marketfxc.com Scam Review: Examining This Suspected

Introduction

In the realm of online trading, forex and contracts-for-difference (CFD) brokers promise big gains with relatively modest investment. For inexperienced traders, the promise of high leverage and fast returns can be alluring. However, platforms like marketfxc.com (also known in reviews under names like MarketsCFDs) have drawn repeated suspicion from watchdogs and users alike. This review digs into what marketfxc.com claims, how it reportedly treats its clients, and why so many believe it is not a legitimate broker.

What marketfxc.com Claims To Be

Based on promotional materials and user impressions, marketfxc.com presents itself with features often found in legitimate trading products, including:

-

A range of trading assets: forex, indices, commodities, perhaps crypto.

-

High leverage options (e.g. up to 1:200).

-

Real-time signals, trading alerts, and other “premium” tools.

-

A web-based trading platform with features like technical indicators, perhaps charting tools.

-

Support for new traders, flashy marketing, and promises of profitable returns.

These features make it appear appealing. Traders who want exposure to financial markets without learning on their own are exactly the kind of audience such platforms target.

Regulation & License Claims vs Reality

One of the most important indicators in validating a broker is regulation. Unfortunately, repeated analyses suggest that marketfxc.com lacks credible, verifiable licensing. Key points in this regard:

-

It reportedly claims some jurisdictional registration and sometimes claims to be a global broker, but authorities in recognized regulatory bodies do not list it among their registered brokers.

-

Because it is unregulated, clients have less legal protection, and complaints may fall on deaf ears.

-

Some regulatory agencies have issued warnings in certain countries cautioning their citizens about marketfxc.com, citing it as an offshore, unlicensed broker.

In effect, marketfxc.com appears to operate without oversight from trustworthy financial authorities, which is a major concern in the trading world.

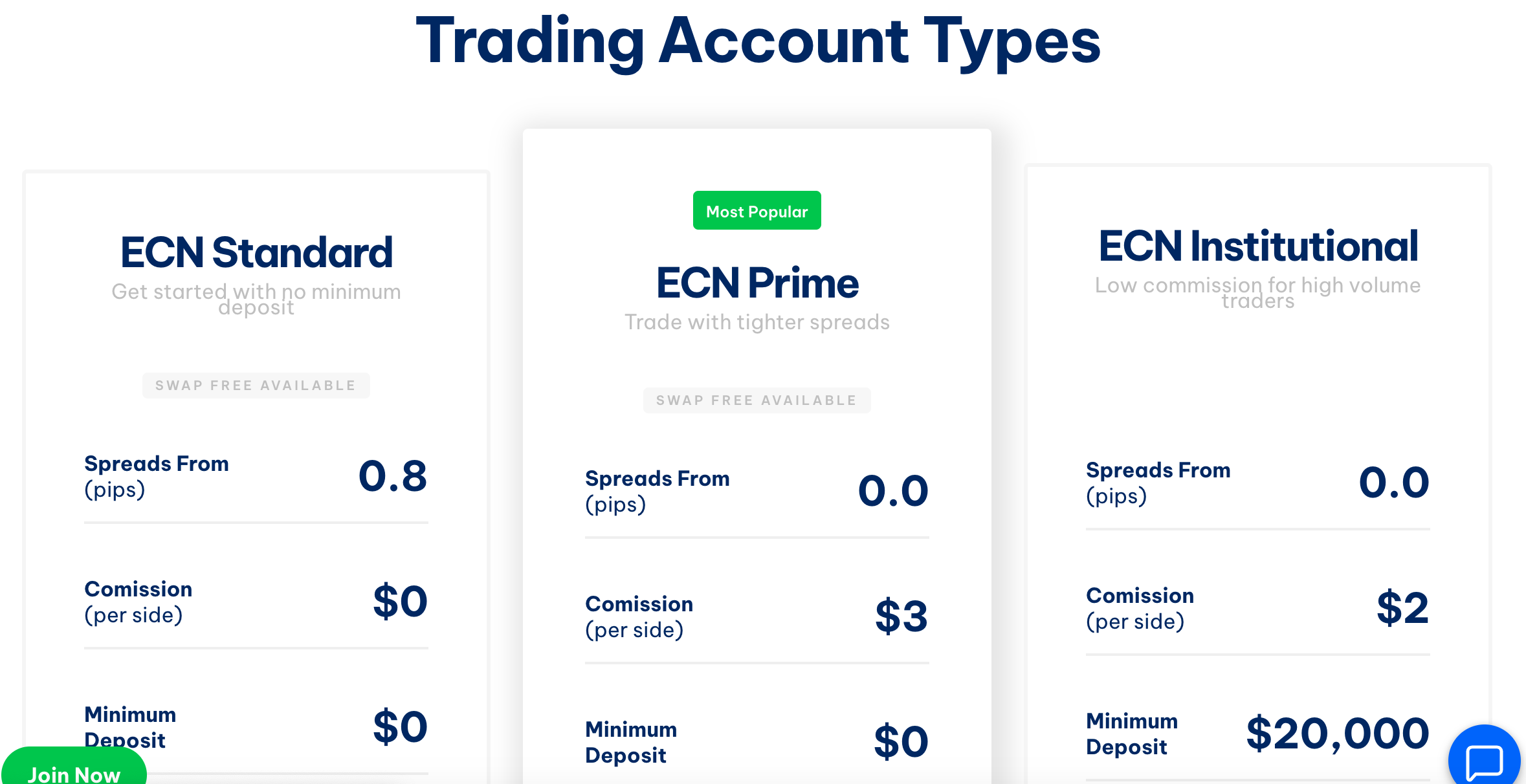

Reported Minimum Deposit, Fees, and Trading Conditions

Users who have looked into marketfxc.com (or MarketsCFDs) report that its terms and requirements are suspicious:

-

The minimum deposit is reported at a relatively high threshold (sometimes $1,000) even for basic account types. This is steep for many retail traders.

-

Spreads and fees may be obscured or stated ambiguously. In some cases, additional fees or “maintenance,” “profit clearance,” or “inactivity” fees appear unexpectedly.

-

The leverage offered (1:200) is high and tends to increase risk significantly, particularly with a broker that lacks regulation.

These conditions align with patterns seen in many brokers who focus on attracting deposits first, rather than emphasizing fair trading conditions or protection for traders.

User Complaints & Red Flags

Several recurring complaints arise in user discussions and reviews. While not every complaint can be independently verified, the similarities in many of them give weight to concerns. Reported issues include:

-

Withdrawal Difficulties

Many users say they have trouble withdrawing their profits (or initial deposit), being told they need to meet higher trading volumes, pay extra fees, or supply more documentation—even after complying with earlier requirements. -

Surprise or Hidden Fees

Users report being charged fees they did not anticipate: “profit clearance fees,” “maintenance fees,” or monthly fees just for having the account open. Sometimes these fees seem designed to eat into profits—or force more deposits. -

False or Misleading Claims

Some of the promised tools or services (trading signals, premium alerts, trading analysis) may not function or exist as described. Promotions suggest sophisticated tools, but users report a basic web interface and limited functionality. -

Regulatory Warnings

Financial authorities in certain countries reportedly have issued warnings about marketfxc.com. One such agency in Italy (CONSOB) has flagged it in warnings. This points to concern in official circles, beyond just online grumbling. -

High Risk Tagging by Watchdog Sites

Broker review and “scam detector” type websites give marketfxc.com poor or very poor marks on trust and safety. Key concerns: unverified status, low transparency, negative feedback from traders. -

Marketing Pressure & Aggressive Sales

Marketing materials often emphasize urgency, special offers, or bonuses for early depositors. Traders report being contacted by “account managers” urging them to invest more to unlock better conditions.

Technical & Structural Weaknesses

Beyond user complaints, there are structural and technical patterns in marketfxc.com that suggest risk:

-

No solid proof of segregation of client funds (i.e. separating client money from company accounts), which is a standard safety feature for regulated brokers.

-

Use of web-based trading interfaces only, sometimes with limited tools and no MT4/MT5 integrations (or poorly explained ones), which may indicate lower development investment.

-

Poor transparency around corporate entity, domain ownership, and who exactly runs the company. Often ownership is obscured or hidden behind offshore registration or private registrars.

-

Hosting or web-infrastructure features that are flagged in risk assessments: connections to other suspect domains, low traceability, or hidden WHOIS data.

Scam Behavior Patterns Seen With marketfxc.com

Putting together reports, marketfxc.com appears to use the following “scam-like” tactics:

| Tactic | Description / How Users Report It Occurs |

|---|---|

| High minimum deposit | Makes it expensive to start; small deposits may be harder to withdraw or ignored. |

| Bonus/trading conditions traps | Offers bonuses that come with heavy trading volume or “clearance” conditions, designed so many users never qualify. |

| Withdrawal delay + extra verification | Document requests or extra fees appear only when withdrawal is requested. |

| Regulation claims without evidence | Stated licensing does not match regulator databases. |

| Aggressive promotional marketing | Pressure to deposit more, “limited time offers,” use of fear of missing out. |

| Negative reviews piling up | Once complaints accumulate, they tend to have a common theme. |

What Happens When Traders Try to Withdraw

For many users, the critical test is withdrawal. With marketfxc.com, the pattern often reported is:

-

After trading and building what appears to be a profit, the user requests withdrawal.

-

The broker (or account manager) asks for additional documents not mentioned earlier (proof of identity, proof of address, sometimes more).

-

Then a “withdrawal fee” or “tax/clearance” fee is asked for. Sometimes users comply with extra requests but find withdrawal still gets delayed or denied.

-

Responses from support tend to get slower, more evasive, or disappear altogether.

These repeated reports raise serious concerns that the broker may be operating in bad faith—accepting deposits but obstructing exits.

Comparison with Legitimate Forex / CFD Broker Standards

To highlight why marketfxc.com’s behavior is suspect, it helps to list what legitimate brokers generally do well, and see where marketfxc.com differs:

| Legitimate Broker Standard | Observations / Where marketfxc.com Falls Short |

|---|---|

| Visible regulatory license, clear corporate registration | marketfxc.com is widely reported to be unregulated or with unverifiable claims |

| Transparent fee schedule and spreads, no hidden fees | Many users report surprise fees and opaque terms |

| Segregated client funds and insurance / protection | No proof or claim of such safeguards in many reports |

| Responsive and transparent support especially regarding withdrawals | Many users say support becomes ineffective when money is involved |

| Reliable trading platforms (e.g. MT4/MT5), real-time tools, robust infrastructure | Users say platform is basic, lacking in promised features or trading tools |

When a broker departs significantly from these standards, the risk of loss grows.

Why Many Refer to marketfxc.com as a Scam Broker

Based on the accumulation of user experiences, technical analysis, regulation checks, and risk assessment, many people conclude that marketfxc.com behaves like a scam broker. The reasons include:

-

Persistent failure of withdrawals or obstructed access to profits.

-

Hidden or unexpected fees.

-

false or misleading promotional claims.

-

Lack of regulatory oversight.

-

Patterns of behavior consistent with brokers who take deposits but make actual profit withdrawal very difficult.

-

Warnings from financial authorities or regulatory bodies in certain jurisdictions.

These elements combine to create more than just suspicion—they form a body of evidence suggesting marketfxc.com is not operating in the best interests of its clients.

What Users Often Experience in Full

To give a sense of what victims often report, this is a composite summary based on many user stories:

-

Trader signs up, deposits a moderate sum (e.g. $1,000).

-

They observe trades, some “simulated gains” or small profit statements.

-

Follow promo messages or account manager suggestions to increase deposit to unlock better bonus or better spreads.

-

At withdrawal time, asked for documents, then told they must pay some fee or meet trade volume. They comply, but then payment is delayed or blocked.

-

Support becomes unhelpful. Dashboard may show profit, but the profit never leaves the platform.

-

If the trader tries to complain publicly or pulls back, access may be restricted or the site may change domain.

These cycles are repeated by many, which gives weight to the pattern—not just isolated cases.

Risk Summary: What To Look Out For

If evaluating marketfxc.com or any similar broker, here are important warning indicators:

-

Check regulator listings in your country of residence. If the broker is not listed with a recognized regulator, be wary.

-

Examine payment / withdrawal history, especially from forum posts—look for consistent inability of users to cash out profits.

-

Read terms & conditions carefully—bonus terms, fee schedule, trade volume requirements. Hidden clauses often appear in small print.

-

Test with small funds first, and try requesting withdrawal early to see whether the process works.

-

Check for anonymous ownership, hidden WHOIS data, or offshore registration—these increase risk.

-

Assess the platform’s features realistically—if tools are promised but missing, charts are only basic, or the interface seems low quality, that may be a signal.

Conclusion

marketfxc.com (MarketsCFDs) demonstrates many of the alarm signals that typically accompany scam or high-risk CFD brokers. From unverified regulatory claims, to high minimum deposits, to surprise fees and withdrawal barriers, the pattern of complaints is strong. While no single user story can prove criminal intent, the consistency of reports, the structural weakness, and the lack of credible oversight suggest that marketfxc.com is not operating as a trustworthy broker.

-

Report marketfxc.com and Recover Your Funds

If you have fallen victim to marketfxc.com and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like marketfxc.com persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception