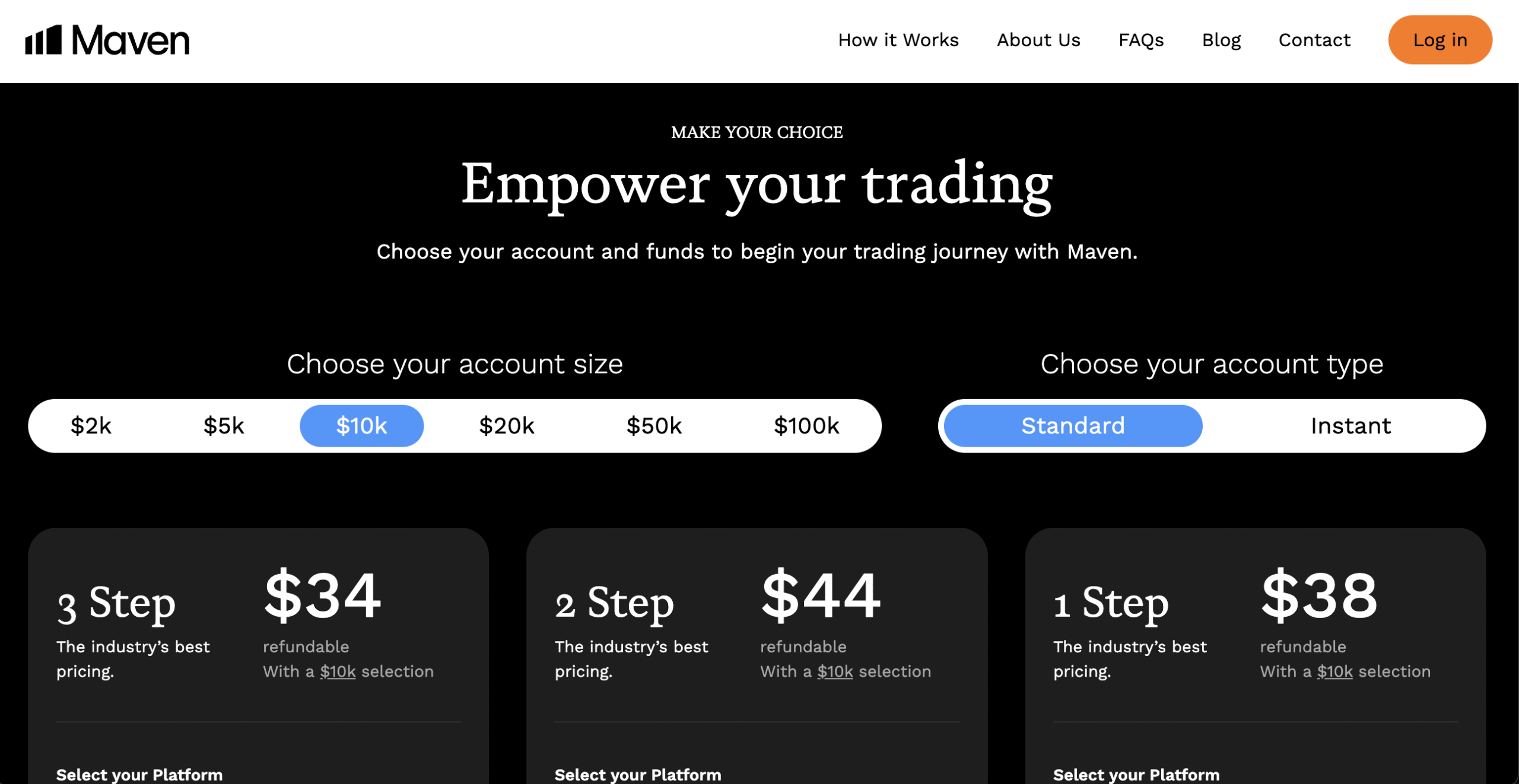

MavenTrading.com presents itself as a professional and trustworthy broker offering access to forex, commodities, indices, and cryptocurrencies. With sleek website design, bold claims of transparency, and promises of fast execution, the platform attempts to appear credible. However, upon closer examination, MavenTrading.com shows all the red flags of a scam operation.

This in-depth review exposes the deceptive tactics, unfair practices, and hidden dangers that make MavenTrading.com an unsafe choice for traders.

First Impressions – Professional Facade With Hidden Dangers

MavenTrading.com’s website looks modern, polished, and well-structured. It promotes itself as a global broker with cutting-edge technology, low spreads, and powerful trading platforms. For a newcomer, such presentation can be convincing.

Scam brokers know that first impressions are crucial. By investing in attractive websites and flashy marketing language, they create a false sense of trust. But underneath this glossy exterior lies a darker reality of manipulation and exploitation.

Questionable Regulatory Status

The most significant factor that determines whether a broker can be trusted is regulation. A regulated broker operates under strict guidelines, provides protections such as segregated accounts, and is monitored by financial authorities.

MavenTrading.com claims to be regulated, but on investigation:

-

Regulatory Details Are Vague: The platform provides no clear information about which authority supervises its operations.

-

Offshore Entities: The company is tied to offshore jurisdictions notorious for weak oversight and minimal trader protections.

-

No Verifiable Licenses: Attempts to verify their license numbers or registration records often lead nowhere.

This lack of proper regulation is one of the strongest signs that MavenTrading.com cannot be trusted. Without genuine oversight, the company is free to manipulate trading conditions and handle client funds without accountability.

