ManoCoin Scam Review: A Fraudulent Platform

Introduction

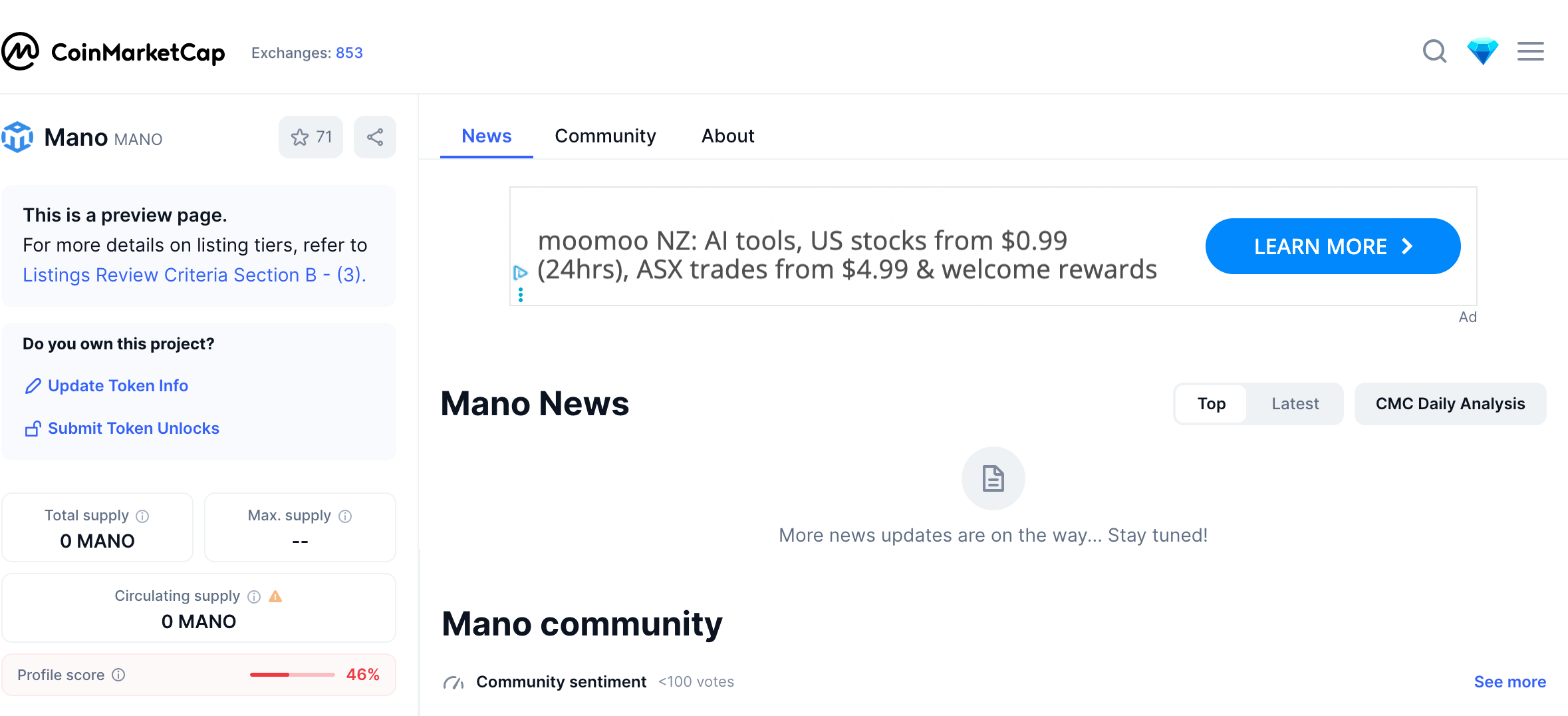

In the fast-paced world of cryptocurrency tokens and blockchain projects, new coin launches seem to pop up almost every day. Many of these promise innovation, high yields, or community rewards. ManoCoin is one such project. On its surface it looks like another crypto token trying to make its mark—with whitepapers, tokenomics, rewards, and perhaps partnerships. But behind the glossy exterior, many participants allege troubling behavior: broken promises, opaque operations, withdrawn or missing benefits, and shifting rules. This review dissects what ManoCoin claims, what people report, and whether the evidence leans more toward legitimate project or scam.

What ManoCoin Presents Itself As

From promotional materials and user impressions, ManoCoin purports to offer:

-

A token with utility in a digital ecosystem: possibly staking, rewards, or transactional use.

-

Token bonus programs or reward structures, encouraging users to hold or promote the token.

-

Detailed tokenomics: allocations, vesting schedules, rewards for early participants, perhaps referral bonuses.

-

Roadmap: planned features, maybe decentralized finance (DeFi) integrations, staking platforms, exchange listings.

These attributes are typical of many crypto token projects—and not inherently wrong. However, as many community members report, what is promised and what is delivered appear to diverge significantly.

Early Engagement: Hype vs. Substance

ManoCoin seems to generate interest through standard crypto-marketing channels:

-

Social media campaigns: posts promising high returns, early adopter bonuses, rewards for sharing or inviting friends.

-

Ambitious whitepaper or roadmap documents that paint a vision of utility, ecosystem growth, and community benefits.

-

Emphasis on community building: Telegram, Discord groups, or other chat communities being invited to contribute, provide feedback, or promote the coin.

While hype is part of many legit token launches, what troubles many is that early traction via hype does not seem to translate into real transparency or sustainable infrastructure in ManoCoin’s case.

Reports of Unfulfilled Promises & Tokenomics Issues

Several recurring complaints around ManoCoin relate directly to tokenomics and how rewards / bonuses are handled. Key issues include:

-

Staking / Reward Delays or Non-Deployment

Some holders report that promised staking tools or reward distributions have been delayed indefinitely or never launched. Even though staking or “holding benefits” are often mentioned, much of it seems to stay on paper. -

Vesting Schedules / Locked Tokens

Many users complain that their tokens are locked behind vesting schedules that were not clearly disclosed, or that release dates have been extended repeatedly. What was originally projected as a short vesting period becomes much longer. -

Referral or Bonus Programs Missing or Underpaid

Participants who promoted the token (via referrals or promotional tasks) say that promised bonus tokens are either underpaid, delayed, or in some cases never delivered. -

Token Listing Delays or Poor Liquidity

Though ManoCoin may promise listings on exchanges, when those listings occur, users find low trading volume, large spreads, or difficulty in selling. Some say the token is effectively hard to convert to more established cryptocurrencies or fiat.

Transparency & Team Accountability Concerns

A big portion of believe-it’s-a-scam stems from how difficult it appears to verify who runs ManoCoin, and how decisions are made. Reported transparency problems include:

-

Unclear leadership: the people listed as developers or advisors are not verifiably traceable or experienced. Sometimes generic images or pseudonyms are used.

-

Minimal or vague legal / business registration: no visible governing entity, physical address, or licensing.

-

Poor communication about changes: when roadmap items are delayed, or rules change, announcements are often vague or inconsistent.

-

Audit or oversight absence: audits of security, token contracts, or token distribution are either not present or not verifiably shared in ways users can review independently.

Withdrawal / Trading / Access Problems

Although ManoCoin is mostly a token project (so “withdrawal” in the sense of moving tokens to one’s own wallet, or selling on exchanges), several problems are consistently reported:

-

Holders being unable to transfer tokens out of platform-controlled wallets or escrow.

-

Fees or gas costs being much higher than anticipated, eating into any potential profits.

-

Token transfers being blocked post-lock or vesting, or after reaching certain thresholds—sometimes requiring additional verification or payment (in crypto) to unlock transfers.

-

Exchanges where the token is “listed” having extraordinarily low liquidity, making it hard for holders to actually sell or exit positions without heavy loss.

Shifting Terms & Hidden Conditions

Another major category of complaints concerns the conditions under which rewards or token benefits are given:

-

Rules changing mid campaign: vesting periods extended, bonus terms altered, rewards reduced.

-

“Fine print” changes: initial whitepaper mentions “unlimited” referral bonuses or high returns, but later legal or terms sections restrict those severely.

-

Surprising lock-in periods for tokens, or delayed unlocks not clearly communicated.

-

Requirement of additional actions (e.g. identity verification, special wallet setup, gas payment) to access promised benefits, sometimes after many months.

These shifting, hidden terms make planning or trusting the project very risky.

Community Feedback & Reputation

Among users and investors, reputation of ManoCoin tends to be mixed at best — many negative experiences, quite a few complaints. Common threads in user feedback include:

-

Frustration over promised features (staking, bonuses, exchange listings) that either underdeliver or never materialize.

-

Anger over changing vesting schedules or locked tokens that were expected to become liquid sooner.

-

Disappointment at inability to sell or move tokens easily, even when listings occur.

-

Poor or vague responses from team members when asked for transparency or justification.

When many people independently report similar problems, the chance that they are due to poor documentation or misunderstanding shrinks, making suspicion more likely.

Unrealistic Profit & Utility Claims

ManoCoin often uses profit or utility promises to attract investors. Some of the suspect claims include:

-

High ROI in short times from holding or staking (sometimes daily or weekly percentages) with minimal risk warnings.

-

Utility features (transactions, governance, bonuses) being portrayed as ready or “coming soon,” but delayed repeatedly.

-

Partnerships or advisors named in marketing that are vague or unverified, seeming more like promotional names than practical involvement.

These types of claims are very common among crypto projects, but when paired with lack of delivery, they become warning signs.

Possible Behaviors Suggesting Scam Operation

While definitive proof is difficult without legal or forensic examination, many of ManoCoin’s reported behaviors match those typical of crypto scam or high-risk projects:

-

Using hype and community marketing rather than delivering technical or functional updates.

-

Creating demand through referral or bonus programs, then restricting conversion or sales of tokens.

-

Maintaining token allocations that favor early insiders, with public allocations being poorly distributed.

-

Applying opaque governance where decisions (vesting, unlocks, partnerships) are made with little public input or accountability.

Case Studies: Example Scenarios Reported by Users

Following are anonymized composite stories drawn from multiple user reports — representative of what many people say they experienced with ManoCoin:

Case A: An early adopter receives promised bonus tokens for referrals. They wait through the stated vesting period, then discover the unlock period was extended by months without notice. When they try to move tokens, transaction fails or wallet is told verification is needed.

Case B: A token sale participant purchases tokens, sees the token listed on a small exchange. They attempt to sell but discover the token has extremely low trading volume, so their sell order is executed at a steep loss or not at all.

Case C: A user participates in community tasks, expecting reward tokens. Later, notices they are placed on a “red list” for “abnormal behavior” without clear reason. Their rewards are reduced or cancelled with no chance to appeal.

Why Many Consider ManoCoin a Scam

Putting together all of the above, many investors and community watchers argue that ManoCoin exhibits multiple overlapping red flags:

-

Promise vs Execution Gap: Many promised features are delayed or missing.

-

Lack of Transparency: Anonymous or unverifiable team, ambiguous ownership/control.

-

Changing Terms After Engagement: Vesting periods, reward terms, unlocks being altered post-investment.

-

Difficulty Exiting or Accessing Value: Low liquidity, high gas fees, blocked transfers.

-

Heavy Reliance on Marketing & Community Praise: More focused on hype, referrals, bonus programs than on product or utility delivery.

Together these suggest a project where the public face is polished, but behind the scenes, many users’ expectations are not fulfilled.

How To Spot Similar Patterns Early

For those evaluating new tokens or crypto projects, the ManoCoin case offers useful red-flags to watch for:

-

Be skeptical of high reward or staking return promises early on.

-

Always check who the developers/advisors are—profiles, past work, verifiable identity.

-

Read tokenomics carefully: what are the vesting schedules, what percentage is reserved for early insiders vs public.

-

Look for transparent reporting: audits, transaction history, proof of contract deployment.

-

Check whether tokens are listed on multiple reliable exchanges, and how much trading volume / liquidity exists.

-

Monitor communication: delays in project updates, vague messages, postponed launches are warning signs.

Final Thoughts

ManoCoin has many of the features that attract investors: claims of utility, rewards, staking, token bonuses, referral programs, and a growing community. But the recurring complaints—undelivered promises, opaque team structure, changing terms, difficulty in accessing value—create a strong case that it could be a high-risk or potentially fraudulent project rather than a reliable investment.

While some participants may get small returns or initial rewards, those successes seem fragile and unreliable. For anyone considering involvement with ManoCoin, scepticism is warranted. Ensure you understand all conditions, be prepared for potential delays, and never assume that promotional materials guarantee actual performance.

-

Report ManoCoin and Recover Your Funds

If you have fallen victim to ManoCoin and lost money, it is crucial to take immediate action. We recommend Report the scam to BOREOAKLTD.COM , a reputable platform dedicated to assisting victims in recovering their stolen funds. The sooner you act, the greater your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like ManoCoin persistently target unsuspecting investors. To safeguard yourself and others from financial fraud, stay informed, avoid unregulated platforms, and report scams to protect. Your vigilance can make a difference in the fight against financial deception