Trading Conditions – Designed to Drain Accounts

MavenTrading.com heavily markets its supposed “competitive trading conditions,” but traders who have interacted with the platform report otherwise. The issues include:

-

Manipulated Spreads: Spreads widen unpredictably during normal market conditions, reducing profitability.

-

Unfair Slippage: Orders execute at far worse prices than displayed, often wiping out potential gains.

-

Stop-Loss Hunting: Price movements mysteriously hit stop-loss levels before rebounding, suggesting manipulation.

-

Excessive Leverage: The platform promotes very high leverage, which may look attractive but pushes traders into risky positions likely to result in heavy losses.

Rather than creating a fair environment, MavenTrading.com appears to stack the odds against clients, ensuring that most accounts eventually lose money.

Deposits Are Easy – Withdrawals Are a Nightmare

A common scam broker tactic is making deposits effortless but withdrawals nearly impossible. MavenTrading.com follows this playbook closely.

-

Instant Deposits: Multiple payment options are offered to make it simple for clients to fund accounts quickly.

-

Withdrawal Delays: Requests for withdrawals are delayed for weeks or months with no valid explanation.

-

Verification Excuses: Clients are asked repeatedly for identification documents, even if they have already provided them during account setup.

-

Rejections Without Cause: Withdrawals are frequently rejected under vague claims of “suspicious activity” or “violation of terms.”

-

Hidden Fees: Unexpected deductions reduce the amount clients finally receive, when payouts are processed at all.

This one-sided approach highlights the broker’s true intentions: to attract as much client money as possible while avoiding actual payouts.

Misleading Promotions and Bonuses

MavenTrading.com entices traders with offers of trading bonuses and promotions. On the surface, these seem like valuable incentives, but in practice, they are traps.

-

Impossible Conditions: Bonus funds often come with trading volume requirements that are practically unattainable.

-

Withdrawal Restrictions: Accepting a bonus often locks client funds, making withdrawals impossible until conditions are met.

-

Psychological Manipulation: Bonuses encourage clients to deposit larger amounts, believing they are receiving extra value.

These so-called promotions are structured to benefit only the broker, not the trader.

Hidden Fees and Extra Charges

Another major concern with MavenTrading.com is the presence of hidden fees that slowly erode client balances. Some of the charges reported include:

-

Inactivity Fees: Accounts not used for a short period are hit with steep charges.

-

Conversion Fees: Currency exchange rates are manipulated to ensure clients lose money.

-

Withdrawal Fees: Excessive charges are applied during withdrawals, cutting deeply into profits.

-

Premium Service Charges: Access to certain features requires extra payment not disclosed upfront.

These hidden costs make trading on MavenTrading.com both unprofitable and frustrating.

Customer Support – Evasive and Unhelpful

A genuine broker provides responsive and professional support. In contrast, MavenTrading.com’s customer service is a source of constant complaints.

-

Long Wait Times: Clients often wait days for responses.

-

Generic Replies: When responses do arrive, they are vague and scripted.

-

Avoidance of Issues: Serious concerns, especially about withdrawals, are ignored or brushed aside.

-

Account Managers Pressuring Deposits: Instead of solving problems, account managers focus on pushing clients to deposit more money.

This lack of genuine support reveals that client satisfaction is not a priority. The company’s focus is solely on extracting more deposits.

Fake Reviews and Reputation Management

Searching online for MavenTrading.com reveals a suspicious pattern. On some review sites, glowing 5-star reviews praise the broker’s services. Yet on independent forums, the feedback is overwhelmingly negative, with consistent complaints of scams and lost funds.

This discrepancy suggests that MavenTrading.com is actively engaging in reputation manipulation by paying for fake positive reviews to drown out genuine negative experiences.

Lack of Transparency

One of the most alarming aspects of MavenTrading.com is its lack of transparency. Important information such as company ownership, regulatory details, and contact information is either buried in fine print or missing altogether.

This lack of openness is a deliberate tactic. By hiding behind vague corporate structures, the people running MavenTrading.com avoid accountability while continuing to exploit clients.

Psychological Manipulation of Clients

MavenTrading.com doesn’t just use technical tricks—it also relies on psychological manipulation to keep traders depositing money.

-

Fear of Missing Out: Promises of “exclusive opportunities” pressure clients into hasty deposits.

-

Account Managers: Pushy representatives encourage traders to deposit larger sums, often claiming higher investment unlocks better services.

-

Confidence-Building: Small early profits may be allowed, tricking clients into trusting the platform before larger losses follow.

These manipulative tactics are carefully designed to exploit human behavior and maximize deposits.

Key Red Flags of MavenTrading.com

Looking at all the evidence, MavenTrading.com displays multiple red flags:

-

Lack of verifiable regulation.

-

Manipulated trading conditions that harm traders.

-

Easy deposits but blocked or delayed withdrawals.

-

Misleading bonuses that trap client funds.

-

Hidden fees and unfair charges.

-

Poor and evasive customer support.

-

Fake positive reviews to mask negative ones.

-

Lack of transparency around ownership.

-

Psychological manipulation to pressure deposits.

When combined, these issues paint a clear picture of a platform designed to deceive and exploit.

Conclusion – Why Traders Should Avoid MavenTrading.com

While MavenTrading.com promotes itself as a professional broker offering global services, the reality is very different. With questionable regulation, unfair trading conditions, blocked withdrawals, misleading promotions, and hidden fees, the platform shows all the hallmarks of a scam broker.

Report MavenTrading.com and Recover Your Funds

If you have fallen victim to MavenTrading.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like MavenTrading.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception.